|

市場調查報告書

商品編碼

1773405

未濃縮橙汁市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Unconcentrated Orange Juice Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

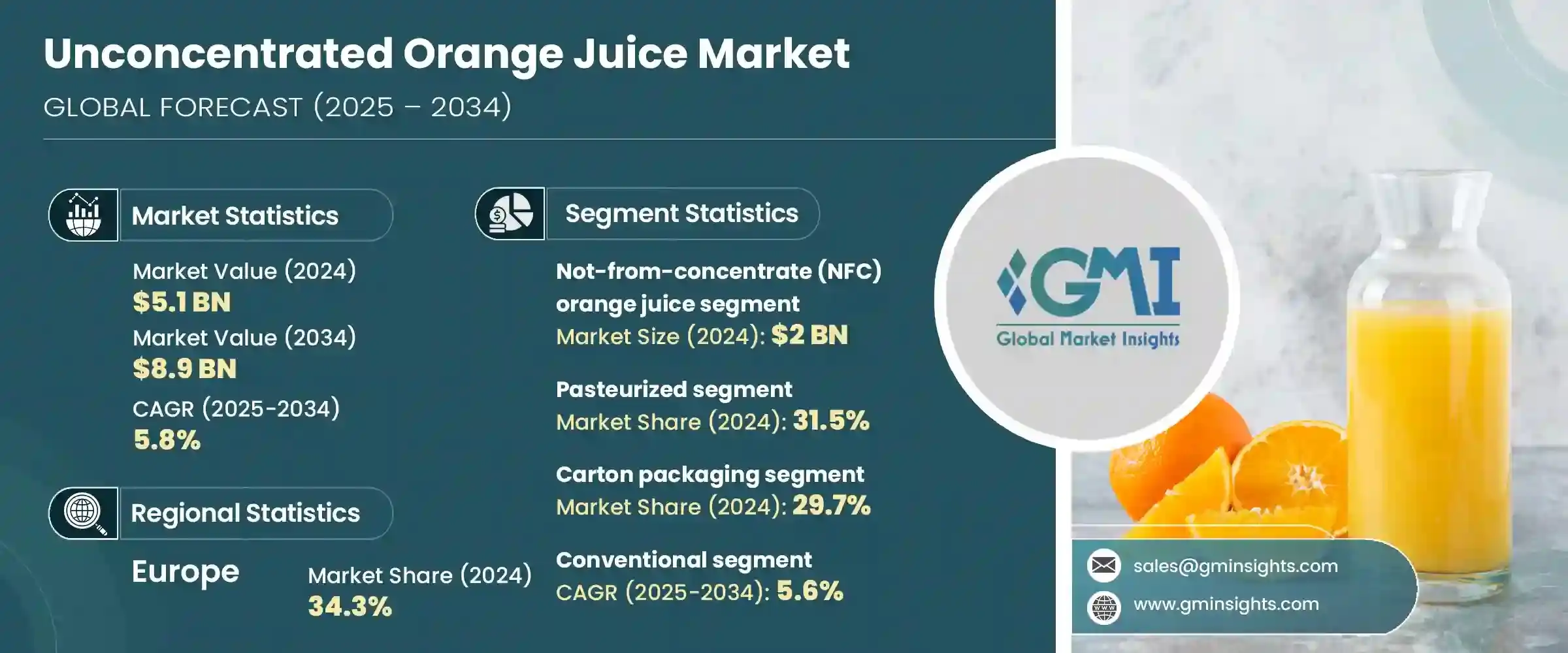

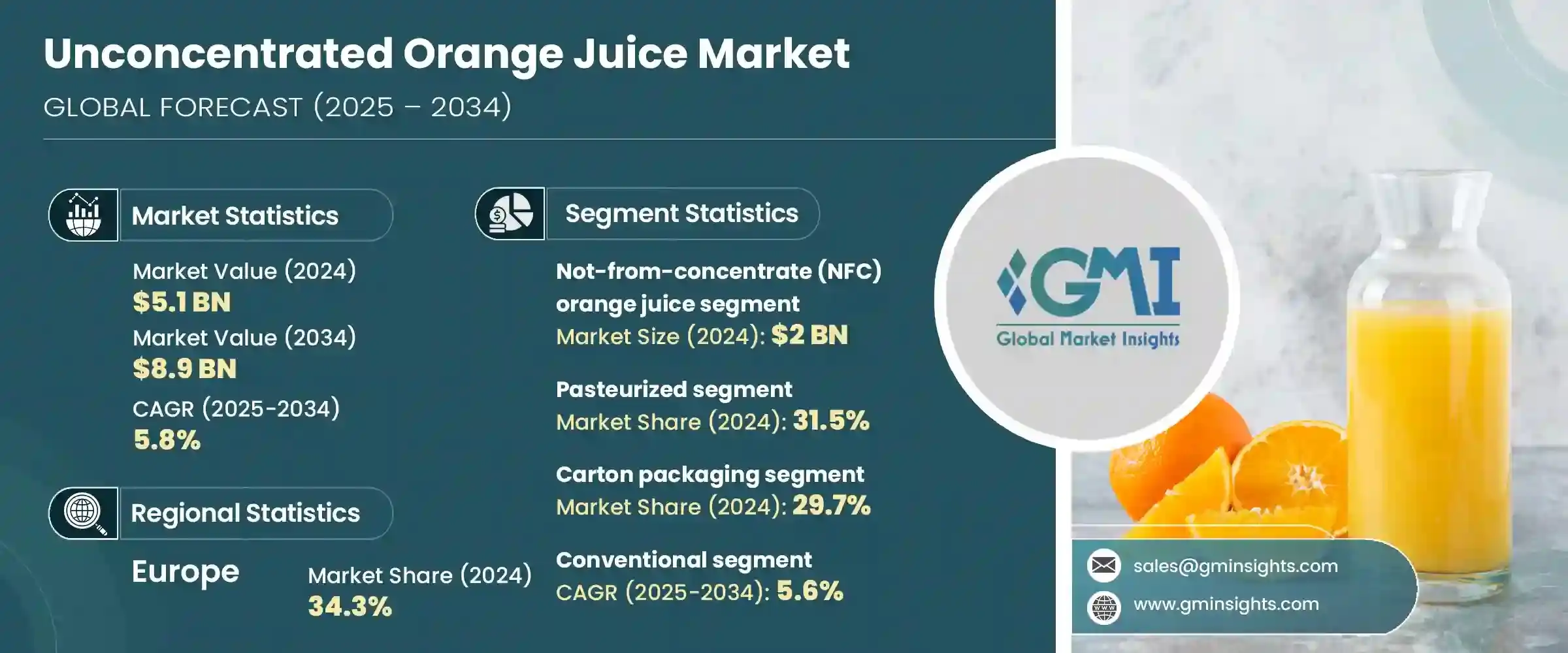

2024年,全球非濃縮橙汁市場規模達51億美元,預計2034年將以5.8%的複合年成長率成長,達到89億美元。這一成長主要源於消費者對新鮮、低加工、注重健康的橙汁產品的日益青睞。在北美和歐洲,注重健康的消費者越來越青睞柳橙汁,將其視為天然、新鮮的飲料替代品。過去十年,無添加劑、清潔標章產品的趨勢愈演愈烈,刺激了人們對耐儲存、冷藏、即飲產品的需求。

