|

市場調查報告書

商品編碼

1773387

等離子照明市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Plasma Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

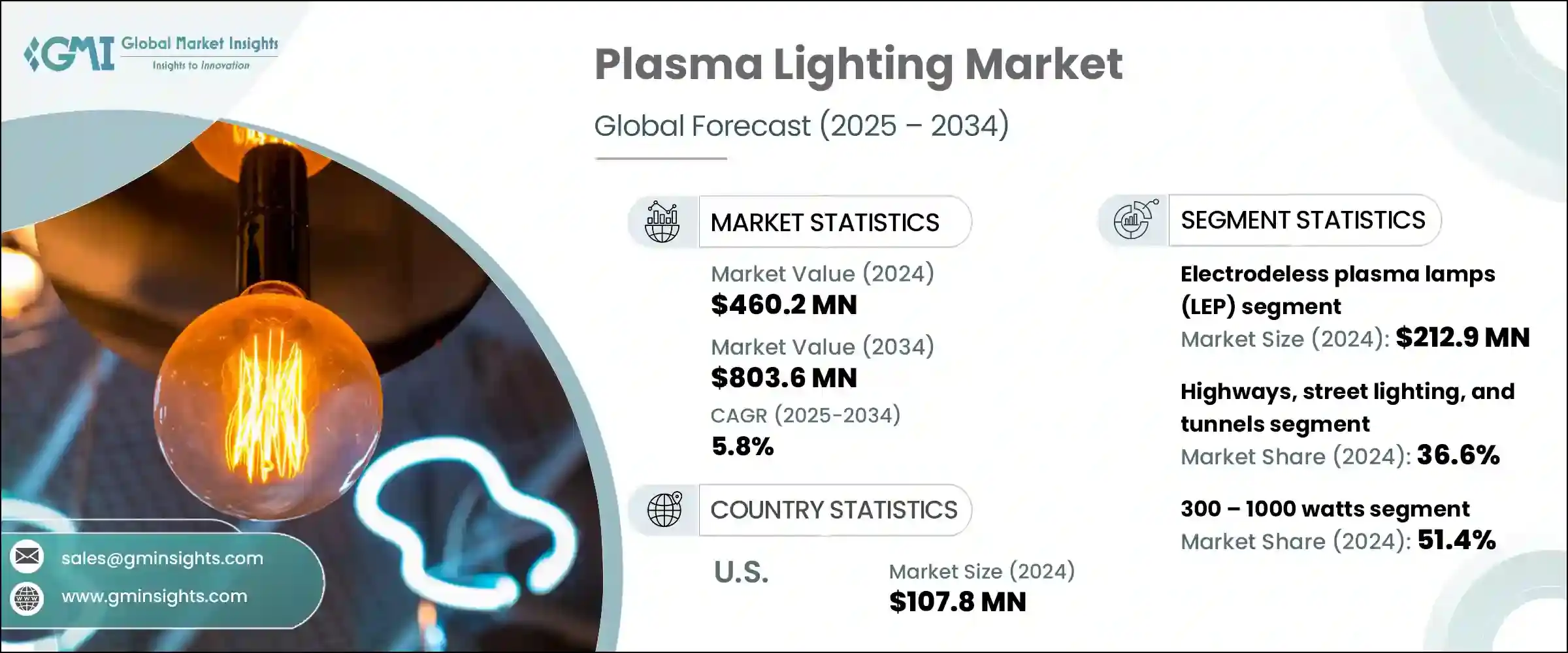

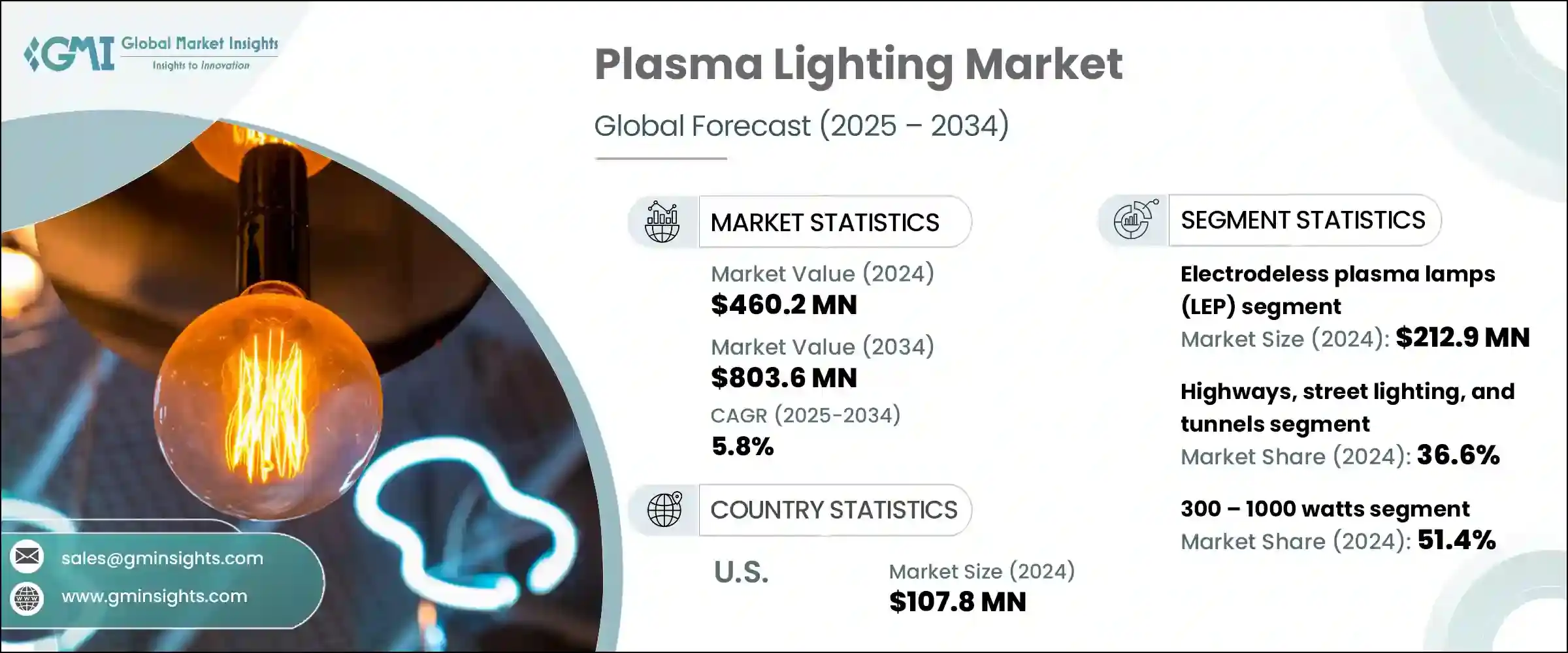

2024年,全球等離子照明市場規模達4.602億美元,預計2034年將以5.8%的複合年成長率成長,達到8.036億美元。園藝照明、工業及戶外照明領域的需求不斷成長,推動了這一成長。受控環境農業 (CEA)、垂直農業和溫室農業系統的擴張是推動園藝領域等離子照明需求的重要因素。

等離子燈產生的光譜與自然光非常相似,有助於植物健康生長並提高產量。其使用壽命長、節能高效且經久耐用,非常適合需要持續穩定照明的環境。同時,工業和戶外應用需要能夠在惡劣條件下提供高流明輸出和長使用壽命的照明解決方案。等離子燈憑藉其高顯色指數 (CRI)、抗衝擊性和耐受溫度波動的能力,完美地滿足了這些要求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.602億美元 |

| 預測值 | 8.036億美元 |

| 複合年成長率 | 5.8% |

政府主導的基礎設施現代化和節能減排舉措,正在顯著加速各行各業從傳統金屬鹵化物和HID照明系統向先進等離子照明技術的轉型。這些政策驅動的措施致力於降低能耗、減少碳足跡,同時提升照明品質和耐用性。因此,等離子照明憑藉其卓越的節能性、更長的使用壽命和更佳的光質,正成為公共基礎設施項目的首選。

