|

市場調查報告書

商品編碼

1773424

預製浴室艙市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Prefabricated Bathroom Pods Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

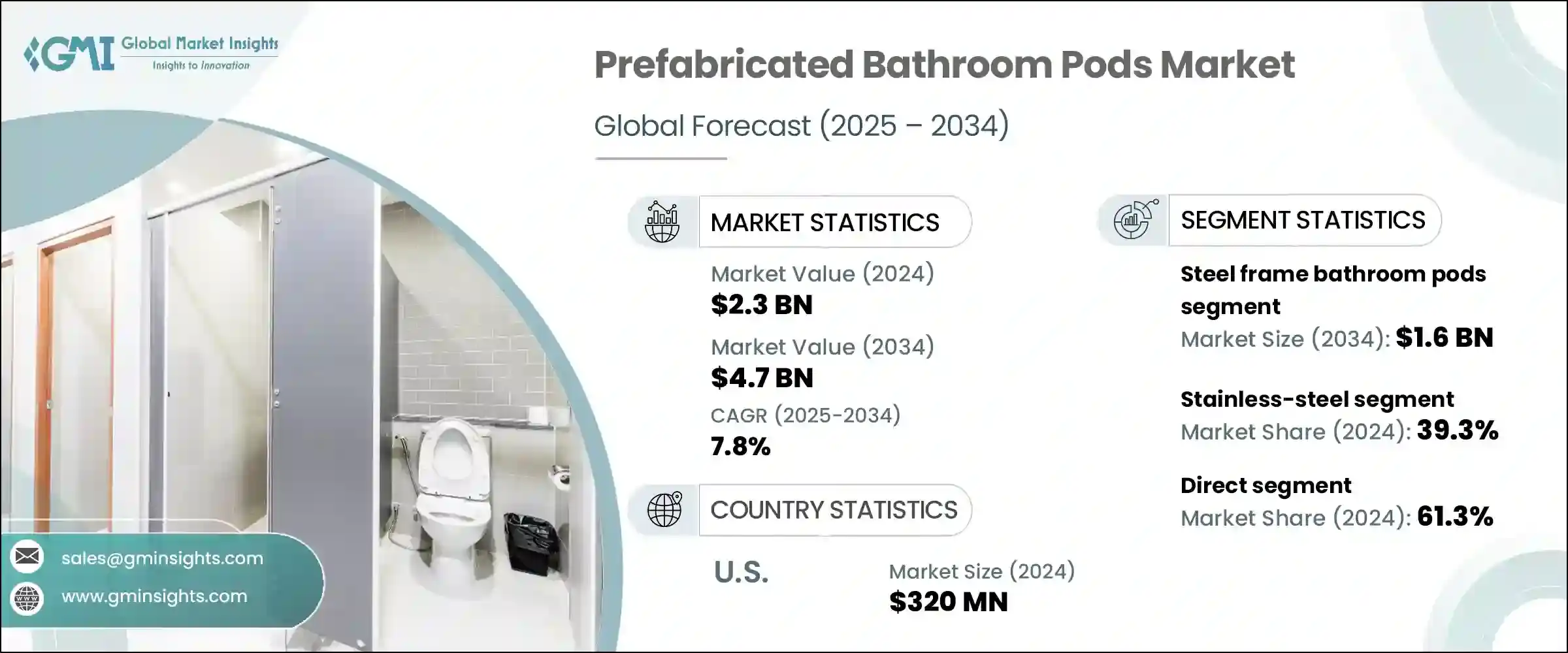

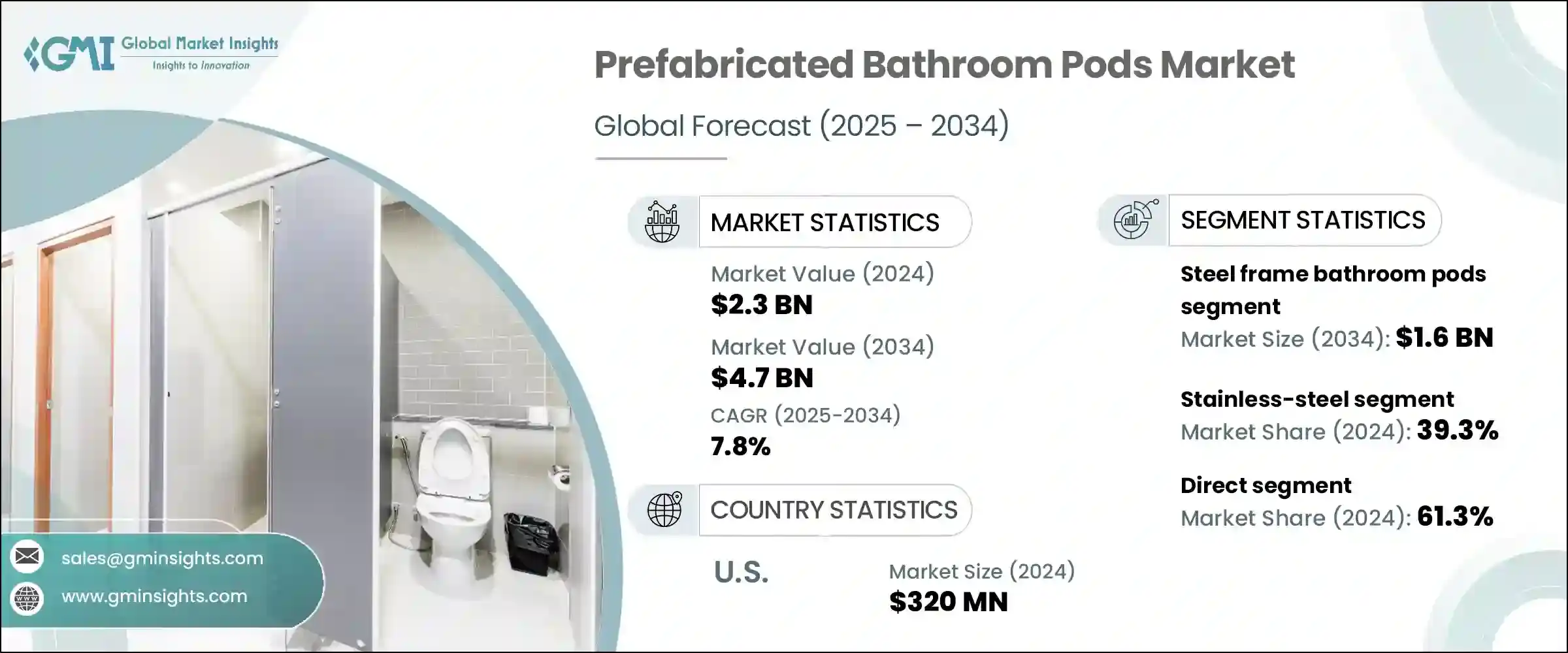

2024年,全球預製浴室艙市場規模達23億美元,預計2034年將以7.8%的複合年成長率成長,達到47億美元。主要成長動力之一是,在時間緊迫的專案中,模組化建築的趨勢日益明顯。浴室艙顯著減少了勞力密集的現場安裝,並大幅縮短了組裝時間,使其成為快節奏開發的理想選擇。

這些艙體在受控條件下於場外設施內生產,確保品質始終如一,並快速交付至施工現場。隨著施工工期日益壓縮,尤其是在學生公寓、醫療保健和酒店業,建築商正轉向預製浴室單元作為高效的解決方案。事實證明,與傳統建築相比,模組化施工方法(包括艙室浴室)可將整體建造時間縮短高達 50%。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 7.8% |

工廠組裝的浴室單元還能減少對戶外勞動力的依賴,有助於緩解持續存在的熟練建築工人短缺問題。透過在場外生產,開發商可以更好地預測專案成本並最大限度地減少材料浪費,這在鋼材和木材等基本材料價格波動的背景下顯得尤為重要。這些優勢使預製浴室單元成為大型開發項目的一個有吸引力的選擇。

