|

市場調查報告書

商品編碼

1773403

手術縫合線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Surgical Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

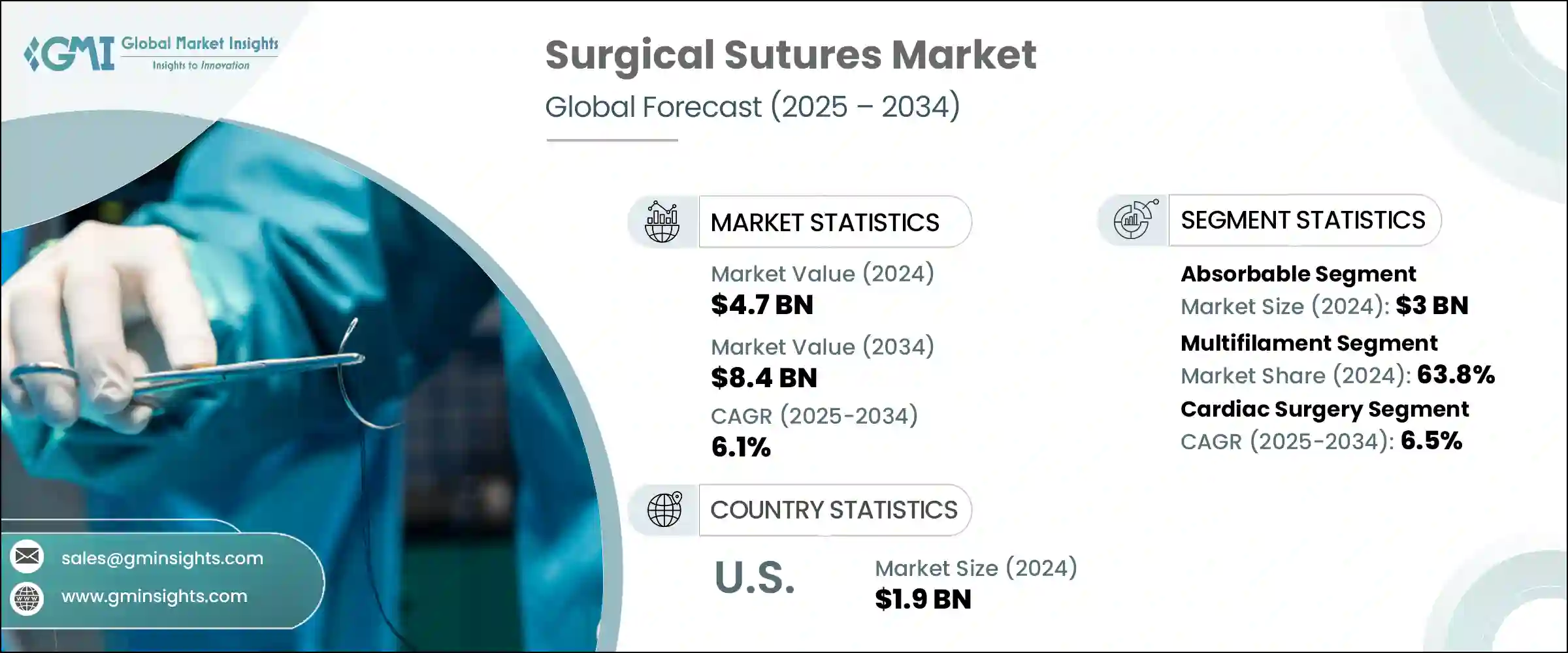

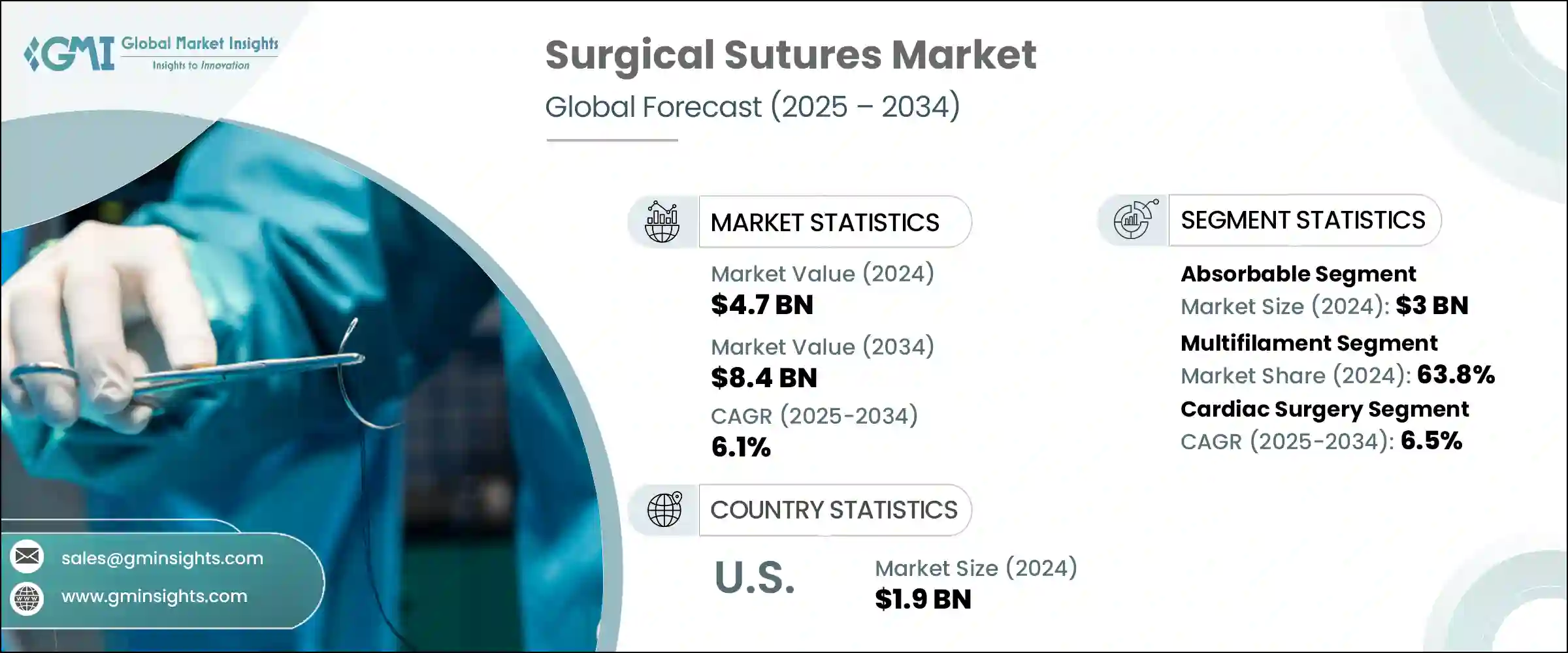

2024年,全球外科縫合線市場規模達47億美元,預計2034年將以6.1%的複合年成長率成長,達到84億美元。市場成長的動力源自於老齡人口的成長以及與老化相關的手術數量的增加,例如骨科和腹部手術。隨著糖尿病、心血管疾病和肥胖等慢性疾病在全球持續攀升,外科手術的需求也隨之成長,這直接刺激了縫線的需求。新一代手術工具的出現,加上微創手術的日益流行,正在加速該行業的創新。

合成可吸收材料的進步也正在改變傷口管理實踐。醫院和外科中心正在擴大其基礎設施,以支持不斷成長的手術量,從而進一步促進了採購。越來越多的醫護人員採用塗層縫線來降低感染風險,這反映出人們更廣泛地轉向感染控制和加速癒合速度。傳統和現代縫線在外科專業領域的需求都在不斷成長,這為市場持續的長期成長奠定了基礎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 47億美元 |

| 預測值 | 84億美元 |

| 複合年成長率 | 6.1% |

2024年,可吸收縫線市場規模達30億美元。其受歡迎程度源自於其能夠在體內組織內自然分解,無需物理性拔除。這項特性提升了患者的舒適度,並縮短了術後護理時間,尤其是在無法拆線的內部手術中。由於可吸收縫合線感染風險更低且生物相容性更好,外科醫生在軟組織手術和兒科手術中越來越傾向於使用可吸收縫合線。此外,人們對微創治療的認知不斷提高,以及需要手術治療的慢性疾病負擔日益加重,也推動了該市場的發展動能。這些因素共同推動了醫院採購策略向可吸收、可生物分解縫線的轉變。