此外,優質有機非濃縮果汁 (NFC) 在全球市場正受到越來越多的關注。發展中國家城鎮化進程的加快,加上冷鏈物流的進步,也有助於克服分銷方面的挑戰,從而實現更廣泛的市場滲透。展望未來,永續包裝、透明採購和電商策略方面的創新有望帶來新的市場機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 89億美元 |

| 複合年成長率 | 5.8% |

儘管面臨橙子供應波動和供應鏈不確定性等挑戰,非濃縮橙汁產業仍展現出蓬勃發展的潛力。這些挑戰雖然嚴峻,但正在透過創新的採購策略和改進的物流來應對,這有助於穩定供應並確保產品供應的一致性。冷鏈技術的進步以及與種植者之間更緊密的合作關係,使企業能夠克服區域限制,更有效地滿足日益成長的消費者需求。此外,消費者對天然、無添加劑飲料的偏好不斷變化,這持續推動著產業的擴張,鼓勵生產商投資優質和有機產品。

非濃縮果汁 (NFC) 市場在 2024 年佔據 40% 的市場佔有率,估值達 20 億美元。 NFC 柳橙汁因其加工程度低、營養豐富,仍是市場主導產品,對尋求天然飲品的消費者極具吸引力。它在零售和餐飲通路的受歡迎程度日益提升,尤其是在城市中心地區,因為那裡的消費者更注重新新鮮健康的產品。

