|

市場調查報告書

商品編碼

1773402

高鎳陰極 (NMC 811) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High-Nickel Cathodes (NMC 811) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

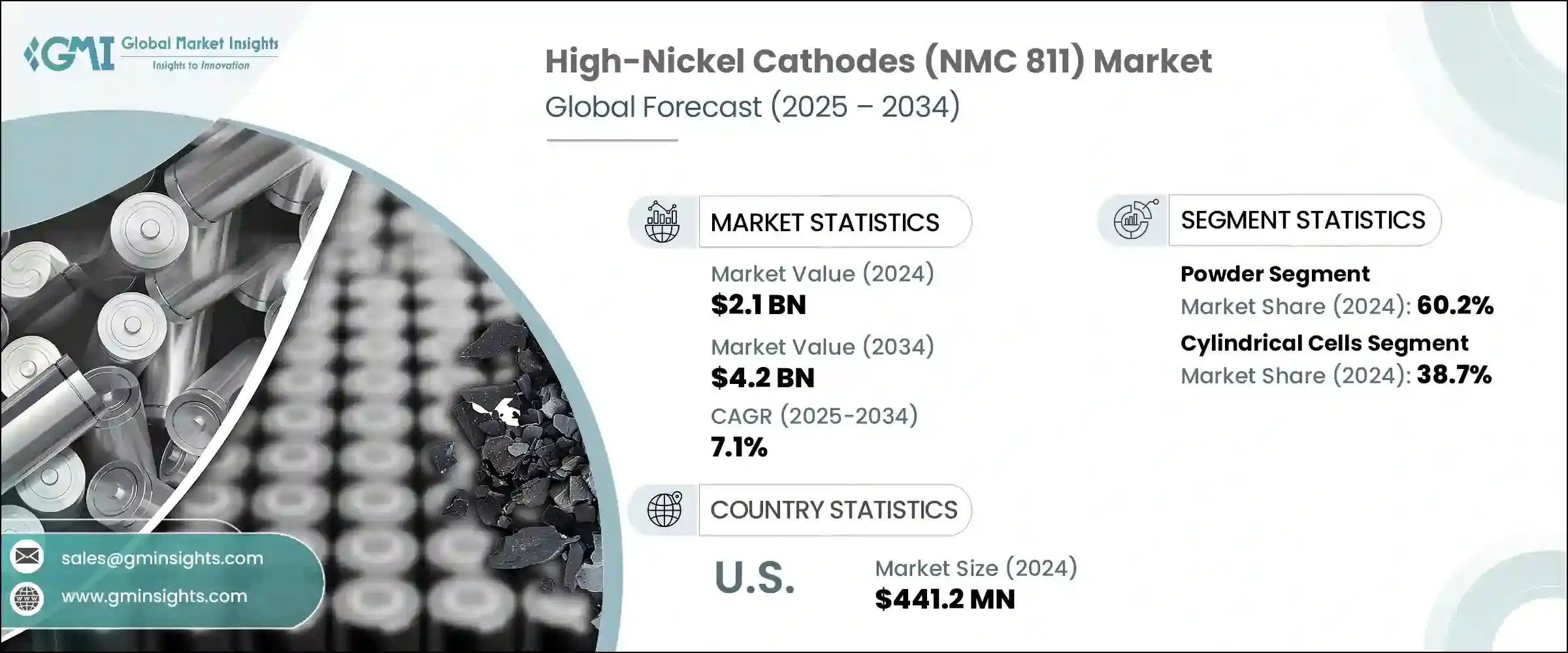

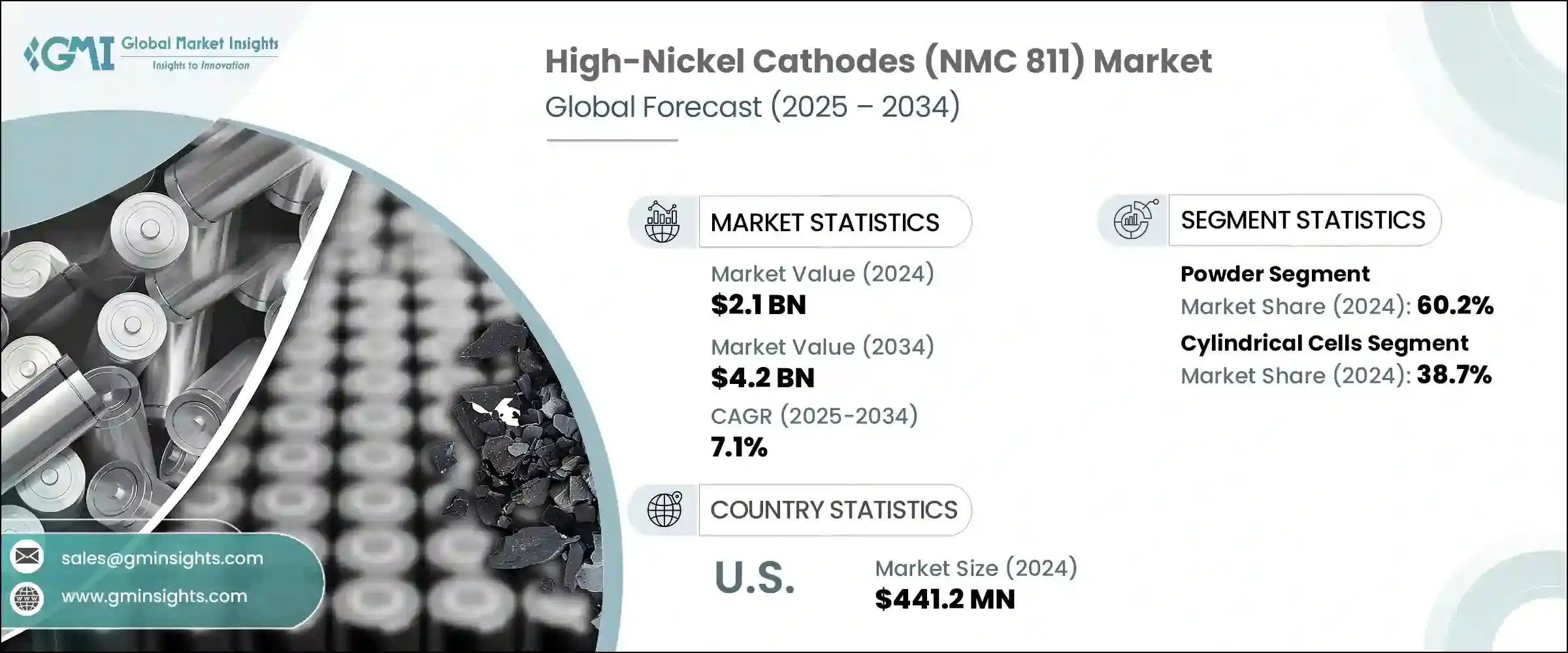

2024年,全球高鎳正極材料 (NMC 811) 市場規模達21億美元,預計到2034年將以7.1%的複合年成長率成長,達到42億美元。這一成長源自於電動車和大規模儲能領域對高性能鋰離子電池需求的激增。 NMC 811正極材料成分為80%的鎳、10%的錳和10%的鈷,具有卓越的能量密度和熱穩定性。該材料日益普及,很大程度上得益於業界努力減少對鈷的依賴。鈷價格高昂,面臨供應鏈挑戰。企業正在轉向富鎳化學材料,以滿足長續航電動車的需求,同時最大限度地降低與鈷採購相關的風險敞口。

電池製造商正在積極擁抱陰極設計和生產方面的創新,以增強電池的穩定性、能量保持能力和高效的熱性能。這些技術進步對於支援下一代電池供電的交通運輸和電網儲能至關重要。此外,鎳鐵鋁等替代材料也正在研究中,以消除鈷的使用。增強的材料加工技術提升了高鎳陰極的性能和可擴展性,使其成為全球各行各業廣泛能源應用的可靠選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 42億美元 |

| 複合年成長率 | 7.1% |

2024年,粉末基NMC 811材料市場佔有60.2%的佔有率。其主導地位歸功於其優異的電化學性能,這得益於更大的表面積,有利於鋰離子更好地移動。粉末形式還具有更高的填充密度和一致的顆粒結構,從而提高了生產效率。隨著全球製造業透過超級工廠蓬勃發展,粉末材料與自動化電池生產系統的兼容性為其廣泛應用提供了支援。此外,粉末材料能夠耐受塗層和燒結工藝,從而減少電池性能下降並延長電池壽命,使其成為現代電池技術的首選。