如今,大多數製造商都將智慧技術和永續功能融入其產品中。這些「豆莢」通常配備運動感應水龍頭、人員感應照明、洩漏監測系統和用水量儀錶板。低流量燈具、LED照明和再生複合材料等環保元素也是許多產品的標準配備。這些功能有助於開發商滿足綠建築認證標準,並符合更廣泛的ESG目標。

鋼框架浴室艙市場在2024年創造了8億美元的收入,預計到2034年將達到16億美元。它們日益普及,源自於其堅固輕巧的結構以及與各種建築設計相融合的能力。這些浴室艙尤其適用於住宅大樓、學生宿舍和豪華飯店等對荷載限制和空間最佳化至關重要的專案。鋼結構還具有抗腐蝕和物理損壞的特性,為追求長期性能的開發商提供了耐用、低維護的解決方案。

2024年,不鏽鋼市場佔據39.3%的市場佔有率,預計到2034年將以6.7%的複合年成長率成長。不銹鋼卓越的耐腐蝕性、易清潔性和光滑的外觀使其成為高人流量環境中的首選材料。無論是用於固定裝置的可見部分,或是用於艙體框架的結構部分,不銹鋼都能在高濕度條件下提供長期耐用性。它還能滿足醫院和機構設施等客戶所要求的衛生標準。該材料的無孔表面能夠有效抑制細菌生長,使其成為對衛生合規性至關重要的高使用率應用的理想選擇。

2024年,美國預製浴室艙市場規模達3.2億美元,預計2034年將以8.3%的複合年成長率成長。快速的城市化、持續的勞動力短缺以及更高效的建築技術趨勢的廣泛轉變,推動了這一市場的需求。模組化單元在飯店開發、醫療保健設施和大型多戶住宅專案中的應用越來越廣泛。隨著美國建築商不斷探索更快、更永續的傳統建築替代方案,浴室艙正成為專案規劃和交付中不可或缺的一部分。

市場上的關鍵製造商包括 Pivotek、Bathsystem、Walker Modular、StercheleGroup、Taplanes、Offsite Solutions、Elements Europe、SurePods、Interpod、Oldcastle SurePods、Modulart、Hydrodiseno、Hellweg Badsysteme、B&T Manufacturing 和 Buildomup。

預製浴室艙領域的公司正在透過擴大生產能力和投資設計靈活性來鞏固其市場地位,以滿足廣泛的建築需求。許多公司正在豐富其產品組合,以涵蓋可自訂的佈局和功能,以滿足不同行業客戶的需求。他們正大力關注智慧科技和永續材料的整合,以滿足監管和環境、社會和治理 (ESG) 目標。與房地產開發商、建築師和總承包商的合作對於確保續約合約和簡化交付週期至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS 編碼 - 940690)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 鋼架浴室艙

- 混凝土浴室艙

- GRP(玻璃纖維)浴室艙

- 混合浴室艙

第6章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 不銹鋼

- 陶瓷

- 玻璃

- 塑膠

- 複合材料

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 新建築

- 翻新/改造

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第 11 章:公司簡介

- B&T Manufacturing

- Bathsystem

- Buildom Prefab Systems

- Elements Europe

- Hellweg Badsysteme

- Hydrodiseno

- Interpod

- Modulart

- Offsite Solutions

- Oldcastle SurePods

- Pivotek

- StercheleGroup

- SurePods

- Taplanes

- Walker Modular

The Global Prefabricated Bathroom Pods Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 4.7 billion by 2034. One of the major growth drivers is the increasing preference for modular construction in time-sensitive projects. Bathroom pods significantly cut down on labor-intensive onsite installation and dramatically reduce assembly times, making them ideal for fast-paced developments.

