|

市場調查報告書

商品編碼

1773436

隔音石膏板材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Soundproof Drywall Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

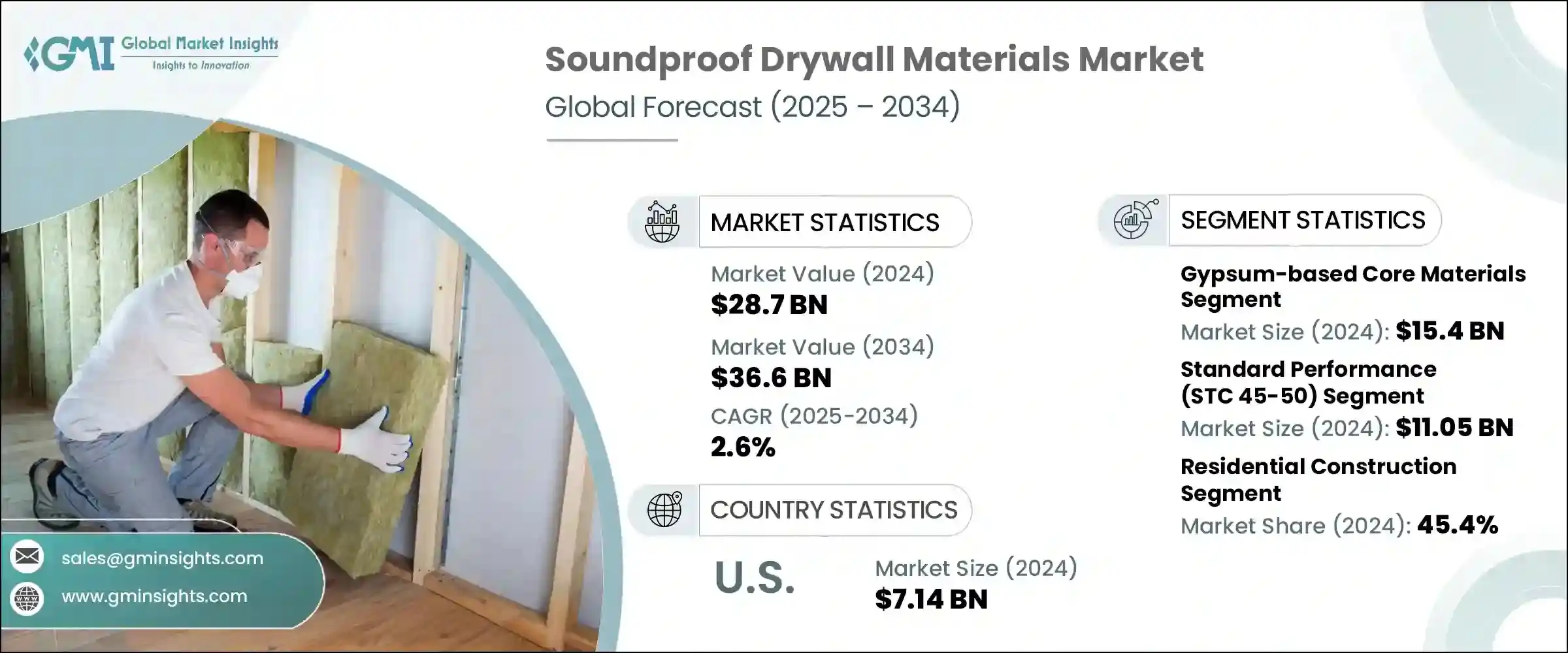

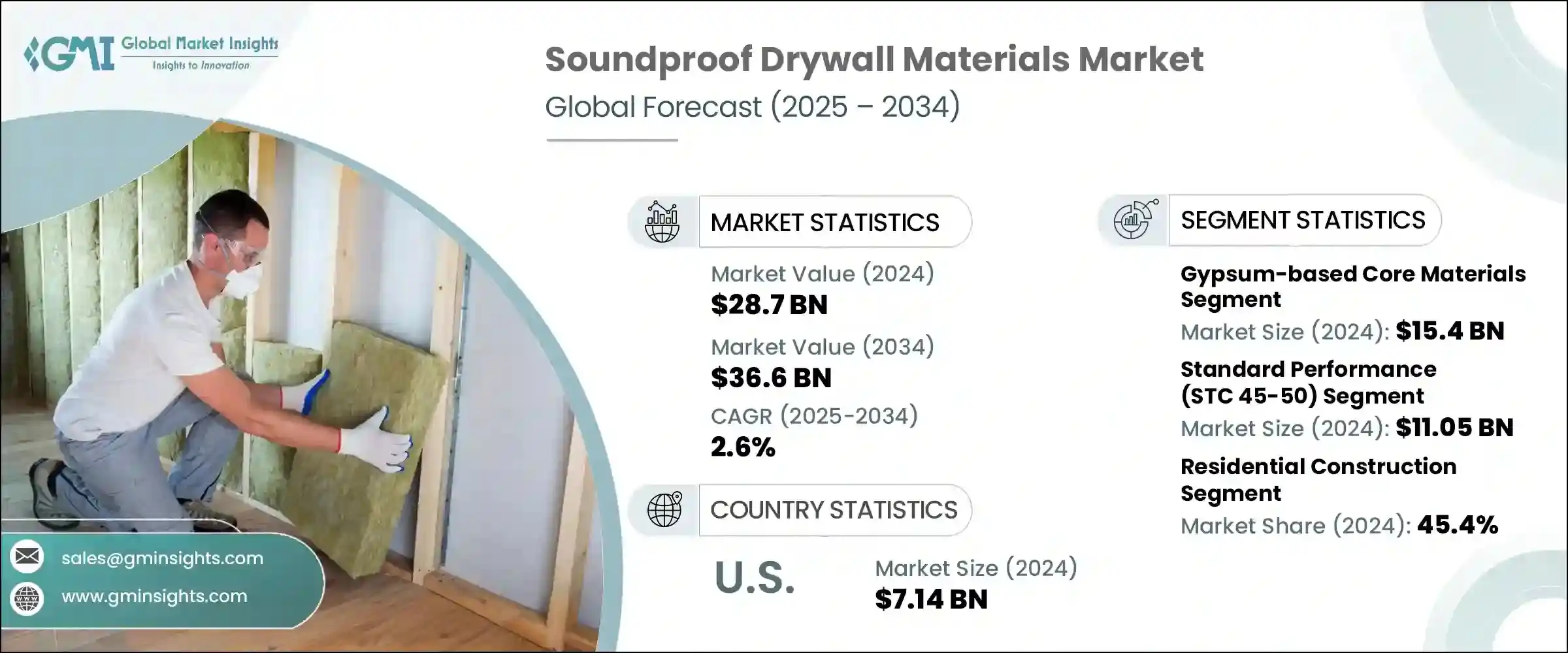

2024 年全球隔音石膏板材料市場規模達 287 億美元,預計到 2034 年將以 2.6% 的複合年成長率成長,達到 366 億美元。這一成長主要源於城市噪音水平的上升以及人們對聲學舒適度日益成長的認知。隨著城市擴張和城鎮化進程的加快,交通堵塞、工業活動和人口密集的住宅區產生的噪音污染顯著增加。這推動了對更優質建築聲學解決方案的需求,使得隔音石膏板材料成為屋主和建築商的首選。如今,消費者更加重視生活和工作環境,這轉化為對更安靜室內空間的需求。這種趨勢在大都市地區尤其明顯,因為噪音干擾是人們日常關注的問題,促使房地產開發商在其建築項目中優先考慮隔音措施。

