|

市場調查報告書

商品編碼

1773392

有機種子品種市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Organic Seed Varieties Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

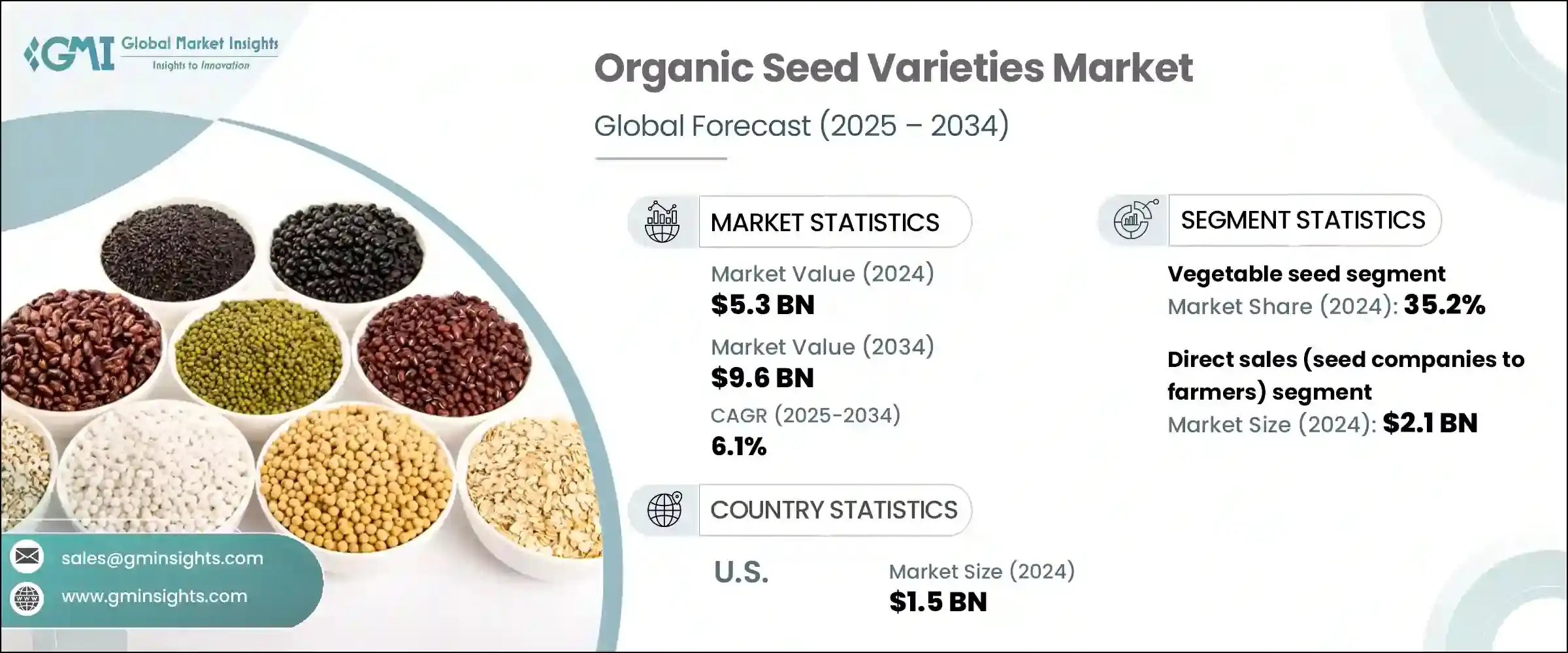

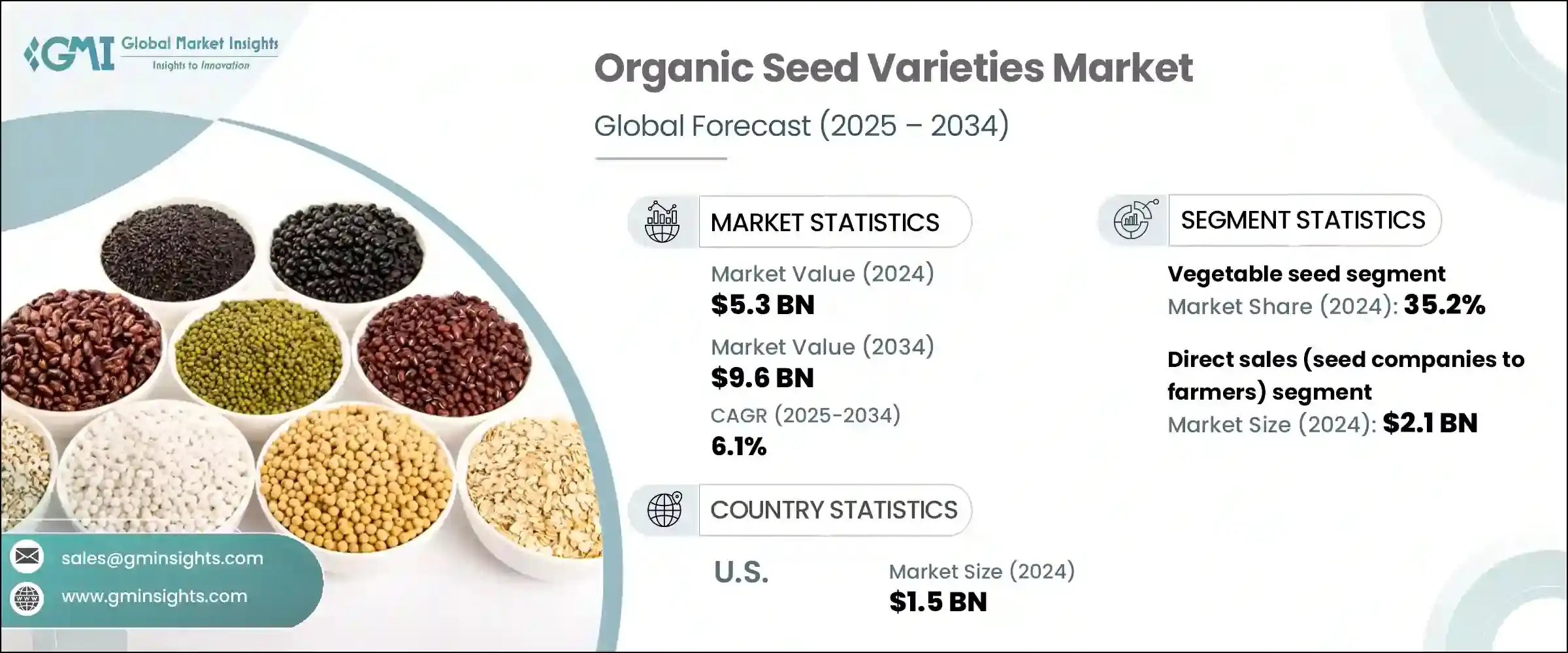

2024 年全球有機種子品種市場價值為 53 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長至 96 億美元。這一成長是由消費者對健康、永續性和糧食安全的意識不斷提高所推動的。隨著越來越多的人轉向更健康的生活方式和環保選擇,對有機種子的需求持續上升。有機農業作為保護生物多樣性、減少化學品使用和促進彈性農業實踐的關鍵策略,發展勢頭強勁。有機種子,通常是傳家寶品種或非常適合特定氣候的種子,透過提高農民在惡劣環境下種植作物的能力,為糧食安全做出貢獻。它們也有助於維護種子主權,對維護農業遺傳多樣性至關重要。氣候變遷凸顯了能夠承受不可預測天氣的抗逆作物的重要性,這進一步提振了市場。

