|

市場調查報告書

商品編碼

1773430

處方護目鏡市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Prescription Goggles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

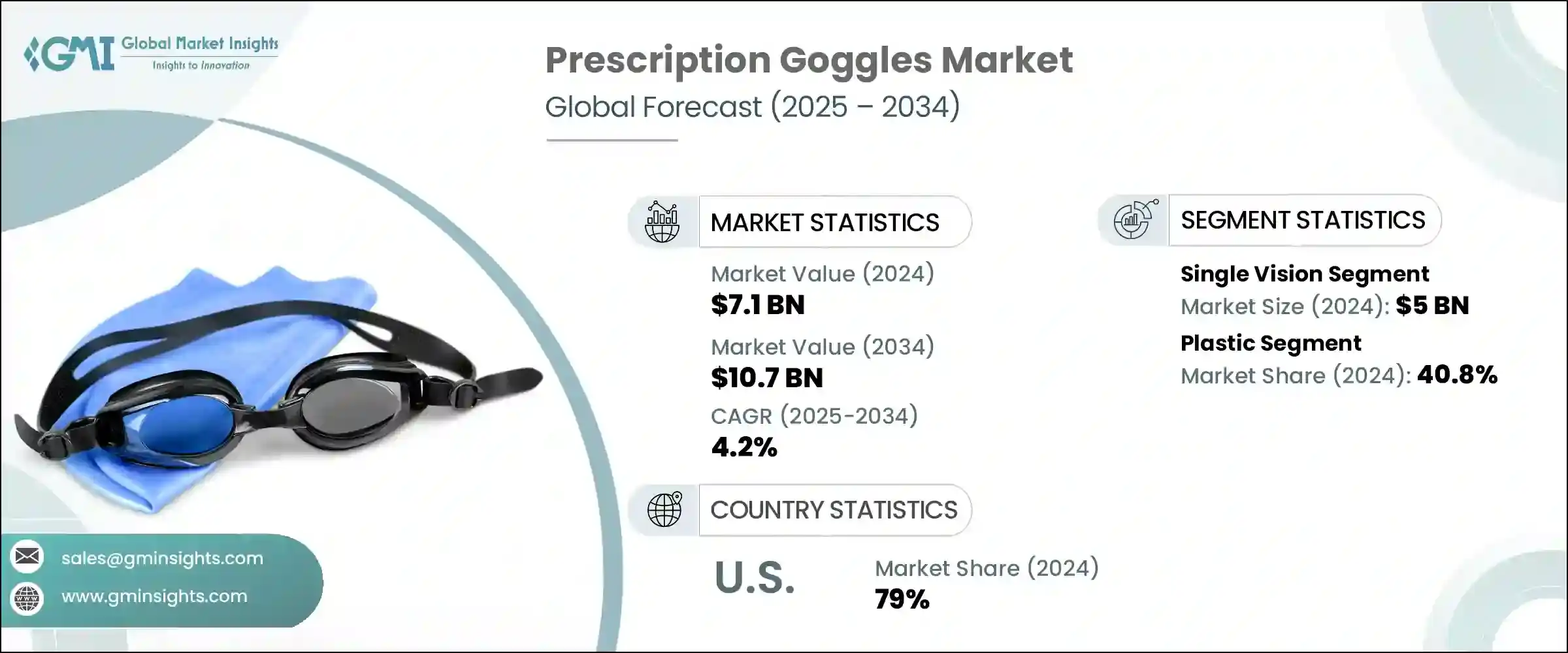

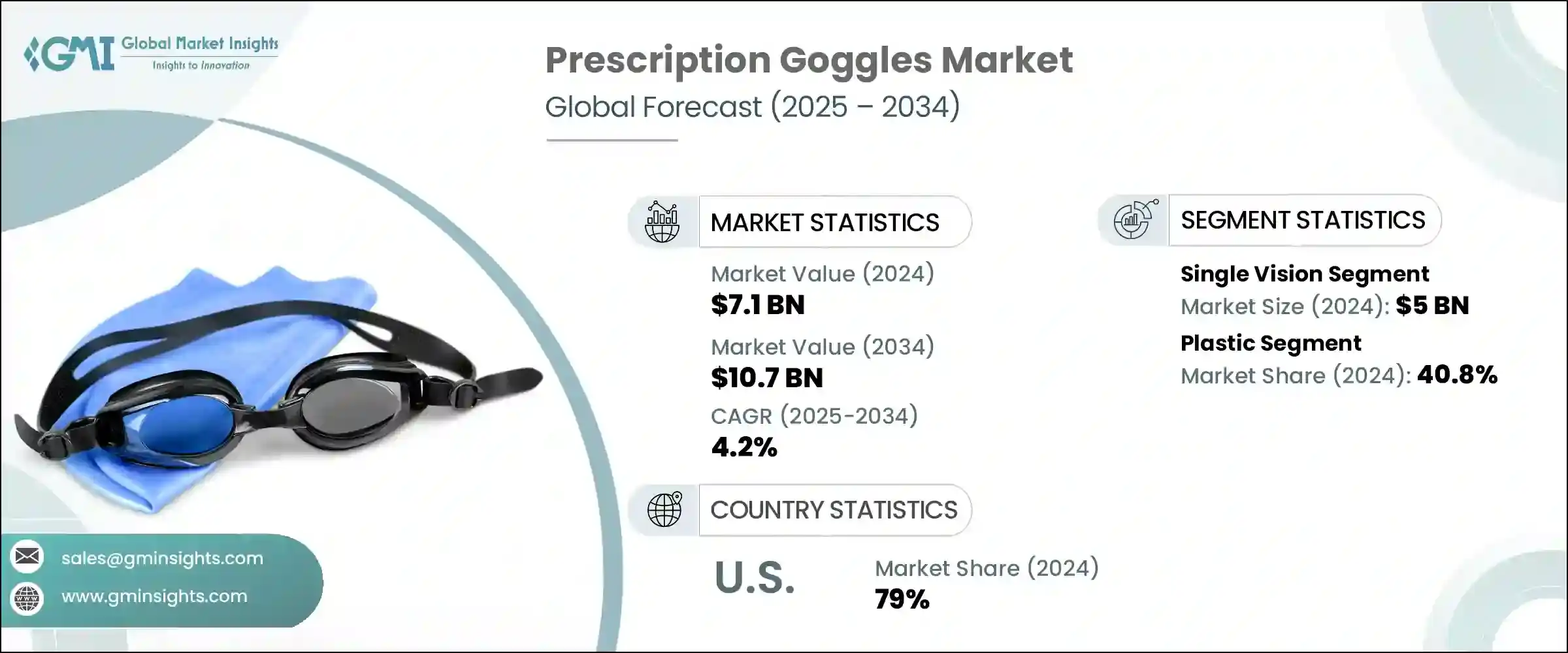

2024 年全球處方護目鏡市場規模達 71 億美元,預計到 2034 年將以 4.2% 的複合年成長率成長至 107 億美元。人們對職業和休閒環境中眼睛保護問題的日益關注,極大地推動了市場的發展。處方安全護目鏡具有雙重功能,不僅可以矯正視力,還可以保護眼睛免受物理傷害。這些護目鏡通常由耐用、抗衝擊的材料製成,能夠有效阻擋空氣中的顆粒物、化學物質飛濺和其他環境危害。隨著全球職業安全準則日益嚴格,雇主有義務為員工配備符合處方要求的防護眼鏡。對更安全工作環境的追求,以及各行各業對合規性要求的嚴格要求,正在推動對安全護目鏡的持續需求。

除了工作場所,消費者也越來越注重日常活動中的眼睛健康。戶外休閒人士尋求既能矯正視力,又能抵禦灰塵、水和紫外線等自然因素的眼鏡。處方護目鏡兼具功能性和舒適性,尤其在鏡片技術不斷發展的今天,滿足了這項需求。塗層技術的創新提升了清晰度、耐刮擦性和鏡片壽命,使防護眼鏡的用途比以往任何時候都更加廣泛。此外,人們越來越青睞由聚碳酸酯製成的輕質鏡片,尤其是具有防反射性能的鏡片,它們可以提升視覺效果並減輕眼睛疲勞。隨著數位接觸的增加,近視、遠視和老花眼等視力問題變得越來越普遍,對矯正性防護鏡的需求也穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 71億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 4.2% |

生活方式的改變,加上長時間坐在數位螢幕前,導致各年齡層的視力問題顯著增加。這刺激了對具有矯正功能的防護眼鏡的需求。此外,人們越來越傾向於健身和休閒活動,這進一步推動了市場的發展,在這些活動中,使用者需要既能矯正視力又不損害安全性的護目鏡。無論是在運動、專業工作或日常活動中使用,處方護目鏡如今都被視為個人防護裝備的重要組成部分。