These pods are manufactured in off-site facilities under controlled conditions, ensuring consistent quality and rapid delivery to construction locations. With construction timelines becoming more compressed, especially in the student housing, healthcare, and hospitality sectors, builders are turning to prefabricated bathroom units as an efficient solution. Modular methods, including bathroom pods, have been shown to reduce overall build times by up to 50% compared to traditional construction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 7.8% |

Factory-assembled bathroom pods also reduce outdoor labor dependency, helping mitigate the ongoing shortage of skilled construction workers. By producing units off-site, developers can better forecast project costs and minimize material waste, which is increasingly important amid fluctuating prices for basic materials like steel and timber. These benefits make prefabricated pods an attractive option for large-scale developments.

Most manufacturers now embed smart technology and sustainable features into their products. These pods often come equipped with motion-sensing faucets, occupancy-triggered lighting, leak-monitoring systems, and water usage dashboards. Environmentally friendly elements such as low-flow fixtures, LED lighting, and recycled composite materials are also standard in many offerings. These features help developers meet green building certification criteria and align with broader ESG objectives.

Steel-frame bathroom pods segment generated USD 800 million in 2024 and is projected to hit USD 1.6 billion by 2034. Their rising popularity comes from their strong yet lightweight structure and ability to blend with diverse architectural designs. These pods are especially well-suited for projects like residential towers, student dormitories, and luxury hotels, where load restrictions and space optimization are critical. Steel construction also resists corrosion and physical damage, providing a durable, low-maintenance solution for developers looking for long-term performance.

In 2024, the stainless steel segment accounted for a 39.3% share and is projected to grow at a CAGR of 6.7% through 2034. Stainless steel's superior corrosion resistance, ease of cleaning, and sleek appearance make it a preferred material in high-traffic environments. Whether used visibly in fixtures or structurally within the pod frame, stainless steel provides long-term durability under high moisture conditions. It also helps meet hygiene standards demanded by clients, such as hospitals and institutional facilities. The material's non-porous surface actively resists bacterial growth, making it ideal for high-usage applications where sanitary compliance is essential.

United States Prefabricated Bathroom Pods Market was valued at USD 320 million in 2024 and is expected to grow at a CAGR of 8.3% through 2034. Demand is being fueled by rapid urbanization, ongoing labor shortages, and a broader shift toward more efficient construction techniques. Modular units are becoming more widely adopted across hospitality developments, healthcare facilities, and large-scale multifamily housing projects. As U.S. builders continue exploring faster, more sustainable alternatives to conventional builds, bathroom pods are becoming integral to project planning and delivery.

Key manufacturers in the market include Pivotek, Bathsystem, Walker Modular, StercheleGroup, Taplanes, Offsite Solutions, Elements Europe, SurePods, Interpod, Oldcastle SurePods, Modulart, Hydrodiseno, Hellweg Badsysteme, B&T Manufacturing, and Buildom Prefab Systems.

Companies operating in the prefabricated bathroom pod space are strengthening their market position by expanding manufacturing capabilities and investing in design flexibility to meet a wide range of architectural requirements. Many are diversifying their product portfolios to include customizable layouts and features aligned with client demands across various sectors. A strong focus is being placed on integrating smart technology and sustainable materials to meet regulatory and ESG targets. Collaborations with real estate developers, architects, and general contractors have become critical to secure repeat contracts and streamline delivery cycles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 940690)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Steel frame bathroom pods

- 5.3 Concrete bathroom pods

- 5.4 GRP (glass reinforced plastic) bathroom pods

- 5.5 Hybrid bathroom pods

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Ceramics

- 6.4 Glass

- 6.5 Plastic

- 6.6 Composites

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Renovation/retrofit

Chapter 8 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 B&T Manufacturing

- 11.2 Bathsystem

- 11.3 Buildom Prefab Systems

- 11.4 Elements Europe

- 11.5 Hellweg Badsysteme

- 11.6 Hydrodiseno

- 11.7 Interpod

- 11.8 Modulart

- 11.9 Offsite Solutions

- 11.10 Oldcastle SurePods

- 11.11 Pivotek

- 11.12 StercheleGroup

- 11.13 SurePods

- 11.14 Taplanes

- 11.15 Walker Modular