此外,隨著人們對永續性和糧食安全的擔憂日益加劇,世界各國政府正在加強對有機農業的支持力度。這包括增加資金、撥款和政策舉措,旨在促進有機種子生產,並推動生態友善農業實踐的轉型。政府的這種支持在促進有機種子產業發展方面發揮關鍵作用,鼓勵大規模生產者和小農戶轉向有機農業方法。這些努力不僅有助於確保農業的長期永續性,也有助於實現生物多樣性保護和減少農業化學品使用的更廣泛目標。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 6.1% |

2024年,蔬菜種子(從種子公司到農民)細分市場佔據35.2%的市場。預計未來十年,該細分市場將以6.4%的穩健複合年成長率成長,反映出消費者對有機、本地種植農產品的偏好日益成長。隨著越來越多的人注重健康,尋求無化學成分的蔬菜,家庭園藝者和商業種植者都擴大轉向有機蔬菜種子品種。這一趨勢推動了對蔬菜種子的需求,因為蔬菜種子被認為是促進營養和健康飲食習慣的關鍵。

2024年,直銷市場規模達21億美元,預計2034年將以6.3%的複合年成長率成長。此模式因其個人化服務而備受青睞,使種子生產商能夠提供客製化解決方案,滿足個別農戶的獨特需求。直銷省去了中間商環節,有助於確保客戶及時收到產品,從而建立更牢固的客戶關係並提高客戶滿意度。此外,直銷還能提供專家建議、物流支援和客製化的配送方案,這也使其成為大型農業經營者和小型獨立農戶的首選管道。

2024年,美國有機種子品種市場規模達15億美元。市場對有機農產品的需求,加上政府的優惠政策和強大的有機供應鏈,共同支持了這一成長。隨著有機農業標準日益嚴格,許多農民開始採用有機種子生產方式以符合法規要求,而種子公司也不斷創新,拓展產品線。隨著農業經營規模化和有機農場數量的不斷成長,美國市場預計將持續擴張。

全球有機種子品種市場的頂級參與者包括 Farm Direct Organic Seeds、Baker Creek Heirloom Seeds、Fedco Seeds、High Mowing Organic Seeds 和 Johnny's Selected Seeds。為了鞏固其地位,有機種子品種市場的公司專注於提供高品質、適應當地情況的種子品種,以滿足特定的環境條件和消費者偏好。種子保存方面的創新和開發新的、抗逆性的品種是其策略的核心。此外,公司正在增加對研發的投資,以提高種子的產量和抗病性。許多公司也透過直銷與農民建立更牢固的關係,並提供個人化服務,以確保滿足農民的需求。環境永續性和支持當地經濟已成為公司的關鍵賣點,因為它們既吸引了環保意識的消費者,也吸引了尋求永續解決方案的農民。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 北美:有機消費者日益成為主流

- 歐洲:永續食品生產實踐將刺激有機種子的需求

- 亞太地區:向有機農業實踐轉型

- 產業陷阱與挑戰

- 有機品種供應有限

- 價格溢價和認證負擔

- 市場機會

- 作物多樣化和利基市場成長

- 區域育種與氣候適應

- 數位化和直接面對消費者的管道

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按作物類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 價值鏈分析

- 種子育種與生產

- 認證和測試

- 分銷和零售

- 最終用途細分市場(商業種植者、小農戶、家庭園丁)

- 永續性和生物多樣性

- 有機種子在農業生態學和糧食安全中的作用

- 生物多樣性保育舉措

- 種子主權與地方種子系統

- 認證和監管

- 美國農業部 NOP 認證的有機種子

- 歐盟有機認證種子

- 其他國家和地區認證

- 非基因改造認證種子

- 種子處理和包衣(符合有機標準)

