|

市場調查報告書

商品編碼

1773393

菌絲磚市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Mycelium Bricks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

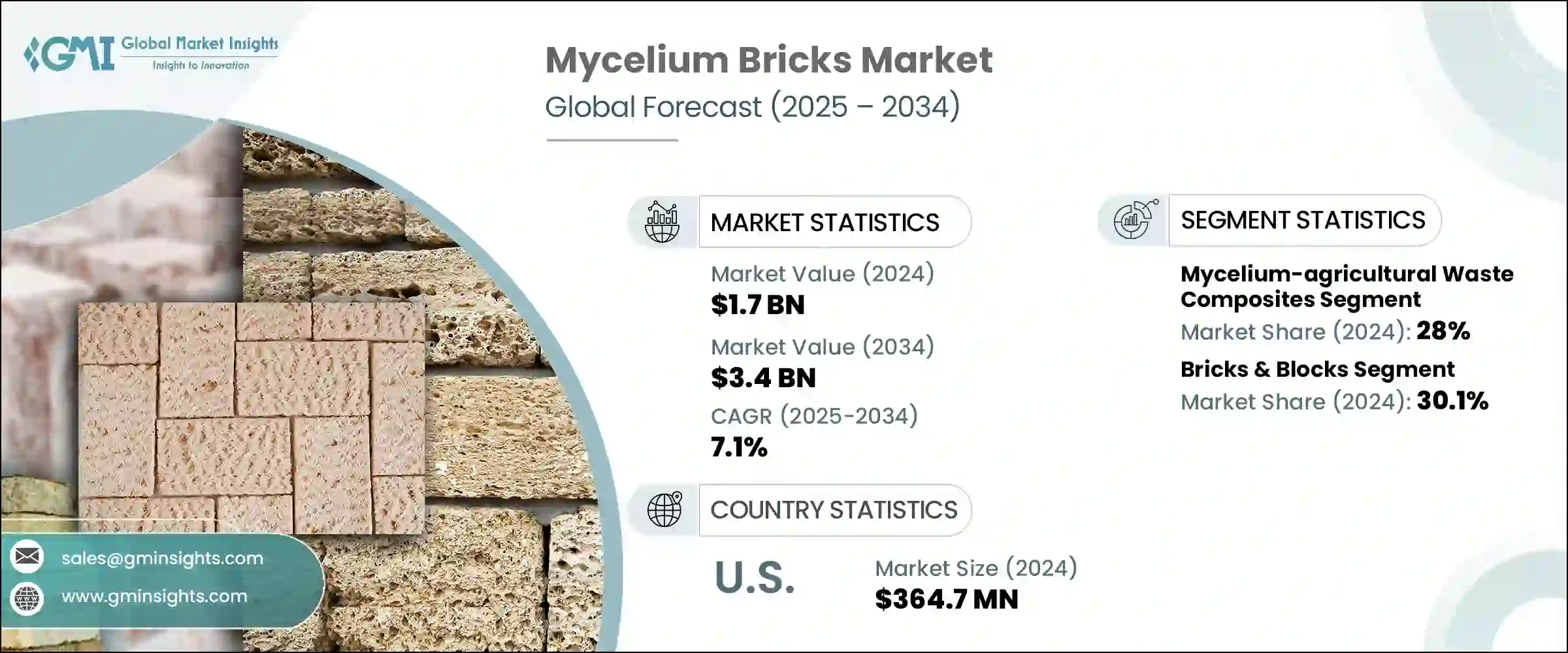

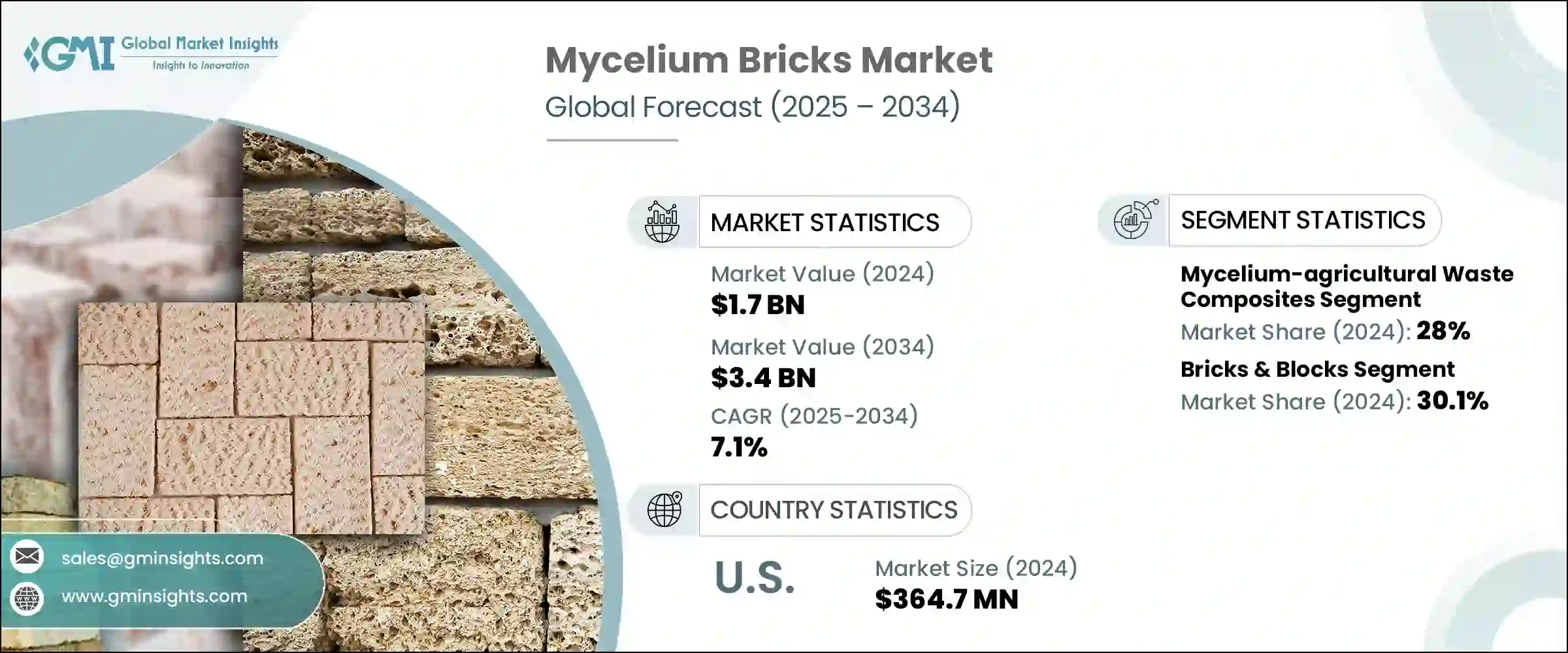

2024 年全球菌絲磚市場價值為 17 億美元,預計到 2034 年將以 7.1% 的複合年成長率成長至 34 億美元。這一成長反映出人們日益轉向永續、低碳建築材料。這些可生物分解的菌絲磚由在農業廢棄物中生長的真菌菌絲體製成,具有出色的隔熱性能,可減少環境污染,同時符合循環生物經濟原則。研究表明,菌絲體複合材料具有負隱含碳(約 -39.5 公斤二氧化碳當量/立方米),生產能耗僅為 7.7 兆焦/公斤,遠低於傳統隔熱材料的 83.5 兆焦/公斤。在此基礎上,培養方法的進步顯著提高了菌絲體材料的性能和價格承受能力,使製造商能夠直接在建築工地生產負碳隔熱材料。

這項創新不僅降低了成本,還顯著減少了運輸排放,使其成為永續建築實踐的關鍵組成部分。透過實現碳負性隔熱材料的現場生產,它消除了長途運輸大件材料的需要,從而減少了與傳統供應鏈相關的碳足跡。此外,製造和運輸相關排放的減少有助於實現更綠色的建築流程,這與日益成長的低影響、環保建築趨勢一致。在本地生產菌絲體產品的能力也能確保更快的周轉時間和更大的供應鏈彈性,同時支援區域經濟。這種精簡的生產方式不僅提高了整體永續性,也增強了菌絲體作為傳統建築材料可行替代品的可擴展性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 7.1% |

菌絲體-農業廢棄物複合材料市場在2024年將佔據28%的市場佔有率,由於其成本效益高,且在亞太已開發國家小麥秸稈和玉米殼等原料供應充足,該領域將繼續蓬勃發展。菌絲體-農業廢棄物複合材料能夠無縫整合到模組化面板系統和隔熱應用中,已成為環保建築計畫的基石。

