|

市場調查報告書

商品編碼

1773408

循環原油、中間體和膠市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cyclic Crude, Intermediate, and Gum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

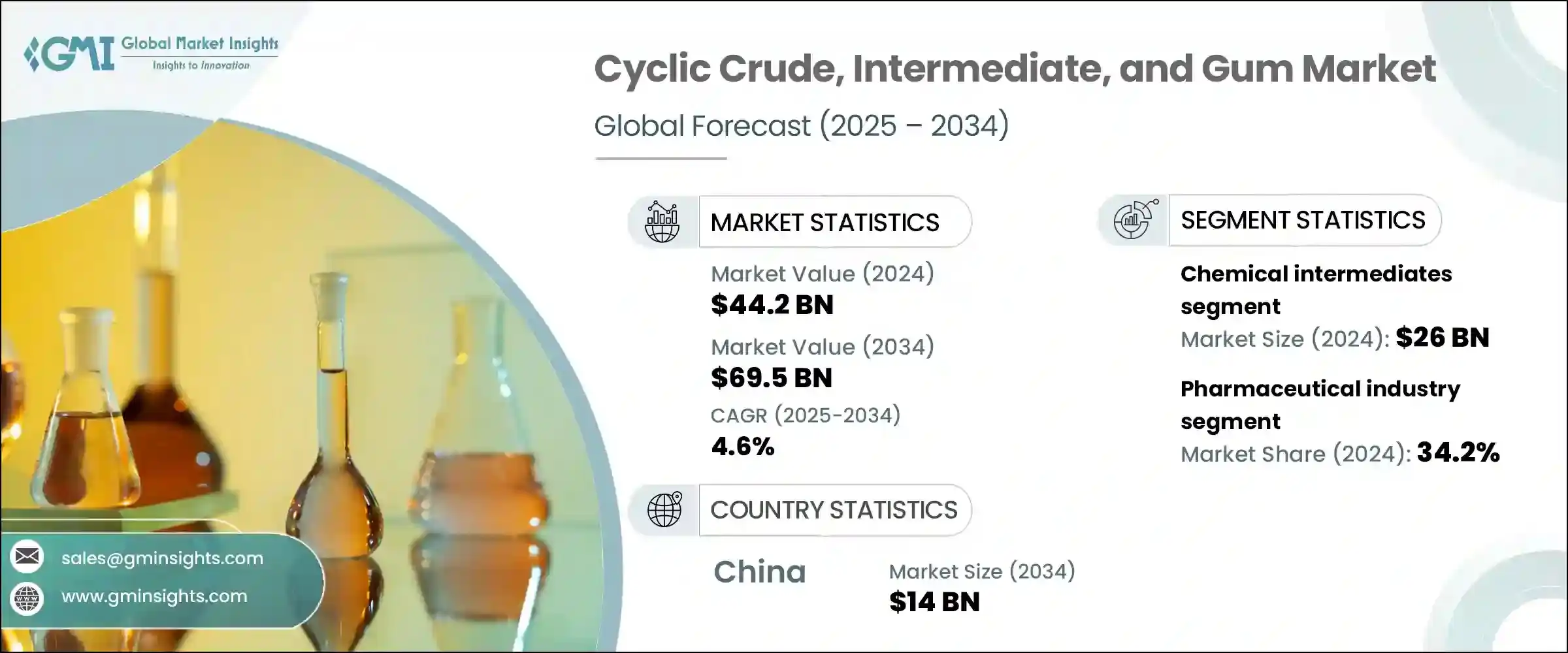

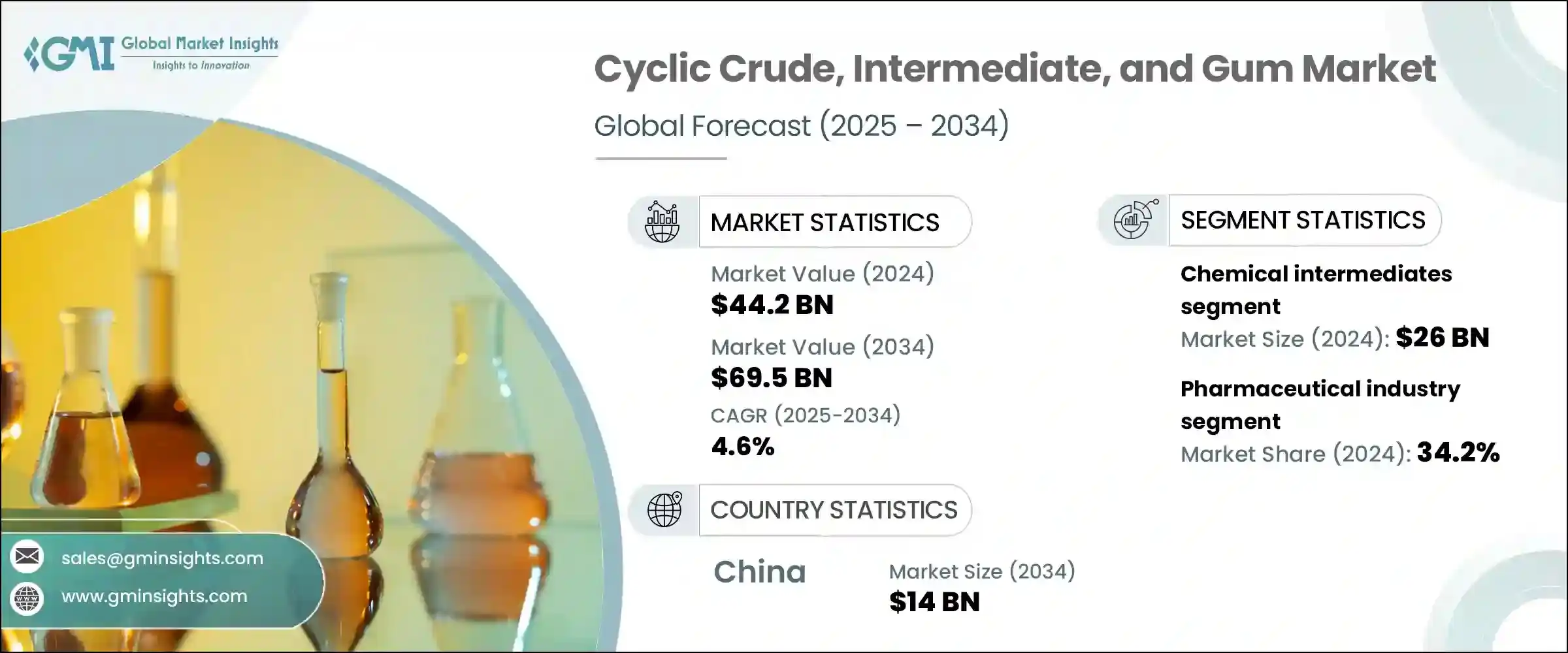

2024年,全球環狀原油、中間體及膠狀物市場規模達442億美元,預計2034年將以4.6%的複合年成長率成長,達到695億美元。市場擴張主要得益於製藥、食品加工、個人護理和化學品製造等行業的持續需求。這些材料在生產流程中發揮著至關重要的作用,它們作為核心成分、溶劑和乳化劑,可以簡化加工流程並提高配方品質。隨著工業生產採用更複雜的生產規程和更嚴格的產品要求,對環狀原油中間體和膠狀物的依賴持續上升。尤其值得一提的是,市場正朝著環保解決方案和高性能添加劑的方向轉變,製造商擴大選擇符合環保標準、能夠實現高效、精準效果的材料。

