|

市場調查報告書

商品編碼

1773383

食物過敏治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Food Allergy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

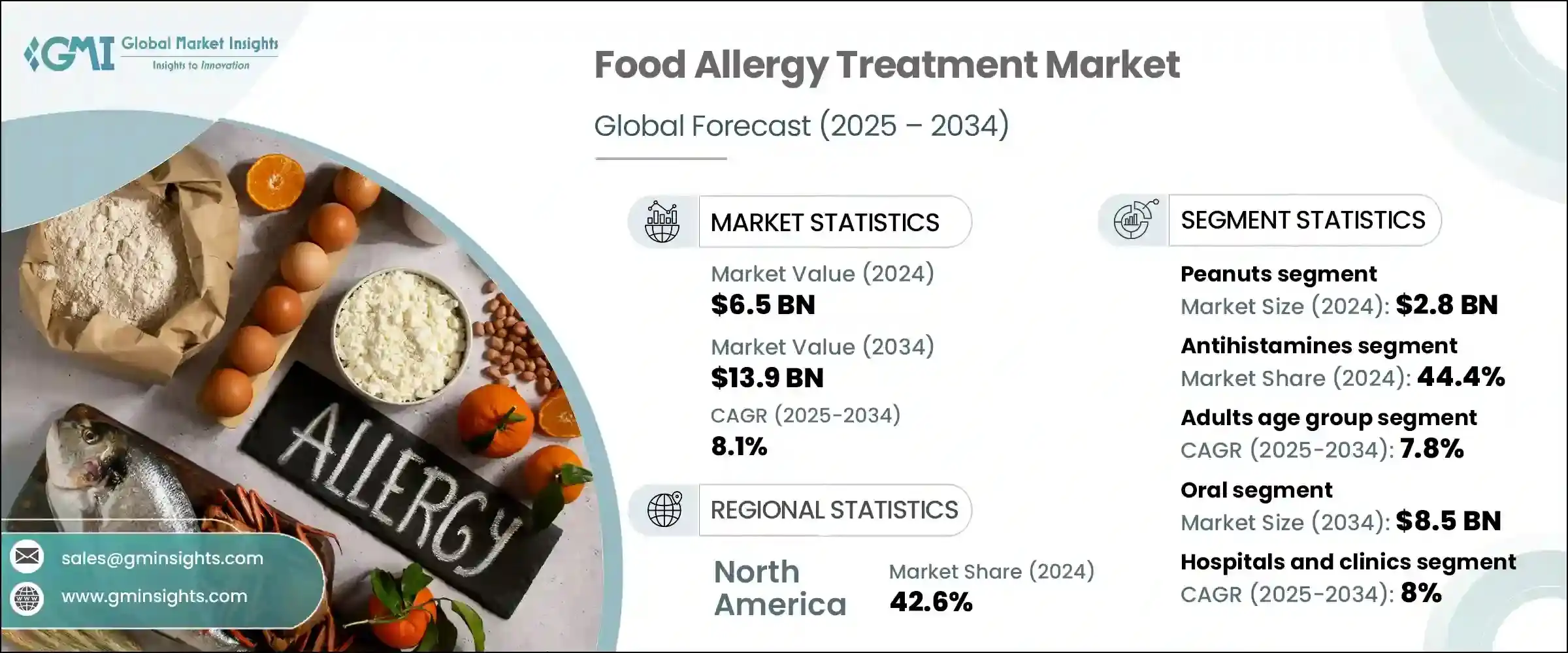

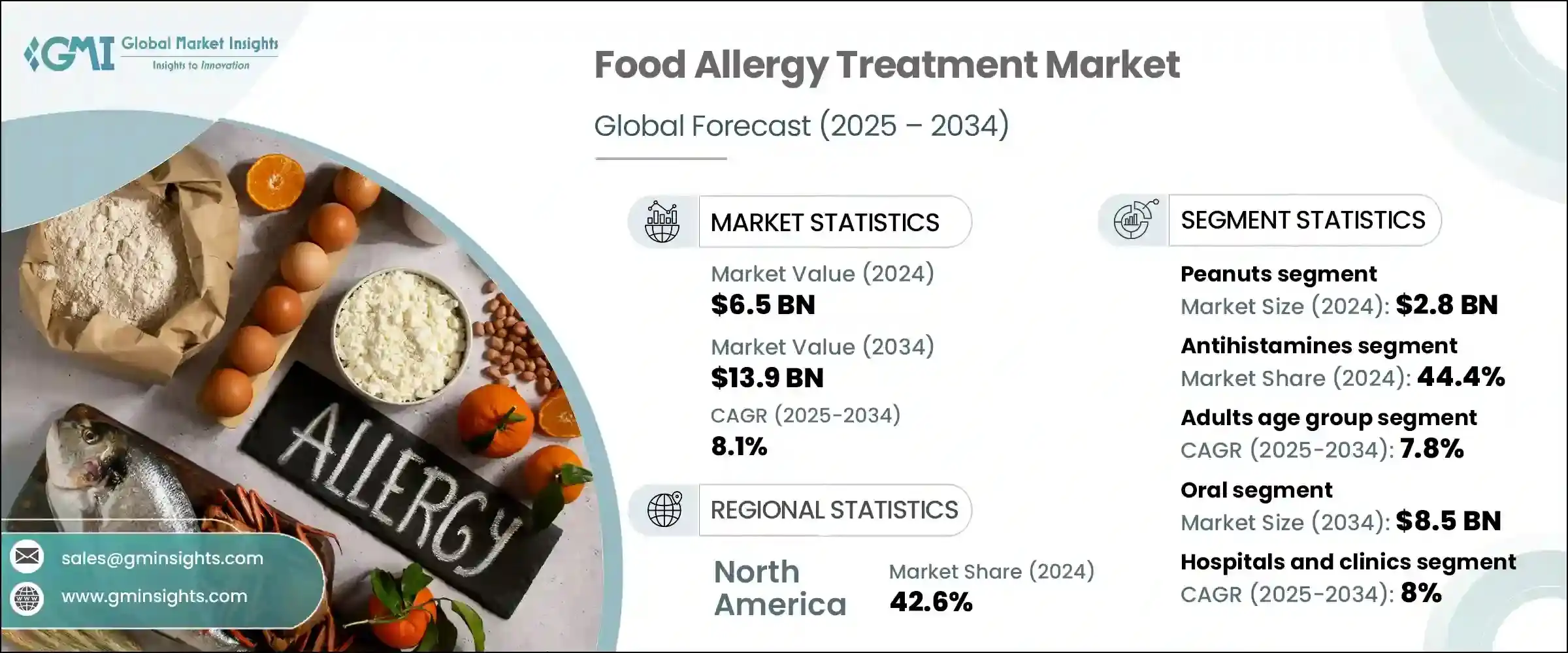

2024年,全球食物過敏治療市場規模達65億美元,預計2034年將以8.1%的複合年成長率成長,達到139億美元。這一強勁成長主要歸因於兒童和成人食物過敏發病率的上升。不斷變化的飲食模式和過敏原接觸的增加,尤其是在發展中地區,推動了對及時診斷和有效治療方案的需求。環境因素和城市生活方式也是加劇過敏反應的關鍵因素,促使人們尋求早期介入。

預防性醫療保健和個人化治療方案的日益普及進一步拓寬了治療領域。隨著人們意識的提高,人們更傾向於早期管理,這不僅可以減少併發症,還能提高患者的長期生活品質。隨著檢測工具的普及以及對門診治療的日益重視,醫療保健生態系統正在快速發展。隨著食物過敏持續影響人們的身心健康和社會福祉,越來越多的學校、工作場所和旅遊機構正在採取支持性政策,加強對過敏相關風險的整體應對。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 139億美元 |