圓柱形電池市場在2024年佔了38.7%的市場。這類電池因其耐用性、易於組裝和標準化格式而廣受歡迎,從而能夠無縫整合到量產中。採用NMC 811正極材料,圓柱形電池可提供更大的能量輸出並改善熱調節。其結構強度使其在電動車、工業工具和其他高耗能系統中的高性能應用中具有高度可靠性。

2024年,美國高鎳正極材料(NMC 811)市值達4.412億美元。北美市場的成長主要由美國引領,美國正在大力投資國內電池供應鏈和電動車基礎設施。在聯邦政府激勵措施的支持下,美國正在建立強大的製造業生態系統,以支持高鎳化學技術的發展。各大汽車製造商正在積極整合NMC 811正極材料,以支援續航里程更長、電池組件更永續的先進電動車。人們對電池性能最佳化和材料道德採購的興趣日益濃厚,也促進了該地區市場的擴張。

高鎳正極(NMC 811)市場參與者包括 LG Chem、L&F Co、寧波容百新能源科技有限公司、Ecopro BM 和寧德時代新能源科技有限公司,它們都在創新、成本效益和產品可靠性方面展開競爭。為了在高鎳正極(NMC 811)產業中獲得競爭優勢,各大公司都強調研發投資,以創造具有更高能量密度和更低鈷含量的下一代化學物質。他們正在擴大生產能力以滿足激增的電動車需求,並與汽車製造商和電池製造商建立合作夥伴關係。供應鏈本地化和後向整合被優先考慮,以限制採購風險。此外,該公司正在最佳化粉末形貌和顆粒塗層,以延長循環壽命、提高充電速度並支援與高壓系統的兼容性,同時確保法規遵循和永續性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按形式

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保計劃

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按材料,2021-2034 年

- 主要趨勢

- 粉末

- 顆粒

- 其他

第6章:市場估計與預測:按電池類型,2021-2034 年

- 主要趨勢

- 圓柱形電池

- 方形電池

- 軟包電池

第7章:市場估計與預測:按應用,2021-2034 年

- 主要趨勢

- 電動車

- 純電動車

- 插電式混合動力電動車

- 油電混合車

- 商用電動車

- 儲能系統

- 公用事業和工業存儲

- 住宅儲能

- 商業和工業存儲

- 消費性電子產品

- 智慧型手機

- 筆記型電腦和平板電腦

- 穿戴式裝置

- 其他

- 電動工具

- 電動自行車和電動滑板車

- 醫療器材

- 航太和國防

- 其他

第8章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Contemporary Amperex Technology

- Ecopro BM

- Haldor Topsoe

- L&F Co.

- LG Chem

- NEI Corporation

- Ningbo Ronbay New Energy Technology

- Sumitomo Metal Mining

- Tanaka Chemical Corporation

- Targray Technology International

- TOB New Energy

- Toda Kogyo

- Umicore

The Global High-Nickel Cathodes (NMC 811) Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 4.2 billion by 2034. This growth stems from the surging need for high-performance lithium-ion batteries used in electric vehicles and large-scale energy storage. With a composition of 80% nickel, 10% manganese, and 10% cobalt, NMC 811 cathodes offer superior energy density and thermal stability. Their rising adoption is largely influenced by industry efforts to reduce dependency on cobalt, which remains expensive and faces supply chain challenges. Companies are turning to nickel-rich chemistries to meet the demands of longer-range EVs while minimizing risk exposure linked to cobalt sourcing.