推動該市場發展的最顯著趨勢之一是轉向天然和植物來源的投入。各公司正積極投資於產品創新和製程最佳化,以提供生物基中間體和可生物分解膠,以滿足日益成長的監管要求和消費者偏好。這些材料目前廣泛應用於對穩定性和一致性要求極高的特殊配方中。尤其是天然膠,作為用途廣泛、功能多樣的成分,在一系列下游應用中越來越受到青睞,進一步鞏固了其市場地位。同時,在一致性和精確度至關重要的行業中,開發符合嚴格技術規格的環狀中間體正變得越來越重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 442億美元 |

| 預測值 | 695億美元 |

| 複合年成長率 | 4.6% |

在市場中,化學中間體是最主要且成長最快的產品類別。該領域在2024年創造了260億美元的收入,預計到2034年將達到410億美元,預測期內的複合年成長率為4.7%。這些中間體是生產各種高價值產品(例如黏合劑、聚合物、特殊溶劑和醫藥製劑)不可或缺的一部分。它們廣泛應用於各個領域,對眾多工業和商業營運至關重要。隨著石化公司持續從以燃料為中心的營運轉向特種化學品生產,中間體在其產品組合策略中的重要性顯著提升。這種演變反映了全球化工業的廣泛趨勢,即創新和增值已成為關鍵的成長動力。

就終端產業而言,製藥業在2024年成為環狀原油、中間體和膠的主要消費產業,佔據全球市場佔有率的34.2%。其需求源自於這些材料在藥物合成、配方和穩定過程中所扮演的重要角色。環狀中間體對於生產複雜的有機化合物至關重要,其高純度標準使其成為製藥生產中不可或缺的材料。此外,對先進藥物傳輸系統的日益依賴,以及生物技術衍生活性成分的廣泛使用,持續推動市場需求。天然膠也因其作為穩定劑、賦形劑和釋放調節劑的特性,廣泛應用於製藥領域。隨著全球醫療支出的成長和人口老化,預計該領域將在預測期內保持市場主導地位。

中國作為一個重要的區域市場脫穎而出,2024年貢獻了89億美元的收入。中國市場預計的複合年成長率為4.7%,到2034年將達到140億美元。中國市場正處於機會與不確定性並存的階段。儘管房地產行業低迷等宏觀經濟因素導致工業採購趨於謹慎,但環狀碳氫化合物的產量仍表現出強勁的韌性。 2024年產量大幅成長,顯示儘管面臨外部經濟壓力,製造業動能依然強勁。中國對化學品製造和製程效率的持續投資預計將推動中間體和天然膠的未來成長。

在競爭方面,全球市場由大型跨國公司和區域性企業共同塑造,每家企業都採取獨特的策略來維持成長。產業參與者高度重視清潔標籤產品的開發,使其產品與消費者日益成長的對健康和永續消費的偏好相一致。合併、收購以及與技術供應商的合作等策略性措施在塑造競爭格局方面發揮關鍵作用。這些合作旨在加速創新週期,增強原料採購能力,並確保為各個應用領域提供充足的先進原料供應。隨著產業應對不斷變化的消費者需求和嚴格的環保法規,創新和策略敏捷性仍然是長期市場成功的關鍵。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 終端使用產業的需求不斷成長

- 製藥領域的應用日益增多

- 特種化學品需求不斷成長

- 生產流程的技術進步

- 產業陷阱與挑戰

- 原物料價格波動

- 環境問題和法規

- 替代品的可用性

- 生產成本高

- 成長動力

- 成長潛力分析

- 監理框架分析

- 國際法規

- 區域監管標準

- FDA對口香糖產品的規定

- 環境合規要求

- 品質認證體系

- 技術格局

- 當前的技術趨勢

- 生產中的新興技術

- 製造業中的自動化與機器人技術

- 研發措施與創新管道

- 定價分析

- 價格趨勢分析

- 成本結構分析

- 影響定價的因素

- 區域價格差異

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

- 戰略儀表板

- 主要利害關係人和市場定位

- 競爭基準測試

- 競爭策略

- 新產品開發

- 併購

- 夥伴關係和合作

- 產能擴張

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 環狀原油

- 芳香烴

- 脂環烴

- 雜環化合物

- 化學中間體

- 環狀中間體

- 環己酮

- 環己烷

- 環戊烷

- 其他環狀中間體

- 醫藥中間體

- 農業化學品中間體

- 其他中間體

- 口香糖及相關產品

- 天然牙齦

- 阿拉伯膠

- 瓜爾膠

- 黃原膠

- 茄替膠

- 其他天然樹膠

- 合成膠

- 口香糖膠基

- 羧甲基纖維素(CMC)

