|

市場調查報告書

商品編碼

1773381

液晶電視核心晶片市場機會、成長動力、產業趨勢分析及2025-2034年預測LCD TV Core Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

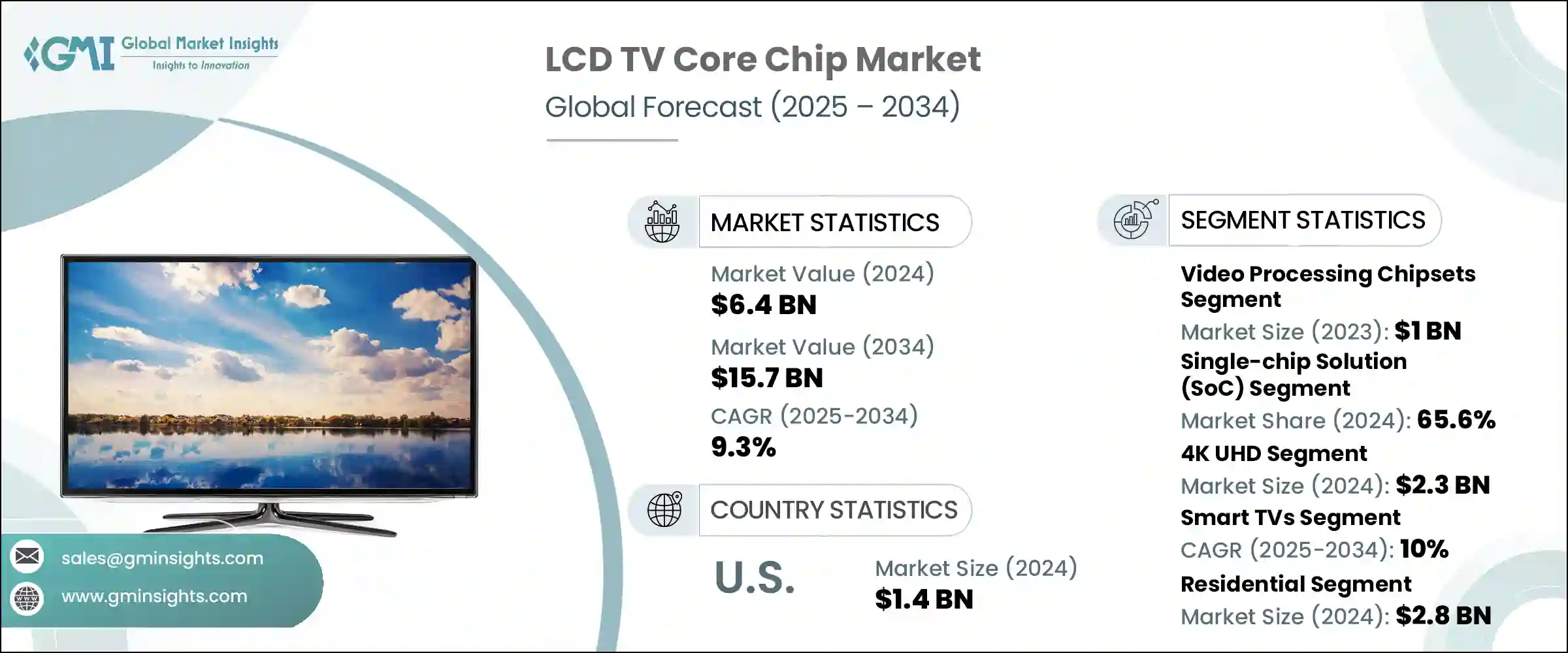

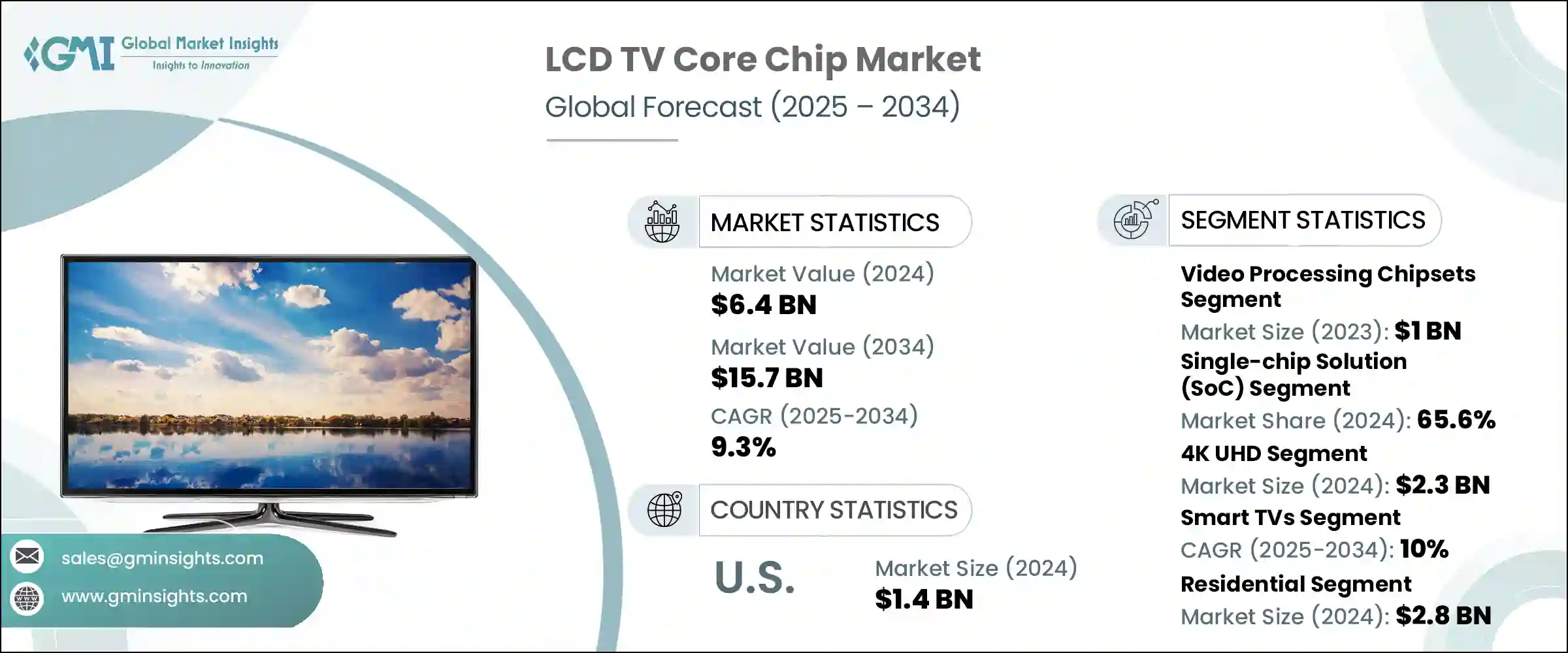

2024年,全球液晶電視核心晶片市場規模達64億美元,預計2034年將以9.3%的複合年成長率成長,達到157億美元。隨著用戶尋求與串流媒體平台、人工智慧語音助理、網路連接和響應式多工處理的無縫整合,智慧連網電視的快速普及將繼續推動這一成長。為此,製造商正在設計高性能處理晶片,以支援包括超高清視訊解碼、高級內容渲染和基於應用程式的使用者介面在內的複雜功能。

