|

市場調查報告書

商品編碼

1773382

分配槍市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dispensing Guns Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

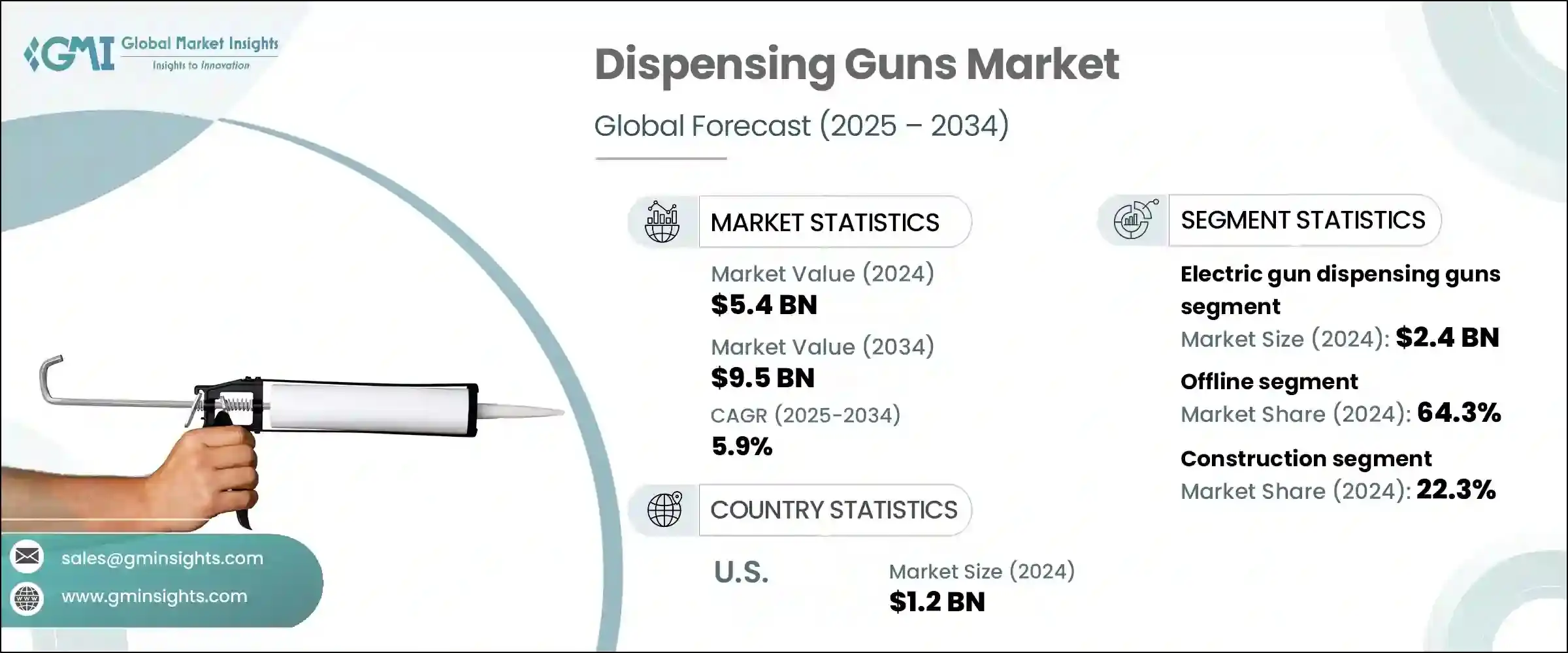

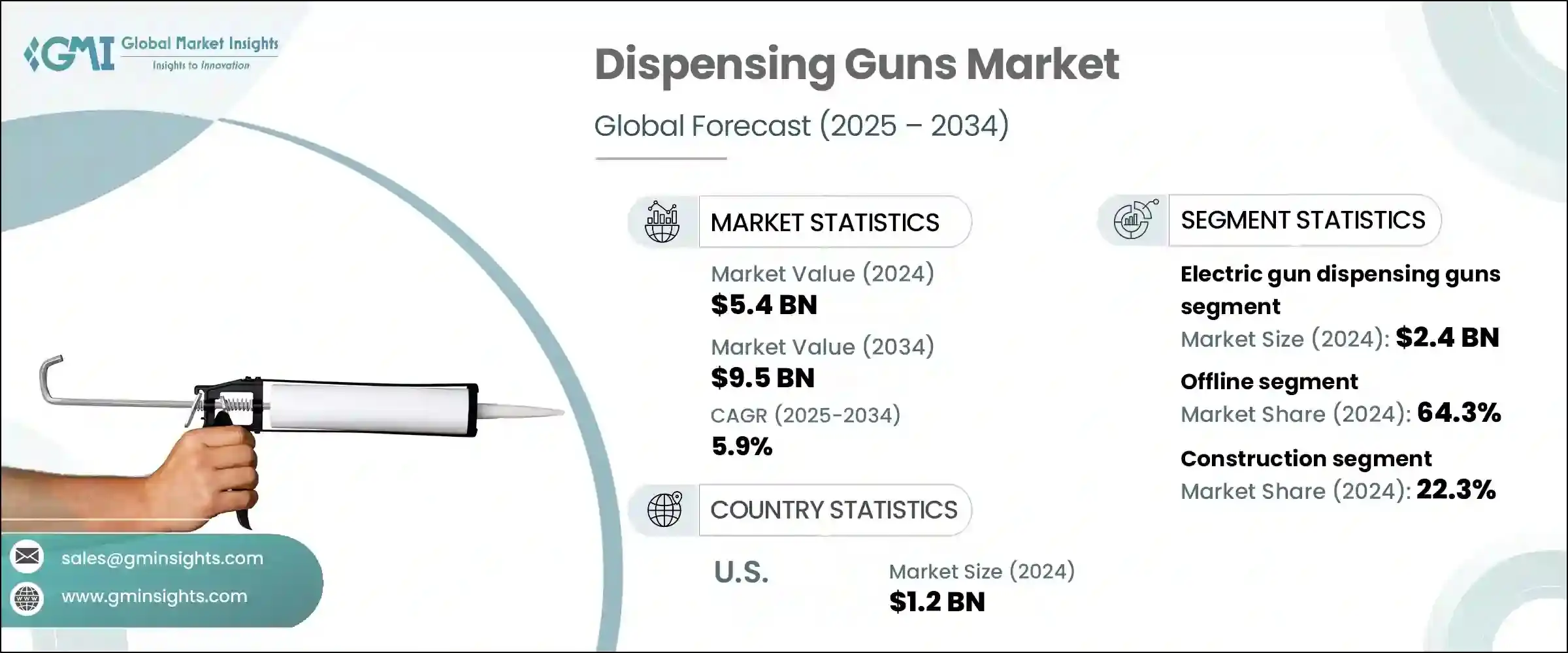

2024年,全球點膠槍市場規模達54億美元,預計2034年將以5.9%的複合年成長率成長,達到95億美元。這一成長主要得益於建築和汽車行業的強勁需求,因為速度和精度在這些行業中至關重要。監管激勵措施,尤其是在北美和歐洲,對這一成長做出了重大貢獻。例如,美國環保署 (EPA) 提倡使用低揮發性有機化合物 (VOC) 黏合劑,而歐洲的綠色協議則鼓勵在建築中使用環保材料。這些法規有助於縮短專案工期並最大限度地減少浪費,從而使壓力供料設備製造商受益。

工業自動化仍然是點膠槍市場的關鍵驅動力,因為自動化點膠機比傳統的手動工具具有更高的可靠性。汽車組裝和建築行業對精度的日益成長的需求確保了該市場將持續擴張。此外,這些先進的點膠槍在材料利用率方面更加高效,這與日益成長的環保解決方案需求相契合,從而支持企業的永續發展計畫。隨著對速度和精度的需求從可選功能逐漸成為標準配置,該技術在市場上的持久生命力將得到保證。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 54億美元 |

| 預測值 | 95億美元 |

| 複合年成長率 | 5.9% |

