|

市場調查報告書

商品編碼

1773431

導管穩定裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Catheter Stabilization Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

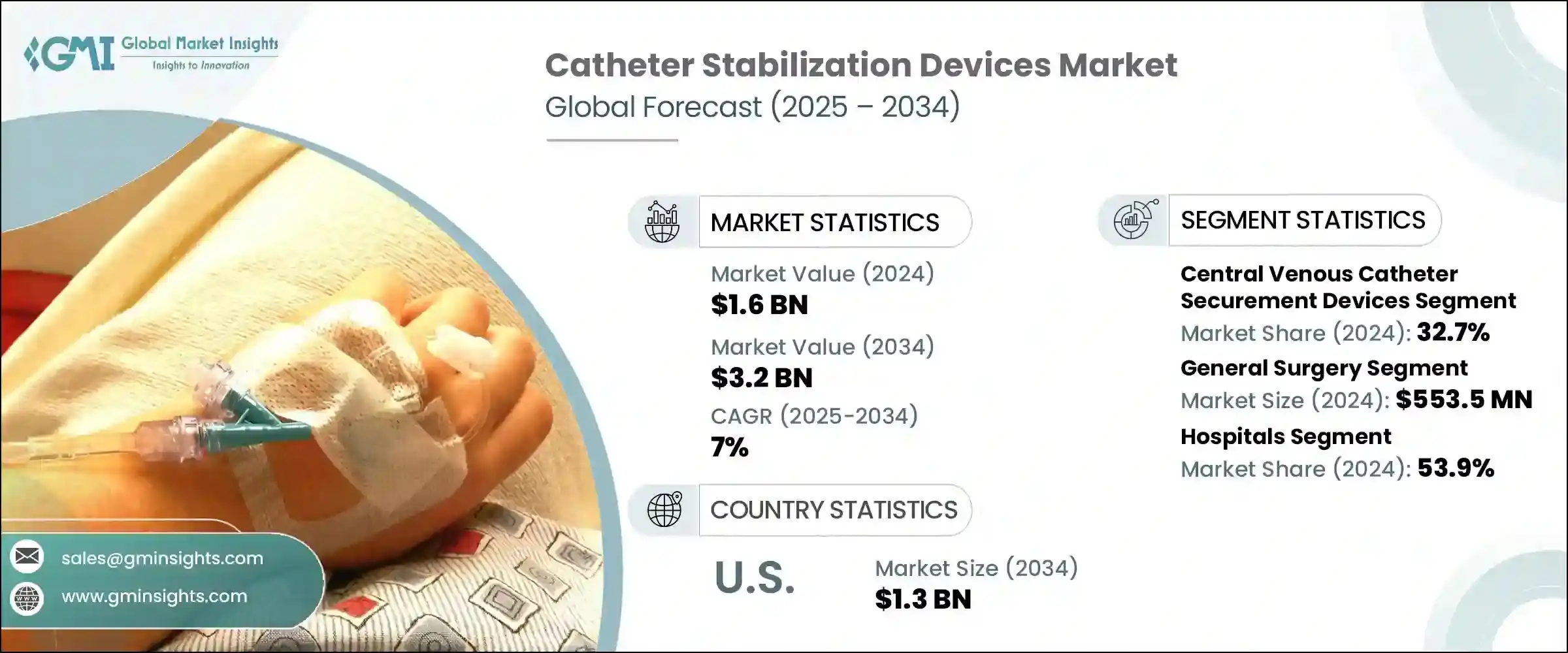

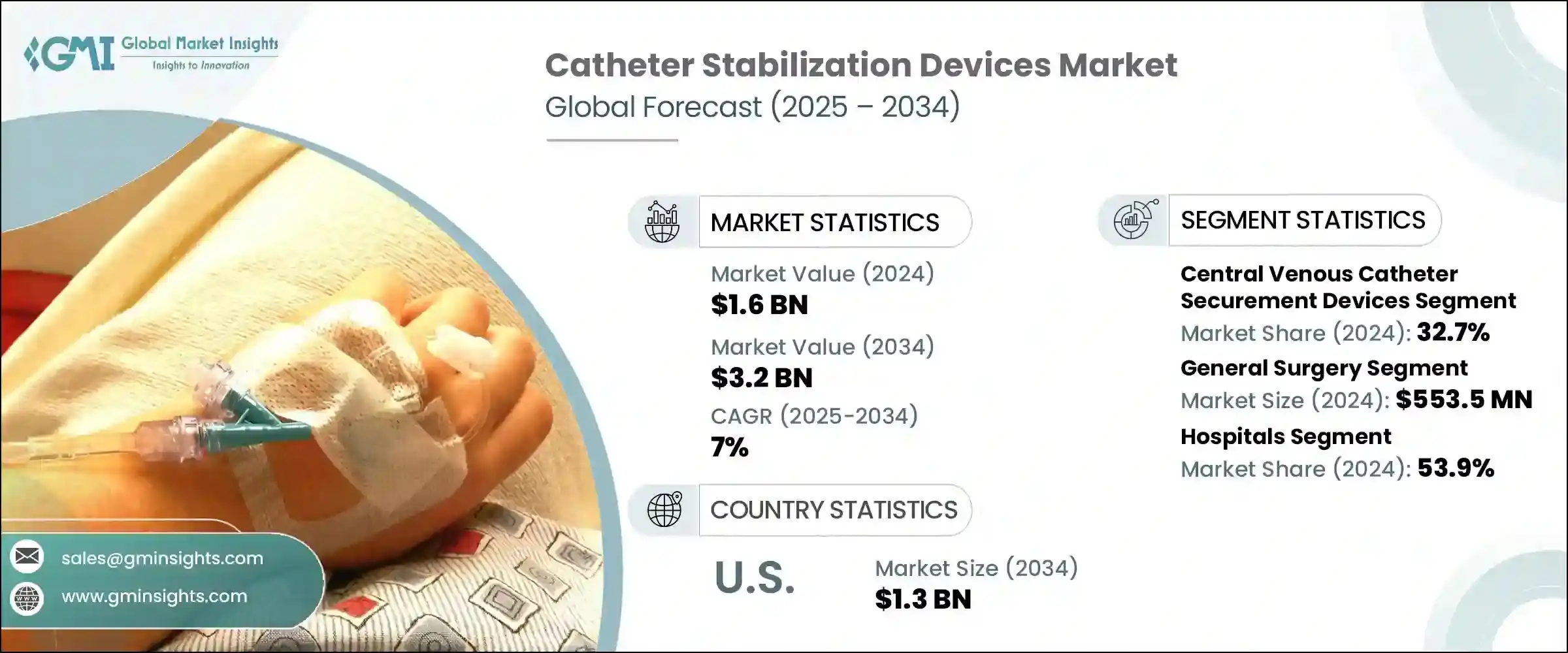

2024年,全球導管穩定裝置市場規模達16億美元,預計到2034年將以7%的複合年成長率成長,達到32億美元。導管穩定裝置是臨床護理中必不可少的工具,旨在將各種類型的導管牢固地固定在身體上,減少移動、防止移位並降低移位風險。這種穩定性不僅保護了患者,還能確保醫療治療的準確與不間斷。癌症、腎衰竭、糖尿病和心血管疾病等慢性疾病在全球的盛行率不斷上升,推動了臨床環境中對長期導管使用的需求。

此外,隨著感染控制在醫院中日益成為優先事項,人們越來越重視透過改進固定方法來預防導管相關感染。老年人群頻繁需要導管相關手術和家庭護理支持,這進一步促進了這個市場的擴張。老年人皮膚脆弱且易受感染,這加劇了對安全舒適的導管固定的需求。因此,對高品質、易於使用的穩定裝置的需求正在快速成長,尤其是在提供長期和居家醫療保健服務的機構中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 7% |

