|

市場調查報告書

商品編碼

1773406

磁磚膠黏劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tile Adhesive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

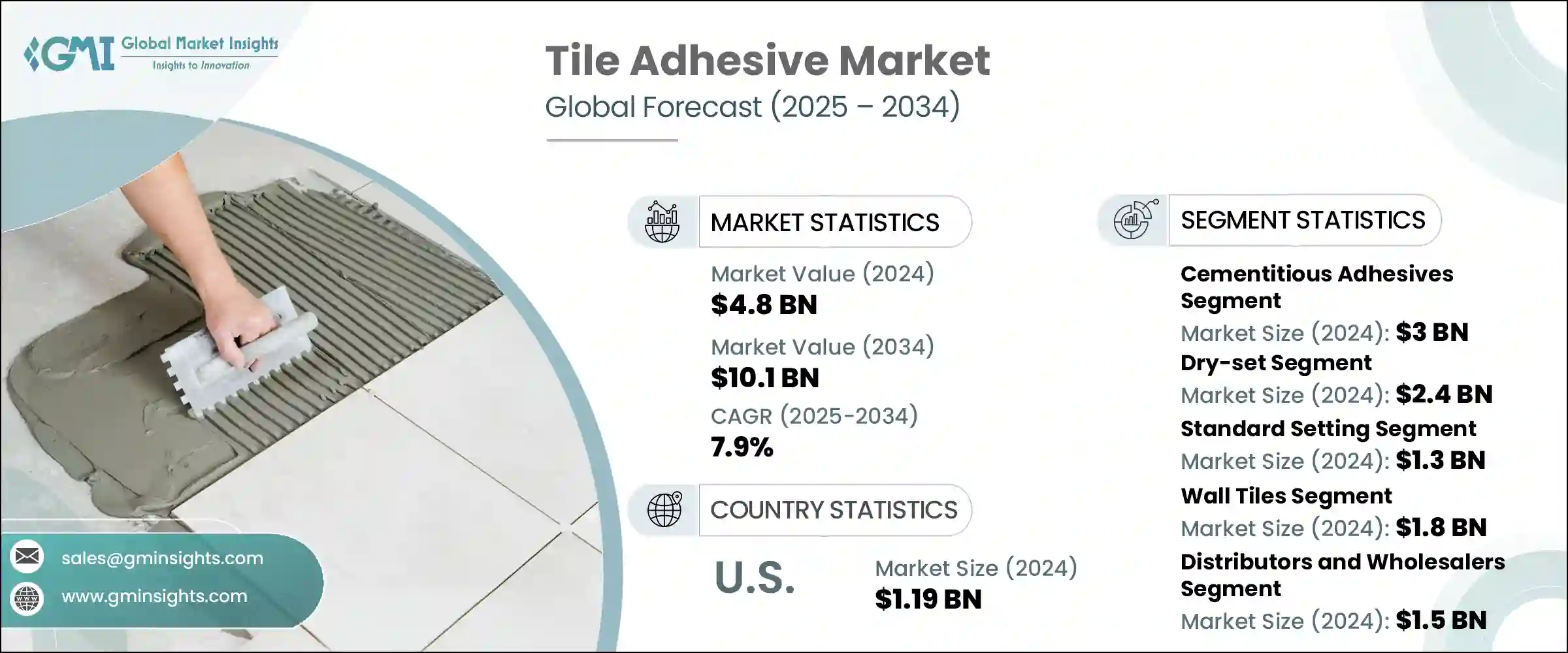

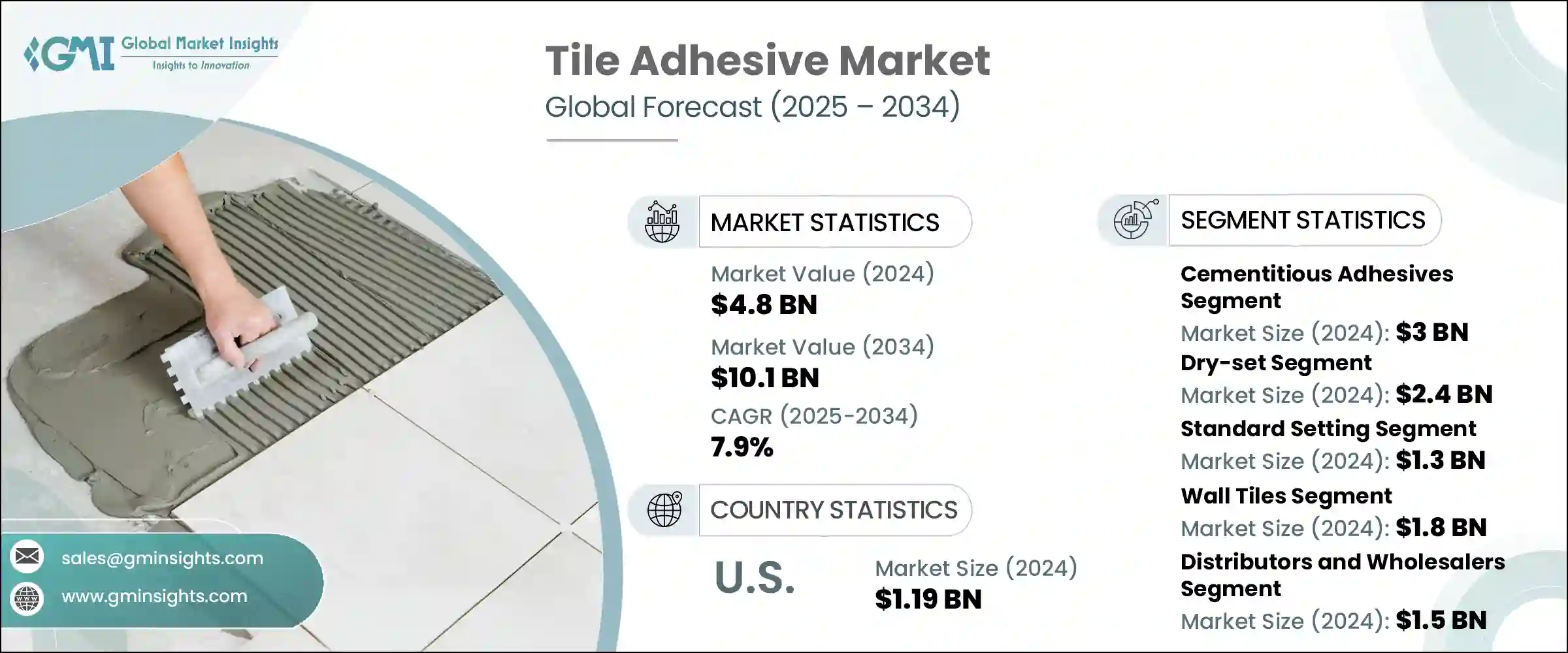

2024年,全球磁磚膠黏劑市場規模達48億美元,預計到2034年將以7.9%的複合年成長率成長,達到101億美元。這一成長主要受到發展中和已開發地區建築活動成長的影響。隨著城市基礎設施的擴張以及新的商業和住宅項目的破土動工,對高性能、省時的建築材料的需求持續成長。磁磚膠黏劑憑藉其卓越的黏結強度、便利的施工和高效的施工效率,正迅速取代傳統的水泥基解決方案。大規模的城市化進程,尤其是在中東和亞太地區快速發展的地區,使得瓷磚膠合劑成為現代建築實踐中不可或缺的產品。

在美國和歐洲,家居裝修和翻新工程(尤其是在老舊房屋中)的激增也推動了需求。由於磁磚膠合劑具有防潮性能且與多種材料相容,翻新工程中擴大在廚房、浴室和人流量大的室內空間中使用磁磚膠合劑。此外,膠合劑配方(尤其是聚合物配方)的創新,使得產品更輕、乾燥時間更快、柔韌性更強、耐熱性更高。這些進步不僅減少了安裝時間和材料浪費,還透過降低施工過程中的能耗來支持環保目標。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 7.9% |