Battery manufacturers are embracing innovations in cathode design and production that allow for enhanced stability, improved energy retention, and efficient thermal performance. These technological advances are critical to supporting the next generation of battery-powered transportation and grid storage. Alternative compositions such as nickel-iron-aluminum, are also being researched to eliminate cobalt use. Enhanced material processing techniques have boosted the performance and scalability of high-nickel cathodes, making them a reliable option for a broad range of energy applications across global industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 7.1% |

The powder-based NMC 811 materials segment held a 60.2% share in 2024. Their dominance is attributed to their superior electrochemical behavior, driven by a larger surface area that facilitates better lithium-ion movement. The powdered form also offers higher packing density and consistent particle structure, improving production efficiency. As global manufacturing ramps up through gigafactories, the powder variant's compatibility with automated battery production systems supports its widespread deployment. Furthermore, its ability to endure coating and sintering processes that reduce degradation and extend battery life has made it a top choice for modern battery technologies.

The cylindrical cells segment accounted for 38.7% share in 2024. These cells are popular for their durability, ease of assembly, and standardized format, which enables seamless integration into mass production. With the incorporation of NMC 811 cathodes, cylindrical cells can deliver greater energy output and improved thermal regulation. Their structural strength makes them highly reliable for high-performance applications in electric vehicles, industrial tools, and other energy-demanding systems.

U.S. High-Nickel Cathodes (NMC 811) Market was valued at USD 441.2 million in 2024. Growth across North America is being led by the U.S., which is heavily investing in domestic battery supply chains and EV infrastructure. Backed by federal incentives, the country is establishing a strong manufacturing ecosystem that supports high-nickel chemistry. Major auto manufacturers are actively integrating NMC 811 cathodes to support advanced EVs with longer ranges and more sustainable battery components. Increasing interest in battery performance optimization and ethical sourcing of materials also contributes to market expansion in the region.

High-Nickel Cathodes (NMC 811) Market players include LG Chem, L&F Co, Ningbo Ronbay New Energy Technology, Ecopro BM, and Contemporary Amperex Technology all competing on innovation, cost-efficiency, and product reliability. To gain a competitive edge in the high-nickel cathodes (NMC 811) industry, major companies are emphasizing R&D investments to create next-gen chemistries with improved energy density and reduced cobalt content. They are scaling up production capabilities to meet surging EV demand and forging partnerships with automakers and battery manufacturers. Supply chain localization and backward integration are being prioritized to limit sourcing risks. Additionally, companies are optimizing powder morphology and particle coatings to enhance cycle life, improve charging speeds, and support compatibility with high-voltage systems-all while ensuring regulatory compliance and sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection method

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Form

- 2.2.3 Battery type

- 2.2.4 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruption

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS Code)

- 3.11.1 Major exporting countries

- 3.11.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiative

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LATAM

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.7 Mergers & acquisitions

- 4.8 Partnerships & collaborations

- 4.9 New product launches

- 4.10 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material, 2021–2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Battery Type, 2021–2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cylindrical cells

- 6.3 Prismatic cells

- 6.4 Pouch cells

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Electric vehicles

- 7.2.1 Battery electric vehicles

- 7.2.2 Plug-in hybrid electric vehicles

- 7.2.3 Hybrid electric vehicles

- 7.2.4 Commercial electric vehicles

- 7.3 Energy storage systems

- 7.3.1 Utility & industrial storage

- 7.3.2 Residential storage

- 7.3.3 Commercial & industrial storage

- 7.4 Consumer electronics

- 7.4.1 Smartphones

- 7.4.2 Laptops and tablets

- 7.4.3 Wearable devices

- 7.4.4 Others

- 7.5 Power tools

- 7.6 E-bikes and E-scooters

- 7.7 Medical devices

- 7.8 Aerospace and defense

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Contemporary Amperex Technology

- 9.2 Ecopro BM

- 9.3 Haldor Topsoe

- 9.4 L&F Co.

- 9.5 LG Chem

- 9.6 NEI Corporation

- 9.7 Ningbo Ronbay New Energy Technology

- 9.8 Sumitomo Metal Mining

- 9.9 Tanaka Chemical Corporation

- 9.10 Targray Technology International

- 9.11 TOB New Energy

- 9.12 Toda Kogyo

- 9.13 Umicore