|

市場調查報告書

商品編碼

1773423

蒸汽氣炸鍋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Steam Air Fryer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

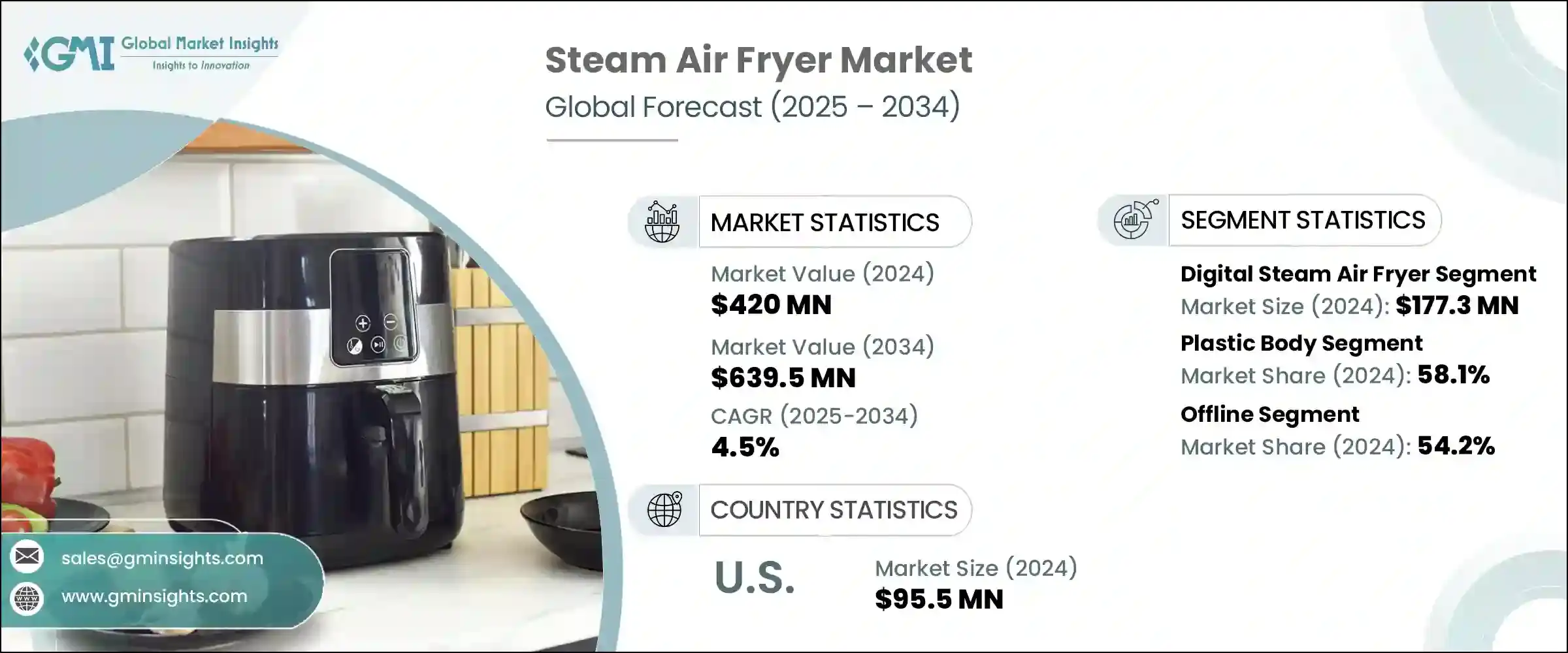

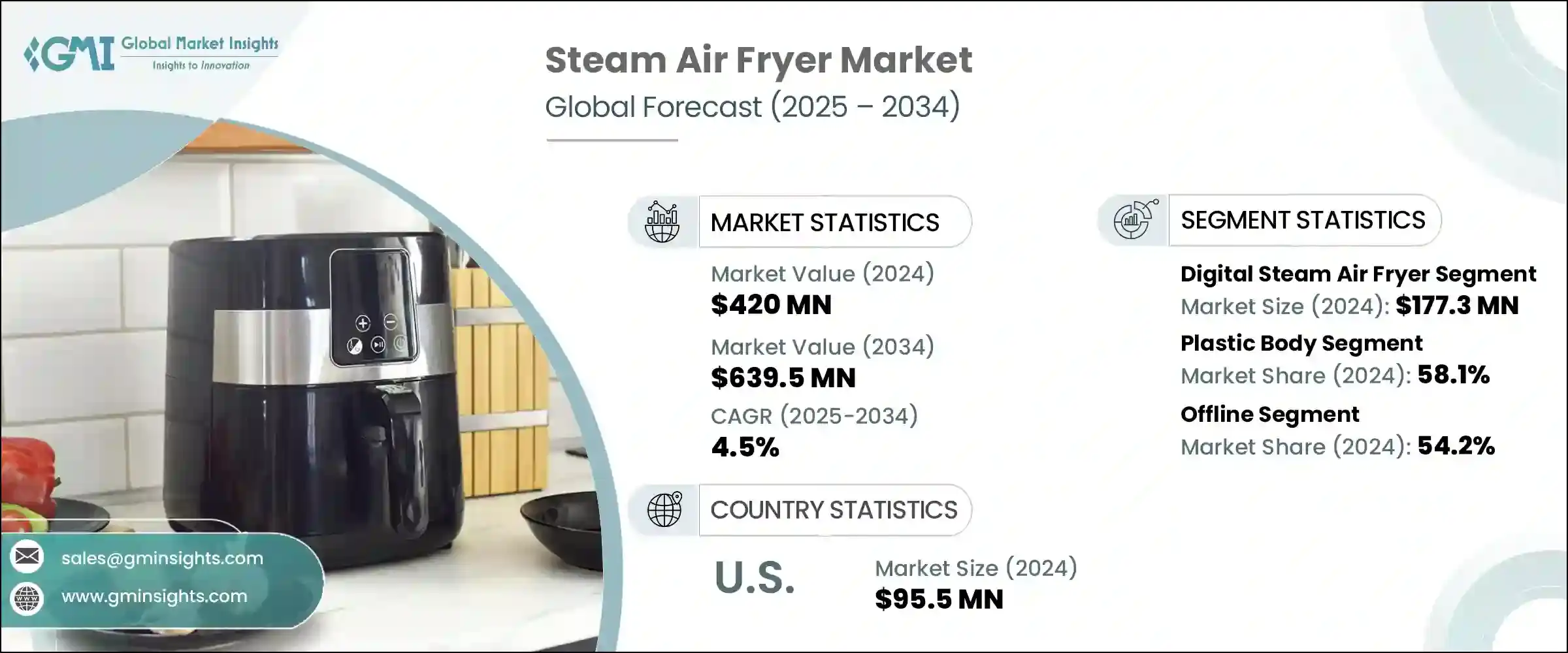

2024 年全球蒸汽氣炸鍋市場規模達 4.2 億美元,預計到 2034 年將以 4.5% 的複合年成長率成長至 6.395 億美元。這一成長主要源於消費者對健康烹飪方式的日益偏好。隨著人們對肥胖、心臟病和生活方式相關疾病的認知不斷提高,越來越多的人開始尋求能夠低脂、營養豐富的烹飪廚房電器。蒸氣氣炸鍋將對流加熱與保濕蒸氣結合,在酥脆口感和營養保留之間取得平衡。這些產品吸引了眾多人群——從尋求快速健康膳食的忙碌專業人士,到希望以最少的油烹調均衡飲食的家庭。注重健康的人士尤其被這些電器所吸引,因為它們能夠有效保留維生素並減少有害的烹飪副產品。

根據營養資料顯示,蒸氣烹飪可保留90%至95%的水溶性維生素,遠勝於通常僅保留60%至70%的傳統烘焙。與傳統油炸相比,光是氣炸鍋一項就能減少高達80%的用油量。這些優勢促使零售商和製造商優先考慮蒸汽氣炸鍋。諸如空氣-蒸汽組合技術、內建食譜平台和智慧烹飪預設等創新技術正在不斷開發,以提高烹飪的便利性和營養價值。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.2億美元 |

| 預測值 | 6.395億美元 |

| 複合年成長率 | 4.5% |

數位蒸汽氣炸鍋市場在2024年創造了1.773億美元的收入,預計到2034年將以4.1%的複合年成長率成長。這些機型因其直覺的功能(例如LED顯示器、數位觸控螢幕和預設烹飪模式)而備受青睞。消費者欣賞其簡便性、準確性以及提供一致結果的能力。與手動機型不同,數位炸鍋可讓使用者立即啟動「酥脆蒸氣」功能,確保更好地保留營養成分並均勻烹飪。它們尤其受到注重健康和高效備餐的用戶的歡迎。

