|

市場調查報告書

商品編碼

1773401

產後益生菌補充劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Postnatal Probiotic Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

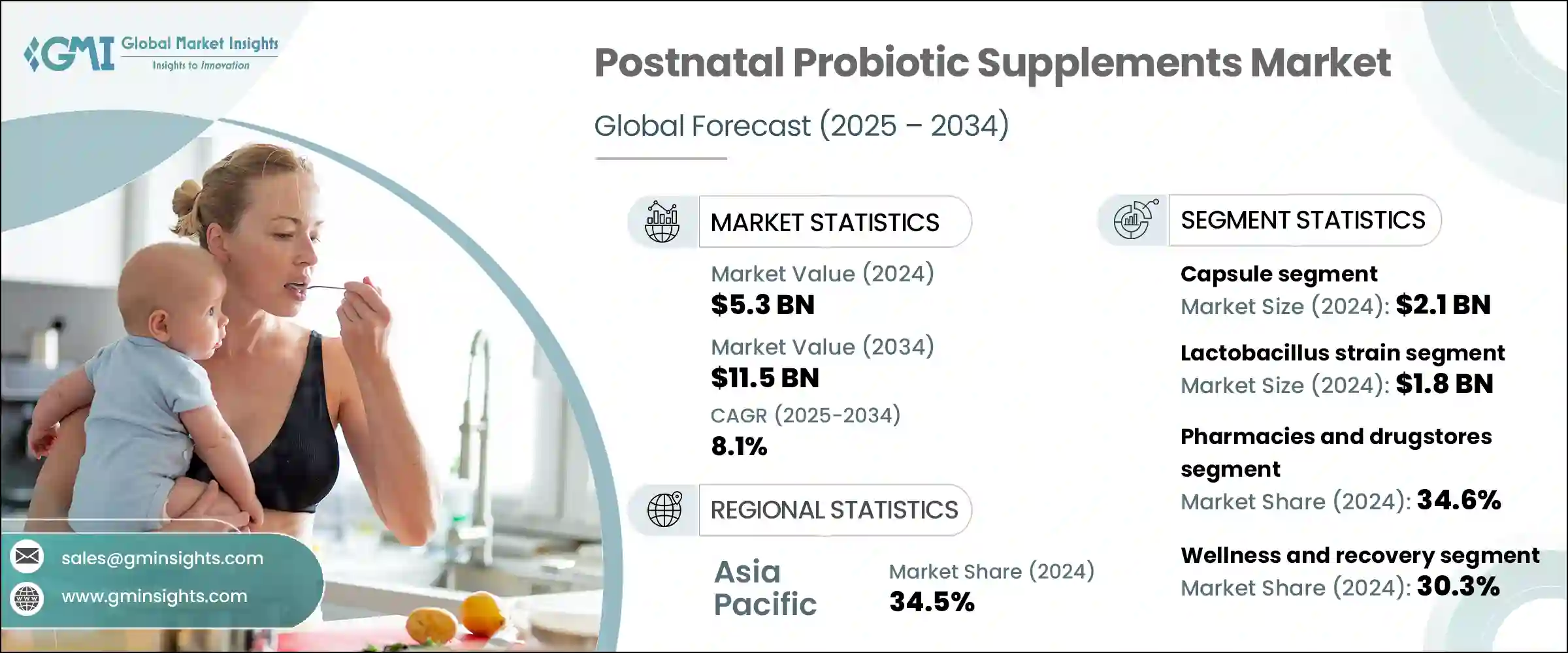

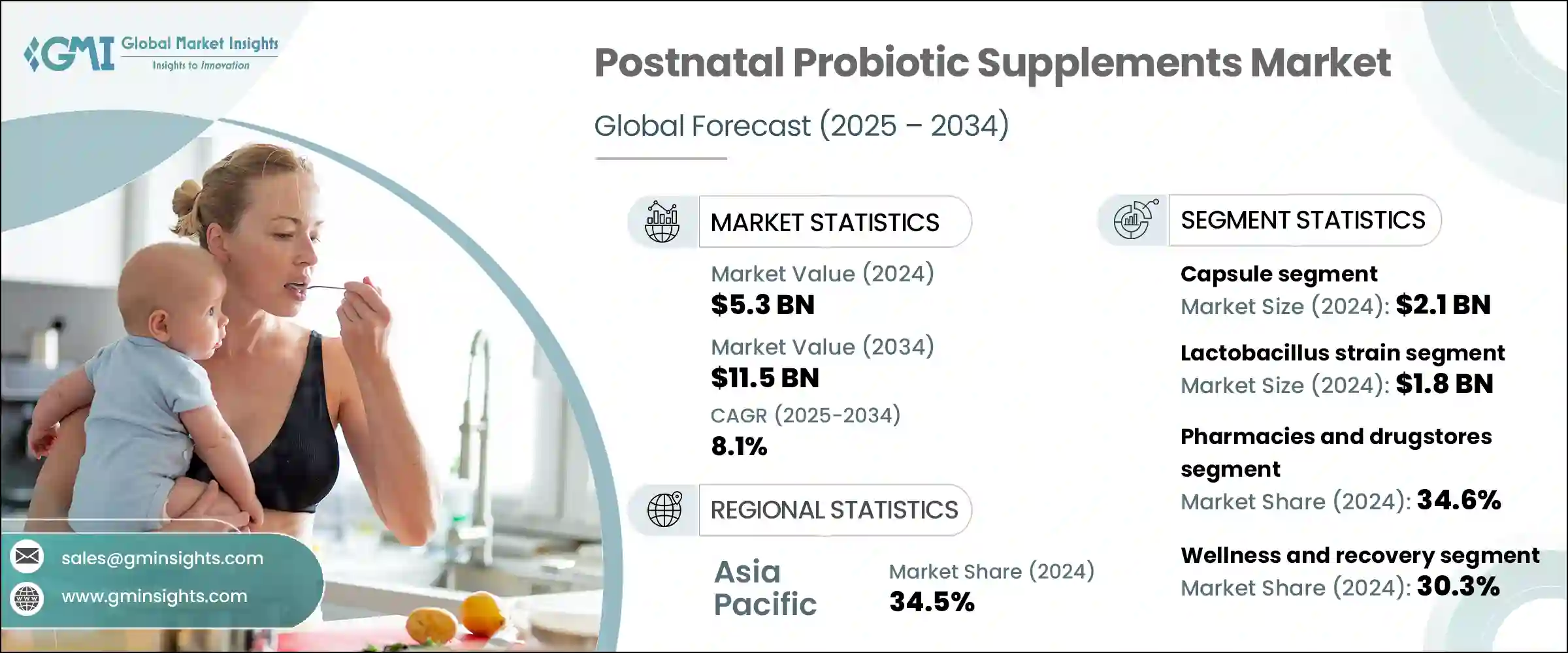

2024年,全球產後益生菌補充劑市場價值為53億美元,預計到2034年將以8.1%的複合年成長率成長,達到115億美元。這些補充劑配方含有多種有益菌種,主要來自乳酸桿菌和雙歧桿菌,有助於維持產後健康。它們有助於恢復腸道平衡,增強免疫反應,預防乳腺炎等感染,並促進情緒和消化系統健康。

消費者對產後自然和功能性恢復方案的興趣日益濃厚,是推動成長的關鍵因素。隨著線上和零售通路的擴張,人們對孕產婦護理的認知不斷提高,也刺激了需求。此外,生育率高且孕產婦保健計畫可近性不斷提高的新興經濟體也帶來了強勁的擴張機會。對個人化配方和經臨床驗證的多菌株解決方案的需求正在進一步塑造產品格局。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 8.1% |

隨著越來越多的醫療保健專業人士認可這些產品,以及各大品牌持續投資擴大其產品組合,市場必將加速創新並得到更廣泛的應用。特定菌株益處的臨床驗證正在提升信任度和需求,促使各公司推出針對產後需求(例如荷爾蒙平衡、消化支持和免疫功能)的針對性配方。