無電極等離子燈 (LEP) 細分市場在 2024 年的市值為 2.129 億美元,憑藉其可靠的技術以及在市政和工業照明領域的廣泛應用,佔據了等離子照明市場的主導地位。 LEP 燈具有穩定的光輸出和較長的使用壽命,非常適合需要穩定高強度照明的場所。然而,LEP 燈的成長面臨著營運成本上升和新興照明技術日益激烈的競爭的挑戰。

2024年,高速公路、街道照明和隧道照明領域佔據市場主導地位,佔據36.6%的顯著佔有率,這主要得益於基礎設施開發項目激增,這些項目對可靠、高強度、低維護的照明解決方案的需求。公共機構和市政當局青睞等離子照明,是因為其在隧道、橋樑和繁忙道路等惡劣的戶外條件下擁有卓越的使用壽命和強大的性能,而這些條件下安全和營運成本的節省至關重要。等離子照明能夠以極低的維護成本提供一致的照明,從而減少關鍵基礎設施環境中的停機時間和更換成本,這進一步增強了公共機構和市政當局的青睞。

2024年,美國等離子照明市場規模達1.078億美元,這得益於政府積極投資基礎設施現代化,以及其在工業和園藝領域的廣泛應用。美國率先採用尖端照明技術,加速了等離子照明融入智慧城市計畫和環境可控農業系統。這些措施強調能源效率、精確的光譜控制和持久的解決方案,進一步增加了等離子照明在各種應用中的需求。強勁的基礎設施支出、技術創新以及特定行業的需求,將在未來幾年維持美國等離子照明市場的強勁成長動能。

等離子照明產業的領導者包括LG電子、Gavita International BV和Ushio Inc.,它們透過持續創新和策略性市場拓展佔據了重要的市場地位。為了鞏固市場地位並建立競爭優勢,等離子照明產業的企業專注於多項策略措施。創新發揮核心作用,企業大力投資開發更節能、更持久的等離子照明解決方案,以滿足園藝和工業應用不斷變化的需求。與農業技術提供者、基礎設施開發商和市政當局的合作,使企業能夠擴大業務範圍,並根據特定客戶需求客製化產品。擴展產品組合以涵蓋智慧可控照明系統,有助於抓住精準農業和智慧城市基礎設施等新興趨勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 園藝照明需求不斷成長

- 卓越的能源效率和使用壽命

- 環保合規壓力

- 工業和戶外應用的需求不斷成長

- 永續照明投資不斷增加

- 產業陷阱與挑戰

- LED技術的競爭

- 有限的供應商生態系統

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 無極等離子燈(LEP)

- 微波等離子照明

- 射頻(RF)等離子照明

第6章:市場估計與預測:按功率,2021-2034

- 主要趨勢

- 小於300瓦

- 300 – 1000 瓦

- 1000瓦以上

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 高速公路、街道照明和隧道

- 工業的

- 體育和娛樂

- 園藝

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Alphalite Inc.

- Gavita International BV

- Green De Corp

- Hive Lighting

- LG Electronics

- Lumartix SA.

- pinkRF

- Plasma International GmbH

- PlasmaBright

- Ushio Inc.

- WAVEPIA CO., LTD.

- Solaronix SA

The Global Plasma Lighting Market was valued at USD 460.2 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 803.6 million by 2034. This growth is fueled by rising demand from both horticultural lighting and industrial and outdoor sectors. The expansion of controlled environment agriculture (CEA), vertical farming, and greenhouse farming systems is a significant factor driving the need for plasma lighting in horticulture.

