|

市場調查報告書

商品編碼

1773435

彈性輸液幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Elastomeric Infusion Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

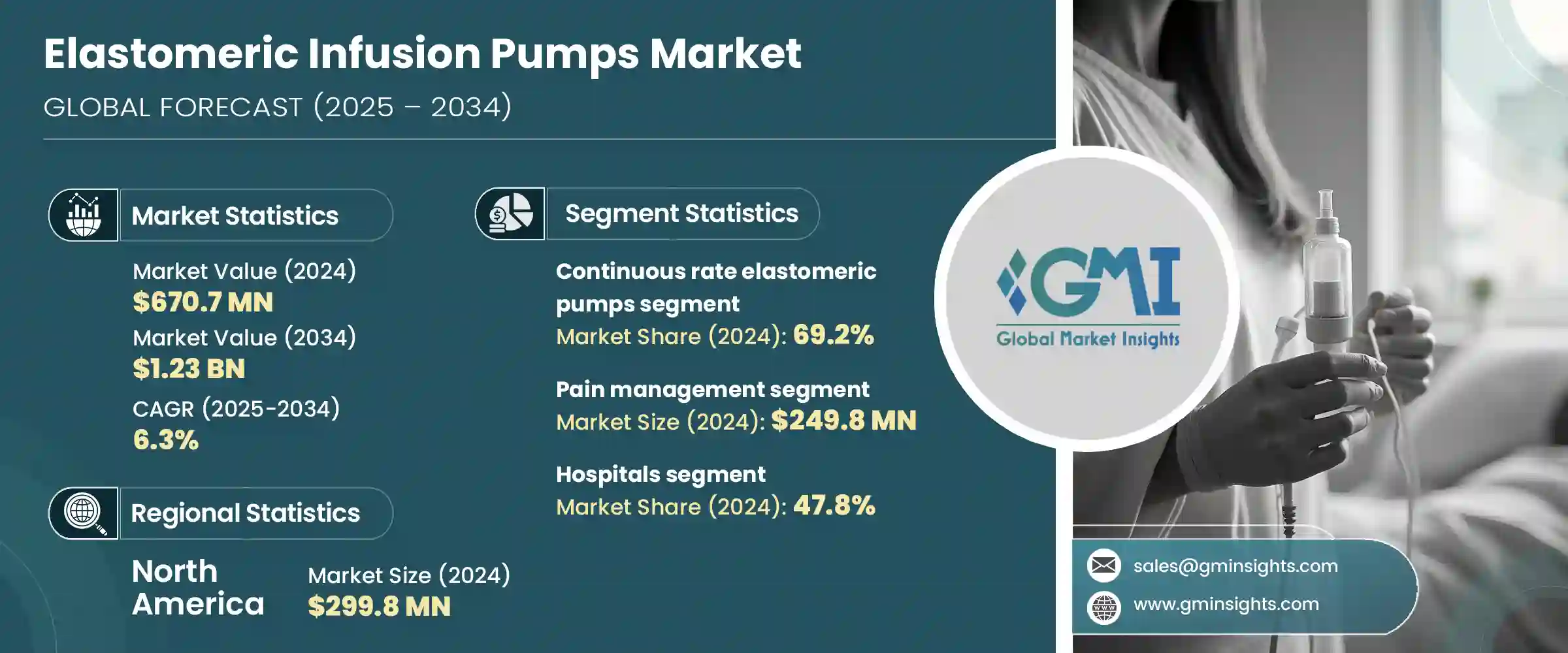

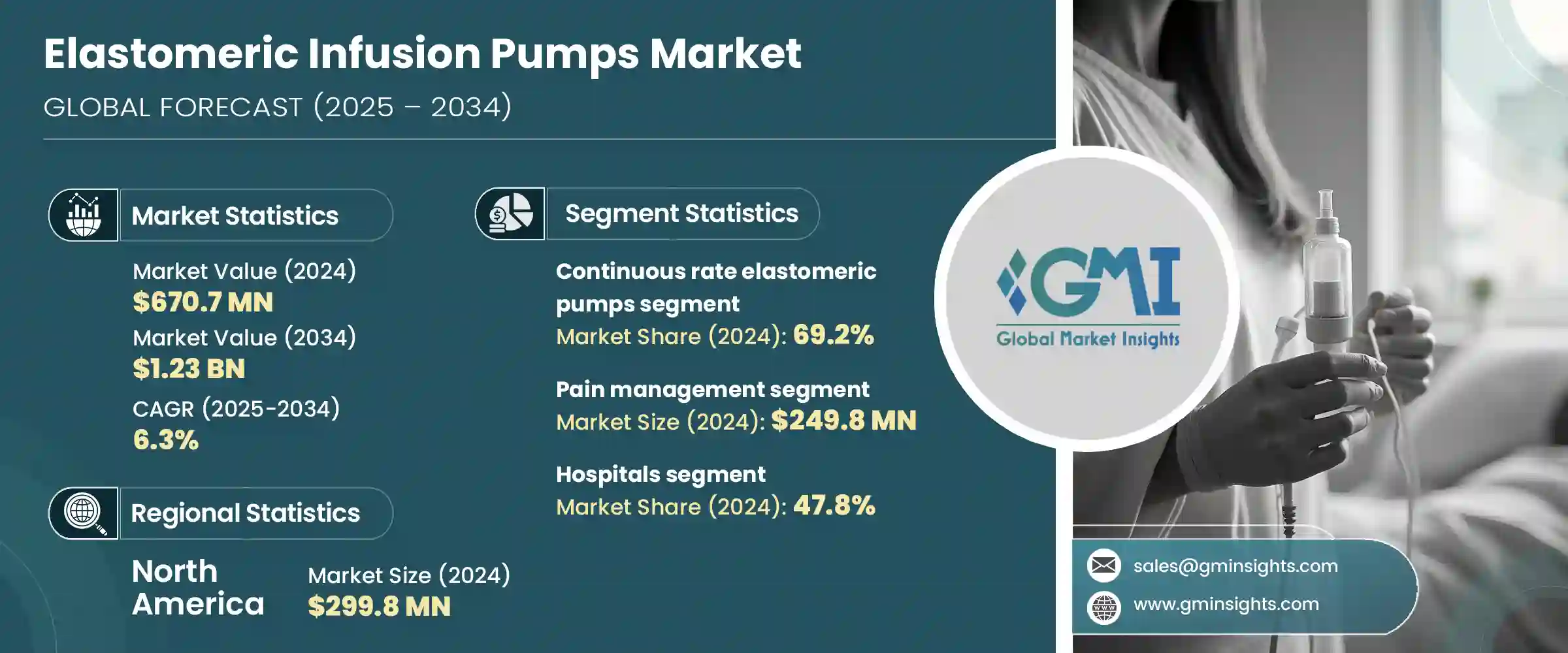

2024年,全球彈性輸液幫浦市場規模達6.707億美元,預估年複合成長率為6.3%,到2034年將達到12.3億美元。居家照護和門診服務日益普及,這持續重塑著醫療保健服務模式,減少了對長期住院的依賴,並降低了醫療成本。彈性輸液幫浦憑藉其方便用戶使用、無需用電的操作和可靠的藥物輸送,已成為推動這一轉變的關鍵因素。這些一次性設備廣泛用於在醫院以外的場所注射抗生素、化療藥物和止痛藥。

慢性病病例的增加、持續用藥的需求以及家庭輸液治療的興起,都推動了此類輸液幫浦的需求成長。其便攜性和易用性,加上患者對家庭護理的偏好日益成長以及就診次數的減少,使得彈性輸液泵在現代治療方案中佔據重要地位。疫情過後,人們對基於價值的照護和患者獨立性的持續重視,正在推動其長期需求,尤其是在癌症、自體免疫疾病和地中海貧血等需要頻繁輸液的疾病領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.707億美元 |

