|

市場調查報告書

商品編碼

1773432

工業木箱市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Wooden Crates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

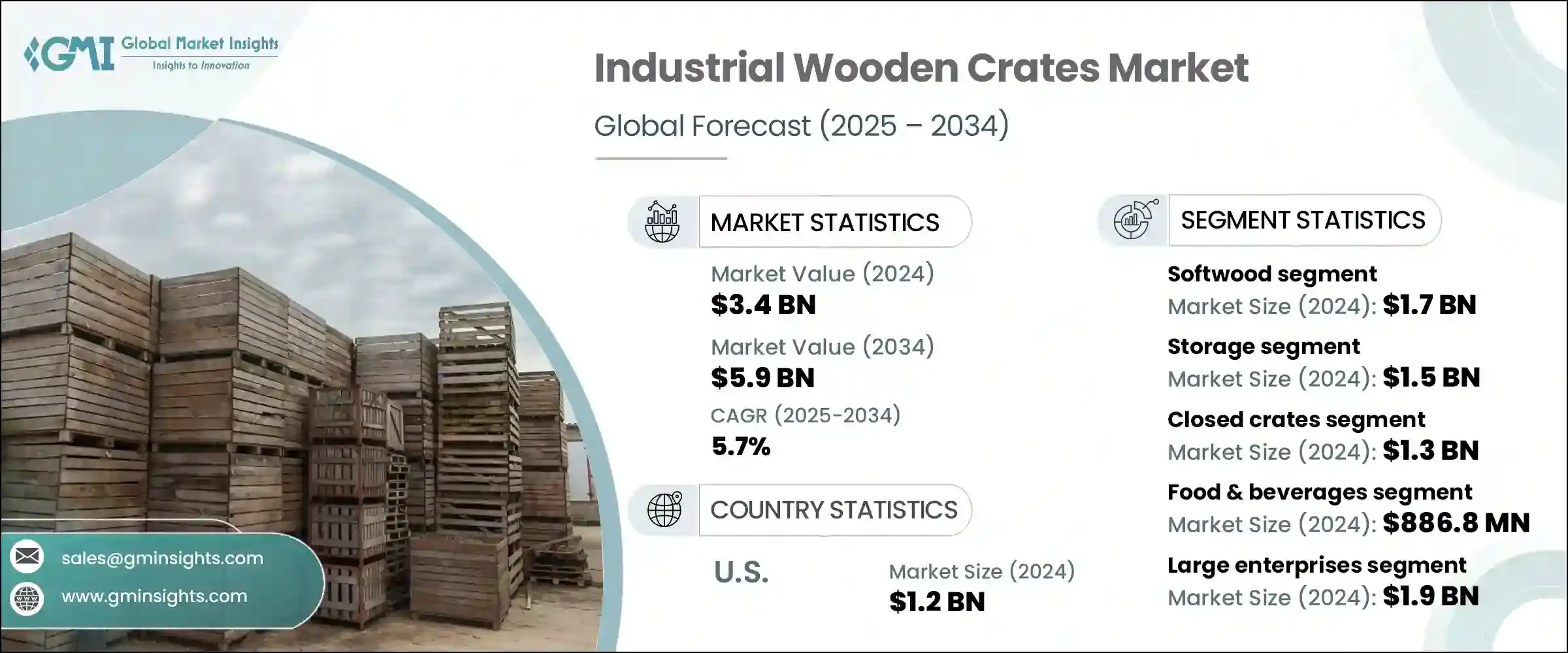

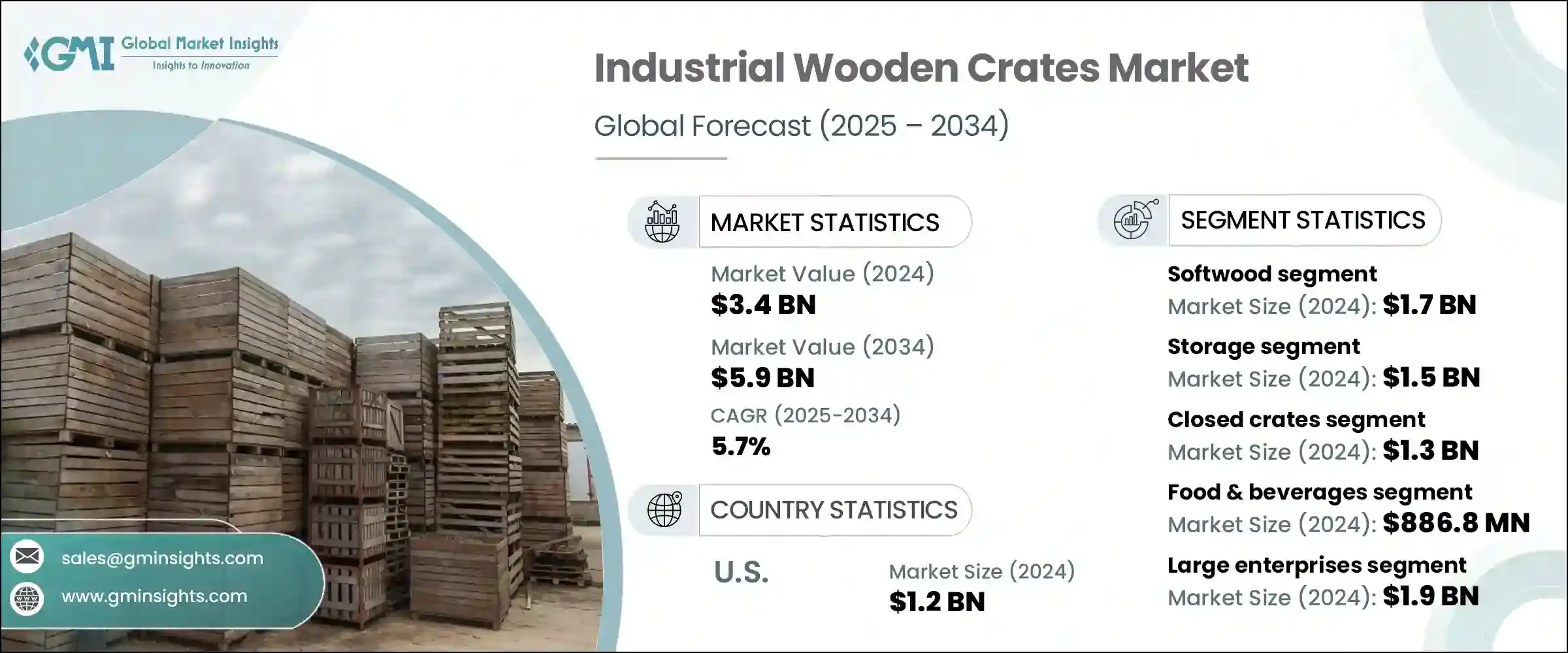

2024年,全球工業木質包裝箱市場價值為34億美元,預計到2034年將以5.7%的複合年成長率成長,達到59億美元。工業木質包裝箱市場的成長可歸因於幾個關鍵因素,包括全球貿易和出口業務的激增,尤其是在農業、汽車和工業機械等行業。在這些行業中,木質包裝箱對於貨物的安全高效處理至關重要。

另一個因素是人們對永續包裝解決方案的日益青睞,木質包裝箱因其可回收和可生物分解的特性而越來越受歡迎。此外,企業正大力選擇環保包裝材料,以減少碳足跡,也推動了木質包裝箱的需求。木質包裝箱和包裝箱生產者物價指數 (PPI) 的上漲也使製造商受益,這表明越來越多的客戶願意為高品質的包裝解決方案支付溢價。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 5.7% |

這一趨勢凸顯了人們日益重視確保產品安全可靠地運輸,從而降低運輸過程中損壞的風險。隨著供應鏈日益複雜和全球化,企業越來越意識到使用包裝解決方案的重要性,這些解決方案不僅能保護產品,還能提升整體客戶體驗。隨著各行各業競爭的加劇,人們對包裝的耐用性和高效性的期望也日益成長,最終能夠保障產品的完整性,並避免代價高昂的損失。

2024年,軟木市場產值達17億美元。松木、冷杉和雲杉等軟木品種因其豐富、價格實惠且重量輕而佔據市場主導地位,是生產木質板條箱的理想選擇。美國農業部 (USDA) 報告稱,軟木供應持續強勁,尤其是來自美國南部的供應,確保了板條箱製造商的穩定原料供應。