塑膠機身蒸汽氣炸鍋在2024年佔據58.1%的市場佔有率,佔據市場領先地位,預計2025年至2034年的複合年成長率將達到5%。這些機型以其經濟實惠、便攜性和緊湊的設計吸引消費者,非常適合小型廚房和城市家庭。製造商使用高級耐熱塑膠來降低生產成本,使其更容易被注重預算的消費者所接受。輕巧的機身和美觀的多功能性進一步提升了它們的吸引力,尤其是在年輕屋主群體中。零售業也支持了它們的受歡迎程度,商店促銷和較高的貨架曝光度使其領先於金屬機身的替代品。

2024年,美國蒸汽氣炸鍋市場規模達9,550萬美元,持續維持北美領先地位。健康飲食習慣的興起以及對智慧廚房電器需求的不斷成長,推動了該市場的成長。由於大量家庭已經配備了現代化的烹飪工具,美國消費者尋求小巧、無油且不影響風味的電器。大型零售連鎖店和線上平台的支援確保了產品的廣泛供應,有助於推動所有人群的消費者採用該產品。

引領蒸汽氣炸鍋行業的知名企業包括 Cuisinart、美的集團、Tovala、Cosori、飛利浦、Breville、Ninja、Geepas、Anova、夏普、Duronic、Ciarra、Secura、Instant Brands 和 Gourmia。領先的製造商正致力於創新,整合先進的蒸汽和空氣循環技術,在提升口感的同時保留營養。各大品牌也推出了智慧應用程式連接功能和自動烹飪預設,以吸引精通科技的消費者。為了提升知名度和普及度,各大公司正與零售巨頭合作,並利用影響力行銷。此外,產品線也日趨多樣化,涵蓋各種尺寸、款式和飾面,以滿足更廣泛的人群需求。永續性是另一個重點,越來越多的品牌採用環保包裝和節能設計。有針對性的促銷活動和向高成長市場的擴張進一步增強了它們的競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對健康烹飪解決方案的需求不斷成長

- 多功能廚房電器日益普及

- 拓展電子商務與D2C通路

- 可支配所得增加和都市化

- 產業陷阱與挑戰

- 與傳統氣炸鍋相比價格更高

- 認知度低且產品供應有限

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 手動蒸汽氣炸鍋

- 數位蒸汽氣炸鍋

- 智慧蒸氣氣炸鍋

第6章:市場估計與預測:依抽屜分類,2021 年至 2034 年

- 主要趨勢

- 單身的

- 雙倍的

第7章:市場估計與預測:依資料,2021 年至 2034 年

- 主要趨勢

- 塑膠機身

- 不銹鋼機身

第8章:市場估計與預測:依產能,2021 年至 2034 年

- 主要趨勢

- 小號(3公升以下)

- 中號(3-5公升)

- 大號(5公升以上)

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 品牌網站

- 離線

- 專業家電商店

- 消費性電子產品商店

- 超市/大賣場

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Anova

- Breville

- Ciarra

- Cosori

- Cuisinart

- Duronic

- Geepas

- Gourmia

- Instant Brands

- Midea Group

- Ninja

- Philips

- Secura

- Sharp

- Tovala

The Global Steam Air Fryer Market was valued at USD 420 million in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 639.5 million by 2034. This growth is primarily driven by increasing consumer preference for healthier cooking methods. Rising awareness around obesity, heart disease, and lifestyle-related conditions is prompting more individuals to look for kitchen appliances that promote low-fat, nutrient-rich cooking. Steam air fryers combine convection heating with moisture-retaining steam, offering a balance of crispness and nutrition retention. These products are appealing to various demographics-from busy professionals looking for quick, health-focused meals to families aiming to prepare balanced diets with minimal oil. Health-conscious individuals are especially drawn to these appliances for their ability to preserve vitamins and reduce harmful cooking by-products.