2024年,電動點膠槍市場規模達24億美元。數位控制、無線連接和即時資料監控等功能如今已成為許多電動機型的標準配備。這些改進有助於工廠團隊加強品質檢查並最佳化生產流程。電池供電設計與輕量化結構相結合,為操作員在長時間輪班期間提供更高的舒適度,從而推動了從氣動型號向電動型號的過渡。汽車和電子產品製造商擴大採用電動點膠槍來實現精確的黏合劑噴塗,從而減少浪費和固化時間,最終縮短生產週期。

2024年,線下市場佔了64.3%的佔有率。為了滿足日益成長的本地需求,分銷商正在巴西、印度和東南亞等新興市場擴大倉庫。這種擴張對實體店市場的發展扮演了至關重要的角色。與航太或家電製造等行業合作開發的客製化設備通常會在展會上首次亮相,並一直展出到最終規格確認,這不僅促進了新訂單的產生,也促進了回頭客的增加。服務技術人員強調了直接實踐培訓的優勢,事實證明,這種培訓比線上教學更有效。

2024年,美國點膠槍市場產值將達12億美元。推動這一市場成長的因素主要有三:汽車工廠的現代化改造、生物醫藥研究的擴展以及綠色建築項目的蓬勃發展。美國環保署(EPA)的新法規促使建築商使用低VOC(揮發性有機化合物)黏合劑,而美國綠色建築委員會預計環保建築計畫每年將成長10%。

點膠槍市場的領導者包括牧田 (Makita)、TigeR、史丹利百得 (Stanley Black & Decker)、羅伯特·博世 (Robert Bosch)、密爾瓦基工具 (Milwaukee Tool)、3M、GreatStar、諾信公司 (Nordson Corporation)、Siroflex、田島 (TaJima)、Irim、Tk; Engineering。各公司為鞏固其在點膠槍市場的地位而採取的關鍵策略包括專注於產品創新,特別是透過整合無線連接、即時資料追蹤和增強的人體工學等先進技術來提高用戶舒適度和生產力。