運輸業是市場中成長最快的領域,預計到2034年複合年成長率將達到6.1%。木質包裝箱因其耐用性和在運輸過程中保持產品品質的能力而成為貨物運輸的首選,尤其是新鮮農產品。隨著全球對新鮮農產品需求的不斷成長,對木質包裝箱等可靠高效的包裝解決方案的需求也在不斷成長。

美國工業木箱市場在2024年創造了12億美元的產值,這得益於其完善的物流基礎設施和日益成長的環保包裝需求。美國林務局也指出,硬木供應的改善為木箱製造商提供了穩定的原料供應。此外,美國農業部批准農產品出口使用木質包裝,進一步推動了美國對工業木箱的需求。

工業木箱產業的主要參與者包括 Brambles Limited (CHEP)、Greif Inc.、Interlake Mecalux、Poole & Sons 和 Universal Forest Products Inc.。為了鞏固市場地位,工業木箱市場的公司正致力於提高產能並拓展原料供應鏈。與物流和運輸公司建立策略夥伴關係及合作,正在增強其分銷網路,確保及時交付和擴大市場覆蓋範圍。此外,製造商正在投資永續生產實踐,採用環保材料,並遵守不斷發展的環境法規,這使其在注重環保的市場中佔據有利地位。為了滿足日益成長的需求,該公司還透過開發針對特定行業(例如農業、汽車和製藥)需求的客製化包裝解決方案來豐富其產品線。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 川普政府關稅政策的中斷

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 全球貿易和出口活動不斷增加

- 物流和倉儲產業的需求不斷成長

- 木質包裝的永續性和可回收性

- 重型機械和汽車運輸中的使用增加

- 成本效益和高承載能力

- 產業陷阱與挑戰

- 木材價格波動與供應鏈波動

- 嚴格的農業生物安全規範和監管義務

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034年)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 打開箱子

- 封閉的板條箱

- 板條箱

- 訂製板條箱

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 軟木

- 松樹

- 雲杉

- 雪松

- 其他

- 硬木

- 橡木

- 楓

- 樺木

- 其他

- 工程木材

- 合板

- OSB(定向塑合板)

- 單板層積材

第7章:市場估計與預測:按功能,2021 - 2034 年

- 主要趨勢

- 貯存

- 運輸

- 國內物流

- 國際出口

第8章:市場估計與預測:按行業,2021 - 2034 年

- 主要趨勢

- 農業

- 製造業

- 食品和飲料

- 製藥

- 物流和運輸

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Brambles Limited (CHEP)

- C&K Box Company

- FoamCraft Packaging Inc

- Greif Inc.

- Herwood Inc

- Interlake Mecalux

- LJB Timber Packaging Pty

- Loscam Ltd.

- Nelson Company LLC

- Ongna Wood Products

- PalletOne Inc.

- PGS Group

- Poole & Sons

- Tree Brand Packaging

- Universal Forest Products Inc.

The Global Industrial Wooden Crates Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 5.9 billion by 2034. The growth of the industrial wooden crates market can be attributed to several key factors, including the surge in global trade and export operations, especially in sectors such as agriculture, automotive, and industrial machinery. In these industries, wooden crates are essential for the safe and efficient handling of goods.

Another contributing factor is the growing preference for sustainable packaging solutions, with wooden crates becoming increasingly appealing due to their recyclability and biodegradability. In addition, companies are making significant efforts to reduce their carbon footprints by opting for eco-friendly packaging materials, which is boosting demand for wooden crates. Manufacturers are also benefiting from the rise in the Producer Price Index (PPI) for wood boxes and crates, indicating a growing customer base willing to pay a premium for high-quality packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 5.7% |

This trend highlights the growing emphasis on ensuring that products are transported safely and securely, reducing the risks of damage during transit. As supply chains become more complex and global, businesses are recognizing the importance of using packaging solutions that not only protect their goods but also enhance the overall customer experience. With heightened competition in various industries, there is a growing expectation for packaging to offer both durability and efficiency, ultimately safeguarding the integrity of the product and preventing costly losses.

In 2024, the softwood segment generated USD 1.7 billion. Softwood varieties like pine, fir, and spruce dominate the market due to their abundance, affordability, and lightweight nature, making them ideal for use in wooden crate production. The U.S. Department of Agriculture (USDA) reports a continuous strong supply of softwood lumber, especially from the Southern U.S., ensuring a steady raw material flow for crate manufacturers.