| 預測值 | 12.3億美元 |

| 複合年成長率 | 6.3% |

隨著家庭護理治療的日益普及,醫療保健提供者擴大使用彈性泵來輸送化療、免疫療法和鐵螯合療法的藥物。這些幫浦無需複雜的機械裝置即可維持穩定的藥物水平,非常適合居家治療,尤其是在患者監測受限的情況下。居家輸液解決方案現已成為管理長期疾病的標準方案之一,尤其是在患者尋求更多自主性和舒適性的情況下。這些幫浦也已被證明對門診治療有益,使醫療保健專業人員能夠支持護理的連續性,同時最大限度地減少醫院資源。它們的一次性使用特性也符合感染控制規範,使其成為患者和臨床醫生的便利選擇。

2024年,持續速率彈性幫浦市場佔有69.2%的佔有率。這些幫浦提供可靠、不間斷的藥物輸注,對於在慢性病管理中維持穩定的治療水準至關重要。無論是控制感染、癌症症狀或疼痛,恆定的流速都能減少給藥錯誤,並幫助患者堅持遵醫囑服藥。無需電力或程式即可運行,使這些幫浦可供廣大患者使用,尤其是居家治療的患者。其簡便性有助於提高依從性,培養患者獨立性,並減輕護理人員和臨床醫生的工作負擔。長期治療中對可預測給藥方案的需求日益成長,也進一步增強了人們對這些幫浦的青睞。

