|

市場調查報告書

商品編碼

1773438

建築用秸稈捆市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Straw Bale for Construction Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

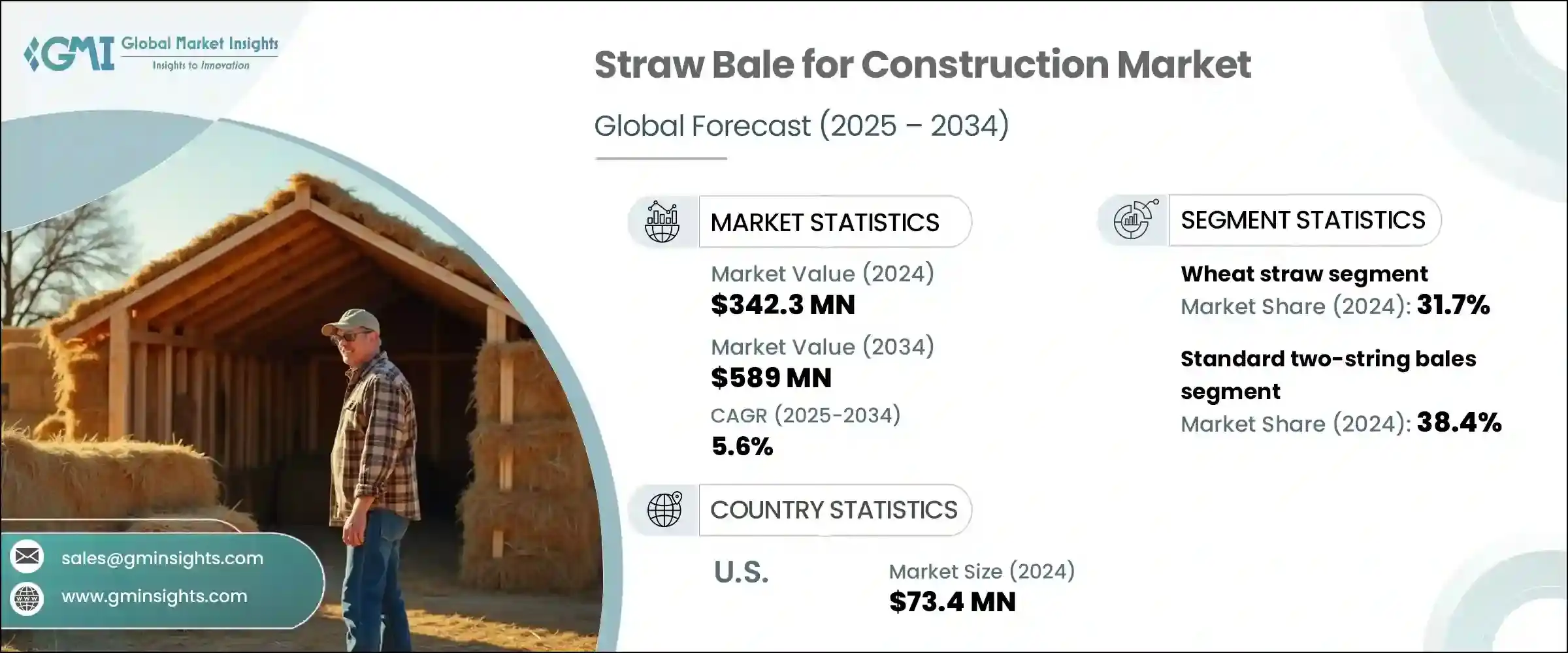

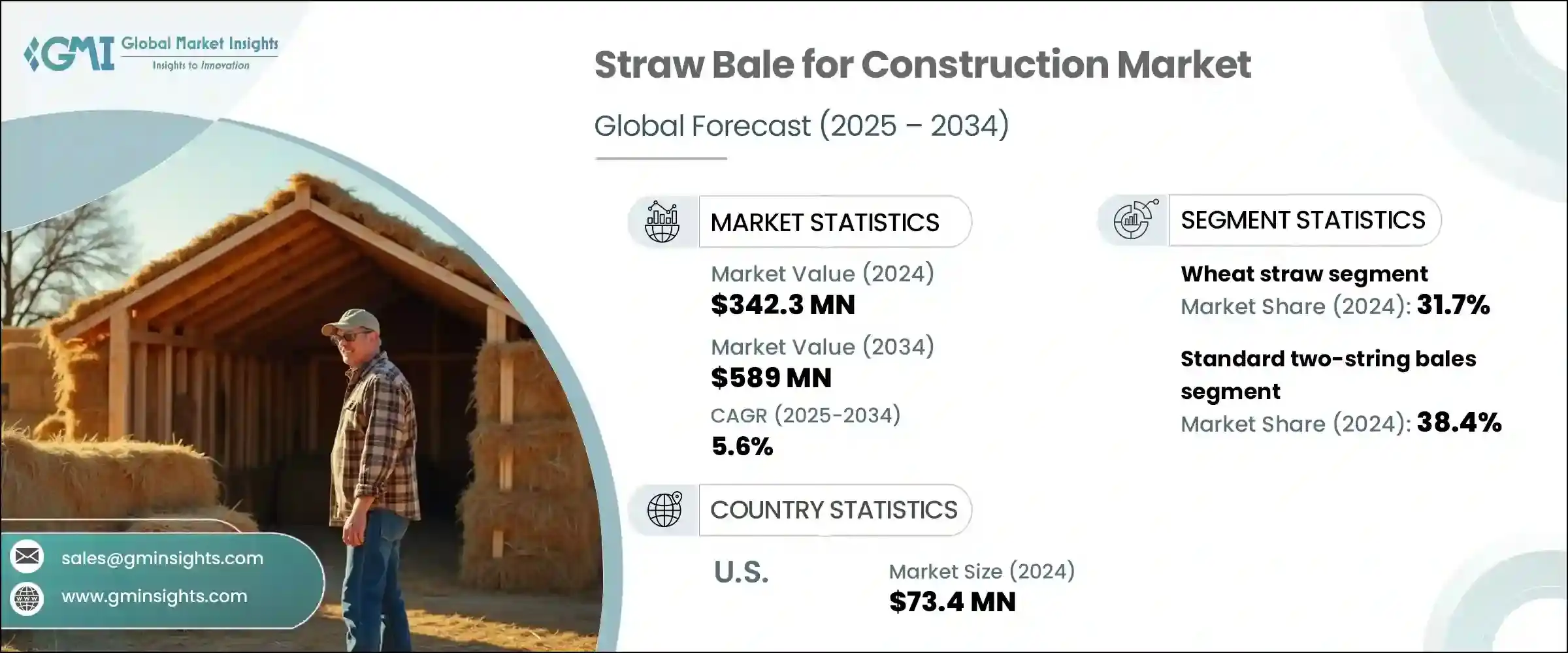

2024年,全球建築用秸稈捆市場價值為3.423億美元,預計到2034年將以5.6%的複合年成長率成長,達到5.89億美元。這項成長主要歸功於秸稈捆建築的環保節能特性。該技術利用緊密壓實的秸稈捆作為主要牆體材料,並以天然灰泥或塗料進行表面處理,因其對環境影響較小而備受青睞。作為農業副產品,秸稈來源豐富且價格低廉,使其成為建築業的永續替代品。秸稈捆結構的優點在於其卓越的隔熱性能,其R值通常在R-30到R-35之間,取決於捆包密度和牆體厚度。

這些高隔熱值可降低能耗,尤其是在暖氣和冷氣方面,從而節省成本並帶來環境效益。此外,秸稈還能作為天然的碳匯,封存植物生長週期中吸收的二氧化碳。這種碳儲存能力增強了材料在減少建築物整體碳足跡方面的作用。隨著人們對低影響建築解決方案的興趣日益濃厚,秸稈捆包建築在不同地區正成為越來越受歡迎的選擇,尤其是在重視綠色基礎設施、永續住房和可再生材料的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.423億美元 |

| 預測值 | 5.89億美元 |

| 複合年成長率 | 5.6% |

小麥秸稈因其易得性和結構優勢,在2024年佔據了31.7%的市場。其纖維平行排列的特性使其在結構應用上具有良好的填充性、優異的隔熱性能和耐久性。此外,小麥秸稈易於生物分解,對建築環境的適應性也使其應用範圍不斷擴大。小麥秸稈因其防潮性能和與生態建築方法的兼容性而廣受認可。小麥秸稈長期以來與傳統建築技術的融合,以及其在當代永續建築中的卓越性能,進一步推動了其在各個地區的應用。