生物技術公司與學術機構之間日益成長的研究合作也推動了基於科學研究成果的產品開發。同時,零售通路的擴大,尤其是透過數位平台,使全球新手媽媽更容易獲得這些補充劑。隨著宣傳活動和教育推廣的加強,產後益生菌補充劑的採用率預計將大幅提升,使其成為現代孕產婦保健習慣的核心組成部分。

膠囊市場佔39.3%的市佔率,2024年銷售額達21億美元。其主導地位源自於其易用性、長期保存期限、精準劑量以及與多菌株配方的兼容性。膠囊尤其受到產後消費者的歡迎,因為它們可以隨餐或空腹服用,而且可靠性高。臨床機構和藥局也青睞膠囊給藥方式,這增強了膠囊的可靠性和市場接受度。許多市場領先的配方都包含關鍵的菌株,可以有效促進產後母親的腸道和免疫健康。

2024年,乳酸桿菌菌株市佔比34.3%,價值18億美元。這些菌株,尤其是像嗜酸乳桿菌、唾液乳桿菌和鼠李糖乳桿菌這樣經過深入研究的菌株,因其耐酸性、強大的腸道定植能力以及已被證實的產後健康益處而備受青睞。它們在減輕發炎、改善消化功能和減少常見產後問題方面發揮著至關重要的作用,使其成為大多數針對新媽媽的高階配方奶粉的首選。

2024年,亞太地區產後益生菌補充劑市場佔有34.5%的佔有率。由於產後恢復意識高漲以及功能性營養解決方案的使用日益增多,該地區各國繼續佔據主導地位。以產後復原為中心的文化習俗也為益生菌產品的推廣創造了有利條件,這些產品有助於消化和免疫。透過藥局、線上平台和健康商店購買益生菌補充劑的管道日益普及,進一步推動了這一成長。

利潔時集團 (Reckitt Benckiser Group plc)、達能公司 (Danone SA)、雅培實驗室 (Abbott Laboratories)、雀巢公司 (Nestle SA) 和 BioGaia AB 等知名公司透過推出客製化產品和提升消費者參與度,推動了該地區的分銷和創新。產後益生菌領域的領先品牌專注於個人化產品開發、菌株特異性研究以及與醫療保健專業人士的合作,以鞏固其市場地位。為了維持競爭力,各公司正在加大研發投入,開發經臨床驗證的多菌株配方,以解決免疫力和腸道健康等產後問題。許多公司也正在擴大其電商業務和直銷管道,以擴大覆蓋範圍。透過育兒平台、社群媒體和健康領域影響力人士進行策略性行銷,有助於教育和吸引新用戶。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 膠囊

- 粉末

- 軟糖

- 液體

- 其他(軟膠囊、小袋)

第6章:市場估計與預測:按益生菌菌株,2021 - 2034 年

- 主要趨勢

- 乳酸桿菌屬

- 鼠李糖乳桿菌

- 唾液乳酸桿菌

- 嗜酸乳桿菌

- 8.2 雙歧桿菌種類

- 長雙歧桿菌

- 乳酸雙歧桿菌

- 多菌株配方

- 新興菌株

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 網路零售

- 藥局和藥局

- 超市和大賣場

- 保健品專賣店

- 醫療保健設施

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 消化健康支持

- 增強免疫系統

- 情緒和心理健康支持

- 乳腺炎的預防和治療

- 整體健康和康復

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Abbott Laboratories

- BioGaia AB

- Danone SA

- Nestle SA

- Bayer AG

- Reckitt Benckiser Group plc

- DuPont Nutrition & Biosciences

The Global Postnatal Probiotic Supplements Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 11.5 billion by 2034. These supplements are formulated with beneficial strains of bacteria, primarily from the Lactobacillus and Bifidobacterium families, to support postpartum wellness. They aid in restoring gut balance, enhancing immune response, preventing infections such as mastitis, and contributing to emotional and digestive well-being.

