|

市場調查報告書

商品編碼

1773417

骨內輸液設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Intraosseous Infusion Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

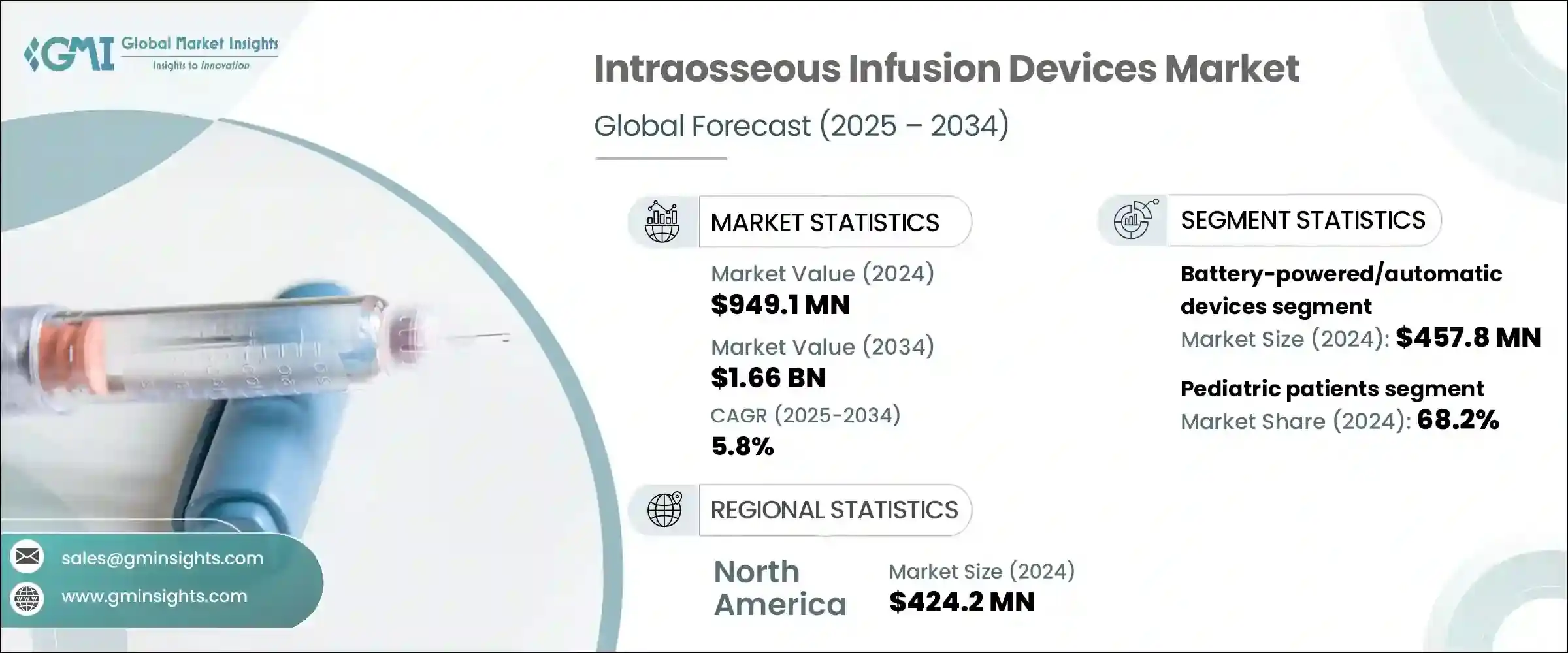

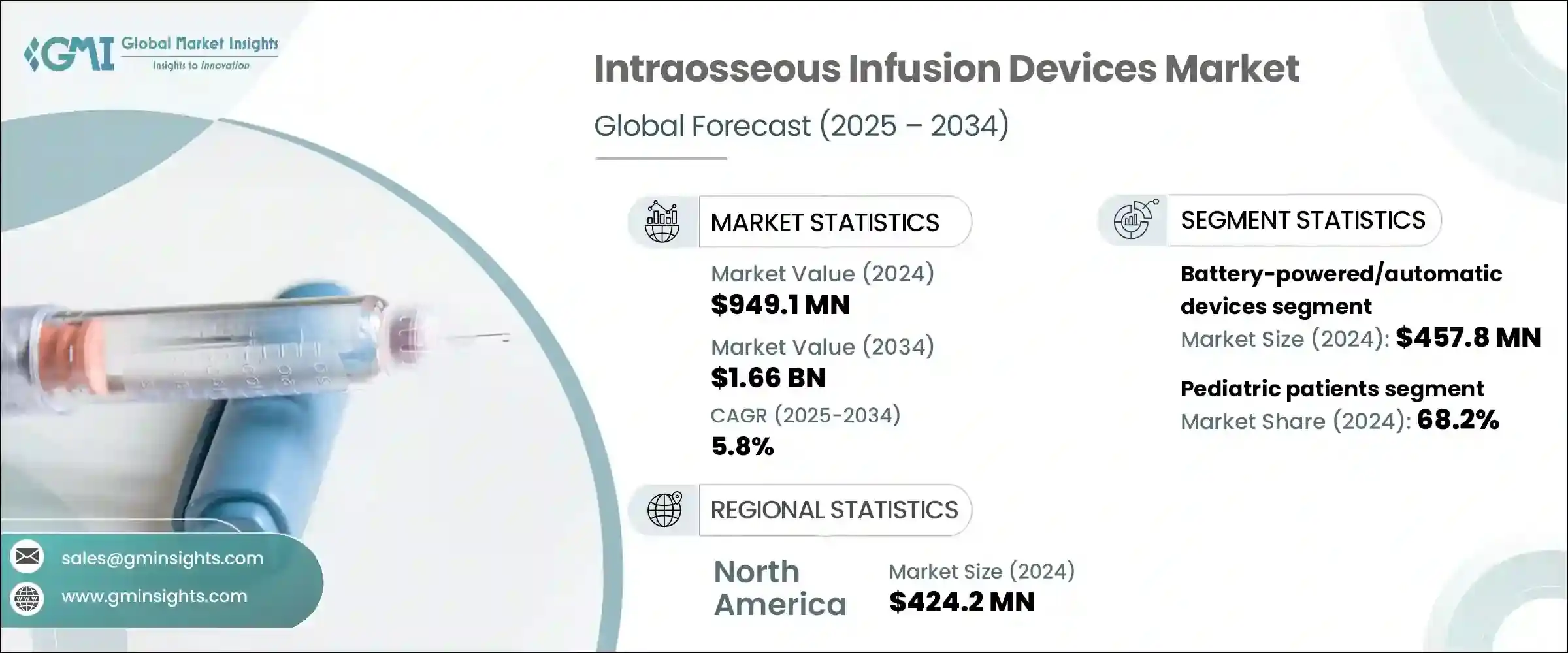

2024年全球骨內輸液設備市場規模達9.491億美元,預計2034年將以5.8%的複合年成長率成長,達到16.6億美元。骨內輸液設備旨在快速將液體、藥物和血液製品直接輸送至骨髓,尤其適用於傳統靜脈通路延遲或無效的情況。這些設備在危急的醫療緊急情況下至關重要,在時間有限或因生理限制或患者病情而無法進入周邊靜脈時,可提供可靠的血管通路。

其快速反應和可靠性使其成為各種醫療環境中緊急醫療方案的基石。它們廣泛應用於創傷病例、休克管理和脫水緊急情況,在這些情況下,快速介入可以顯著改善患者的預後。