2024年,標準雙繩捆包市佔38.4%的市佔率。這些捆包因其易於整合到承重建築系統中而被廣泛使用。其均衡的尺寸和重量提高了搬運效率,並且與傳統捆包設備相容,使其非常容易獲得。建築商、承包商和自建房業主青睞這些捆包,因為它們經濟高效且易於運輸。此外,旨在推廣永續建築的培訓計畫和教育活動經常將這些捆包作為教學工具,幫助增強社區對環保建築實踐的理解。

2024年,美國建築用秸稈捆市場產值達7,340萬美元。美國在秸稈捆建築領域的領先地位得益於日益重視環保住房,以及推廣低碳建築方法的區域性舉措。秸稈作為農業副產品的可取得性,加上市場對永續離網和客製化住宅日益成長的需求,持續推動著秸稈捆建築的普及。政府鼓勵生態住宅開發的計劃,以及注重清潔材料的州級能源政策,進一步強化了這一趨勢,並促進了全球郊區和半鄉村地區的秸稈捆建築的擴張。

全球建築用秸稈捆產業仍較為分散,Endeavour Centre、Strawcture Eco、ModCell Straw Technology、Ecococon 和 Straw-Bale Building UK 等主要參與者積極佈局利基市場,並滿足本地需求。建築用秸稈捆市場中的企業正在採取有針對性的策略,以增強其市場影響力,並適應不斷變化的環境和消費者需求。

許多公司專注於秸稈的本地生產和採購,以降低物流成本和碳排放。產品標準化工作正在推進,以符合地區建築規範並贏得主流建築業的信任。與建築師和注重永續發展的開發商的策略合作,有助於公司展示秸稈捆包建築在現代生態住宅中的應用案例。以教育為主導的活動和以社區為基礎的研討會進一步提升了市場認知,而實踐培訓計劃則增強了承包商和自建者的信心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按秸稈類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按秸稈類型,2021 - 2034 年

- 主要趨勢

- 麥秸

- 稻草

- 大麥秸稈

- 燕麥秸稈

- 黑麥秸稈

- 其他

第6章:市場估計與預測:按捆包格式,2021 - 2034 年

- 主要趨勢

- 標準雙繩捆包

- 三串捆包

- 巨型捆包

- 客製尺寸的捆包

- 預製秸稈板

第7章:市場估計與預測:依施工方法,2021 - 2034 年

- 主要趨勢

- 承重/內布拉斯加風格

- 柱樑填充

- 混合方法

- 預製板系統

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 外牆

- 內牆

- 屋頂隔熱

- 地板隔熱

- 隔音效果

- 其他

第9章:估計和預測:按最終用途領域,2021 - 2034 年

- 主要趨勢

- 住宅建築

- 獨棟住宅

- 多戶建築

- 微型住宅和小木屋

- 增建和翻新

- 商業建築

- 教育設施

- 生態旅遊設施

- 零售和辦公空間

- 其他

- 農業建築

- 社區與公共建築

- 其他

第10章:估計與預測:按表面處理類型,2021 - 2034 年

- 主要趨勢

- 石灰石膏

- 黏土灰泥

- 水泥灰泥

- 土製灰泥

- 壁板和覆層

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- BRAR AGRO WORKS

- CalFibre

- Ecococon

- Endeavour Centre

- Grass Land Gold Pvt. Ltd

- Gruppo Carli

- ModCell Straw Technology

- Profodd Private Limited

- Straw-Bale Building UK

- Strawcture Eco

The Global Straw Bale for Construction Market was valued at USD 342.3 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 589 million by 2034. This growth is largely attributed to the eco-friendly and energy-efficient characteristics of straw bale construction. Utilizing tightly compacted straw bales as primary wall material, the technique is finished with natural plasters or coatings and has gained traction for its low environmental impact. As an agricultural by-product, straw is abundantly available and affordable, making it a sustainable alternative in construction. What makes straw bale structures stand out is their impressive insulation capability, with R-values typically ranging between R-30 and R-35, depending on bale density and wall thickness.