根據鏡片類型,市場細分為單光鏡片和雙光漸進鏡片。單光鏡片佔最大佔有率,2024年收入達50億美元。這種優勢可以歸因於單光護目鏡在矯正近視和遠視等常見疾病方面的有效性。這類護目鏡因其價格實惠、易於自訂和適用性廣泛而備受青睞。它們可以配備各種鍍膜和材質,以滿足不同的使用者需求,適合不同年齡和職業的人士。與雙光鏡片或漸進鏡片相比,單光鏡片相對較低的價格也使其廣受歡迎。

就鏡框材質而言,處方護目鏡市場分為塑膠、矽膠/橡膠和其他材質。 2024年,塑膠鏡框佔據了全球40.8%的市場佔有率,估值達29.1億美元。塑膠鏡框的廣泛應用主要源自於其輕量和抗破損的特性。在塑膠材料中,聚碳酸酯仍然是首選,因其卓越的抗衝擊性和內建的紫外線防護功能而聞名。這些特性在安全性至關重要的應用中尤其重要。其他材料,例如矽膠和橡膠,則用於密封圈和綁帶等非光學部件,以增強佩戴的貼合度和舒適度,但由於它們無法提供矯正視力的功能,因此不適用於鏡片。

北美繼續成為處方護目鏡行業的領先地區,其中美國扮演著核心角色。 2024年,美國佔了該地區79%的市場佔有率,凸顯了該國對眼部健康和矯正視力產品的高度重視。高視力矯正使用率和安全意識的提升,正在推動處方護目鏡在消費和職業領域的普及。美國眼鏡的普及也反映了光學解決方案的廣泛普及以及消費者對視力保護益處的認知度不斷提高。

產業新興趨勢包括採用先進的鏡片材料和改進的鍍膜,例如具有藍光過濾和眩光減少功能的鍍膜。可客製化的鏡框設計和個人化的配戴選擇正變得越來越普遍,這與消費者追求個人化產品的普遍趨勢相契合。電商平台的興起使消費者更容易獲得各種符合特定視覺和生活方式需求的處方護目鏡。

塑造全球格局的關鍵參與者包括領先的光學製造商和處方安全眼鏡領域的專業廠商。這些公司正在利用技術,將防霧、變色鏡片和偏光塗層等功能融入其產品中。他們也專注於採用耐用且輕巧的材料,例如Trivex和聚碳酸酯,以增強使用者的舒適度和防護性。從工作場所到休閒娛樂,處方護目鏡在當今這個對視覺要求極高的世界變得越來越不可或缺。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 視力障礙盛行率

- 眼部健康和安全意識不斷增強

- 增加戶外和體育活動的參與度

- 對個性化和時尚眼鏡的需求

- 產業陷阱與挑戰

- 專用鏡頭和客製化成本高

- 組裝和客製化的複雜性

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按產品

- 按地區

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按鏡頭類型,2021 - 2034 年

- 主要趨勢

- 單視

- 雙焦漸進鏡片

第6章:市場估計與預測:按框架材料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 矽/橡膠

- 其他

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按消費者群體,2021 - 2034 年

- 主要趨勢

- 男性

- 女性

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 游泳/浮潛護目鏡

- 運動護目鏡

- 工業安全護目鏡

- 時尚護目鏡

- 摩托車/自行車護目鏡

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 專賣店

- 大型零售商店

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Arena

- First Lens

- GOGGLEMAN

- SafeVision

- John Jacobs

- Liberty Sport

- MSA Safety

- Oakley

- RxSport

- Safety-RX

- Speedo

- Sutton Swimwear

- TYR

- Uvex

- Wiley X

The Global Prescription Goggles Market was valued at USD 7.1 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 10.7 billion by 2034. Growing concerns about eye protection across professional and recreational environments are significantly driving the market. Prescription safety goggles serve a dual function by not only correcting vision but also shielding eyes from physical harm. These goggles are commonly manufactured using durable, impact-resistant materials that offer a reliable barrier against airborne particles, chemical splashes, and other environmental hazards. With occupational safety guidelines becoming increasingly stringent worldwide, employers are obligated to equip their workforce with proper protective eyewear that accommodates prescription needs. The push for safer work environments, along with compliance mandates across industrial sectors, is fueling consistent demand.