| 複合年成長率 | 8.1% |

治療方法的創新是該市場的另一個驅動力,對免疫療法貼片、口腔黏膜治療和以微生物組為重點的療法等新型製劑的需求激增。該行業正在經歷一場範式轉變,轉向包容性和性別中立的醫療保健方案,這凸顯了擴大兒童以外人群的治療覆蓋範圍的必要性。隨著人們越來越擔心食物過敏帶來的心理負擔,患者和照護者擴大接受安全性更高、療效更好的標靶療法。

依過敏原類型,市場細分為乳製品、花生、樹堅果和其他過敏原。其中,花生類過敏原貢獻最大,2024年創造了28億美元的收入。人們對花生的敏感度日益增加,尤其是在城市人群中,這導致對先進療法的需求不斷增加。過敏反應的嚴重性和干涉的緊迫性使花生過敏成為藥物研發的重點。這一趨勢促使生技公司加強投資力度,並獲得監管機構的大力支持,為安全性和有效性更高的尖端療法鋪平了道路。

根據治療類型,市場分為抗組織胺、腎上腺素、免疫療法和其他。抗組織胺在2024年佔據主導地位,市佔率為44.4%。這些藥物是治療輕度至中度症狀(如搔癢、腫脹或充血)的首選藥物。它們使用方便、供應廣泛且為非處方藥,是許多患者的首選。抗組織胺通常是急救和預防護理的第一道防線,這鞏固了它們在治療領域的強勢地位。