These high insulation values reduce energy consumption, especially in heating and cooling, resulting in cost savings and environmental benefits. Additionally, straw serves as a natural carbon sink, sequestering carbon dioxide absorbed during the plant's growth cycle. This carbon-storing ability enhances the material's role in reducing the overall carbon footprint of buildings. With rising interest in low-impact building solutions, straw bale construction is becoming an increasingly popular choice across different geographies, particularly in areas emphasizing green infrastructure, sustainable housing, and renewable materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $342.3 Million |

| Forecast Value | $589 Million |

| CAGR | 5.6% |

The wheat straw segment held a 31.7% share in 2024 due to its availability and structural advantages. Its parallel fiber orientation enables compact packing, consistent insulation, and durability in structural applications. Furthermore, its ease of biodegradation and adaptability to construction environments contribute to its growing use. Wheat straw is recognized for its moisture-resistant properties and compatibility with eco-construction methods. The material's long-standing integration into traditional building techniques and its proven performance in contemporary sustainable construction further boost its adoption across various regions.

The standard two-string bales segment held a 38.4% share in 2024. These bales are widely used because of their ease of integration into load-bearing construction systems. Their balanced size and weight improve handling efficiency, and their compatibility with conventional baling equipment makes them highly accessible. Builders, contractors, and self-builders favor these bales for their cost-effectiveness and ease of transport. Additionally, training programs and educational initiatives aimed at promoting sustainable building often feature these bales as teaching tools, helping to enhance community understanding of eco-friendly construction practices.

United States Straw Bale for Construction Market generated USD 73.4 million in 2024. The country's leadership in straw bale construction is supported by a growing emphasis on environmentally conscious housing and regional initiatives promoting low-carbon building methods. The availability of straw as a farming by-product, combined with evolving demand for sustainable off-grid and custom-built homes, continues to push adoption forward. Support from governmental programs encouraging ecological housing development, alongside state-level energy policies focused on clean materials, reinforces this trend and fosters expansion in suburban and semi-rural areas globally.

The Global Straw Bale for Construction Industry remains moderately fragmented, with key players such as Endeavour Centre, Strawcture Eco, ModCell Straw Technology, Ecococon, and Straw-Bale Building UK actively operating in niche markets and supporting localized demand. Companies in the straw bale construction market are employing targeted strategies to bolster their market presence and adapt to changing environmental and consumer demands.

Many firms are focusing on local production and sourcing of straw to reduce logistics costs and carbon emissions. Product standardization efforts are being pursued to comply with regional building codes and gain trust from mainstream construction sectors. Strategic collaborations with architects and sustainability-focused developers help companies showcase use cases of straw bale construction in modern eco-homes. Education-driven campaigns and community-based workshops further promote market awareness, while hands-on training initiatives increase confidence among contractors and self-builders.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Straw type

- 2.2.2 Bale format

- 2.2.3 Construction method

- 2.2.4 Application

- 2.2.5 End use sector

- 2.2.6 Finishing type

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By straw type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Straw Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Wheat straw

- 5.3 Rice straw

- 5.4 Barley straw

- 5.5 Oat straw

- 5.6 Rye straw

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Bale Format, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Standard two-string bales

- 6.3 Three-string bales

- 6.4 Jumbo bales

- 6.5 Custom-sized bales

- 6.6 Prefabricated straw panels

Chapter 7 Market Estimates and Forecast, By Construction Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Load-bearing/nebraska style

- 7.3 Post-and-beam infill

- 7.4 Hybrid methods

- 7.5 Prefabricated panel systems

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Exterior walls

- 8.3 Interior walls

- 8.4 Roof insulation

- 8.5 Floor insulation

- 8.6 Sound insulation

- 8.7 Others

Chapter 9 Estimates and Forecast, By End Use Sector, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Residential construction

- 9.2.1 Single-family homes

- 9.2.2 Multi-family buildings

- 9.2.3 Tiny homes and cabins

- 9.2.4 Additions and renovations

- 9.3 Commercial construction

- 9.3.1 Educational facilities

- 9.3.2 Eco-tourism facilities

- 9.3.3 Retail and office spaces

- 9.3.4 Others

- 9.4 Agricultural buildings

- 9.5 Community and public buildings

- 9.6 Others

Chapter 10 Estimates and Forecast, By Finishing Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Lime plaster

- 10.3 Clay plaster

- 10.4 Cement stucco

- 10.5 Earthen plasters

- 10.6 Siding and cladding

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 BRAR AGRO WORKS

- 12.2 CalFibre

- 12.3 Ecococon

- 12.4 Endeavour Centre

- 12.5 Grass Land Gold Pvt. Ltd

- 12.6 Gruppo Carli

- 12.7 ModCell Straw Technology

- 12.8 Profodd Private Limited

- 12.9 Straw-Bale Building UK

- 12.10 Strawcture Eco