According to nutritional data, steam retains between 90% to 95% of water-soluble vitamins, far outperforming conventional baking, which typically retains just 60% to 70%. Air frying alone can cut oil use by up to 80% when compared to traditional frying. These benefits are prompting both retailers and manufacturers to prioritize steam air fryers in their offerings. Innovations such as air-steam combination technology, built-in recipe platforms, and smart cooking presets are being developed to improve convenience and nutritional outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $420 Million |

| Forecast Value | $639.5 Million |

| CAGR | 4.5% |

Digital steam air fryers segment generated USD 177.3 million in 2024 and is projected to grow at a CAGR of 4.1% through 2034. These models are favored for their intuitive features like LED displays, digital touch panels, and pre-set cooking modes. Consumers appreciate their simplicity, accuracy, and ability to deliver consistent results. Unlike manual models, digital fryers allow users to activate a "crisp and steam" function instantly, ensuring better nutrient retention and uniform cooking. They are particularly popular among users prioritizing health and time efficiency in meal preparation.

Plastic-body steam air fryers segment led the market by capturing 58.1% share in 2024 and is expected to grow at a CAGR of 5% from 2025 to 2034. Consumers are drawn to these models for their affordability, portability, and compact design-ideal for smaller kitchens and urban households. Manufacturers use high-grade heat-resistant plastic to reduce production costs, making them more accessible to budget-conscious buyers. Their lightweight and aesthetic versatility further boost appeal, particularly among younger homeowners. Their popularity is also supported by the retail sector, with store promotions and high shelf visibility pushing them ahead of metal-bodied alternatives.

U.S. Steam Air Fryer Market accounted for USD 95.5 million in 2024 and remains the leading market in North America. Growth is fueled by a surge in wellness-driven food habits and rising demand for smart kitchen appliances. With a large share of households already equipped with modern cooking tools, American consumers seek compact, oil-free appliances that don't compromise flavor. Support from major retail chains and online platforms ensures wide product availability, helping to drive consumer adoption across all demographics.

Noteworthy companies shaping the Steam Air Fryer Industry include Cuisinart, Midea Group, Tovala, Cosori, Philips, Breville, Ninja, Geepas, Anova, Sharp, Duronic, Ciarra, Secura, Instant Brands, and Gourmia. Leading manufacturers are prioritizing innovation through the integration of advanced steam and air-circulation technologies that support nutrient retention while enhancing taste. Brands are also introducing smart, app-connected features with automated cooking presets to attract tech-savvy consumers. To boost visibility and adoption, companies are collaborating with retail giants and leveraging influencer marketing. Additionally, product lines are being diversified to include various sizes, styles, and finishes, catering to a wider demographic. Sustainability is another key focus, with more brands incorporating eco-friendly packaging and energy-efficient designs. Targeted promotional campaigns and expansion into high-growth markets further reinforce their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Drawer

- 2.2.4 Material

- 2.2.5 Capacity

- 2.2.6 End use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for healthy cooking solutions

- 3.2.1.2 Rising popularity of multifunctional kitchen appliances

- 3.2.1.3 Expansion of e-commerce and D2C channels

- 3.2.1.4 Rising disposable income & urbanization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Higher price compared to traditional air fryers

- 3.2.2.2 Low awareness & limited product availability

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual steam air fryers

- 5.3 Digital steam air fryers

- 5.4 Smart steam air fryers

Chapter 6 Market Estimates & Forecast, By Drawer, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Single

- 6.3 Double

Chapter 7 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic body

- 7.3 Stainless steel body

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Small (below 3 liters)

- 8.3 Medium (3–5 liters)

- 8.4 Large (above 5 liters)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Brand websites

- 10.3 Offline

- 10.3.1 Specialty appliance store

- 10.3.2 Consumer electronics stores

- 10.3.3 Supermarkets/hypermarkets

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Anova

- 12.2 Breville

- 12.3 Ciarra

- 12.4 Cosori

- 12.5 Cuisinart

- 12.6 Duronic

- 12.7 Geepas

- 12.8 Gourmia

- 12.9 Instant Brands

- 12.10 Midea Group

- 12.11 Ninja

- 12.12 Philips

- 12.13 Secura

- 12.14 Sharp

- 12.15 Tovala