|

市場調查報告書

商品編碼

1773391

結構黏合劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Structural Bonding Agents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

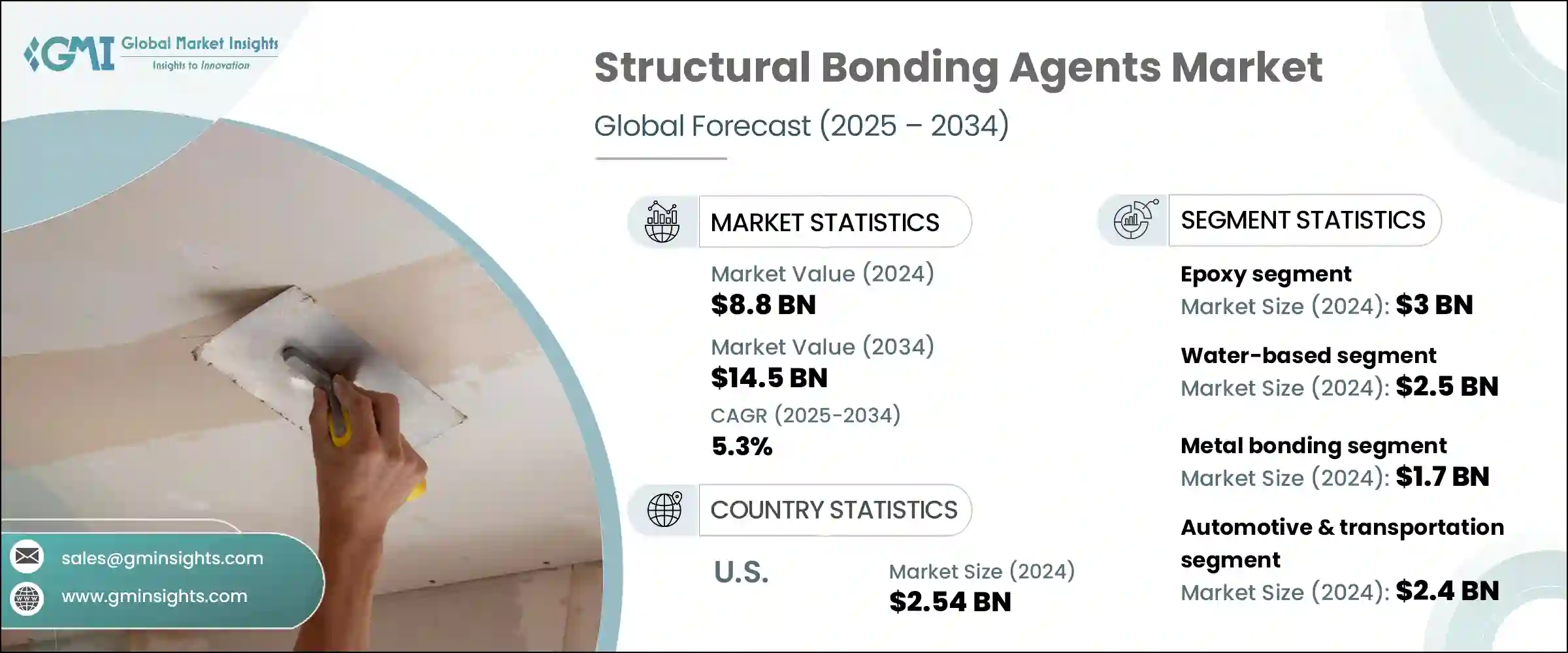

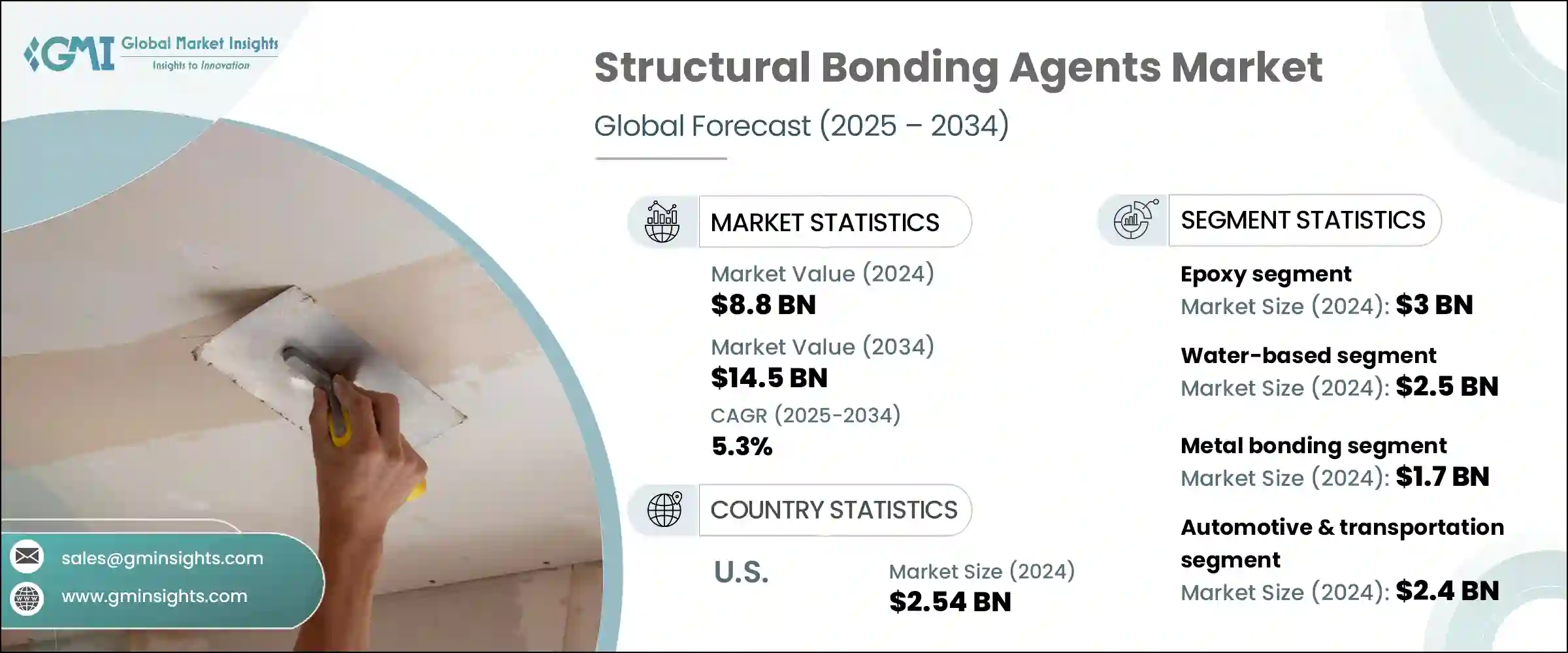

2024年,全球結構黏合劑市場規模達88億美元,預計到2034年將以5.3%的複合年成長率成長,達到145億美元。市場擴張的促進因素有很多,其中最顯著的是汽車和航太工業對輕量化材料日益成長的需求。這些行業擴大使用黏合劑來支持更輕的複合材料,這有助於在不犧牲結構強度的情況下提高燃油效率、減少排放。

複合材料憑藉其優異的強度重量比和耐用性,在各種應用中的日益普及也推動了市場的成長。結構性黏合劑在提升這些材料在嚴苛環境下的性能和接受度方面發揮著至關重要的作用。此外,全球正在進行的建設項目也顯著促進了需求成長,因為黏合劑在負載分佈、美觀度和抗環境壓力方面均優於傳統的機械緊固件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 88億美元 |