- 其他合成膠

- 木材化學品

- 妥爾油

- 木炭

- 海軍物資

- 其他木材化學品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 製藥

- 活性藥物成分 (API)

- 輔料

- 藥物輸送系統

- 化學品和材料

- 特種化學品

- 聚合物和樹脂

- 油漆和塗料

- 黏合劑和密封劑

- 食品和飲料

- 乳化劑和穩定劑

- 增稠劑

- 糖果產品

- 飲料

- 石油和天然氣

- 鑽井液

- 提高石油採收率

- 燃油添加劑

- 紡織品

- 纖維中間體

- 染料和顏料

- 紡織助劑

- 化妝品和個人護理

- 潤膚劑

- 界面活性劑

- 流變改質劑

- 農業

- 殺蟲劑和除草劑

- 植物生長調節劑

- 土壤改良劑

- 其他

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 製藥業

- 學名藥

- 品牌藥物

- 合約製造

- 化工

- 基礎化學品

- 特種化學品

- 精細化學品

- 食品加工業

- 烘焙和糖果

- 乳製品

- 飲料

- 加工食品

- 石油和天然氣產業

- 上游

- 中游

- 下游

- 紡織業

- 服飾

- 技術紡織品

- 家紡

- 化妝品和個人護理行業

- 皮膚護理

- 頭髮護理

- 口腔護理

- 農業產業

- 作物保護

- 種子處理

- 土壤改良

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第9章:公司簡介

- BASF SE

- Albemarle Corporation

- Alland & Robert

- BioAmber Inc.

- Boc Sciences

- Chevron Phillips Chemical Company

- Clariant AG

- ComWin

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Corporation

- Hefei TNJ Chemical

- Invista

- Kantilal Brothers

- Kerry Group

- Koninklijke DSM NV

- Lonza Group

- Manus Aktteva Biopharma LLP

- Myriant Corporation

- Nexira Inc.

- Realsun Chemical

- Reliance Industries Limited

- Reverdia

- Royal Dutch Shell plc

- Sinopec Limited

- Succinity GmbH

- The Dow Chemical Company

- TIC Gums

- Topas Advanced Polymers Inc.

- Wuxi Gum Base Manufacture Co., Ltd.

The Global Cyclic Crude, Intermediate, and Gum Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 69.5 billion by 2034. The market expansion is largely fueled by consistent demand from industries such as pharmaceuticals, food processing, personal care, and chemical manufacturing. These materials play a crucial role in production workflows by acting as core ingredients, solvents, and emulsifying agents that simplify processing and enhance formulation quality. As industrial operations adopt more sophisticated production protocols and stricter product requirements, the reliance on cyclic crude intermediates and gums continues to rise. In particular, the market is witnessing a shift toward eco-friendly solutions and higher-performing additives, with manufacturers increasingly opting for materials that align with environmental standards and deliver efficient, targeted results.

One of the most notable trends driving this market is the movement toward natural and plant-derived inputs. Companies are actively investing in product innovation and process optimization to offer bio-based intermediates and biodegradable gums that meet growing regulatory and consumer preferences. These materials are now widely used in specialized formulations that demand both stability and consistent performance. Natural gums, in particular, are gaining traction as versatile, multifunctional components in a range of downstream applications, further strengthening their market position. At the same time, the development of cyclic intermediates that meet exacting technical specifications is becoming more important in industries where consistency and precision are non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $69.5 Billion |

| CAGR | 4.6% |

Within the market, chemical intermediates represent the most dominant and fastest-growing product category. This segment generated USD 26 billion in revenue in 2024 and is anticipated to reach USD 41 billion by 2034, expanding at a CAGR of 4.7% during the forecast period. These intermediates are integral to the production of a wide range of high-value goods such as adhesives, polymers, specialty solvents, and medical formulations. Their widespread applicability across various sectors makes them essential for numerous industrial and commercial operations. As petrochemical companies continue to pivot from fuel-centric operations toward specialty chemical production, the importance of intermediates in their portfolio strategies has grown considerably. This evolution reflects broader trends in the global chemical sector, where innovation and value addition have become key growth drivers.