2024年,複絲縫合線市場佔有63.8%的佔有率。這些縫合線由編織或絞線組成,具有卓越的抗張強度、良好的結紮安全性和柔韌性——這些關鍵特性使其成為需要可靠縫合的手術的理想選擇。其結構使其在複雜的手術中能夠實現更精確的控制和輕鬆的操作,這對於涉及肌肉、胃腸道組織或生殖器官的手術至關重要。複絲縫合線因其能夠有效固定傷口並在壓力下防止斷裂的能力,廣泛應用於一般外科、骨科、婦科和胃腸道手術。

2024年,美國外科縫線市場產值達19億美元。這一成長得益於美國先進的醫療基礎設施、人口老化以及高手術量。美敦力、愛惜康(強生公司)和泰利福等全球領導企業的市場影響力,確保醫院和外科中心能夠及時獲得創新的縫合解決方案。這些企業透過完善的分銷網路營運,使新技術在公立和私人醫療系統中快速應用。在美國,術後效果、病人安全和降低感染率的重視,正在推動住院和門診手術環境中對先進塗層和可吸收縫線的需求。

影響外科縫合線市場的知名公司包括 Dolphin Sutures、Boston Scientific、Corza Medical、Smith and Nephew、B. Braun Melsungen、Kono Seisakusho、Integra Lifesciences、Advanced Medical Solutions、Teleflex、Zimmer Biomet、Healthium Medtech、Peters Surgical、Ethunx(強生)、CONatMED、MIT Gx朋友、EthMEDx), GCONx)、CONatMEDing 和 GCONx), GxCON準備。這些製造商深深植根於價值鏈,並透過創新和全球合作不斷擴大其影響力。

外科縫合線市場的主要參與者正致力於持續研發,以改善縫合線材料的性能,從而提高強度、生物分解性和抗菌性能。各公司正積極擴展其產品組合,包括塗層縫合線、倒鉤縫合線和藥物嵌入縫合線,以支持感染控制並加速癒合。策略性收購和合作夥伴關係有助於領先公司進入新的區域市場並加強分銷。製造和供應鏈的本地化正在被採用,以降低成本並確保高需求地區的產品供應。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 手術數量不斷成長

- 創傷發生率上升

- 縫合設計和材料的技術進步

- 老年人口不斷增加

- 產業陷阱與挑戰

- 高級縫合類型報銷不一致

- 替代傷口閉合方法的可用性

- 市場機會

- 對客製化和特定手術縫合線的需求不斷成長

- 越來越傾向微創外科手術

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 定價分析

- 依產品類型

- 按地區

- 差距分析

- 波特的分析

- PESTLE 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 可吸收縫線

- 天然縫合線

- 合成縫合線

- 不可吸收縫合線

- 尼龍

- 普理靈

第6章:市場估計與預測:按燈絲,2021 年至 2034 年

- 主要趨勢

- 單絲

- 複絲

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 眼科手術

- 心臟手術

- 骨科手術

- 神經外科

- 婦科手術

- 其他手術

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 醫院

- 門診手術中心

- 專科診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Advanced Medical Solutions

- B. Braun Melsungen

- Boston Scientific

- CONMED

- Corza Medical

- Dolphin Sutures

- Ethicon (Johnson & Johnson)

- GPC Medical

- Healthium Medtech

- Integra Lifesciences

- Kono Seisakusho

- Medtronic

- Peters Surgical

- Smith and Nephew

- Stryker

- Teleflex

- Zimmer Biomet

The Global Surgical Sutures Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 8.4 billion by 2034. Market growth is being driven by a rising elderly population and an increasing number of surgeries related to aging, such as orthopedic and abdominal procedures. As chronic conditions, including diabetes, cardiovascular disorders, and obesity, continue to climb globally, so does the demand for surgical interventions, directly fueling the need for sutures. The availability of next-generation surgical tools, combined with the growing trend toward minimally invasive operations, is accelerating innovation in the industry.