急診室、救護車服務和野戰醫療單位的醫護人員依靠這些設備進行高效的復甦和藥物輸送,尤其是在時間緊迫的情況下。骨內通路的廣泛應用也得益於民用和軍用醫療服務部門對訓練計畫和方案整合的日益重視。其緊湊的結構、便攜性和易用性進一步推動了其在傳統醫院環境之外的應用,使其能夠在遠端和院前護理中得到更廣泛的部署。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.491億美元 |

| 預測值 | 16.6億美元 |

| 複合年成長率 | 5.8% |

市場按產品類型細分為電池供電型、手動骨內注射針(或稱自動設備)以及衝擊驅動系統。 2024年,電池供電/自動設備細分市場佔據最大收益佔有率,達到4.578億美元。這些設備由於其快速且方便的部署,已成為急救護理的首選解決方案,通常比手動設備更有效率。當傳統靜脈注射途徑不可行時,尤其是在高壓環境下,自動骨內系統提供了可靠的替代方案。其設計只需極少的培訓,同時仍能提供較高的首次嘗試成功率,使其成為急救車輛、空中救護車和軍事行動的首選工具。它們在極端條件下的卓越性能推動了全球醫療保健系統的採用,各國政府為加強緊急準備和戰鬥護理系統而投入的資金也進一步增強了其應用。