Rising consumer interest in natural and functional recovery options after childbirth is a key factor fueling growth. Growing awareness around maternal care, supported by increasing online and retail distribution, is also amplifying demand. In addition, emerging economies with high birth rates and improving access to maternal health programs present strong expansion opportunities. The need for personalized formulations and clinically validated, multi-strain solutions is further shaping the product landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 8.1% |

The market is set for accelerated innovation and broader adoption as more healthcare professionals endorse these products, and major brands continue to invest in expanding their portfolios. Clinical validation of strain-specific benefits is driving greater trust and demand, prompting companies to introduce targeted formulations tailored to postpartum needs such as hormonal balance, digestive support, and immune function.

Increasing research collaborations between biotech firms and academic institutions are also fueling product development rooted in science-backed outcomes. Simultaneously, expanding retail availability, especially through digital platforms, makes these supplements more accessible to new mothers globally. As awareness campaigns and educational outreach strengthen, the adoption of postnatal probiotic supplements is expected to rise significantly, turning them into a core component of modern maternal health routines.

The capsules segment held a 39.3% share and generated USD 2.1 billion in 2024. Their dominance is tied to ease of use, long shelf stability, precise dosing, and compatibility with multi-strain formulations. Capsules are particularly popular with postpartum consumers due to their ability to be taken with or without meals and their perceived reliability. Clinical settings and pharmacies also favor capsule delivery, which adds to their strong credibility and uptake. Many market-leading formulations include key bacterial strains that address gut and immune health in mothers following childbirth.

The Lactobacillus strain segment accounted for a 34.3% share in 2024, amounting to USD 1.8 billion. These strains-especially well-researched types like L. acidophilus, L. salivarius, and L. rhamnosus-are prominent due to their acid resistance, strong gut colonization ability, and proven benefits for postnatal health. They play a crucial role in reducing inflammation, improving digestion, and minimizing common postpartum issues, making them a preferred choice in most premium formulations targeting new mothers.

Asia Pacific Postnatal Probiotic Supplements Market held a 34.5% share in 2024. Countries across this region continue to dominate due to high awareness of postnatal recovery and the increasing use of functional nutrition solutions. Cultural practices centered on postpartum healing also create favorable conditions for the adoption of probiotic products that support digestion and immunity. This growth is further supported by growing access to supplements through pharmacies, online platforms, and wellness stores.

Prominent companies like Reckitt Benckiser Group plc, Danone S.A., Abbott Laboratories, Nestle S.A., and BioGaia AB have helped in driving distribution and innovation within the region through tailored product launches and growing consumer engagement. Leading brands in the postnatal probiotic sector are focused on personalized product development, strain-specific research, and partnerships with healthcare professionals to strengthen their market position. To stay competitive, companies are increasing R&D investments to develop clinically proven, multi-strain formulas targeting postpartum concerns like immunity and gut health. Many are also expanding their e-commerce footprint and direct-to-consumer sales to boost reach. Strategic marketing through parenting platforms, social media, and wellness influencers helps educate and attract new users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Probiotic strain

- 2.2.4 Distribution channel

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsules

- 5.3 Powders

- 5.4 Gummies

- 5.5 Liquids

- 5.6 Others (soft gels, sachets)

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus species

- 6.2.1 L. rhamnosus

- 6.2.2 L. salivarius

- 6.2.3 L. acidophilus

- 6.3 8.2 Bifidobacterium species

- 6.3.1 B. longum

- 6.3.2 B. lactis

- 6.4 Multi-strain formulations

- 6.5 Emerging strains

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online retail

- 7.3 Pharmacies and drug stores

- 7.4 Supermarkets and hypermarkets

- 7.5 Specialty health stores

- 7.6 Healthcare facilities

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Digestive health support

- 8.3 Immune system enhancement

- 8.4 Mood and mental health support

- 8.5 Mastitis prevention and treatment

- 8.6 Overall wellness and recovery

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 BioGaia AB

- 10.3 Danone S.A.

- 10.4 Nestle S.A.

- 10.5 Bayer AG

- 10.6 Reckitt Benckiser Group plc

- 10.7 DuPont Nutrition & Biosciences