In terms of end-use industries, the pharmaceutical sector emerged as the leading consumer of cyclic crude, intermediates, and gums in 2024, accounting for 34.2% of the global market share. The demand stems from the essential role these materials play in drug synthesis, formulation, and stabilization. Cyclic intermediates are critical for producing complex organic compounds, and their high purity standards make them indispensable in pharmaceutical manufacturing. Additionally, the increasing reliance on advanced drug delivery systems, along with the expanding use of biotechnologically derived active ingredients, continues to drive market demand. Natural gums are also widely used in pharmaceutical applications due to their properties as stabilizers, excipients, and release-modifying agents. As healthcare spending grows globally and the population ages, this segment is expected to maintain its market dominance through the forecast period.

China stands out as a key regional market, contributing USD 8.9 billion in revenue in 2024. The country is projected to grow at a CAGR of 4.7% and is expected to reach USD 14 billion by 2034. The market in China is undergoing a mixed phase of opportunity and uncertainty. While macroeconomic factors such as a subdued real estate sector have introduced caution in industrial procurement, the production volume of cyclic hydrocarbons showed strong resilience. Output saw a sharp rise in 2024, suggesting that manufacturing momentum remains intact despite external economic pressures. The country's continued investment in chemical manufacturing and process efficiency is expected to fuel future growth across both intermediates and natural gums.

On the competitive front, the global market is shaped by a blend of large multinational firms and regional players, each adopting distinct approaches to sustain growth. Industry participants are focusing heavily on clean-label product development, aligning their offerings with the increasing consumer inclination toward health-conscious and sustainable options. Strategic moves such as mergers, acquisitions, and partnerships with technology providers are playing a critical role in shaping the competitive landscape. These collaborations aim to drive faster innovation cycles, enhance raw material sourcing, and ensure a robust supply of advanced ingredients across various application sectors. As the industry navigates through evolving consumer demands and stringent environmental mandates, innovation and strategic agility remain central to long-term market success.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand from end use industries

- 3.7.1.2 Increasing applications in pharmaceuticals

- 3.7.1.3 Rising demand for specialty chemicals

- 3.7.1.4 Technological advancements in production processes

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 Environmental concerns and regulations

- 3.7.2.3 Availability of substitutes

- 3.7.2.4 High production costs

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Regulatory framework analysis

- 3.9.1 International regulations

- 3.9.2 Regional regulatory standards

- 3.9.3 FDA regulations for gum products

- 3.9.4 Environmental compliance requirements

- 3.9.5 Quality certification systems

- 3.10 Technology landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies in production

- 3.10.3 Automation and robotics in manufacturing

- 3.10.4 R&D initiatives and innovation pipeline

- 3.11 Pricing analysis

- 3.11.1 Price trend analysis

- 3.11.2 Cost structure analysis

- 3.11.3 Factors affecting pricing

- 3.11.4 Regional price variations

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Strategic dashboard

- 4.6 Key stakeholders and market positioning

- 4.7 Competitive benchmarking

- 4.8 Competitive strategies

- 4.8.1 New product developments

- 4.8.2 Mergers and acquisitions

- 4.8.3 Partnerships and collaborations

- 4.8.4 Capacity expansions

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Cyclic crude

- 5.2.1 Aromatic hydrocarbons

- 5.2.2 Alicyclic hydrocarbons

- 5.2.3 Heterocyclic compounds

- 5.3 Chemical intermediates

- 5.3.1 Cyclic intermediates

- 5.3.2 Cyclohexanone

- 5.3.3 Cyclohexane

- 5.3.4 Cyclopentane

- 5.3.5 Other cyclic intermediates

- 5.3.6 Pharmaceutical intermediates

- 5.3.7 Agrochemical intermediates

- 5.3.8 Other intermediates

- 5.4 Gums and related products

- 5.4.1 Natural gums

- 5.4.2 Gum arabic

- 5.4.3 Guar gum

- 5.4.4 Xanthan gum

- 5.4.5 Ghatti gum

- 5.4.6 Other natural gums

- 5.4.7 Synthetic gums

- 5.4.8 Chewing gum base

- 5.4.9 Carboxymethyl cellulose (CMC)