2024年,菌絲磚市場中的磚塊和砌塊部分佔據了30.1%的市場佔有率,其標準化尺寸和堅固的結構特性使其備受青睞。這些特性使其成為傳統材料的直接替代品,使建築商能夠採用更環保的替代方案,而無需犧牲現有的施工流程。

美國菌絲磚市場規模預計2024年達到3.647億美元,得益於強而有力的監管環境,包括綠建築激勵措施和LEED認證。專注於永續設計的建築公司和創新中心日益增多,加上城市需求(尤其是來自具有環保意識的年輕一代)的不斷成長,推動了可生物分解、美觀的菌絲磚在全國範圍內的使用穩步成長。

菌絲磚產業的知名企業包括 Biohm、MycoWorks、Ecovative Design、Grown Bio 和 Mogu Srl。這些公司正在透過建立研究合作夥伴關係來改進種植和生產流程,投資研發以提高耐火性和結構性能,以及開發可擴展的生產系統,從而鞏固其市場地位。此外,他們也正在爭取認證(例如 LEED、BREEAM)以提高在綠建築市場的信譽,透過板材、隔熱材料和模組化解決方案來豐富產品線,並與建築師和建築商合作以提高其應用率。這些策略增強了市場信任度,並確保了長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034 年

- 主要趨勢

- 純菌絲磚

- 菌絲體-農業廢棄物複合材料

- 秸稈基複合材料

- 玉米殼和玉米秸稈複合材料

- 稻殼與農作物殘渣複合材料

- 其他

- 菌絲體-木材廢料複合材料

- 鋸末和木屑複合材料

- 紙和紙板廢料複合材料

- 其他

- 菌絲體增強複合材料

- 纖維增強複合材料

- 礦物增強複合材料

- 其他

- 專門設計的菌絲體產品

第6章:市場估計與預測:依形式,2021-2034 年

- 主要趨勢

- 磚塊和砌塊

- 標準磚

- 聯鎖塊

- 客製化形狀的積木

- 面板和電路板

- 平板

- 隔音板

- 結構板

- 絕緣材料

- 鬆散填充絕緣材料

- 硬質隔熱板

- 噴塗絕緣材料

- 3D列印和定製表格

- 其他

第7章:市場估計與預測:按應用,2021-2034 年

- 主要趨勢

- 建築施工

- 室內非承重牆

- 絕緣

- 聲學

- 結構部件

- 其他

- 室內設計和家具

- 裝飾元素

- 家具部件

- 其他

- 臨時建築和展覽

- 展覽展示

- 臨時設施

- 事件結構

- 包裝和保護材料

- 藝術與設計應用

- 其他

第8章:市場估計與預測:依最終用途,2021-2034 年

- 主要趨勢

- 住宅建築

- 商業建築

- 辦公大樓

- 零售和酒店

- 其他

- 機構及公共建築

- 教育設施

- 文化和社區建築

- 醫療保健設施

- 其他

- 工業和製造業

- 其他

第9章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Biohm

- Biomyc

- Ecovative Design

- Grown Bio

- Mogu Srl

- Mycel

- Mycovation

- MycoWorks

The Global Mycelium Bricks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3.4 billion by 2034. This growth reflects a growing shift toward sustainable, low-carbon construction materials. Made from fungal mycelium grown on agricultural waste, these biodegradable bricks deliver outstanding insulation and reduce environmental pollution while aligning with circular bioeconomy principles. Studies show mycelium composites have negative embodied carbon (approximately -39.5 kg CO2e/m3) and consume only 7.7 MJ/kg in production, far less than conventional insulation materials at 83.5 MJ/kg. Building on this momentum, advancements in cultivation methods are significantly enhancing the performance and affordability of mycelium-based materials, allowing manufacturers to produce carbon-negative insulation directly at construction sites.

This innovation not only reduces costs but also significantly lowers transportation emissions, making it a key component of sustainable construction practices. By enabling on-site production of carbon-negative insulation, it eliminates the need for long-distance transportation of bulky materials, thereby decreasing the carbon footprint associated with traditional supply chains. Furthermore, the reduction in manufacturing and transportation-related emissions contributes to greener building processes, aligning with the growing push toward low-impact, eco-friendly construction. The ability to produce mycelium-based products locally also ensures faster turnaround times and greater supply chain flexibility, while simultaneously supporting regional economies. This streamlined production approach not only improves overall sustainability but also enhances the scalability of mycelium as a viable alternative to conventional building materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 7.1% |

The mycelium-agricultural waste composites segment, holding a 28% share in 2024, continues to thrive due to its cost efficiency and the ready availability of raw materials like wheat straw and corn husks in developed Asia-Pacific countries. Their seamless integration into modular panel systems and insulation applications has made them a cornerstone of eco-friendly construction projects.