Advancements in synthetic absorbable materials are also transforming wound management practices. Hospitals and surgical centers are expanding their infrastructure to support rising procedure volumes, further boosting procurement. Healthcare professionals are increasingly adopting coated sutures that reduce infection risks, reflecting a broader shift toward infection control and faster healing. Both traditional and modern suture types are experiencing elevated demand across surgical specialties, positioning the market for sustained long-term expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 6.1% |

The absorbable sutures segment generated USD 3 billion in 2024. Their popularity lies in their ability to naturally degrade within body tissues, removing the need for physical extraction. This feature enhances patient comfort and shortens post-operative care, especially in internal procedures where suture removal is impractical. Surgeons increasingly prefer absorbable sutures in soft tissue operations and pediatric surgeries due to reduced infection risks and better biocompatibility. The segment's momentum is also supported by growing awareness around minimally invasive treatments and the rising burden of chronic diseases that require surgical resolution. These factors collectively support a shift in hospital procurement strategies toward absorbable, biodegradable options.

The multifilament sutures segment held a 63.8% share in 2024. These sutures are composed of braided or twisted strands, delivering superior tensile strength, knot security, and flexibility-key attributes that make them ideal for surgeries that demand reliable closure. Their structure allows for more precise control and easy handling during intricate operations, which is essential for procedures involving muscle, gastrointestinal tissue, or reproductive organs. Multifilament sutures are used extensively in general, orthopedic, gynecological, and gastrointestinal surgeries due to their ability to secure wounds effectively and resist breakage under pressure.

U.S. Surgical Sutures Market generated USD 1.9 billion in 2024. This growth is supported by the country's advanced healthcare infrastructure, an aging population, and high surgical volumes. The market presence of global leaders such as Medtronic, Ethicon (Johnson & Johnson), and Teleflex ensures that hospitals and surgical centers have prompt access to innovative suturing solutions. These players operate through well-established distribution networks, enabling rapid adoption of new technologies across public and private health systems. In the U.S., emphasis on post-operative outcomes, patient safety, and reduced infection rates is pushing demand for advanced coated and absorbable sutures across both inpatient and outpatient surgical settings.

Notable companies influencing the Surgical Sutures Market include Dolphin Sutures, Boston Scientific, Corza Medical, Smith and Nephew, B. Braun Melsungen, Kono Seisakusho, Integra Lifesciences, Advanced Medical Solutions, Teleflex, Zimmer Biomet, Healthium Medtech, Peters Surgical, Ethicon (Johnson & Johnson), CONMED, Medtronic, Stryker, and GPC Medical. These manufacturers are deeply embedded in the value chain and continue to expand their reach through innovation and global partnerships.

Major players in the surgical sutures market are focusing on continuous R&D to improve suture material properties-enhancing strength, biodegradability, and antimicrobial performance. Companies are actively expanding their portfolios to include coated, barbed, and drug-embedded sutures that support infection control and accelerate healing. Strategic acquisitions and partnerships help leading firms enter new regional markets and strengthen distribution. Localization of manufacturing and supply chains is being adopted to reduce costs and ensure product availability in high-demand areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filament

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing growth in surgeries

- 3.2.1.2 Rising incidence of trauma

- 3.2.1.3 Technological advances in suture design and material

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistency in reimbursement for advanced suture types

- 3.2.2.2 Availability of alternative wound closure methods

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for customized and procedure specific sutures

- 3.2.3.2 Increasing preference toward minimally invasive surgical procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable sutures

- 5.2.1 Natural sutures

- 5.2.2 Synthetic sutures

- 5.3 Non-absorbable sutures

- 5.3.1 Nylon

- 5.3.2 Prolene

Chapter 6 Market Estimates and Forecast, By Filament, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Monofilament

- 6.3 Multifilament

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Ophthalmic surgery

- 7.3 Cardiac surgery

- 7.4 Orthopaedic surgery

- 7.5 Neurological surgery

- 7.6 Gynaecology surgery

- 7.7 Other surgeries

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Hospitals

- 8.2 Ambulatory surgical centers

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profile

- 10.1 Advanced Medical Solutions

- 10.2 B. Braun Melsungen

- 10.3 Boston Scientific

- 10.4 CONMED

- 10.5 Corza Medical

- 10.6 Dolphin Sutures

- 10.7 Ethicon (Johnson & Johnson)

- 10.8 GPC Medical

- 10.9 Healthium Medtech

- 10.10 Integra Lifesciences

- 10.11 Kono Seisakusho

- 10.12 Medtronic

- 10.13 Peters Surgical

- 10.14 Smith and Nephew

- 10.15 Stryker

- 10.16 Teleflex

- 10.17 Zimmer Biomet