Apart from the workplace, consumers are becoming more mindful of maintaining their eye health during daily activities. People involved in outdoor recreation are seeking eyewear that provides both visual correction and defense from natural elements like dust, water, and UV radiation. Prescription goggles meet this demand by combining functionality with comfort, especially as lens technology continues to evolve. Innovations in coatings that improve clarity, scratch resistance, and lens longevity are making protective eyewear more versatile than ever. There is also a rising preference for lightweight lenses made from polycarbonate, especially those with anti-reflective properties, which enhance visual performance and reduce eye strain. As digital exposure increases, vision issues such as nearsightedness, farsightedness, and presbyopia have become more common, and the need for corrective protective goggles is steadily increasing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4.2% |

Changing lifestyles, combined with longer hours in front of digital screens, are contributing to a noticeable uptick in vision-related problems across various age groups. This has spurred a rise in demand for protective eyewear with corrective capabilities. The market is further supported by the growing inclination toward physical fitness and recreational activities, where users require goggles that offer vision correction without compromising on safety. Whether used during sports, professional work, or everyday activities, prescription goggles are now considered an essential part of personal protective equipment.

By lens type, the market is segmented into single vision and bifocal progressive lenses. The single vision category accounted for the largest share, bringing in USD 5 billion in revenue in 2024. This dominance can be attributed to the effectiveness of single vision goggles in correcting widely prevalent conditions like nearsightedness and farsightedness. These goggles are often preferred due to their affordability, ease of customization, and wide applicability. They can be equipped with various coatings and materials to meet diverse user requirements, making them suitable for individuals across different age groups and occupations. Their relatively lower cost compared to bifocal or progressive lenses also contributes to their popularity.

In terms of frame materials, the prescription goggles market is categorized into plastic, silicone/rubber, and others. Plastic frames held a significant 40.8% of the global market share in 2024, with a valuation of USD 2.91 billion. The widespread use of plastic in frames is primarily due to its lightweight properties and resistance to breakage. Among plastic materials, polycarbonate remains a leading choice, known for its superior impact resistance and built-in UV protection. These features are especially critical in applications where safety is non-negotiable. Other materials, such as silicone and rubber, are used in non-optical components like seals and straps to enhance fit and comfort, although they are not suitable for lenses due to their inability to support corrective vision properties.

North America continues to be a leading region for the prescription goggles industry, with the United States playing a central role. In 2024, the U.S. held 79% of the regional market, underscoring the country's strong focus on eye health and corrective vision products. A high rate of vision correction usage and heightened safety awareness are pushing the adoption of prescription goggles across consumer and occupational segments. The popularity of eyewear in the U.S. also reflects widespread access to optical solutions and heightened consumer awareness regarding the benefits of vision protection.

Emerging trends in the industry include the adoption of advanced lens materials with improved coatings, such as those offering blue light filtration and glare reduction. Customizable frame designs and personalized fitting options are becoming more common, aligning with the broader consumer trend toward individualized products. The rise of e-commerce platforms is making it easier for consumers to access a wide range of prescription goggles tailored to specific visual and lifestyle needs.

Key players shaping the global landscape include leading optical manufacturers and niche specialists in prescription safety eyewear. These companies are leveraging technology to integrate features like anti-fogging, photochromic lenses, and polarized coatings into their products. They are also focusing on durable yet lightweight materials such as Trivex and polycarbonate to enhance user comfort and protection. From workplace applications to recreational use, prescription goggles are becoming increasingly indispensable in a visually demanding world.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Lens type

- 2.2.3 Frame material

- 2.2.4 Price

- 2.2.5 Consumer group

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Prevalence of vision impairment

- 3.2.1.2 Growing awareness of eye health and safety

- 3.2.1.3 Increased participation in outdoor and sports activities

- 3.2.1.4 Demand for personalized and fashionable eyewear

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High costs of specialized lenses and customization

- 3.2.2.2 Fitting and customization complexity

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Product

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Lens Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single vision

- 5.3 Bi-focal progressive

Chapter 6 Market Estimates and Forecast, By Frame Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Silicon/rubber

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Male

- 8.3 Female

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Swimming/snorkeling goggles

- 9.3 Sports goggles

- 9.4 Industrial safety goggles

- 9.5 Fashion goggles

- 9.6 Motorcycle/bicycle goggles

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty stores

- 10.3.2 Mega retail stores

- 10.3.3 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Arena

- 12.2 First Lens

- 12.3 GOGGLEMAN

- 12.4 SafeVision

- 12.5 John Jacobs

- 12.6 Liberty Sport

- 12.7 MSA Safety

- 12.8 Oakley

- 12.9 RxSport

- 12.10 Safety-RX

- 12.11 Speedo

- 12.12 Sutton Swimwear

- 12.13 TYR

- 12.14 Uvex

- 12.15 Wiley X