2024年,水泥基膠黏劑市場規模達30億美元,預計到2034年將維持強勁成長,複合年成長率預計為7.1%。這些膠合劑因其成本效益高、經久耐用且適用於商業和住宅建築,仍然是建築業的首選。它們在發展中國家的廣泛應用反映了其經濟實惠的價格和久經考驗的強度。聚合物改質膠黏劑已變得越來越普遍,為涉及大尺寸瓷磚或易受潮區域的安裝提供了更佳的性能。其更高的柔韌性和防水性使其成為現代建築應用的理想選擇。隨著施工方法不斷發展以滿足更嚴苛的性能標準,這些升級版水泥基膠黏劑正在多個專案類型和地理市場中佔據主導地位。

標準型膠合劑市場在2024年的市值為13億美元,預計2034年的複合年成長率將達到5.9%。標準型膠合劑和速凝型膠合劑的選擇很大程度上取決於專案的性質和所需的工期。在工期允許的典型施工中,標準型膠合劑因其強大的黏合力和充足的施工時間而被廣泛使用。然而,在時間敏感的環境中,例如商業翻新或公共設施升級,速凝型膠合劑因其能夠加快竣工速度並減少停機時間而更受青睞。由於商業場所和零售店通常要求盡量減少營運中斷,因此對高性能、快速固化膠合劑的需求將持續成長。

2024年,美國磁磚膠黏劑市場規模達11.9億美元,預計到2034年將以7.6%的複合年成長率成長。住宅和商業建築活動的增加,以及國家對永續建築實踐的重視,共同推動了這一成長。隨著老舊建築的更新換代,對高效環保的膠合劑產品的需求日益成長。美國消費者越來越重視那些不僅能提升室內裝潢效果,還能持久耐用的產品。這種轉變促使製造商更加重視先進環保的膠合劑,這些膠合劑既符合現代性能標準,又符合綠建築計劃。

全球磁磚膠黏劑市場的競爭格局由 Ardex Group、Sika AG、Laticrete International, Inc.、Saint-Gobain Weber 和 Mapei SpA 等主要參與者塑造,這些公司以其對產品開發和市場擴張的持續投資而聞名。

磁磚膠黏劑市場的領導者正積極透過創新、合作和區域擴張等多種方式鞏固其市場地位。產品開發是重中之重,許多企業正在投資先進的聚合物改質膠合劑,以提高其耐用性、防水性和柔韌性。這些新配方通常針對現代建築需求量身定做,包括輕質瓷磚和潮濕區域安裝。同時,企業正在透過與承包商和分銷商建立策略合作夥伴關係來增強其全球分銷網路。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依化學類型,2021-2034

- 主要趨勢

- 水泥基黏合劑

- 標準水泥基(C1)

- 改良水泥基材 (C2)

- 速凝水泥基材料

- 其他

- 分散黏合劑

- 標準色散(D1)

- 改善分散性(D2)