依年齡層分類,市場分為成人和兒科患者。 2024年,兒科患者佔據了大多數市場佔有率,佔總市場佔有率的68.2%。由於幼童(尤其是嬰兒和新生兒)的靜脈細小且脆弱,建立血管通路往往面臨獨特的挑戰。骨內輸液提供了一種有效的替代方案,使醫護人員能夠快速可靠地實施挽救生命的治療。因此,重症監護病房、門診和急診對兒科專用骨內器械的需求不斷成長。全球兒科急救標準擴大將骨內通路納入第一線干預措施,這鼓勵了醫療機構投資於相容的設備和以兒科護理為重點的綜合培訓計畫。

就最終用途而言,市場細分為醫院和診所、門診手術中心和其他場所。醫院和診所細分市場在2024年佔據領先地位,預計未來幾年將保持強勁成長。創傷、心臟驟停以及敗血症和低血容量性休克等重症疾病病例的增加,加劇了住院和急診環境中對快速可靠的血管通路解決方案的需求。在靜脈通路延遲或無法建立的情況下,骨內輸液已成為關鍵選擇,尤其對於病情危重或靜脈難以定位的患者。各大醫療機構已將骨內輸液設備納入其急救方案,進一步加速了其在全球醫院和創傷中心的普及。

2024年,北美領先全球市場,總估值達4.242億美元。這一領先地位得益於該地區先進的醫療基礎設施和大量的急救程序。在美國,該市場規模從2023年的3.655億美元成長至2024年的3.829億美元。高需求源自於各種需要立即建立血管通路的緊急情況,尤其是對於無法進行靜脈注射的患者。這些設備已成為緊急醫療方案的重要組成部分,為各種臨床應用提供了可靠的替代方案。

全球競爭格局呈現成熟企業與新創企業交織的局面。 Pyng Medical、Teleflex、Dickinson and Company、PerSys Medical、Becton 和 Cardinal Health 等主要參與者合計佔了 2024 年全球約 70% 的收入。這些公司正積極透過收購、產品創新和策略合作進行擴張,以鞏固其市場佔有率。同時,一些區域和本地製造商正透過提供經濟高效的替代方案來滲透市場。為了擴大客戶群並提高產品可近性,併購、新產品的推出以及區域擴張計畫的激增進一步加劇了競爭態勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 緊急情況和創傷病例發生率上升

- 軍事和緊急醫療服務(EMS)的採用率不斷提高

- 設備設計的技術進步

- 醫療保健專業人員的意識和培訓不斷提高

- 產業陷阱與挑戰

- 先進的骨內輸液裝置成本高昂

- 因放置不當而導致併發症的風險

- 市場機會

- 新興市場對創傷護理的投入不斷增加

- 加強與院前和救護車護理方案的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 定價分析

- 依產品類型

- 按地區

- 差距分析

- 波特的分析

- PESTLE 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 手動骨內注射針

- 電池供電/自動設備

- 衝擊驅動裝置

第6章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 兒科患者

- 成年患者

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Aero Healthcare

- Becton, Dickinson and Company

- Biopsybell

- Bound Tree Medical

- Cardinal Health

- Cook Medical

- Henry Schein

- Implox

- PAVmed

- PerSys Medical

- Pyng Medical

- SAM Medical

- Sarnova

- Teleflex

- Vidacare

The Global Intraosseous Infusion Devices Market was valued at USD 949.1 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 1.66 billion by 2034.Intraosseous infusion devices are designed for rapid administration of fluids, medications, and blood products directly into the bone marrow, particularly when conventional intravenous access proves to be delayed or ineffective. These devices are essential in critical medical emergencies, offering dependable vascular access when time is limited or peripheral veins are inaccessible due to physiological constraints or patient conditions.