2024年,疼痛管理細分市場規模達2.498億美元。微創手術和增強型復健方案的廣泛應用,進一步強化了對術後有效疼痛控制的重視。彈性輸注裝置常用於持續給藥局部麻醉藥或鴉片類止痛藥,確保持續緩解疼痛,無需依賴電子設備。其便攜性使其能夠在門診護理中心和門診手術環境中部署,從而支持快速出院和更快的康復時間。彈性泵的簡便性和有效性,使其在全球範圍內繼續成為強化術後護理策略的一部分。

預計到2034年,美國彈性輸液幫浦市場規模將達到5.047億美元,這得益於美國民眾日益青睞門診治療模式和高效的出院後照護。過去僅限於住院的醫療程序,如今擴大透過門診中心和家庭保健服務進行管理。彈性輸液幫浦憑藉其便攜性、安全性和易用性,在這轉變過程中發揮關鍵作用。它們常用於緩解疼痛、化療和抗生素給藥。美國的報銷框架,包括醫療保險對耐用醫療設備的覆蓋,增強了醫療機構在家庭輸液項目中採用這些設備的商業理由。在強力的政策推動下,這些輸液幫浦致力於縮短住院時間和提高護理效率,能夠為醫療機構提供支持,使其與價值導向模式保持一致。

全球彈性輸液幫浦市場的領導者包括 ICU Medical、Ambu、Terumo、Baxter、B. Braun、Woo Young Medical、Nipro、Avanos、Smiths Medical、ACE Medical、Halyard、JMS、Leventon、KB Medical 和 Fresenius Kabi。彈性輸液幫浦市場的主要企業正在大力投資產品創新,以提高輸液幫浦的準確性、舒適度以及居家和門診病患使用的安全性。

各公司正致力於拓展家用輸液產品線,提供多樣化的流量選擇、防篡改設計和更符合人體工學的設計。與醫療保健提供者和家庭健康機構的策略合作正幫助企業加強分銷網路,拓寬病患用藥管道。許多企業也在最佳化生產流程,以保持產品價格合理和可擴展性。此外,各公司也正在申請國際監管部門的批准,以進入尚未開發的地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 擴大採用門診和家庭護理

- 癌症和地中海貧血等慢性病發生率上升

- 成本效益高,不依賴電力或電池

- 泵浦設計和材料技術的進步

- 產業陷阱與挑戰

- 限制體積和流量控制

- 劑量錯誤的風險

- 市場機會

- 攜帶式輸液幫浦在門診化療的應用日益增多

- 對生物相容性和環保材料的需求不斷增加

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 報銷場景

- 報銷政策對市場成長的影響

- 未來市場趨勢

- 消費者行為分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 連續速率彈性泵

- 可變速率彈性泵

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 疼痛管理

- 化療

- 抗生素輸送

- 抗病毒治療

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ACE Medical

- Ambu

- Avanos

- B. Braun

- Baxter

- Fresenius Kabi

- Halyard

- ICU Medical

- JMS

- KB Medical

- Leventon

- Nipro

- Smiths Medical

- Terumo

- Woo Young Medical

The Global Elastomeric Infusion Pumps Market was valued at USD 670.7 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.23 billion by 2034. The increasing shift toward home-based care and outpatient services continues to reshape the healthcare delivery model, reducing reliance on prolonged hospital admissions and lowering healthcare costs. Elastomeric infusion pumps have become a key enabler of this transition due to their user-friendly, power-free operation and reliable drug delivery. These disposable devices are widely used for administering antibiotics, chemotherapeutic agents, and pain-relief medications in settings beyond the hospital environment.

Rising chronic illness cases, the need for continuous medication delivery, and the growth in home infusion therapy have all contributed to the increasing demand for these pumps. Their portability and ease of use, coupled with growing patient preferences for home care options and fewer clinic visits, have established elastomeric infusion pumps as an asset in modern treatment protocols. The continued emphasis on value-based care and patient independence post-pandemic is driving long-term demand, especially for conditions requiring frequent infusions like cancer, autoimmune disorders, and thalassemia.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $670.7 Million |

| Forecast Value | $1.23 Billion |

| CAGR | 6.3% |

As homecare treatment becomes more prevalent, healthcare providers are increasingly using elastomeric pumps to deliver medication for chemotherapy, immunotherapy, and iron chelation therapy. The ability to maintain steady medication levels without complicated machinery makes these pumps well-suited for home-based therapies, particularly in cases where patient monitoring is limited. Home infusion solutions are now part of standard protocols for managing long-term diseases, especially as patients seek more autonomy and comfort. These pumps are also proving beneficial for outpatient treatments, enabling healthcare professionals to support continuity of care while minimizing hospital resources. Their disposable nature also aligns with infection control practices and makes them a convenient choice for patients and clinicians alike.