The bricks and blocks segment from the mycelium bricks market accounted for a 30.1% share in 2024, favored for their standardized dimensions and robust structural qualities. These attributes make them a straightforward substitute for traditional materials, allowing builders to adopt greener alternatives without compromising established construction workflows.

U.S. Mycelium Bricks Market, valued at USD 364.7 million in 2024, benefits from a strong regulatory environment, including green building incentives and LEED certifications. The growing presence of architecture firms and innovation centers focused on sustainable design, coupled with increasing urban demand-especially from environmentally conscious younger generations-is fueling steady growth in the use of biodegradable, aesthetically pleasing mycelium bricks across the country.

Prominent players include Biohm, MycoWorks, Ecovative Design, Grown Bio, and Mogu S.r.l. Companies in the mycelium bricks industry are strengthening their position by forming research partnerships to refine cultivation and production processes, investing in R&D to improve fire resistance and structural performance, and developing scalable manufacturing systems. They're also securing certifications (e.g., LEED, BREEAM) to enhance credibility in green construction markets, diversifying product lines with panel, insulation, and modular solutions, and pursuing collaborations with architects and builders to increase adoption. These strategies enhance market trust and ensure long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Form method

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021–2034 (USD Billion) (Cubic Meters)

- 5.1 Key trends

- 5.2 Pure mycelium bricks

- 5.3 Mycelium-agricultural waste composites

- 5.3.1 Straw-based composites

- 5.3.2 Corn husk & stalk composites

- 5.3.3 Rice hulls & crop residue composites

- 5.3.4 Others

- 5.4 Mycelium-wood waste composites

- 5.4.1 Sawdust & wood chip composites

- 5.4.2 Paper & cardboard waste composites

- 5.4.3 Others

- 5.5 Mycelium-reinforced composites

- 5.5.1 Fiber-reinforced composites

- 5.5.2 Mineral-reinforced composites

- 5.5.3 Others

- 5.6 Specialized & engineered mycelium products

Chapter 6 Market Estimates and Forecast, By Form, 2021–2034 (USD Billion) (Cubic Meters)

- 6.1 Key trends

- 6.2 Bricks & blocks

- 6.2.1 Standard bricks

- 6.2.2 Interlocking blocks

- 6.2.3 Custom-shaped blocks

- 6.3 Panels & boards

- 6.3.1 Flat panels

- 6.3.2 Acoustic panels

- 6.3.3 Structural panels

- 6.4 Insulation materials

- 6.4.1 Loose fill insulation

- 6.4.2 Rigid insulation boards

- 6.4.3 Spray-applied insulation

- 6.5 3D-printed & custom forms

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Cubic Meters)

- 7.1 Key trends

- 7.2 Building construction

- 7.2.1 Interior non-load bearing walls

- 7.2.2 Insulation

- 7.2.3 Acoustic

- 7.2.4 Structural components

- 7.2.5 Others

- 7.3 Interior design & furniture

- 7.3.1 Decorative elements

- 7.3.2 Furniture components

- 7.3.3 Others

- 7.4 Temporary structures & exhibitions

- 7.4.1 Exhibition displays

- 7.4.2 Temporary installations

- 7.4.3 Event structures

- 7.5 Packaging & protective materials

- 7.6 Art & design applications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021–2034 (USD Billion) (Cubic Meters)

- 8.1 Key trends

- 8.2 Residential construction

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail & hospitality

- 8.3.3 Others

- 8.4 Institutional & public buildings

- 8.4.1 Educational facilities

- 8.4.2 Cultural & community buildings

- 8.4.3 Healthcare facilities

- 8.4.4 Others

- 8.5 Industrial & manufacturing

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Cubic Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Biohm

- 10.2 Biomyc

- 10.3 Ecovative Design

- 10.4 Grown Bio

- 10.5 Mogu S.r.l.

- 10.6 Mycel

- 10.7 Mycovation

- 10.8 MycoWorks