Their rapid action and reliability make them a cornerstone in emergency medical protocols across various healthcare environments. They are widely used in trauma cases, shock management, and dehydration emergencies where quick intervention can significantly impact patient outcomes. Healthcare professionals in emergency departments, ambulance services, and field medical units rely on these devices for efficient resuscitation and drug delivery, especially in time-sensitive scenarios. The expanding use of intraosseous access has also been supported by increasing emphasis on training programs and protocol integration across both civilian and military medical services. Their compact build, portability, and ease of use have further propelled adoption beyond traditional hospital settings, enabling wider deployment in remote and pre-hospital care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $949.1 Million |

| Forecast Value | $1.66 Billion |

| CAGR | 5.8% |

The market is segmented by product type into battery-powered, manual IO needles, or automatic devices, and impact-driven systems. In 2024, the battery-powered/automatic devices segment captured the largest revenue share, reaching USD 457.8 million. These devices have become the go-to solution in emergency care due to their speed and ease of deployment, often proving more efficient than their manual counterparts. Automatic intraosseous systems offer a reliable alternative when conventional intravenous routes are not an option, especially under high-pressure circumstances. Their design requires minimal training while still delivering high first-attempt success rates, making them a preferred tool in emergency vehicles, air ambulances, and military operations. Their performance in extreme conditions has boosted adoption across healthcare systems worldwide, further reinforced by investments from governments to enhance emergency readiness and combat care systems.

By age group, the market is categorized into adult and pediatric patients. In 2024, pediatric patients accounted for the majority share, commanding 68.2% of the total market. Establishing vascular access in young patients, especially infants and neonates, often presents unique challenges due to small and fragile veins. Intraosseous infusion offers an effective alternative, allowing medical professionals to administer life-saving treatments quickly and reliably. As a result, the demand for pediatric-specific intraosseous devices has grown across intensive care units, ambulatory services, and emergency departments. Global standards for pediatric emergency response increasingly incorporate intraosseous access as a frontline intervention, which has encouraged healthcare facilities to invest in compatible equipment and comprehensive training programs focused on pediatric care.

In terms of end use, the market is segmented into hospitals and clinics, ambulatory surgical centers, and other settings. The hospitals and clinics segment held the leading position in 2024 and is expected to maintain strong growth over the coming years. Rising cases of trauma, cardiac arrest, and critical conditions such as sepsis and hypovolemic shock have intensified the need for swift and reliable vascular access solutions in inpatient and emergency environments. Intraosseous infusion has become a critical option in scenarios where intravenous access is either delayed or unachievable, especially in patients who are critically ill or whose veins are hard to locate. Major healthcare organizations have integrated intraosseous devices into their emergency care protocols, further accelerating their presence across hospitals and trauma centers globally.

North America led the global market in 2024, with a total valuation of USD 424.2 million. This leadership is supported by advanced healthcare infrastructure and a high volume of emergency procedures across the region. In the United States, the market grew from USD 365.5 million in 2023 to USD 382.9 million in 2024. High demand stems from the need to handle a wide range of emergency cases that require immediate vascular access, especially in patients for whom intravenous methods are not viable. These devices have become a vital component of emergency medical protocols, offering a dependable alternative across a spectrum of clinical use cases.

The global competitive landscape features a mix of well-established players and emerging companies. Key participants such as Pyng Medical, Teleflex, Dickinson and Company, PerSys Medical, Becton, and Cardinal Health collectively accounted for around 70% of global revenue in 2024. These companies are actively expanding through acquisitions, product innovations, and strategic partnerships to reinforce their market share. At the same time, several regional and local manufacturers are penetrating the market by offering cost-effective alternatives. Competitive dynamics are further intensified by a surge in mergers, new product rollouts, and regional expansion initiatives aimed at broadening customer bases and enhancing product accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Age group

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of emergency conditions and trauma cases

- 3.2.1.2 Increased adoption by military and emergency medical services (EMS)

- 3.2.1.3 Technological advancements in device design

- 3.2.1.4 Growing awareness and training among healthcare professionals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced intraosseous infusion devices

- 3.2.2.2 Risk related to complications due to improper placements

- 3.2.3 Market opportunities

- 3.2.3.1 Growing investments in trauma care across emerging markets

- 3.2.3.2 Increased integration into pre-hospital and ambulance care protocols

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manual IO needles

- 5.3 Battery-powered/automatic devices

- 5.4 Impact-driven devices

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric patients

- 6.3 Adult patients

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Aero Healthcare

- 9.2 Becton, Dickinson and Company

- 9.3 Biopsybell

- 9.4 Bound Tree Medical

- 9.5 Cardinal Health

- 9.6 Cook Medical

- 9.7 Henry Schein

- 9.8 Implox

- 9.9 PAVmed

- 9.10 PerSys Medical

- 9.11 Pyng Medical

- 9.12 SAM Medical

- 9.13 Sarnova

- 9.14 Teleflex

- 9.15 Vidacare