| 預測值 | 145億美元 |

| 複合年成長率 | 5.3% |

新興趨勢也指向永續性,製造商專注於環保、低VOC和無溶劑的黏合劑,以滿足更嚴格的法規和消費者偏好。這種轉變不僅是出於環保合規的考慮,也是出於對更健康的室內空氣品質和減少生態影響日益成長的需求。隨著綠建築認證和排放標準日益嚴格,企業正在積極改進其黏合劑配方,以符合不斷變化的全球基準。市場對水性和生物基結構黏合劑的偏好日益成長,尤其是在建築、包裝和運輸等永續性已成為核心設計考慮因素的行業。

2024年,環氧樹脂市場的規模達30億美元,預計到2034年將以5%的複合年成長率成長。環氧樹脂膠黏劑因其在航太、汽車、建築和電子等行業的廣泛應用而引領市場。這類膠合劑具有優異的機械強度、耐化學性,以及黏合金屬和輕質複合材料的能力,使其成為高成長產業中不可或缺的材料。此外,它們能夠有效分配負載,並提供美觀的飾面,這也進一步增加了市場需求。

2024年,水性結構膠合劑市場規模達25億美元,預計2034年將以5.8%的複合年成長率成長。在嚴格的環保法規和低VOC配方趨勢的推動下,水性膠合劑正日益受到青睞,尤其是在建築和包裝行業。這些膠合劑提供了更安全、更環保的替代方案,且不會影響黏合強度或性能。