商業房地產也推動了隔音石膏板需求的成長,因為建築物業主意識到噪音控制對員工生產力和客戶滿意度的影響。辦公室、醫療中心、飯店和教育機構正在增加對先進石膏板材料的投資,以改善室內聲環境。建築業的公司正在調整其產品以滿足不斷變化的聲學需求。開發商不僅將隔音石膏板融入新項目,還使用改進的材料改造現有建築結構,以適應不斷變化的建築標準和消費者期望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 287億美元 |

| 預測值 | 366億美元 |

| 複合年成長率 | 2.6% |

就材料而言,石膏基芯牆繼續佔據市場主導地位。該細分市場在2024年的市值為154億美元,預計在預測期內的複合年成長率為1.8%。其受歡迎程度源自於其成本效益和易於安裝的特性。然而,為了保持競爭力並滿足日益成長的市場預期,製造商正在透過提高吸音和防火性能來增強這些材料的性能。這些創新有助於維持石膏基芯牆作為住宅和商業建築主流解決方案的需求。

從性能角度來看,標準隔音等級 (STC) 45-50 的石膏板仍然被廣泛使用,尤其是在成本效益至關重要的專案中。 2024 年,該類別的市值為 110.5 億美元,預計 2025 年至 2034 年的複合年成長率將達到 1.3%。儘管對這種標準隔音等級的需求保持穩定,但許多應用領域明顯轉向了更高性能的石膏板。 STC 等級提升至 51-55 的石膏板正日益受到青睞,尤其是在公寓大樓、辦公空間和翻新工程中。它在成本和性能之間實現了最佳平衡,對於希望在不大幅增加成本的情況下提升聲學性能的開發人員來說,它是一個理想的選擇。

住宅建築業佔據全球市場最大佔有率,2024年價值將達130億美元。預計到2034年,該領域將以2.9%的複合年成長率擴張,佔據45.4%的市佔率。城市住宅(尤其是高層公寓和多戶住宅)對噪音控制的需求不斷成長,是推動這一趨勢的主要因素。隨著屋主越來越重視舒適度和幸福感,住宅項目擴大在牆壁、天花板和隔間中使用隔音石膏板。

在美國,隔音石膏板材料市場規模在2024年達到71.4億美元,預計2025年至2034年的複合年成長率將達到2.3%。這一成長主要源於家庭和工作場所對聲學舒適度日益成長的需求。城市人口的成長、人們對噪音健康影響的認知的提高以及主要州嚴格的建築規範,促使承包商採用高STC等級的石膏板產品。此外,遠距辦公模式的持續普及也增加了對更安靜的家庭辦公環境的需求,從而進一步刺激了對隔音石膏板解決方案的需求。

隔音石膏板材料市場的頂級製造商憑藉著持續創新、規模化生產和結構完善的分銷體系,保持著領先地位。這些公司持續投入研發,致力於開發具有卓越隔音、防潮和防火性能的石膏板解決方案。他們能夠提供全面的牆體系統,這使其在住宅和商業建築領域都擁有競爭優勢。為了確保早期產品規格,這些公司積極與建築師、建築商和承包商合作。他們還支持採用符合綠色建築標準的環保認證建築材料。透過提供技術支援、安裝人員培訓計畫和精準的行銷策略,他們持續引領市場趨勢,並鞏固其在全球隔音石膏板材料產業的主導地位。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 石膏基芯材

- 標準密度石膏

- 高密度石膏

- 輕質石膏配方

- 黏彈性阻尼材料

- 聚合物基阻尼化合物

- 瀝青阻尼材料

- 混合阻尼系統

- 隔音膜與隔音屏障

- 質量負載乙烯基(MLV)

- 聚合物聲學膜

- 複合阻隔材料

- 加固和飾面材料

- 紙面材料

- 玻璃纖維氈飾面

- 非織物合成布料

- 添加劑和性能增強劑

- 阻燃添加劑

- 防潮添加劑

- 聲學性能增強劑

第6章:市場估計與預測:依性能等級,2021-2034

- 主要趨勢

- 標準性能(STC 45-50)

- 增強效能(STC 51-55)

- 高性能(STC 56-60)

- 卓越性能(STC 60+)

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 住宅建築

- 室內隔牆

- 地板-天花板組件

- 外牆系統

- 商業建築

- 辦公大樓和企業設施

- 飯店及餐飲業

- 零售和娛樂場所

- 制度建設

- 醫療保健設施

- 教育建築

- 政府及市政建築

- 工業和專業應用

- 生產設施

- 資料中心和技術大樓

- 錄音室和劇院

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- 3A Composites Holding AG

- 3M Company

- Acoustical Surfaces, Inc.

