|

市場調查報告書

商品編碼

1773418

影像增強器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Image Intensifier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

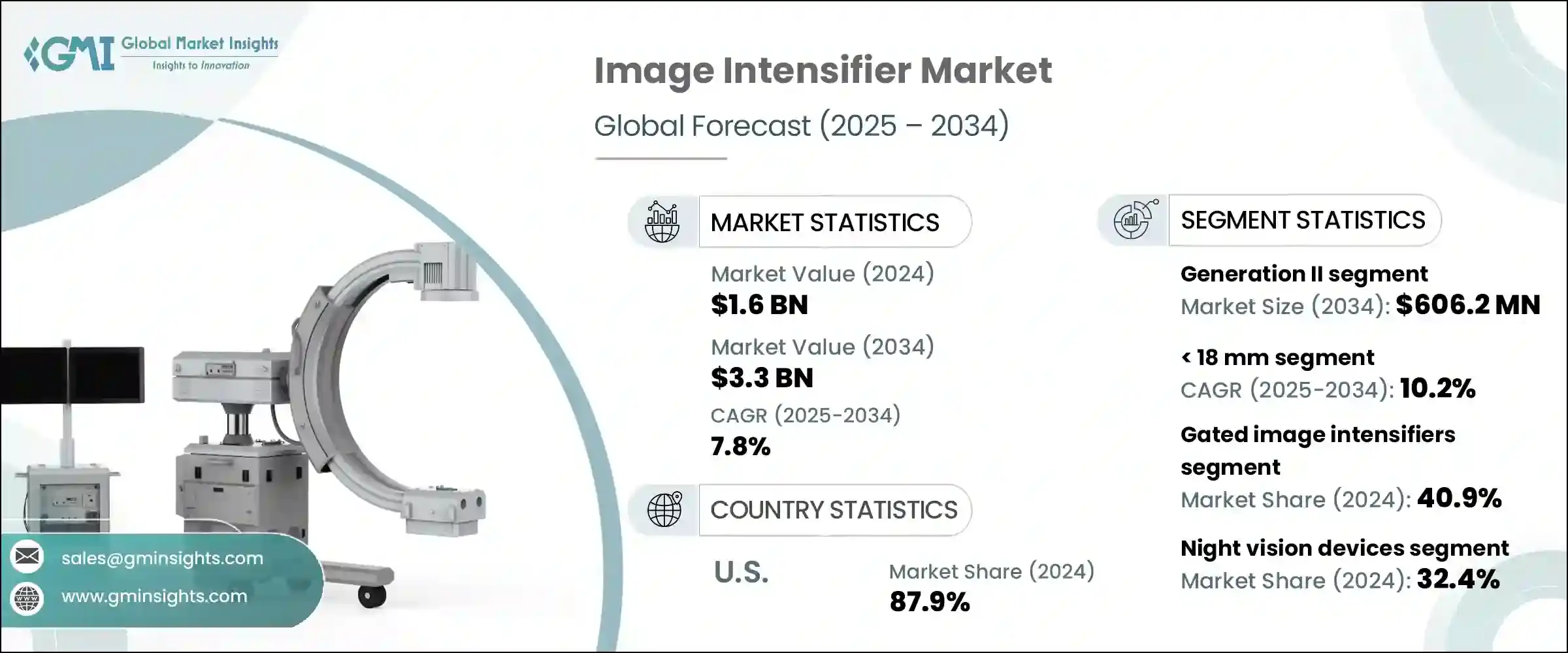

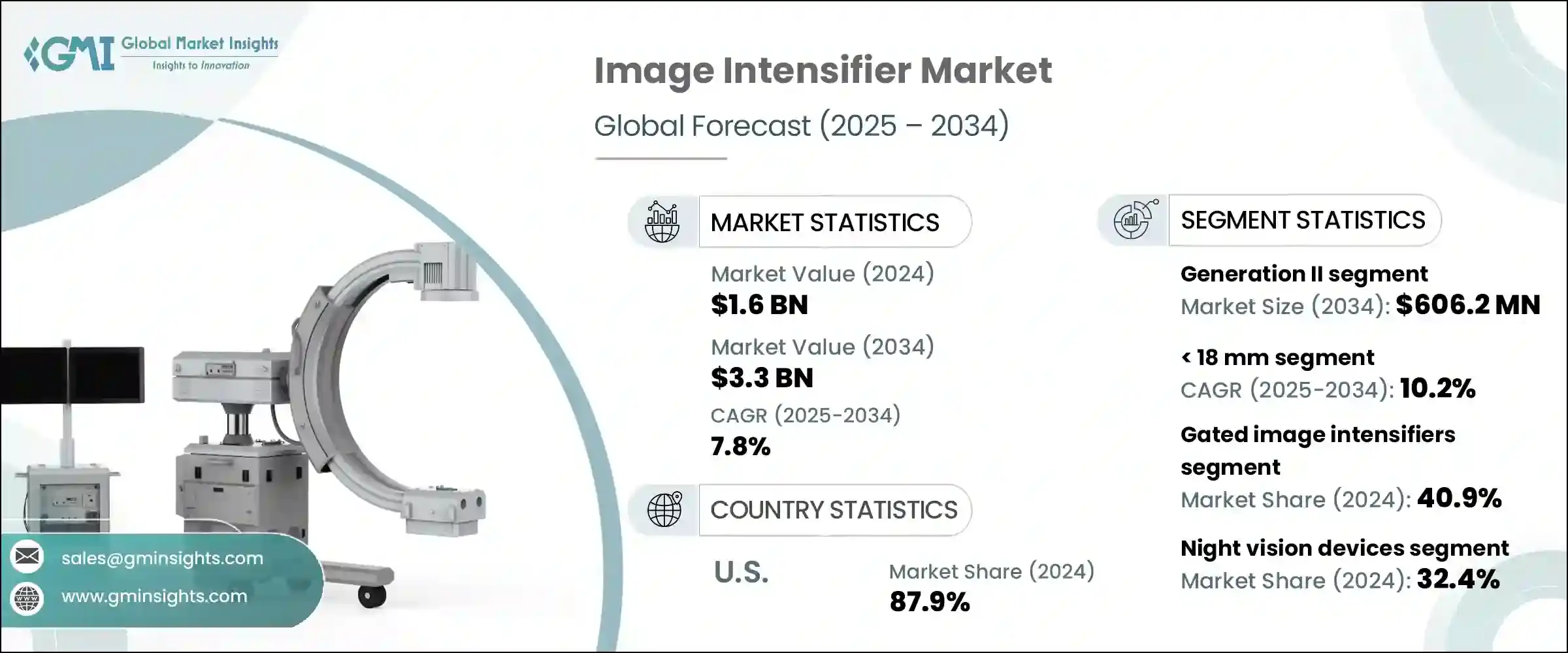

2024年,全球影像增強器市場規模達16億美元,預計2034年將以7.8%的複合年成長率成長,達到33億美元。該領域的成長主要得益於其在醫學影像和國防相關應用領域的不斷普及。由於影像增強器具有強大的即時成像能力、卓越的靈敏度和成本效益,螢光透視裝置、介入放射學工具和C臂等醫療系統持續推動對這些設備的需求。由於醫療保健機構優先考慮價格合理的高品質成像,因此對影像增強器的需求持續保持高位。同時,各主要地區的軍事和安全部隊高度依賴影像增強器,以確保其在監視、偵察和目標捕獲任務中的低光操作可靠性。