2024年,導管設備領域佔32.7%的市佔率。這些導管廣泛應用於重症監護、腫瘤科和急診,用於藥物給藥和營養支持等關鍵治療。隨著這些臨床領域對先進療法的需求不斷成長,固定裝置已成為最大程度減少併發症(例如由導管移動或污染引起的血流感染、心內膜炎和敗血症)的關鍵。為了降低這些風險,醫療機構和管理機構實施了更嚴格的感染控制規程,其中許多規程強制使用導管固定工具。這些監管變化正在推動固定裝置在多種護理環境中的普及。

2024年,一般外科手術市場規模達5.535億美元。導管在外科手術中被廣泛用於麻醉、體液監測和生命徵象追蹤。穩定裝置對於確保導管在手術和術後護理期間(尤其是在從手術室到恢復室的過渡期間)保持完整至關重要。醫院面臨降低中心靜脈導管相關血流感染和手術部位感染發生率的壓力,這些感染通常發生在外科手術過程中。這加劇了對符合醫院安全計畫並能改善手術效果的穩定解決方案的需求。

2024年,美國導管穩定裝置市場規模達6.675億美元,預計2034年將達到13億美元。美國各地慢性病病例的增加推動了導管治療的需求,進而推動了穩定裝置的普及。美國醫院遵守各醫療機構制定的嚴格安全法規,這些法規要求各機構採用標準化的感染控制措施。不遵守這些安全基準可能會導致報銷額度減少和經濟處罰,促使供應商投資於固定裝置。這些趨勢正使美國牢牢佔據全球導管穩定裝置領域關鍵成長區域的地位。

目前,BD、3M、Cardinal Health、ConvaTec 和 B. Braun 等公司佔據著該行業的主導地位,合計佔據約 65% 的市場佔有率。導管穩定裝置市場的領導者正在利用多種策略來提升其市場佔有率並確保長期成長。主要重點在於開發先進的、患者友善產品,以降低感染風險並提高使用便利性。

公司正在加強研發力度,以提供滿足特定醫療需求並適應老年人等弱勢患者群體的創新設計。透過合作夥伴關係、本地製造和策略性分銷協議進行地理擴張,有助於擴大其產品線的覆蓋範圍。監管合規性也是一個重點,因為公司需要與不斷發展的臨床標準保持一致,以提升機構信任。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 慢性病發生率不斷上升

- 全球人口老化

- 導管穩定技術的持續創新

- 固定裝置的成本效益

- 產業陷阱與挑戰

- 替代產品的可用性

- 嚴格的監管要求

- 市場機會

- 外科手術量增加

- 預防醫院內感染的需求日益成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 報銷場景

- 報銷政策對市場成長的影響

- 專利分析

- 波特的分析

- PESTEL分析

- 消費者行為分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 動脈固定裝置

- 中心靜脈導管固定裝置

- 周邊固定裝置

- 導尿管固定裝置

- 胸腔引流管固定裝置

- 其他產品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 心血管手術

- 一般外科

- 泌尿外科手術

- 腫瘤科手術

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B. Braun

- Baxter International

- Becton, Dickinson and Company

- Cardinal Health

- Centurion Medical Products

- ConvaTec

- Dale Medical Products

- DeRoyal Industries

- Merit Medical Systems

- Pepper Medical

- Smiths Medical

- TIDI Products

- VYGON

- Zibo Qichuang Medical Products

- 3M

The Global Catheter Stabilization Devices Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 3.2 billion by 2034. Catheter stabilization devices are essential tools in clinical care, designed to securely anchor various types of catheters to the body, reducing movement, preventing dislodgement, and lowering the risk of migration. This stability not only safeguards the patient but also ensures accurate and uninterrupted delivery of medical treatments. The increasing global prevalence of chronic illnesses such as cancer, kidney failure, diabetes, and cardiovascular conditions is driving the need for long-term catheter use in clinical settings.