企業也正在拓展其全球分銷網路,以滿足東南亞、印度和巴西等新興市場日益成長的需求。與航太、汽車和生物醫藥等產業的策略合作,對於獲得長期合約至關重要。此外,製造商正在透過開發符合監管標準的環保解決方案來強調永續性。這些策略不僅有助於企業鞏固市場地位,也能使其產品在競爭激烈的產業中脫穎而出。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 手動槍

- 氣動槍

- 電動槍

- 其他

第5章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 建造

- 汽車

- 工業製造

- 食品和飲料

- 衛生保健

- 其他

第6章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 無線

- 有線

第7章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 金屬

- 塑膠

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 離線

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- 3M

- Albion Engineering

- GreatStar

- Henkel

- Irion

- Makita

- METABO

- Milwaukee Tool

- Nordson Corporation

- PC Cox

- Robert Bosch

- Siroflex

- Stanley Black & Decker

- TaJima

- Tiger

The Global Dispensing Guns Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 9.5 billion by 2034. This growth is largely driven by the strong demand from the construction and automotive sectors, where speed and precision are essential. Regulatory incentives, particularly in North America and Europe, have contributed significantly to this growth. For instance, the U.S. Environmental Protection Agency (EPA) promotes the use of low-VOC adhesives, while Europe's Green Deal encourages the use of environmentally friendly materials in construction. These regulations help reduce project timelines and minimize waste, benefiting manufacturers of pressure-fed equipment.

Industrial automation continues to be a key driver in the dispensing-gun market, as automated applicators provide higher reliability than traditional hand-operated tools. The rising need for precision in the automotive assembly and building industries ensures that this market will continue to expand. Additionally, these advanced dispensing guns are more efficient in material usage, aligning well with the growing demand for eco-friendly solutions, which supports companies' sustainability initiatives. As demand for speed and accuracy becomes standard rather than an optional feature, technology's longevity in the market is assured.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $9.5 Billion |

| CAGR | 5.9% |

In 2024, the electric dispensing guns segment generated USD 2.4 billion. Features such as digital controls, wireless connectivity, and real-time data monitoring are now commonplace in many electric models. These improvements help factory teams enhance quality checks and optimize production processes. Battery-powered designs, combined with lightweight builds, provide operators with greater comfort during extended shifts, encouraging the transition from pneumatic models to electric units. Automotive and electronics manufacturers are increasingly adopting these guns to achieve precise adhesive applications that reduce waste and cure time, which ultimately leads to faster production cycles.

The offline segment held a 64.3% share in 2024. Distributors are expanding their warehouses across emerging markets such as Brazil, India, and Southeast Asia to meet the rising local demand. This expansion has been pivotal in supporting the brick-and-mortar segment. Custom rigs developed in collaboration with industries like aerospace or appliance manufacturing often debut at trade shows and remain on display until final specifications are confirmed, fueling both new orders and repeat business. Service technicians have emphasized the benefits of direct, hands-on training, which proves far more effective than online tutorials.

United States Dispensing Guns Market generated USD 1.2 billion in 2024. Three factors are driving this market growth: the modernization of automotive factories, expansion in biomedicine research, and the boom in green construction projects. The EPA's new regulations push builders toward using low-VOC adhesives, while the U.S. Green Building Council anticipates a 10% annual increase in eco-friendly construction projects.

Leading players in the Dispensing Guns Market include Makita, TigeR, Stanley Black & Decker, Robert Bosch, Milwaukee Tool, 3M, GreatStar, Nordson Corporation, Siroflex, TaJima, Irion, METABO, PC Cox, Henkel, Albion Engineering. Key strategies adopted by companies to solidify their position in the dispensing guns market include focusing on product innovation, particularly through the integration of advanced technologies like wireless connectivity, real-time data tracking, and enhanced ergonomics to improve user comfort and productivity.

Companies are also expanding their global distribution networks to meet rising demand in emerging markets such as Southeast Asia, India, and Brazil. Strategic collaborations with industries like aerospace, automotive, and biomedicine have been instrumental in securing long-term contracts. Additionally, manufacturers are emphasizing sustainability by developing eco-friendly solutions in line with regulatory standards. These strategies help companies not only strengthen their market foothold but also differentiate their offerings in a highly competitive industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Material

- 2.2.5 Technology

- 2.2.6 Distribution channel

- 2.3 CXO Perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 4.1 Key trends

- 4.2 Manual gun

- 4.3 Pneumatic gun

- 4.4 Electric gun

- 4.5 Others

Chapter 5 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Construction

- 5.3 Automotive

- 5.4 Industrial manufacturing

- 5.5 Food and beverage

- 5.6 Healthcare

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cordless

- 6.3 Corded

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Metal

- 7.3 Plastic

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Albion Engineering

- 10.3 GreatStar

- 10.4 Henkel

- 10.5 Irion

- 10.6 Makita

- 10.7 METABO

- 10.8 Milwaukee Tool

- 10.9 Nordson Corporation

- 10.10 PC Cox

- 10.11 Robert Bosch

- 10.12 Siroflex

- 10.13 Stanley Black & Decker

- 10.14 TaJima

- 10.15 Tiger