這些設備在邊境監視和夜間行動中持續發揮關鍵作用,在這些行動中,低光照條件下的可靠可視性至關重要。隨著地緣政治緊張局勢加劇,各國優先考慮國防能力現代化,利用尖端技術增強戰術基礎設施的需求也日益迫切。影像增強器使部隊能夠全天候探測威脅、進行偵察並保持態勢感知,確保戰備狀態和安全。它們能夠在充滿挑戰的環境中提供清晰的即時影像,這對於旨在保護邊境和關鍵資產,並在不斷變化的衝突局勢中保持戰略優勢的軍事和安全機構來說,是必不可少的。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 33億美元 |

| 複合年成長率 | 7.8% |

第三代影像增強器市場預計在2034年將以8.7%的複合年成長率成長。該系列以其先進的靈敏度和更清晰的成像而聞名,廣泛應用於國防和醫療保健領域。它們在複雜和低能見度場景下的可靠性能,使其在對影像清晰度和速度要求極高的關鍵任務中更具吸引力。

預計到2034年,18毫米類別的複合年成長率將達到10.2%,成長最高。這些影像增強器設計緊湊輕巧,是穿戴式和攜帶式系統的理想選擇,包括護目鏡、手持式光學設備和頭盔式裝備。其小巧的尺寸和強大的性能使其非常適合戰術和臨床環境中的快速反應任務。

預計2034年中國影像增強器市場將以9.8%的複合年成長率成長。這一快速成長得益於政府加大對安防技術和醫療基礎設施的投資。在國家鼓勵減少進口依賴的政策推動下,影像系統的國產化發展勢頭強勁。軍事採購和醫院升級改造的需求將繼續增強該地區的市場。

塑造影像增強器市場的主要產業參與者包括Canon、L3Harris、Elbit Systems、Hamamatsu Photonics、Argus、Dantec Dynamics 和 Harder Digital。為了提升市場地位,影像增強器產業的主要參與者正在大力投資研發,以開發更高解析度、使用壽命更長、低光性能更佳的先進技術。各公司正在尋求與醫療設備製造商簽訂軍事合約並建立戰略合作夥伴關係,以確保長期供應協議。此外,他們還專注於擴大區域製造中心,尤其是在亞太地區,以滿足不斷成長的需求並避免供應鏈中斷。為了滿足不斷發展的國防和醫療應用需求,產品小型化和與穿戴式系統的整合被列為優先事項。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 國防和安全應用的持續需求

- 醫學影像應用的成長

- 工業和汽車測試的擴展

- 與CMOS和CCD感測器整合

- 向數位成像的技術轉變

- 產業陷阱與挑戰

- 先進影像增強器設備成本高昂

- 固態影像技術競爭日益激烈

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034年)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依代數,2021-2034

- 主要趨勢

- 第一代

- 第二代

- 第三代

第6章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 門控影像增強器

- 非門控影像增強器

- 自動門控影像增強器

第7章:市場估計與預測:依直徑,2021-2034

- 主要趨勢

- < 18 毫米

- 18 毫米至 <25 毫米

- 25毫米至<37毫米

- ≥37毫米

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 夜視設備

- 風鏡

- 雙筒望遠鏡

- 單筒望遠鏡

- 網路攝影系統

- 科學影像

- X光影像

- 其他

第9章:市場估計與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 國防和安全

- 工業的

- 醫療的

- 其他

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Argus

- Aselsan

- Canon

- Dantec Dynamics

- Elbit Systems

- Hamamatsu Photonics

- Harder Digital

- Katod

- L3Harris Technologies

- Lambert Instruments

- Photek

- Photonis Technologies

- Siemens

The Global Image Intensifier Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 3.3 billion by 2034. Growth in this sector is primarily fueled by expanding adoption in both medical imaging and defense-related applications. Medical systems such as fluoroscopy units, interventional radiology tools, and C-arms continue to drive demand for these devices, as image intensifiers provide strong real-time imaging capabilities, excellent sensitivity, and cost efficiency. As healthcare providers prioritize high-quality imaging with affordability, demand remains consistently high. Meanwhile, military and security forces across key regions rely heavily on image intensifiers for their low-light operational reliability in surveillance, reconnaissance, and target acquisition tasks.