巴氏殺菌橙汁市場在2024年佔31.5%的市場佔有率,預計複合年成長率將達到5.2%,從而擴大其消費群體。巴氏殺菌法因其能夠延長保存期限、確保微生物安全,同時保持良好的風味和營養成分,繼續受到青睞。雖然未經巴氏殺菌的果汁吸引了注重健康的消費者,他們追求最新鮮的口味,但其較短的保存期限限制了其更廣泛的銷售。

2024年,歐洲非濃縮柳橙汁市場佔有34.3%的市佔率。各地區需求差異大,受當地消費者偏好、柳橙供應及零售業發展的影響。在北美,需求保持穩定,並逐漸轉向高階、有機和NFC果汁,這反映了消費者對清潔標籤、健康產品的興趣。在歐洲,冷壓和鮮榨柳橙汁在零售和餐飲服務領域日益普及,消費模式也較為強勁。

塑造非濃縮橙汁市場的領先公司包括路易達孚公司 (LDC)、百事可樂公司 (Tropicana)、佛羅裡達天然種植者公司、可口可樂公司 (Simply Orange、Minute Maid) 和 Citrosuco。這些主要參與者在創新、分銷網路和永續發展計劃方面展開激烈競爭,以維持和擴大其市場佔有率。為了鞏固其在非濃縮橙汁市場的立足點,該公司專注於持續的產品創新,開發有機和優質的 NFC 果汁,以滿足日益注重健康的消費者的需求。擴大分銷管道,尤其是透過電子商務和直接面對消費者的平台,有助於擴大其市場範圍。對永續和環保包裝的投資不僅吸引了具有環保意識的買家,也符合全球監管趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 非濃縮(NFC)柳橙汁

- 鮮榨柳橙汁

- 冷壓柳橙汁

- 優質未濃縮橙汁

第6章:市場估計與預測:按加工方法,2021 - 2034 年

- 主要趨勢

- 巴氏殺菌

- 未經巴氏消毒

- 高壓處理(HPP)

- 脈衝電場(PEF)

- 其他

第7章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 紙箱包裝

- 利樂

- Pure-Pak

- 其他

- 塑膠瓶

- PET瓶

- HDPE瓶

- 其他

- 玻璃瓶

- 散裝包裝

- 盒中袋

- 無菌罐

- 鼓

- 其他

第8章:市場估計與預測:按性質,2021 - 2034 年

- 主要趨勢

- 傳統的

- 有機的

- 天然/清潔標籤

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店

- 網路零售

- 專賣店

- 餐飲服務

- HoReCa (飯店、餐廳、咖啡館)

- 機構

- 其他餐飲服務

- 其他

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 直接消費

- 烹飪應用

- 混合飲料

- 功能性飲料

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- The Coca-Cola Company (Minute Maid, Simply Orange)

- PepsiCo, Inc. (Tropicana)

- Florida's Natural Growers

- Citrosuco

- Louis Dreyfus Company (LDC)

- Sucocitrico Cutrale

- COFCO International

- Uncle Matt's Organic

- Rauch Fruchtsafte GmbH & Co OG

- Trade Winds Citrus Limited

- Ventura Coastal LLC

- Nestle SA

- ITC Limited

- Sumol + Compal Marcas SA

- Huiyuan Juice Group Limited

The Global Unconcentrated Orange Juice Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 8.9 billion by 2034. This growth is driven by rising consumer preference for fresh, minimally processed orange juice products that emphasize health and wellness. In North America and Europe, health-conscious consumers increasingly favor orange juice as a natural, fresh beverage alternative. Over the last decade, the trend toward additive-free, clean-label products has gained momentum, fueling demand for shelf-stable, chilled, ready-to-drink options.

Additionally, premium and organic not-from-concentrate (NFC) juices are capturing greater market interest globally. The increasing urbanization in developing countries, paired with advancements in cold chain logistics, has also helped overcome distribution challenges, enabling wider market penetration. Looking ahead, innovations in sustainable packaging, transparent sourcing, and e-commerce strategies are expected to open market opportunities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 5.8% |

Despite challenges such as fluctuating orange supplies and supply chain uncertainties, the unconcentrated orange juice sector offers promising potential for dynamic growth. These obstacles, while significant, are being addressed through innovative sourcing strategies and improved logistics that help stabilize supply and ensure consistent product availability. Advances in cold chain technology and better relationships with growers are enabling companies to overcome regional limitations and meet rising consumer demand more effectively. Furthermore, evolving consumer preferences toward natural, additive-free beverages continue to drive expansion, encouraging producers to invest in premium quality and organic offerings.