In addition, as infection control becomes a growing priority in hospitals, there is an increasing focus on preventing catheter-related infections through improved securement methods. An aging population that frequently requires catheter-based procedures and home care support further contributes to this market's expansion. Fragile skin and susceptibility to infections in older adults heighten the need for secure and comfortable catheter fixation. The demand for high-quality, easy-to-apply stabilization devices is therefore rising rapidly, especially across facilities providing long-term and in-home healthcare services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 7% |

In 2024, the devices segment held a 32.7% share. These catheters are widely applied in intensive care, oncology, and emergency care for critical treatments such as drug administration and nutritional support. With the rise in demand for advanced therapies in these clinical areas, securement devices have become essential in minimizing complications like bloodstream infections, endocarditis, and septic conditions that stem from catheter movement or contamination. To reduce these risks, healthcare institutions and governing bodies have enforced stricter infection control protocols, many of which mandate the use of catheter securement tools. These regulatory shifts are boosting the adoption of securement devices across multiple care settings.

The general surgery segment generated USD 553.5 million in 2024. Catheters are used extensively in surgical procedures for delivering anesthesia, monitoring fluids, and tracking vital signs. Stabilization devices are indispensable in ensuring catheter placement remains intact during surgeries and post-operative care, especially during transitions from operating theaters to recovery areas. Hospitals are under pressure to lower rates of central line-associated bloodstream infections and surgical site infections, which often occur during surgical interventions. This is intensifying the demand for stabilization solutions that align with hospital safety initiatives and improve procedural outcomes.

U.S. Catheter Stabilization Devices Market was valued at USD 667.5 million in 2024 and is expected to reach USD 1.3 billion by 2034. Rising chronic disease cases across the country are driving the need for catheter-based treatments, and in turn, increasing the adoption of stabilization devices. U.S. hospitals follow stringent safety regulations set by various healthcare bodies, which require institutions to use standardized infection control practices. Failure to comply with these safety benchmarks could lead to reduced reimbursement and financial penalties, prompting providers to invest in securement devices. These trends are firmly positioning the U.S. as a key growth region in the global catheter stabilization space.

Companies such as BD, 3M, Cardinal Health, ConvaTec, and B. Braun currently dominate the industry and collectively hold around 65% of the total market share. Leading players in the catheter stabilization devices market are leveraging multiple strategies to boost their presence and secure long-term growth. A primary focus lies in the development of advanced, patient-friendly products that reduce infection risk and enhance application ease.

Companies are strengthening their R&D efforts to deliver innovative designs that cater to specific medical needs and accommodate fragile patient populations, such as the elderly. Geographic expansion through partnerships, local manufacturing, and strategic distribution agreements helps widen access to their product lines. Regulatory compliance is also a major focus, as firms align with evolving clinical standards to increase institutional trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases

- 3.2.1.2 Global aging population

- 3.2.1.3 Continuous innovations in catheter stabilization technology

- 3.2.1.4 Cost-benefits of securement devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative products

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in surgical procedure volume

- 3.2.3.2 Growing demand for preventing hospital acquired infections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Price trends

- 3.5.1 By region

- 3.5.2 By product

- 3.6 Future market trends

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Arterial securement devices

- 5.3 Central venous catheter securement devices

- 5.4 Peripheral securement devices

- 5.5 Urinary catheters securement devices

- 5.6 Chest drainage tubes securement devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular procedures

- 6.3 General surgery

- 6.4 Urological procedures

- 6.5 Oncology procedures

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B. Braun

- 9.2 Baxter International

- 9.3 Becton, Dickinson and Company

- 9.4 Cardinal Health

- 9.5 Centurion Medical Products

- 9.6 ConvaTec

- 9.7 Dale Medical Products

- 9.8 DeRoyal Industries

- 9.9 Merit Medical Systems

- 9.10 Pepper Medical

- 9.11 Smiths Medical

- 9.12 TIDI Products

- 9.13 VYGON

- 9.14 Zibo Qichuang Medical Products

- 9.15 3M