These devices continue to play a critical role in border surveillance and night-time operations, where reliable visibility in low-light conditions is vital. As geopolitical tensions rise and countries prioritize the modernization of their defense capabilities, there is an increased urgency to enhance tactical infrastructure with cutting-edge technologies. Image intensifiers enable forces to detect threats, conduct reconnaissance, and maintain situational awareness around the clock, ensuring operational readiness and security. Their ability to deliver clear, real-time imagery in challenging environments makes them indispensable for military and security agencies aiming to protect borders, and critical assets, and maintain strategic advantages in evolving conflict scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 7.8% |

Generation III image intensifiers segment is expected to grow at a CAGR of 8.7% during 2034. Known for their advanced sensitivity and sharper imaging, this generation is widely used in defense and healthcare environments. Their dependable performance in complex and low-visibility scenarios continues to boost their appeal for critical missions where image clarity and speed are non-negotiable.

The 18 mm category segment is expected to see the highest growth at a CAGR of 10.2% through 2034. Designed to be compact and lightweight, these image intensifiers are ideal for wearable and portable systems including goggles, handheld optics, and helmet-mounted gear. Their small size and powerful performance make them extremely suitable for fast-response tasks in both tactical and clinical settings.

China Image Intensifier Market is projected to grow at a CAGR of 9.8% throughout 2034. This rapid rise is due to increased government investments in both security technologies and healthcare infrastructure. Domestic production of imaging systems is gaining strong momentum, backed by national policies encouraging reduced reliance on imports. Demand from both military procurement and hospital upgrades will continue to strengthen the market in this region.

Major industry players shaping the Image Intensifier Market include Canon, L3Harris, Elbit Systems, Hamamatsu Photonics, Argus, Dantec Dynamics, and Harder Digital. To enhance their market position, key players in the image intensifier industry are heavily investing in R&D to develop advanced generation technologies with higher resolution, longer lifespan, and better low-light performance. Companies are pursuing military contracts and strategic partnerships with healthcare equipment manufacturers to secure long-term supply deals. Additionally, they are focusing on expanding regional manufacturing hubs, especially in Asia-Pacific, to meet growing demand and avoid supply chain disruptions. Product miniaturization and integration into wearable systems are being prioritized to cater to evolving defense and medical applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Wood type

- 2.2.3 Entry type

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Sustained demand in defense and security applications

- 3.2.1.2 Growth in medical imaging applications

- 3.2.1.3 Expansion in industrial and automotive testing

- 3.2.1.4 Integration with CMOS and CCD sensors

- 3.2.1.5 Technological shift toward digital imaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced image intensifier devices

- 3.2.2.2 Growing competition from solid-state imaging technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&d

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Generation,2021-2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Generation I

- 5.3 Generation II

- 5.4 Generation III

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Gated image intensifiers

- 6.3 Non-gated image intensifiers

- 6.4 Auto-gated image intensifiers

Chapter 7 Market Estimates & Forecast, By Diameter, 2021-2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 < 18 mm

- 7.3 18 mm to <25 mm

- 7.4 25 mm to <37 mm

- 7.5 ≥ 37 mm

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Night vision devices

- 8.3 Goggles

- 8.4 Binoculars

- 8.5 Monoculars

- 8.6 Camera systems

- 8.7 Scientific imaging

- 8.8 X-ray imaging

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 Defense & security

- 9.3 Industrial

- 9.4 Medical

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Argus

- 11.2 Aselsan

- 11.3 Canon

- 11.4 Dantec Dynamics

- 11.5 Elbit Systems

- 11.6 Hamamatsu Photonics

- 11.7 Harder Digital

- 11.8 Katod

- 11.9 L3Harris Technologies

- 11.10 Lambert Instruments

- 11.11 Photek

- 11.12 Photonis Technologies

- 11.13 Siemens