The transportation sector is the fastest-growing segment in the market, expected to grow at a CAGR of 6.1% through 2034. Wooden crates are favored for transporting goods, particularly fresh produce, due to their durability and ability to maintain product quality during transit. As global demand for fresh produce increases, the need for reliable and efficient packaging solutions, like wooden crates, is also on the rise.

United States Industrial Wooden Crates Market generated USD 1.2 billion in 2024 due to its well-developed logistics infrastructure and growing focus on eco-friendly packaging. The U.S. Forest Service has also noted improved availability of hardwood, which supports a steady supply of raw materials for crate manufacturers. Additionally, the USDA's endorsement of wooden packaging for agricultural exports further drives the demand for industrial wooden crates in the country.

Key players in the Industrial Wooden Crates Industry include Brambles Limited (CHEP), Greif Inc., Interlake Mecalux, Poole & Sons, and Universal Forest Products Inc. To strengthen their market position, companies in the industrial wooden crates market are focusing on increasing their production capacity and expanding their raw material supply chains. Strategic partnerships and collaborations with logistics and transportation firms are enhancing their distribution networks, ensuring timely delivery and market reach. Moreover, manufacturers are investing in sustainable production practices, incorporating eco-friendly materials, and complying with evolving environmental regulations, which positions them favorably in an eco-conscious market. To meet the growing demand, companies are also diversifying their product offerings by developing custom packaging solutions tailored to specific industry needs, such as agriculture, automotive, and pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Product type trends

- 2.2.3 Material trends

- 2.2.4 Function trends

- 2.2.5 Industry trends

- 2.2.6 End use trends

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.2 Disruptions Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global trade and export activities

- 3.3.1.2 Growing demand from logistics and warehousing sectors

- 3.3.1.3 Sustainability and recyclability of wooden packaging

- 3.3.1.4 Increased use in heavy machinery and automotive shipments

- 3.3.1.5 Cost-effectiveness and high load-bearing capacity

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Fluctuating timber prices and supply chain volatility

- 3.3.2.2 Strict agricultural biosecurity norms and regulatory obligations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 Historical price analysis (2021-2024)

- 3.9.2 Price trend drivers

- 3.9.3 Regional price variations

- 3.9.4 Price forecast (2025-2034)

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Sustainability measures

- 3.13.1 Sustainable materials assessment

- 3.13.2 Carbon footprint analysis

- 3.13.3 Circular economy implementation

- 3.13.4 Sustainability certifications and standards

- 3.13.5 Sustainability ROI analysis

- 3.14 Global consumer sentiment analysis

- 3.15 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Open crates

- 5.3 Closed crates

- 5.4 Slatted crates

- 5.5 Customized crates

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Softwood

- 6.2.1 Pine

- 6.2.2 Spruce

- 6.2.3 Cedar

- 6.2.4 Other

- 6.3 Hardwood

- 6.3.1 Oak

- 6.3.2 Maple

- 6.3.3 Birch

- 6.3.4 Others

- 6.4 Engineered Wood

- 6.4.1 Plywood

- 6.4.2 OSB (Oriented Strand Board)

- 6.4.3 Laminated veneer lumber

Chapter 7 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Transportation

- 7.3.1 Domestic logistics

- 7.3.2 International export

Chapter 8 Market Estimates and Forecast, By Industry, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Agriculture

- 8.3 Manufacturing

- 8.4 Food and beverages

- 8.5 Pharmaceuticals

- 8.6 Logistics and shipping

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 Small & medium enterprises

- 9.3 Large enterprises

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Brambles Limited (CHEP)

- 11.2 C&K Box Company

- 11.3 FoamCraft Packaging Inc

- 11.4 Greif Inc.

- 11.5 Herwood Inc

- 11.6 Interlake Mecalux

- 11.7 LJB Timber Packaging Pty

- 11.8 Loscam Ltd.

- 11.9 Nelson Company LLC

- 11.10 Ongna Wood Products

- 11.11 PalletOne Inc.

- 11.12 PGS Group

- 11.13 Poole & Sons

- 11.14 Tree Brand Packaging

- 11.15 Universal Forest Products Inc.