Plasma lights produce a broad spectrum of light closely resembling natural sunlight, which promotes healthier plant growth and higher yields. Their long lifespan, energy efficiency, and robust durability make them highly suitable for environments that require consistent, continuous lighting. Meanwhile, industrial and outdoor applications demand lighting solutions that deliver high-lumen output and long operational life under tough conditions. Plasma lighting fits these requirements perfectly due to its high color rendering index (CRI), resistance to shocks, and ability to withstand temperature fluctuations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $460.2 Million |

| Forecast Value | $803.6 Million |

| CAGR | 5.8% |

Infrastructure modernization and energy-efficient initiatives led by governments are significantly accelerating the transition from traditional metal halide and HID lighting systems to advanced plasma lighting technologies across various sectors. These policy-driven efforts focus on reducing energy consumption and lowering carbon footprints while enhancing lighting quality and durability. As a result, plasma lighting, with its superior energy efficiency, longer lifespan, and better light quality, is becoming the preferred choice for public infrastructure projects.

The electrodeless plasma lamps (LEP) segment held a market value of USD 212.9 million in 2024, dominating the plasma lighting market because of its dependable technology and widespread adoption in municipal and industrial lighting applications. LEP lamps offer a consistent light output and long service life, making them ideal for locations demanding steady, high-intensity illumination. However, their growth faces challenges from increasing operational costs and rising competition from emerging lighting technologies.

The highways, street lighting, and tunnels segment dominated the market in 2024, holding a significant 36.6% share, driven primarily by the surge in infrastructure development projects demanding dependable, high-intensity, and low-maintenance lighting solutions. Public authorities and municipalities favor plasma lighting because of its exceptional longevity and robust performance under tough outdoor conditions, such as in tunnels, bridges, and busy roadways, where both safety and operational cost savings are paramount. This preference is reinforced by plasma lighting's ability to deliver consistent illumination with minimal maintenance, reducing downtime and replacement costs in critical infrastructure settings.

United States Plasma Lighting Market was valued at USD 107.8 million in 2024, fueled by proactive government investments in modernizing infrastructure alongside widespread applications in industrial and horticultural sectors. The country's early embrace of cutting-edge lighting technologies has accelerated the integration of plasma lighting into smart city projects and controlled environment agriculture systems. These initiatives emphasize energy efficiency, precise light spectrum control, and long-lasting solutions, further increasing the demand for plasma lighting across diverse applications. The combination of robust infrastructure spending, technological innovation, and sector-specific demand is set to sustain strong growth momentum in the U.S. plasma lighting market over the coming years.

Leading companies in the Plasma Lighting Industry include LG Electronics, Gavita International B.V., and Ushio Inc., which hold significant market positions through continuous innovation and strategic market outreach. To strengthen their market presence and build a competitive edge, companies in the plasma lighting sector focus on multiple strategic initiatives. Innovation plays a central role, with firms investing heavily in developing more energy-efficient, longer-lasting plasma lighting solutions that meet the evolving needs of horticultural and industrial applications. Partnerships and collaborations with agricultural technology providers, infrastructure developers, and municipal authorities allow companies to expand their reach and tailor products to specific client demands. Expanding product portfolios to include smart, controllable lighting systems helps tap into emerging trends like precision agriculture and smart city infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Power trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for horticultural lighting

- 3.2.1.2 Superior energy efficiency and lifespan

- 3.2.1.3 Environmental compliance pressure

- 3.2.1.4 Increasing demand from industrial & outdoor applications

- 3.2.1.5 Growing investments in sustainable lighting

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from LED technology

- 3.2.2.2 Limited vendor ecosystem

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and ip analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Electrodeless plasma lamps (LEP)

- 5.3 Microwave plasma lighting

- 5.4 Radio frequency (RF) plasma lighting

Chapter 6 Market Estimates & Forecast, By Power, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 300 watts

- 6.3 300 – 1000 watts

- 6.4 Above 1000 watts

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Highways, street lighting, and tunnels

- 7.3 Industrial

- 7.4 Sports & entertainment

- 7.5 Horticulture

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alphalite Inc.

- 9.2 Gavita International B.V.

- 9.3 Green De Corp

- 9.4 Hive Lighting

- 9.5 LG Electronics

- 9.6 Lumartix SA.

- 9.7 pinkRF

- 9.8 Plasma International GmbH

- 9.9 PlasmaBright

- 9.10 Ushio Inc.

- 9.11 WAVEPIA CO., LTD.

- 9.12 Solaronix SA