In 2024, the continuous rate elastomeric pumps segment held a 69.2% share. These pumps offer reliable, uninterrupted drug infusion, vital for maintaining stable therapeutic levels in chronic care management. Whether managing infections, cancer symptoms, or pain, a constant flow rate reduces dosing errors and helps patients remain compliant with prescribed regimens. The ability to function without electricity or programming makes these pumps accessible to a broad patient population, especially those receiving treatment at home. Their simplicity encourages adherence, fosters patient independence, and lowers the workload on caregivers and clinicians. The preference for these pumps is also reinforced by the growing demand for predictable dosing schedules in long-term therapies.

The pain management segment accounted for USD 249.8 million in 2024. The widespread adoption of minimally invasive surgeries and enhanced recovery protocols has intensified the focus on efficient post-operative pain control. Elastomeric infusion devices are frequently used to administer continuous doses of local anesthetics or opioid-based analgesics, ensuring consistent pain relief without reliance on electronic devices. Their portability enables deployment in ambulatory care centers and outpatient surgery settings, supporting rapid discharges and faster recovery timelines. The simplicity and effectiveness of elastomeric pumps continue to drive their use as part of enhanced post-surgical care strategies globally.

United States Elastomeric Infusion Pumps Market is projected to reach USD 504.7 million by 2034, supported by the nation's growing preference for outpatient treatment models and efficient post-discharge care. Procedures once confined to inpatient settings are now increasingly managed through ambulatory centers and home health services. Elastomeric infusion pumps are playing a key role in this transition by offering portability, safety, and ease of use. They are regularly utilized for pain relief, chemotherapy, and antibiotic administration. U.S. reimbursement frameworks, including Medicare's coverage for durable medical equipment, have strengthened the business case for providers to adopt these devices across home infusion programs. With a strong policy push toward reducing hospitalization durations and increasing care efficiency, these pumps are well-positioned to support healthcare institutions as they align with value-based models.

Leading players in the Global Elastomeric Infusion Pumps Market include ICU Medical, Ambu, Terumo, Baxter, B. Braun, Woo Young Medical, Nipro, Avanos, Smiths Medical, ACE Medical, Halyard, JMS, Leventon, KB Medical, and Fresenius Kabi. Key players in the elastomeric infusion pumps market are investing heavily in product innovation to enhance pump accuracy, comfort, and safety for patients in home and outpatient settings.

Companies are focusing on expanding their home infusion product lines with versatile flow-rate options, tamper-evident designs, and better ergonomic features. Strategic collaborations with healthcare providers and home health agencies are helping firms strengthen their distribution networks and broaden patient access. Many players are also optimizing manufacturing processes to maintain product affordability and scalability. Alongside this, companies are obtaining international regulatory approvals to enter untapped regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of ambulatory and home-based care

- 3.2.1.2 Rising prevalence of chronic diseases such as cancer and thalassemia

- 3.2.1.3 Cost-effectiveness and non-dependence on electricity or batteries

- 3.2.1.4 Advancements in pump design and material technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited volume and flow rate control

- 3.2.2.2 Risk of dosing errors

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoptions of portable infusion pumps in outpatient chemotherapy

- 3.2.3.2 Increasing demand for biocompatible and eco-friendly materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Future market trends

- 3.9 Consumer behaviour analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous rate elastomeric pumps

- 5.3 Variable rate elastomeric pumps

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pain management

- 6.3 Chemotherapy

- 6.4 Antibiotic delivery

- 6.5 Antiviral treatment

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACE Medical

- 9.2 Ambu

- 9.3 Avanos

- 9.4 B. Braun

- 9.5 Baxter

- 9.6 Fresenius Kabi

- 9.7 Halyard

- 9.8 ICU Medical

- 9.9 JMS

- 9.10 KB Medical

- 9.11 Leventon

- 9.12 Nipro

- 9.13 Smiths Medical

- 9.14 Terumo

- 9.15 Woo Young Medical