- 5.4.10 Other synthetic gums

- 5.5 Wood chemicals

- 5.6 Tall oil

- 5.7 Charcoal

- 5.8 Naval stores

- 5.9 Other wood chemicals

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Pharmaceuticals

- 6.2.1 Active pharmaceutical ingredients (APIs)

- 6.2.2 Excipients

- 6.2.3 Drug delivery systems

- 6.3 Chemicals and materials

- 6.3.1 Specialty chemicals

- 6.3.2 Polymers and resins

- 6.3.3 Paints and coatings

- 6.3.4 Adhesives and sealants

- 6.4 Food and beverages

- 6.4.1 Emulsifiers and stabilizers

- 6.4.2 Thickening agents

- 6.4.3 Confectionery products

- 6.4.4 Beverages

- 6.5 Oil and gas

- 6.5.1 Drilling fluids

- 6.5.2 Enhanced oil recovery

- 6.5.3 Fuel additives

- 6.6 Textiles

- 6.6.1 Fiber intermediates

- 6.6.2 Dyes and pigments

- 6.6.3 Textile auxiliaries

- 6.7 Cosmetics and personal care

- 6.7.1 Emollients

- 6.7.2 Surfactants

- 6.7.3 Rheology modifiers

- 6.8 Agriculture

- 6.8.1 Pesticides and herbicides

- 6.8.2 Plant growth regulators

- 6.8.3 Soil conditioners

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Pharmaceutical industry

- 7.2.1 Generic drugs

- 7.2.2 Branded drugs

- 7.2.3 Contract manufacturing

- 7.3 Chemical industry

- 7.3.1 Basic chemicals

- 7.3.2 Specialty chemicals

- 7.3.3 Fine chemicals

- 7.4 Food processing industry

- 7.4.1 Bakery and confectionery

- 7.4.2 Dairy products

- 7.4.3 Beverages

- 7.4.4 Processed foods

- 7.5 Oil and gas industry

- 7.5.1 Upstream

- 7.5.2 Midstream

- 7.5.3 Downstream

- 7.6 Textile industry

- 7.6.1 Apparel

- 7.6.2 Technical textiles

- 7.6.3 Home textiles

- 7.7 Cosmetics and personal care industry

- 7.7.1 Skin care

- 7.7.2 Hair care

- 7.7.3 Oral care

- 7.8 Agricultural industry

- 7.8.1 Crop protection

- 7.8.2 Seed treatment

- 7.8.3 Soil enhancement

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Albemarle Corporation

- 9.3 Alland & Robert

- 9.4 BioAmber Inc.

- 9.5 Boc Sciences

- 9.6 Chevron Phillips Chemical Company

- 9.7 Clariant AG

- 9.8 ComWin

- 9.9 Eastman Chemical Company

- 9.10 Evonik Industries AG

- 9.11 ExxonMobil Corporation

- 9.12 Hefei TNJ Chemical

- 9.13 Invista

- 9.14 Kantilal Brothers

- 9.15 Kerry Group

- 9.16 Koninklijke DSM N.V.

- 9.17 Lonza Group

- 9.18 Manus Aktteva Biopharma LLP

- 9.19 Myriant Corporation

- 9.20 Nexira Inc.

- 9.21 Realsun Chemical

- 9.22 Reliance Industries Limited

- 9.23 Reverdia

- 9.24 Royal Dutch Shell plc

- 9.25 Sinopec Limited

- 9.26 Succinity GmbH

- 9.27 The Dow Chemical Company

- 9.28 TIC Gums

- 9.29 Topas Advanced Polymers Inc.

- 9.30 Wuxi Gum Base Manufacture Co., Ltd.