2024年,美國結構黏合劑市場規模達25.4億美元,預計2025年至2034年複合年成長率為4.8%。美國市場的成長主要得益於航太和汽車產業對高性能、輕量化黏合解決方案的需求,以及對基礎設施和建築項目的大量投資。黏合劑技術的創新和政府的利多政策將繼續推動市場擴張。

全球結構黏合劑市場的領導企業,例如阿科瑪集團、漢高股份公司、3M公司、西卡股份公司和HB Fuller公司,正在多個策略層面積極競爭。結構黏合劑市場的公司透過專注於創新和擴展針對新興產業需求的產品組合(尤其是輕質環保黏合劑)來鞏固其地位。他們投入大量資金進行研發,以開發符合環境法規並提高性能的配方。與汽車、航太和建築領域的主要參與者建立策略合作與夥伴關係有助於擴大市場範圍和信譽。此外,向快速成長地區的地理擴張也支持了收入成長。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 環氧樹脂

- 單組分環氧樹脂

- 雙組分環氧樹脂

- 改質環氧樹脂

- 聚氨酯

- 單組分聚氨酯

- 雙組分聚氨酯

- 丙烯酸纖維

- 氰基丙烯酸酯

- 改性丙烯酸酯

- 甲基丙烯酸甲酯(MMA)

- 矽酮

- 其他

第6章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 水性

- 溶劑型

- 熱熔膠

- 反應式

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 金屬黏合

- 鋼

- 鋁

- 其他金屬

- 複合材料黏接

- 碳纖維複合材料

- 玻璃纖維複合材料

- 其他複合材料

- 塑膠黏接

- 熱塑性塑膠

- 熱固性塑膠

- 木材黏合

- 玻璃黏合

- 混凝土和石材黏合

- 多材料黏合

- 其他

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 汽車與運輸

- 搭乘用車

- 商用車

- 電動車

- 軌

- 其他

- 航太

- 商用飛機

- 軍用機

- 通用航空

- 空間應用

- 建築與施工

- 住宅

- 商業的

- 工業的

- 基礎設施

- 風能

- 陸域風電

- 離岸風電

- 海洋

- 造船

- 船舶建造

- 海上結構

- 電子產品

- 消費性電子產品

- 工業電子

- 醫療的

- 工業裝配

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Henkel AG & Co. KGaA

- 3M Company

- Sika AG

- HB Fuller Company

- Huntsman Corporation

- Arkema Group

- Lord Corporation (Parker Hannifin Corporation)

- Ashland Global Holdings Inc.

- Illinois Tool Works Inc.

- Dow Inc.

- Mapei SpA

- RPM International Inc.

- Permabond LLC

- Master Bond Inc.

- Dymax Corporation

- Jowat SE

- Delo Industrial Adhesives

- Pidilite Industries Ltd.

- Parson Adhesives, Inc.

- Hernon Manufacturing, Inc.

The Global Structural Bonding Agents Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 14.5 billion by 2034. The market expansion is driven by several factors, most notably the rising demand for lightweight materials in the automotive and aerospace industries. These sectors are increasingly incorporating bonding agents to support lighter composite materials, which help boost fuel efficiency and reduce emissions without sacrificing structural strength.

The growing adoption of composite materials across various applications also fuels market growth, thanks to their superior strength-to-weight ratio and durability. Structural bonding agents play a crucial role by enhancing the performance and acceptance of these materials in challenging environments. Additionally, ongoing global construction projects contribute significantly to demand, as bonding agents offer advantages over traditional mechanical fasteners in terms of load distribution, aesthetics, and resistance to environmental stressors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 5.3% |

Emerging trends also point toward sustainability, with manufacturers focusing on eco-friendly, low-VOC, and solvent-free adhesives to meet stricter regulations and consumer preferences. This shift is not only driven by environmental compliance but also by the increasing demand for healthier indoor air quality and reduced ecological impact. As green building certifications and emissions standards become more stringent, companies are proactively reformulating their bonding agents to align with evolving global benchmarks. The market is witnessing a growing preference for water-based and bio-based structural adhesives, particularly in sectors like construction, packaging, and transportation, where sustainability has become a core design consideration.

The epoxy segment held a market value of USD 3 billion in 2024 and is expected to grow at a 5% CAGR through 2034. Epoxy adhesives lead the market due to their wide-ranging applications in industries like aerospace, automotive, construction, and electronics. These adhesives provide excellent mechanical strength, chemical resistance, and the ability to bond both metals and lightweight composites, making them indispensable in high-growth sectors. Their ability to distribute loads effectively and deliver visually appealing finishes adds to their demand.