- American Gypsum

- Continental Building Products

- Dow Inc.

- Georgia-Pacific LLC

- Guardian Building Products

- Henkel AG & Co. KGaA

- Johns Manville (Berkshire Hathaway)

- Kinetics Noise Control, Inc.

- Knauf Group

- National Gypsum Company

- Owens Corning

- PABCO Gypsum

- Rockwool International A/S

- RPG Acoustical Systems

- Saint-Gobain (Gyproc/CertainTeed)

- Sika AG

- Trademark Soundproofing

- USG Corporation (Berkshire Hathaway)

The Global Soundproof Drywall Materials Market was valued at USD 28.7 billion in 2024 and is estimated to grow at a CAGR of 2.6% to reach USD 36.6 billion by 2034. This growth is largely driven by the rising levels of urban noise and the growing awareness around acoustic comfort. As cities expand and urbanization intensifies, noise pollution from heavy traffic, industrial activities, and densely packed residential zones has significantly increased. This has fueled the need for better acoustic solutions in buildings, making soundproof drywall materials a preferred choice among homeowners and builders alike. Consumers today are more conscious of their living and working environments, which has translated into a demand for quieter interiors. The trend is particularly strong in metropolitan areas where noise intrusion is a daily concern, prompting real estate developers to prioritize soundproofing in their construction projects.

Commercial properties are also contributing to the growing demand for soundproof drywall, as building owners recognize the impact of noise control on employee productivity and customer satisfaction. Offices, healthcare centers, hospitality facilities, and educational institutions are increasingly investing in advanced drywall materials to improve interior sound environments. Companies in the construction industry are adapting their offerings to meet these evolving acoustic requirements. Developers are not only integrating soundproof drywall into new projects but are also retrofitting existing structures with improved materials to stay aligned with changing building standards and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.7 billion |

| Forecast Value | $36.6 billion |

| CAGR | 2.6% |

In terms of material, gypsum-based core drywall continues to dominate the market. This segment was valued at USD 15.4 billion in 2024 and is expected to grow at a CAGR of 1.8% during the forecast period. Its popularity stems from its cost-effectiveness and ease of installation. However, to stay competitive and cater to rising expectations, manufacturers are enhancing these materials by incorporating better sound absorption and fire-resistance features. These innovations are helping maintain the demand for gypsum-based cores as a mainstream solution in both residential and commercial construction.

From a performance standpoint, the standard sound transmission class (STC) 45-50 segment remains widely used, especially in projects where cost efficiency is a key factor. This category was valued at USD 11.05 billion in 2024 and is set to grow at a CAGR of 1.3% from 2025 to 2034. Although demand for this standard level of soundproofing remains steady, there is a visible shift toward higher-performance drywall in many applications. Drywall with an improved STC rating of 51-55 is gaining traction, particularly in apartment buildings, office spaces, and renovation projects. It offers an optimal balance between cost and performance, making it a favorable choice for developers looking to boost acoustic performance without significantly raising costs.

The residential construction sector accounted for the largest share of the global market, reaching a value of USD 13 billion in 2024. This segment is expected to expand at a CAGR of 2.9% through 2034, securing a 45.4% share of the market. Rising demand for noise control in urban housing, particularly in high-rise apartments and multi-family units, is a major factor driving this trend. With homeowners placing greater emphasis on comfort and well-being, residential projects are increasingly incorporating soundproof drywall into walls, ceilings, and partitions.