- 合規成本和市場影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依作物類型,2021-2034

- 主要趨勢

- 蔬菜種子

- 萵苣

- 番茄

- 菠菜

- 紅蘿蔔

- 黃瓜

- 甜椒

- 穀物種子

- 小麥

- 玉米

- 米

- 大麥

- 燕麥

- 粟

- 藜麥

- 水果種子

- 瓜

- 西瓜

- 草莓

- 漿果品種

- 草本植物和花卉種子

- 羅勒

- 香菜

- 香菜

- 向日葵

- 百日草

- 萬壽菊

- 油籽和替代穀物

- 大豆

- 亞麻

- 蕎麥

- 莧菜

- 芝麻

第6章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接銷售(種子公司對農民)

- 零售通路(園藝中心、農場用品店)

- 網路銷售與電子商務平台

- 合作社和採購俱樂部

- 批發和機構買家

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Adaptive Seeds

- Baker Creek Heirloom Seeds

- Eden Seeds

- Farm Direct Organic Seeds

- Fedco Seeds

- High Mowing Organic Seeds

- Johnny's Selected Seeds

- Kusa Seed Society

- Quality Organic

- Resilient Seeds

- Seed Savers Exchange

- Southern Exposure Seed Exchange

- Victory Seeds

- Vitalis Organic Seeds

The Global Organic Seed Varieties Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 9.6 billion by 2034. This growth is being driven by increasing consumer awareness surrounding health, sustainability, and food security. As more people shift toward healthier lifestyles and environmentally conscious choices, the demand for organic seeds continues to rise. Organic farming is gaining momentum as a key strategy to preserve biodiversity, reduce chemical use, and promote resilient agricultural practices. Organic seeds, typically heirloom varieties or those well-suited to specific climates, contribute to food security by enhancing farmers' ability to grow crops in challenging environments. They also help to maintain seed sovereignty and are vital in maintaining genetic diversity in agriculture. Climate change has highlighted the importance of resilient crops that can endure unpredictable weather, further boosting the market.

Moreover, as concerns about sustainability and food security continue to rise, governments globally are intensifying their support for organic farming. This includes increased funding, grants, and policy initiatives designed to promote organic seed production and facilitate the transition toward eco-friendly agricultural practices. Such government backing plays a critical role in fostering the growth of the organic seed industry, encouraging both large-scale producers and smallholder farmers to shift towards organic farming methods. These efforts not only help ensure the long-term sustainability of agriculture but also support the broader goals of biodiversity conservation and reduced chemical usage in farming.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 6.1% |

The vegetable seed (seed companies to farmers) segment held a 35.2% share in 2024. This segment is projected to expand at a solid CAGR of 6.4% over the next decade, reflecting growing consumer preferences for organic, locally grown produce. As more individuals become health-conscious and seek chemical-free vegetables, both home gardeners and commercial farmers are increasingly turning to organic vegetable seed varieties. This trend is driving demand for vegetable seeds, which are considered essential for promoting better nutrition and healthier eating habits.

The direct sales segment was valued at USD 2.1 billion in 2024 and is expected to grow at a CAGR of 6.3% through 2034. This model is favored for its personalized service, allowing seed producers to offer tailored solutions that address the unique needs of individual farmers. By eliminating intermediaries, direct sales help ensure that customers receive products in a timely manner, fostering stronger relationships and higher levels of customer satisfaction. The ability to offer expert advice, logistical support, and customized delivery options also contributes to the success of direct sales, making it a preferred channel for both large-scale agricultural operations and smaller, independent farmers.

U.S. Organic Seed Varieties Market was valued at USD 1.5 billion in 2024. The demand for organic produce, coupled with favorable government policies and a strong organic supply chain, supports this growth. As organic farming standards become more stringent, many farmers are adopting organic seed production to comply with regulations, while seed companies continue to innovate and expand their product offerings. With large-scale agricultural operations and a growing number of organic farms, the U.S. market is poised for continued expansion.