The water-based structural bonding agents segment accounted for USD 2.5 billion in 2024 and is anticipated to grow at a CAGR of 5.8% through 2034. Driven by stringent environmental regulations and a shift toward low-VOC formulations, water-borne adhesives are gaining traction, especially in the construction and packaging industries. These adhesives provide a safer, more environmentally friendly alternative without compromising bond strength or performance.

U.S. Structural Bonding Agents Market was valued at USD 2.54 billion in 2024 and is forecasted to grow at a CAGR of 4.8% from 2025 to 2034. Growth in the U.S. is largely fueled by the demand for high-performance, lightweight bonding solutions in the aerospace and automotive sectors, alongside substantial investments in infrastructure and construction projects. Innovation in adhesive technology and favorable government policies continue to bolster market expansion.

Leading players in the Global Structural Bonding Agents Market, such as Arkema Group, Henkel AG & Co. KGaA, 3M Company, Sika AG, and H.B. Fuller Company, are actively competing across several strategic dimensions. Companies in the structural bonding agents market strengthen their position by focusing on innovation and expanding product portfolios tailored to emerging industry needs, particularly lightweight and eco-friendly adhesives. They invest heavily in R&D to develop formulations that comply with environmental regulations while enhancing performance. Strategic collaborations and partnerships with key players in the automotive, aerospace, and construction sectors help expand market reach and credibility. Additionally, geographic expansion into fast-growing regions supports revenue growth.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy

- 5.2.1 One-component epoxy

- 5.2.2 Two-component epoxy

- 5.2.3 Modified epoxy

- 5.3 Polyurethane

- 5.3.1 One-component polyurethane

- 5.3.2 Two-component polyurethane

- 5.4 Acrylic

- 5.4.1 Cyanoacrylates

- 5.4.2 Modified acrylics

- 5.5 Methyl methacrylate (MMA)

- 5.6 Silicone

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Water-based

- 6.3 Solvent-based

- 6.4 Hot melt

- 6.5 Reactive

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal Bonding

- 7.2.1 Steel

- 7.2.2 Aluminum

- 7.2.3 Other metals

- 7.3 Composite bonding

- 7.3.1 Carbon fiber composites

- 7.3.2 Glass fiber composites

- 7.3.3 Other composites

- 7.4 Plastic bonding

- 7.4.1 Thermoplastics

- 7.4.2 Thermosets

- 7.5 Wood bonding

- 7.6 Glass bonding

- 7.7 Concrete and stone bonding

- 7.8 Multi-material bonding

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.2.1 Passenger vehicles

- 8.2.2 Commercial vehicles

- 8.2.3 Electric vehicles

- 8.2.4 Rail

- 8.2.5 Others

- 8.3 Aerospace

- 8.3.1 Commercial aircraft

- 8.3.2 Military aircraft

- 8.3.3 General aviation

- 8.3.4 Space applications

- 8.4 Building & construction

- 8.4.1 Residential

- 8.4.2 Commercial

- 8.4.3 Industrial

- 8.4.4 Infrastructure

- 8.5 Wind Energy

- 8.5.1 Onshore wind

- 8.5.2 Offshore wind

- 8.6 Marine

- 8.6.1 Shipbuilding

- 8.6.2 Boat Building

- 8.6.3 Offshore structures

- 8.7 Electronics

- 8.7.1 Consumer electronics

- 8.7.2 Industrial electronics

- 8.8 Medical

- 8.9 Industrial assembly

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Henkel AG & Co. KGaA

- 10.2 3M Company

- 10.3 Sika AG

- 10.4 H.B. Fuller Company

- 10.5 Huntsman Corporation

- 10.6 Arkema Group

- 10.7 Lord Corporation (Parker Hannifin Corporation)

- 10.8 Ashland Global Holdings Inc.

- 10.9 Illinois Tool Works Inc.

- 10.10 Dow Inc.

- 10.11 Mapei S.p.A.

- 10.12 RPM International Inc.

- 10.13 Permabond LLC

- 10.14 Master Bond Inc.

- 10.15 Dymax Corporation

- 10.16 Jowat SE

- 10.17 Delo Industrial Adhesives

- 10.18 Pidilite Industries Ltd.

- 10.19 Parson Adhesives, Inc.

- 10.20 Hernon Manufacturing, Inc.