就年齡層而言,市場分為兒童和成人。 2024年,成人佔據主導地位,預計在預測期內將以7.8%的顯著複合年成長率成長。隨著成人食物過敏病例的增加以及人們對延遲診斷的認知不斷提高,這個細分市場正在迅速擴張。加工食品消費增加擾亂了腸道菌群,過敏反應加劇等因素也促進了這個細分市場的成長。此外,像過敏性休克這樣的嚴重過敏反應在成人中更為常見,這加劇了對綜合治療方案的需求。

依給藥途徑分類,口服藥物在2024年佔據市場主導地位,預計2034年將達到85億美元。口服藥物因其便利性和價格實惠而備受青睞。與注射劑相比,口服藥物所需的臨床監督更少,從而提高了患者的依從性並降低了治療成本。這些優勢使其在家庭護理和臨床環境中廣泛應用。

按最終用途細分,市場包括醫院和診所、家庭護理機構和其他機構。醫院和診所在2024年的收入佔有率最高,預計在預測期內的複合年成長率為8%。這些機構提供專業的診斷工具和緊急應變能力,對於管理嚴重的過敏反應至關重要。此外,醫院提供的臨床計畫和後續治療支援持續護理,確保更好地管理長期過敏狀況。醫療基礎設施投資的增加,尤其是在新興經濟體,也推動了醫院過敏治療服務的成長。

從區域來看,北美佔據全球市場主導地位,2024 年的市佔率高達 42.6%。該地區受益於早期診斷、強大的醫療基礎設施以及過敏管理醫療支出的不斷成長。光是美國市場就從 2023 年的 23 億美元成長到 2024 年的 25 億美元,反映出市場對個人化治療的需求不斷成長,以及公共衛生措施的有力推進。

歐洲緊隨其後,2024 年市場價值達 17 億美元,預計將呈現強勁成長。政府支持的計畫、治療技術的進步以及生物製劑和精準療法可及性的提高,正在提升歐洲的市場格局。製藥公司與公共機構之間的策略合作也在推動創新和確保更廣泛地獲得新型療法方面發揮關鍵作用。

競爭格局仍然高度活躍,主要參與者包括賽諾菲、梯瓦製藥、Kenvue、基因泰克和 Hal Allergy,它們在 2024 年佔據了近 60% 的市場佔有率。這些公司專注於透過收購、產品發布和研發計劃來擴大其產品組合。同時,區域性和本地公司繼續透過提供符合本地需求且經濟高效的解決方案來創造競爭壓力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球食物過敏盛行率不斷上升,尤其是在兒童中

- 增加對創新和有針對性的治療方案的投資

- 公眾意識不斷增強,過敏管理更加積極主動

- 產業陷阱與挑戰

- 缺乏標準化的診斷工具

- 新興療法的不良反應風險

- 市場機會

- 口服免疫療法和生物製劑的擴展

- 製藥公司與研究機構的合作

- 成長動力

- 成長潛力分析

- 管道分析

- 未來市場趨勢

- 技術和創新格局

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按過敏原類型,2021 - 2034 年

- 主要趨勢

- 乳製品

- 花生

- 樹堅果

- 其他過敏原類型

第6章:市場估計與預測:按治療類型,2021 - 2034 年

- 主要趨勢

- 抗組織胺藥

- 腎上腺素

- 免疫療法

- 其他治療類型

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 孩子們

- 成年人

第8章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

- 鼻內

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AdvaCare

- Aimmune Therapeutics

- Alerje

- ARS Pharma

- Camallergy

- Celltrion

- DBV Technologies

- Genentech

- Hal Allergy

- Kenvue

- Sanofi

- Stallergenes Greer

- Teva Pharmaceutical

The Global Food Allergy Treatment Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.9 billion by 2034. This robust growth is largely attributed to the rising incidence of food allergies across both pediatric and adult populations. Evolving dietary patterns and increased exposure to allergens, especially in developing regions, are driving the demand for timely diagnosis and efficient treatment solutions. Environmental factors and urban lifestyles also play a crucial role in aggravating allergic reactions, prompting individuals to seek early intervention.

Preventive healthcare and the growing popularity of personalized treatment plans are further broadening the treatment landscape. With improved awareness, people are opting for early-stage management, which not only reduces complications but also enhances the long-term quality of life for patients. The healthcare ecosystem is rapidly evolving with the availability of detection tools and a growing emphasis on outpatient care. As food allergies continue to impact mental, physical, and social well-being, more schools, workplaces, and travel organizations are adopting supportive policies, strengthening the overall response to allergy-related risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 8.1% |

Innovation in treatment approaches is another driver of this market, with demand surging for newer formulations such as immunotherapy patches, oral mucosal treatments, and microbiome-focused therapeutics. The industry is experiencing a paradigm shift toward inclusive and gender-neutral healthcare protocols, highlighting the need for broader treatment access beyond children. With rising concerns over the psychological toll of living with food allergies, patients and caregivers are increasingly embracing targeted therapies that offer better safety profiles and improved outcomes.