- 其他

- 反應樹脂膠合劑

- 環氧基

- 聚氨酯基

- 其他

- 其他

第6章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 幹固

- 即用型

- 雙組分

- 其他

第7章:市場估計與預測:依功能,2021-2034

- 主要趨勢

- 標準制定

- 快速設定

- 靈活/可變形

- 防滑

- 防水

- 抗霜凍

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 牆磚

- 內牆

- 外牆

- 其他

- 地磚

- 室內地板

- 室外地板

- 其他

- 天花板

- 游泳池和潮濕區域

- 其他

第9章:市場估計與預測:依磁磚類型,2021-2034

- 主要趨勢

- 磁磚

- 磁磚

- 天然石材磁磚

- 大理石

- 花崗岩

- 石板

- 其他

- 玻璃磚

- 馬賽克瓷磚

- 大尺寸磁磚

- 其他

第10章:市場估計與預測:依最終用途領域,2021-2034

- 主要趨勢

- 住宅

- 新建築

- 裝修和改造

- 其他

- 商業的

- 辦公大樓

- 零售空間

- 飯店業

- 醫療保健設施

- 教育機構

- 其他

- 工業的

- 生產設施

- 倉庫

- 其他

- 機構

- 政府大樓

- 宗教建築

- 其他

- 其他

第 11 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 分銷商和批發商

- 家居裝飾店

- 專賣店

- 網路零售

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第13章:公司簡介

- Sika AG

- Mapei SpA

- Ardex Group

- Laticrete International, Inc.

- Saint-Gobain Weber

- HB Fuller Company

- Bostik SA (Arkema Group)

- Henkel AG & Co. KGaA

- Pidilite Industries Ltd.

- Wacker Chemie AG

- Custom Building Products

- Parex Group (Sika AG)

- Fosroc International Ltd.

- Kerakoll SpA

- 3M Company

The Global Tile Adhesive Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 10.1 billion by 2034. This growth is strongly influenced by rising construction activity across both developing and developed regions. As urban infrastructure expands and new commercial and residential projects break ground, demand for high-performance, time-saving building materials continues to rise. Tile adhesives are rapidly replacing conventional cement-based solutions due to their superior bond strength, easier application, and efficiency. Large urbanization efforts, especially in fast-growing areas across the Middle East and Asia-Pacific, have made these products essential for modern building practices.

In the U.S. and Europe, a surge in home improvement and remodeling efforts, particularly in aging properties, is also contributing to demand. Renovation projects are increasingly using tile adhesives in kitchens, bathrooms, and high-traffic interiors due to their resistance to moisture and their compatibility with a range of materials. Additionally, innovation in adhesive formulations-especially with polymers-has resulted in lighter products with faster drying times, enhanced flexibility, and improved thermal resistance. These advancements not only reduce installation time and material waste but also support environmental goals by lowering energy use during application.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 7.9% |

In 2024, the cementitious adhesives segment generated USD 3 billion and is expected to maintain strong growth with a projected CAGR of 7.1% through 2034. These adhesives remain a preferred choice due to their cost-effectiveness, durability, and adaptability for both commercial and residential construction. Their widespread use in developing nations reflects their affordability and proven strength. Polymer-modified variants have become increasingly common, offering enhanced performance for installations involving large-format tiles or moisture-prone areas. Their improved flexibility and water resistance make them ideal for modern building applications. As construction methods evolve to meet more demanding performance criteria, these upgraded cementitious adhesives are securing a dominant role across multiple project types and geographic markets.

The standard-setting adhesives segment was valued at USD 1.3 billion in 2024 and is expected to grow at a CAGR of 5.9% during 2034. The choice between standard and fast-setting adhesives depends heavily on the nature of the project and the required timelines. For typical construction where schedules allow, standard-setting adhesives are widely used because they provide strong adhesion and ample working time. However, in time-sensitive environments-such as commercial refurbishments or public facility upgrades-fast-setting adhesives are preferred for their ability to expedite completion and reduce downtime. As commercial spaces and retail outlets often demand minimal operational disruption, the demand for high-performance, quick-curing adhesives will continue to rise.

United States Tile Adhesive Market was valued at USD 1.19 billion in 2024 and is expected to grow at a CAGR of 7.6% through 2034. This expansion is fueled by increasing residential and commercial construction activity, coupled with a national emphasis on sustainable building practices. As older buildings are updated and replaced, there is a growing demand for efficient, environmentally conscious adhesive products. U.S. consumers are placing a higher value on products that not only enhance the appearance of interiors but also offer long-lasting durability. This shift is pushing manufacturers to focus more on advanced, eco-friendly adhesives that meet modern performance standards while aligning with green construction initiatives.