物聯網和智慧家庭生態系統的發展進一步擴大了對晶片的需求,這些晶片不僅性能更強大,而且節能高效。隨著消費者逐漸轉向 4K 和 8K 解析度,核心晶片必須提供顯著增強的運算能力,以應對這些格式帶來的高頻寬、壓縮和影像處理需求。這一發展趨勢將下一代晶片定位為電視體驗的核心,徹底改變用戶與內容、應用程式和智慧功能的互動方式。隨著對速度更快、更智慧、更節能的電視的需求日益成長,先進的核心處理單位正成為效能和創新的核心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 64億美元 |

| 預測值 | 157億美元 |

| 複合年成長率 | 9.3% |

系統單晶片 (SoC) 解決方案是推動這項轉變的主要力量,2022 年市值將達到 12 億美元。這些整合晶片組將中央處理、圖形渲染、記憶體管理和連接等關鍵功能整合到一個平台中,大幅簡化了內部架構。這種整合可以實現更快的資料傳輸、更低的延遲和更流暢的多工處理,所有這些都有助於帶來卓越的觀看體驗。 SoC 讓智慧電視能夠有效率地運行串流平台、AI 功能和互動服務,使其成為當今互聯客廳中不可或缺的一部分。

2024年,單晶片解決方案市場佔65.6%的市場佔有率,進一步鞏固了其在提升電視效能方面的作用。這些緊湊型晶片減少了對多個組件的需求,從而最大限度地減少了功耗和電路板空間。其高效率和設計靈活性使其在中高階液晶電視領域備受青睞,這些電視製造商致力於在不犧牲智慧功能的情況下,提供時尚的外觀、極速的運行速度和極具競爭力的生產成本。

2024年,美國液晶電視核心晶片市場規模達14億美元,這得益於消費者對配備高清顯示器和嵌入式串流媒體技術的先進智慧電視的強烈偏好。憑藉持續的創新和強勁的消費水平,美國市場已成為晶片需求和開發的領先中心。研發投入以及全球主要供應商的佈局進一步鞏固了美國在該領域的地位。

液晶電視核心晶片市場的頂級公司包括聯詠科技、聯發科技和瑞昱半導體。液晶電視核心晶片市場公司採用的關鍵策略包括整合 AI 驅動的增強功能以及對 8K 和 UHD 等超高解析度內容格式的支援。主要參與者正在開發客製化晶片,以最大限度地降低能耗,同時最大限度地提高處理能力,並針對智慧電視生態系統進行客製化。許多公司專注於與領先的電視製造商合作,共同開發功能豐富的平台。此外,公司優先考慮系統級整合和更快的上市時間,提供將記憶體、顯示控制和連接等多種功能集於一身的 SoC。對研發和下一代壓縮演算法的持續投資也增強了它們在快速發展的數位娛樂環境中的競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 智慧和連網電視的普及

- 過渡到更高的顯示解析度

- 人工智慧能力的整合

- OTT平台的出現

- 中產階級消費者的全球擴張

- 產業陷阱與挑戰

- 價格壓力和利潤

- 半導體供應鏈波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依晶片組類型,2021-2034

- 主要趨勢

- 視訊處理晶片組

- 音訊處理晶片組

- 調諧器和解調器晶片組

- 電源管理IC

- 時序控制器 (TCON) IC

- 系統單晶片 (SoC)

- 其他

第6章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 單晶片解決方案(SoC)

- 多晶片解決方案

第7章:市場估計與預測:依決議,2021-2034

- 主要趨勢

- 高清(720p)

- 全高清 (1080p)

- 4K 超高清

- 8K 超高清

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 智慧電視

- 非智慧型(傳統)液晶電視

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Analog Devices Inc.

- Broadcom Inc.

- Hisilicon (Huawei Technologies)

- Innosilicon

- MediaTek Inc.

- Novatek Microelectronics Corp.

- NXP Semiconductors

- Parade Technologies

- Realtek Semiconductor Corp.

- ROHM Semiconductor

- Samsung Electronics (System LSI)

- Skyworks Solutions

- Socionext Inc.

- Sony Semiconductor Solutions

- STMicroelectronics

- Synaptics Inc.

- Texas Instruments

- Toshiba Electronic Devices & Storage Corporation

The Global LCD TV Core Chip Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 15.7 billion by 2034. Rapid adoption of smart and connected TVs continues to fuel this growth, as users seek seamless integration with streaming platforms, AI-powered voice assistants, internet connectivity, and responsive multitasking. In response, manufacturers are designing high-performance processing chips to support complex functions, including ultra-high-definition video decoding, advanced content rendering, and app-based user interfaces.