By allergen type, the market is segmented into dairy products, peanuts, tree nuts, and other allergens. Among these, the peanuts segment emerged as the largest contributor, generating USD 2.8 billion in revenue in 2024. Increasing sensitivity to peanuts, particularly in urban populations, has led to heightened demand for advanced therapies. The severity of reactions and the immediate need for intervention have made peanut allergies a focal point for pharmaceutical R&D. This trend has resulted in increased investments from biotech firms and strong support from regulatory bodies, paving the way for cutting-edge therapies with improved safety and efficacy.

Based on treatment type, the market is categorized into antihistamines, epinephrine, immunotherapy, and others. Antihistamines maintained dominance in 2024 with a market share of 44.4%. These are the go-to medications for managing mild to moderate symptoms like itching, swelling, or congestion. Their ease of use, wide availability, and over-the-counter status make them an accessible choice for many patients. Antihistamines are often the first line of defense in both emergency and preventive care, supporting their strong position in the treatment landscape.

In terms of age group, the market is divided between children and adults. Adults held the leading share in 2024 and are projected to grow at a notable CAGR of 7.8% over the forecast period. With growing adult-onset food allergies and rising awareness about late diagnoses, this segment is rapidly expanding. Factors such as increased consumption of processed foods disrupted gut microbiota, and stronger allergic reactions are contributing to the segment's growth. Additionally, severe allergic reactions like anaphylaxis are more common among adults, intensifying the demand for comprehensive treatment options.

On the basis of the route of administration, the oral segment led the market in 2024 and is expected to reach USD 8.5 billion by 2034. Oral medications are favored for their convenience and affordability. Compared to injectables, they require less clinical oversight, resulting in higher patient compliance and lower treatment costs. These advantages have contributed to their wide adoption across both home care and clinical settings.

When segmented by end use, the market includes hospitals and clinics, home care settings, and others. Hospitals and clinics accounted for the highest revenue share in 2024 and are estimated to grow at a CAGR of 8% during the forecast timeline. These facilities offer specialized diagnostic tools and emergency response capabilities, making them essential for managing severe allergic reactions. Moreover, clinical programs and follow-up treatments available in hospitals support continuity of care, ensuring better management of long-term allergic conditions. Increased investment in healthcare infrastructure, particularly in emerging economies, is also fueling the growth of hospital-based allergy treatment services.

Regionally, North America dominated the global market with a commanding share of 42.6% in 2024. The region benefits from early diagnosis, strong healthcare infrastructure, and rising healthcare expenditure on allergy management. The market in the United States alone rose from USD 2.3 billion in 2023 to USD 2.5 billion in 2024, reflecting the heightened demand for personalized therapies and robust public health initiatives.

Europe followed with a market value of USD 1.7 billion in 2024 and is expected to show strong growth. Government-backed programs, advancements in treatment technology, and improved accessibility to biologics and precision therapies are enhancing the regional landscape. Strategic collaborations between pharmaceutical companies and public institutions are also playing a key role in driving innovation and ensuring better access to novel treatments.

The competitive landscape remains highly dynamic, led by major players such as Sanofi, Teva Pharmaceutical, Kenvue, Genentech, and Hal Allergy, who together accounted for nearly 60% of the market in 2024. These companies are focused on expanding their portfolios through acquisitions, product launches, and R&D initiatives. Meanwhile, regional and local firms continue to create competitive pressure by offering cost-effective solutions tailored to local demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Allergen type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of food allergies, especially among children

- 3.2.1.2 Increasing investment in innovative and targeted treatment options

- 3.2.1.3 Growing public awareness and proactive allergy management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized diagnostic tools

- 3.2.2.2 Risk of adverse reactions to emerging therapies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of oral immunotherapy and biologics

- 3.2.3.2 Collaborations between pharmaceutical firms and research institutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Technology and innovation landscape

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Allergen Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dairy products

- 5.3 Peanuts

- 5.4 Tree nuts

- 5.5 Other allergen types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antihistamines

- 6.3 Epinephrine

- 6.4 Immunotherapy

- 6.5 Other treatment types

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Children

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Intranasal

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvaCare

- 11.2 Aimmune Therapeutics

- 11.3 Alerje

- 11.4 ARS Pharma

- 11.5 Camallergy

- 11.6 Celltrion

- 11.7 DBV Technologies

- 11.8 Genentech

- 11.9 Hal Allergy

- 11.10 Kenvue

- 11.11 Sanofi

- 11.12 Stallergenes Greer

- 11.13 Teva Pharmaceutical