The not-from-concentrate (NFC) segment accounted for a 40% share in 2024, with a valuation of USD 2 billion. NFC orange juice remains the dominant product type due to its minimal processing and high nutritional content, appealing strongly to consumers seeking natural beverage options. Its popularity is rising in both retail and food service channels, especially in urban centers where fresh, wholesome products are highly valued.

The pasteurized orange juice segment represented a 31.5% share in 2024 and is expected to grow at a CAGR of 5.2%, expanding its consumer base. Pasteurization continues to be favored for its ability to extend shelf life and ensure microbial safety while maintaining an acceptable flavor profile and nutrient retention. Though unpasteurized juice attracts health-conscious buyers looking for the freshest taste, its shorter shelf life restricts its broader distribution.

Europe Unconcentrated Orange Juice Market held a 34.3% share in 2024. Regional demand varies significantly, shaped by local consumer preferences, orange availability, and retail developments. In North America, demand remains steady, with a gradual shift towards premium, organic, and NFC juices reflecting consumers' interest in clean-label, health-oriented products. Europe exhibits robust consumption patterns in countries where cold-pressed and freshly squeezed orange juices have gained popularity across retail and food service sectors.

Among the leading companies shaping the Unconcentrated Orange Juice Market are Louis Dreyfus Company (LDC), PepsiCo, Inc. (Tropicana), Florida's Natural Growers, The Coca-Cola Company (Simply Orange, Minute Maid), and Citrosuco. These major players compete fiercely on innovation, distribution networks, and sustainability initiatives to maintain and grow their market shares. To strengthen their foothold in the unconcentrated orange juice market, companies focus on continuous product innovation, developing organic and premium NFC juices to cater to evolving health-conscious consumers. Expanding distribution channels, especially through e-commerce and direct-to-consumer platforms, helps broaden their market reach. Investments in sustainable and eco-friendly packaging not only appeal to environmentally aware buyers but also align with global regulatory trends.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Not-From-Concentrate (NFC) orange juice

- 5.3 Freshly squeezed orange juice

- 5.4 Cold-pressed orange juice

- 5.5 Premium unconcentrated orange juice

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Pasteurized

- 6.3 Unpasteurized

- 6.4 High-pressure processing (HPP)

- 6.5 Pulsed electric field (PEF)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Carton packaging

- 7.2.1 Tetra Pak

- 7.2.2 Pure-Pak

- 7.2.3 Others

- 7.3 Plastic bottles

- 7.3.1 PET bottles

- 7.3.2 HDPE bottles

- 7.3.3 Others

- 7.4 Glass bottles

- 7.5 Bulk packaging

- 7.5.1 Bag-in-Box

- 7.5.2 Aseptic tanks

- 7.5.3 Drums

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Organic

- 8.4 Natural/Clean label

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Online retail

- 9.5 Specialty stores

- 9.6 Foodservice

- 9.6.1 HoReCa (Hotel, Restaurant, Cafe)

- 9.6.2 Institutional

- 9.6.3 Other foodservice

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 Direct consumption

- 10.3 Culinary applications

- 10.4 Beverage blends

- 10.5 Functional beverages

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.3.7 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 The Coca-Cola Company (Minute Maid, Simply Orange)

- 12.2 PepsiCo, Inc. (Tropicana)

- 12.3 Florida's Natural Growers

- 12.4 Citrosuco

- 12.5 Louis Dreyfus Company (LDC)

- 12.6 Sucocitrico Cutrale

- 12.7 COFCO International

- 12.8 Uncle Matt's Organic

- 12.9 Rauch Fruchtsafte GmbH & Co OG

- 12.10 Trade Winds Citrus Limited

- 12.11 Ventura Coastal LLC

- 12.12 Nestle S.A.

- 12.13 ITC Limited

- 12.14 Sumol + Compal Marcas S.A.

- 12.15 Huiyuan Juice Group Limited