The top players in the Global Organic Seed Varieties Market include Farm Direct Organic Seeds, Baker Creek Heirloom Seeds, Fedco Seeds, High Mowing Organic Seeds, and Johnny's Selected Seeds. To strengthen their position, companies in the organic seed varieties market are focusing on offering high-quality, locally adapted seed varieties that cater to specific environmental conditions and consumer preferences. Innovations in seed preservation and the development of new, resilient varieties are central to their strategies. Furthermore, companies are increasingly investing in research and development to improve seed yield and disease resistance. Many are also building stronger relationships with farmers through direct sales and providing personalized services to ensure farmers' needs are met. Environmental sustainability and supporting local economies have become key selling points for companies, as they appeal to both eco-conscious consumers and farmers looking for sustainable solutions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crop type

- 2.2.3 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 North America: organic consumers are increasingly mainstream

- 3.2.1.2 Europe: sustainable food production practices to boost the demand of organic seeds

- 3.2.1.3 Asia pacific: transformation towards organic agriculture practices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited organic variety availability

- 3.2.2.2 Price premiums and certification burden

- 3.2.3 Market opportunities

- 3.2.3.1 Crop diversification and niche market growth

- 3.2.3.2 Regional breeding and climate adaptation

- 3.2.3.3 Digitalization and direct-to-consumer channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By crop type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Value chain analysis

- 3.13.1 Seed breeding and production

- 3.13.2 Certification and testing

- 3.13.3 Distribution and retail

- 3.13.4 End use segments (commercial growers, smallholders, home gardeners)

- 3.14 Sustainability and biodiversity

- 3.14.1 Role of organic seed in agroecology and food security

- 3.14.2 Biodiversity conservation initiatives

- 3.14.3 Seed sovereignty and local seed systems

- 3.15 Certification and regulation

- 3.15.1 USDA NOP certified organic seeds

- 3.15.2 EU organic certified seeds

- 3.15.3 Other national and regional certifications

- 3.15.4 Non-GMO verified seeds

- 3.15.5 Seed treatment and coating (Organic-Compliant)

- 3.15.6 Compliance costs and market impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Crop Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Vegetable seeds

- 5.2.1 Lettuce

- 5.2.2 Tomato

- 5.2.3 Spinach

- 5.2.4 Carrot

- 5.2.5 Cucumber

- 5.2.6 Bell pepper

- 5.3 Grain seeds

- 5.3.1 Wheat

- 5.3.2 Corn

- 5.3.3 Rice

- 5.3.4 Barley

- 5.3.5 Oats

- 5.3.6 Millet

- 5.3.7 Quinoa

- 5.4 Fruit seeds

- 5.4.1 Melon

- 5.4.2 Watermelon

- 5.4.3 Strawberry

- 5.4.4 Berry varieties

- 5.5 Herb and flower seeds

- 5.5.1 Basil

- 5.5.2 Cilantro

- 5.5.3 Parsley

- 5.5.4 Sunflower

- 5.5.5 Zinnia

- 5.5.6 Marigold

- 5.6 Oilseed and alternative grains

- 5.6.1 Soybean

- 5.6.2 Flax

- 5.6.3 Buckwheat

- 5.6.4 Amaranth

- 5.6.5 Sesame

Chapter 6 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Litres)

- 6.1 Key trend

- 6.2 Direct sales (seed companies to farmers)

- 6.3 Retail channels (garden centres, farm supply stores)

- 6.4 Online sales and e-commerce platforms

- 6.5 Cooperatives and buying clubs

- 6.6 Wholesale and institutional buyers

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Litres)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 Adaptive Seeds

- 8.2 Baker Creek Heirloom Seeds

- 8.3 Eden Seeds

- 8.4 Farm Direct Organic Seeds

- 8.5 Fedco Seeds

- 8.6 High Mowing Organic Seeds

- 8.7 Johnny's Selected Seeds

- 8.8 Kusa Seed Society

- 8.9 Quality Organic

- 8.10 Resilient Seeds

- 8.11 Seed Savers Exchange

- 8.12 Southern Exposure Seed Exchange

- 8.13 Victory Seeds

- 8.14 Vitalis Organic Seeds