In the United States, the soundproof drywall materials market stood at USD 7.14 billion in 2024 and is anticipated to witness a CAGR of 2.3% from 2025 to 2034. This growth is fueled by the increasing importance of acoustic comfort in both homes and workplaces. Growing urban populations, higher awareness of the health effects of noise, and strict building codes in key states are prompting contractors to adopt drywall products with high STC ratings. Additionally, the continued adoption of remote work practices has increased the need for quieter home office environments, further boosting demand for acoustic drywall solutions.

Top manufacturers in the soundproof drywall materials market maintain their leadership by focusing on continuous innovation, large-scale production, and well-structured distribution systems. These companies are consistently investing in R&D to develop drywall solutions that offer enhanced acoustic, moisture, and fire-resistance properties. Their ability to deliver comprehensive wall systems gives them a competitive edge in both residential and commercial construction segments. To secure early product specifications, these players actively collaborate with architects, builders, and contractors. They also support the adoption of eco-friendly and certified building materials in line with green construction standards. By offering technical support, installer training programs, and targeted marketing strategies, they continue to shape market preferences and uphold their dominance in the global soundproof drywall materials industry.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Performance Class

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Gypsum-based core materials

- 5.2.1 Standard density gypsum

- 5.2.2 High-density gypsum

- 5.2.3 Lightweight gypsum formulations

- 5.3 Viscoelastic damping materials

- 5.3.1 Polymer-based damping compounds

- 5.3.2 Bituminous damping materials

- 5.3.3 Hybrid damping systems

- 5.4 Acoustic membranes and barriers

- 5.4.1 Mass-loaded vinyl (MLV)

- 5.4.2 Polymer acoustic membranes

- 5.4.3 Composite barrier materials

- 5.5 Reinforcement and facing materials

- 5.5.1 Paper facing materials

- 5.5.2 Fiberglass mat facing

- 5.5.3 Non-woven synthetic facings

- 5.6 Additives and performance enhancers

- 5.6.1 Fire retardant additives

- 5.6.2 Moisture resistance additives

- 5.6.3 Acoustic performance enhancers

Chapter 6 Market Estimates & Forecast, By Performance Class, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Standard performance (STC 45-50)

- 6.3 Enhanced performance (STC 51-55)

- 6.4 High performance (STC 56-60)

- 6.5 Premium performance (STC 60+)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Interior partition walls

- 7.2.2 Floor-ceiling assemblies

- 7.2.3 Exterior wall systems

- 7.3 Commercial construction

- 7.3.1 Office buildings and corporate facilities

- 7.3.2 Hotels and hospitality

- 7.3.3 Retail and entertainment venues

- 7.4 Institutional construction

- 7.4.1 Healthcare facilities

- 7.4.2 Educational buildings

- 7.4.3 Government and municipal buildings

- 7.5 Industrial and specialty applications

- 7.5.1 Manufacturing facilities

- 7.5.2 Data centers and technical buildings

- 7.5.3 Recording studios and theaters

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3A Composites Holding AG

- 9.2 3M Company

- 9.3 Acoustical Surfaces, Inc.

- 9.4 American Gypsum

- 9.5 Continental Building Products

- 9.6 Dow Inc.

- 9.7 Georgia-Pacific LLC

- 9.8 Guardian Building Products

- 9.9 Henkel AG & Co. KGaA

- 9.10 Johns Manville (Berkshire Hathaway)

- 9.11 Kinetics Noise Control, Inc.

- 9.12 Knauf Group

- 9.13 National Gypsum Company

- 9.14 Owens Corning

- 9.15 PABCO Gypsum

- 9.16 Rockwool International A/S

- 9.17 RPG Acoustical Systems

- 9.18 Saint-Gobain (Gyproc/CertainTeed)

- 9.19 Sika AG

- 9.20 Trademark Soundproofing

- 9.21 USG Corporation (Berkshire Hathaway)