The competitive landscape in the Global Tile Adhesive Market is shaped by major players such as Ardex Group, Sika AG, Laticrete International, Inc., Saint-Gobain Weber, and Mapei S.p.A. These companies are known for their consistent investment in product development and market expansion.

Leading companies in the tile adhesive market are actively working to strengthen their market foothold through a mix of innovation, partnerships, and regional expansion. Product development is a top priority, with many firms investing in advanced polymer-modified adhesives that offer greater durability, water resistance, and flexibility. These new formulations are often tailored for modern building requirements, including lightweight tiles and wet-area installations. In parallel, companies are enhancing their global distribution networks by forming strategic partnerships with contractors and distributors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemical Type

- 2.2.3 Type

- 2.2.4 Feature

- 2.2.5 Application

- 2.2.6 Tile Type

- 2.2.7 End Use Sector

- 2.2.8 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Chemical Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cementitious Adhesives

- 5.2.1 Standard Cementitious (C1)

- 5.2.2 Improved Cementitious (C2)

- 5.2.3 Fast-Setting Cementitious

- 5.2.4 Others

- 5.3 Dispersion Adhesives

- 5.3.1 Standard Dispersion (D1)

- 5.3.2 Improved Dispersion (D2)

- 5.3.3 Others

- 5.4 Reaction Resin Adhesives

- 5.4.1 Epoxy-Based

- 5.4.2 Polyurethane-Based

- 5.4.3 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry-Set

- 6.3 Ready-to-Use

- 6.4 Two-Component

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Feature, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Standard Setting

- 7.3 Fast Setting

- 7.4 Flexible/Deformable

- 7.5 Slip-Resistant

- 7.6 Water-Resistant

- 7.7 Frost-Resistant

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Wall Tiles

- 8.2.1 Interior Walls

- 8.2.2 Exterior Walls

- 8.2.3 Others

- 8.3 Floor Tiles

- 8.3.1 Interior Floors

- 8.3.2 Exterior Floors

- 8.3.3 Others

- 8.4 Ceiling

- 8.5 Swimming Pools and Wet Areas

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Tile Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Ceramic Tiles

- 9.3 Porcelain Tiles

- 9.4 Natural Stone Tiles

- 9.4.1 Marble

- 9.4.2 Granite

- 9.4.3 Slate

- 9.4.4 Others

- 9.5 Glass Tiles

- 9.6 Mosaic Tiles

- 9.7 Large Format Tiles

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use Sector, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Residential

- 10.2.1 New Construction

- 10.2.2 Renovation and Remodeling

- 10.2.3 Others

- 10.3 Commercial

- 10.3.1 Office Buildings

- 10.3.2 Retail Spaces

- 10.3.3 Hospitality

- 10.3.4 Healthcare Facilities

- 10.3.5 Educational Institutions

- 10.3.6 Others

- 10.4 Industrial

- 10.4.1 Manufacturing Facilities

- 10.4.2 Warehouses

- 10.4.3 Others

- 10.5 Institutional

- 10.5.1 Government Buildings

- 10.5.2 Religious Buildings

- 10.5.3 Others

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Direct Sales

- 11.3 Distributors and Wholesalers

- 11.4 Home Improvement Stores

- 11.5 Specialty Stores

- 11.6 Online Retail

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East & Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East & Africa

Chapter 13 Company Profiles

- 13.1 Sika AG

- 13.2 Mapei S.p.A.

- 13.3 Ardex Group

- 13.4 Laticrete International, Inc.

- 13.5 Saint-Gobain Weber

- 13.6 H.B. Fuller Company

- 13.7 Bostik SA (Arkema Group)

- 13.8 Henkel AG & Co. KGaA

- 13.9 Pidilite Industries Ltd.

- 13.10 Wacker Chemie AG

- 13.11 Custom Building Products

- 13.12 Parex Group (Sika AG)

- 13.13 Fosroc International Ltd.

- 13.14 Kerakoll S.p.A.

- 13.15 3M Company