The growth of IoT and smart home ecosystems has further amplified the demand for chips that are not only more powerful but also energy efficient. As consumers gravitate toward 4K and 8K resolutions, core chips must deliver significantly enhanced computing capabilities to manage the high bandwidth, compression, and image processing needs associated with these formats. This evolution is positioning next-generation chips at the heart of the television experience, transforming how users interact with content, apps, and smart features. As the demand for faster, smarter, and more energy-efficient TVs grows, advanced core processing units are becoming central to performance and innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 9.3% |

System-on-chip (SoC) solutions are driving much of this shift, valued at USD 1.2 billion in 2022. These integrated chipsets combine critical functions-such as central processing, graphics rendering, memory management, and connectivity-into a single platform, drastically simplifying internal architecture. This integration allows for quicker data transmission, reduced latency, and smoother multitasking, all of which contribute to a superior viewing experience. SoCs enable smart TVs to operate streaming platforms, AI features, and interactive services efficiently, making them essential in today's connected living rooms.

In 2024, the single-chip solutions segment held a 65.6% share, reinforcing its role in advancing TV performance. These compact chips reduce the need for multiple components, minimizing power consumption and space on circuit boards. Their efficiency and design flexibility make them highly favored in mid-range to premium LCD TVs, where manufacturers strive to deliver sleek aesthetics, lightning-fast operation, and competitive production costs without compromising on smart capabilities.

U.S. LCD TV Core Chip Market was valued at USD 1.4 billion in 2024, driven by strong consumer preference for advanced smart TVs featuring high-definition displays and embedded streaming technologies. With continuous innovation and robust consumption levels, the U.S. market is a leading hub for chip demand and development. Investments in R&D and the presence of major global suppliers have further solidified the country's position in this space.

Top companies in the LCD TV Core Chip Market include Novatek Microelectronics Corp., MediaTek Inc., and Realtek Semiconductor Corp. Key strategies adopted by companies in the LCD TV core chip market include the integration of AI-driven enhancements and support for ultra-high-resolution content formats, such as 8K and UHD. Major players are developing customized chips that minimize energy use while maximizing processing power, tailored to smart TV ecosystems. Many focus on partnerships with leading TV manufacturers to co-develop feature-rich platforms. Additionally, companies are prioritizing system-level integration and faster time-to-market, offering SoCs that combine multiple functionalities like memory, display control, and connectivity in one unit. Ongoing investment in R&D and next-gen compression algorithms also strengthens their competitive edge in a rapidly evolving digital entertainment environment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Proliferation of smart and connected TVs

- 3.4.1.2 Transition to higher display resolutions

- 3.4.1.3 Integration of AI capabilities

- 3.4.1.4 Emergence of OTT platforms

- 3.4.1.5 Global expansion of middle-class consumers

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Price pressure and margins

- 3.4.2.2 Semiconductor supply chain volatility

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type of Chipset, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Video processing chipsets

- 5.3 Audio processing chipsets

- 5.4 Tuner & demodulator chipsets

- 5.5 Power management ICs

- 5.6 Timing Controller (TCON) ICs

- 5.7 System-on-Chip (SoC)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Single-chip Solution (SoC)

- 6.3 Multi-chip solution

Chapter 7 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 HD (720p)

- 7.3 Full HD (1080p)

- 7.4 4K UHD

- 7.5 8K UHD

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Smart TVs

- 8.3 Non-smart (Conventional) LCD TVs

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices Inc.

- 11.2 Broadcom Inc.

- 11.3 Hisilicon (Huawei Technologies)

- 11.4 Innosilicon

- 11.5 MediaTek Inc.

- 11.6 Novatek Microelectronics Corp.

- 11.7 NXP Semiconductors

- 11.8 Parade Technologies

- 11.9 Realtek Semiconductor Corp.

- 11.10 ROHM Semiconductor

- 11.11 Samsung Electronics (System LSI)

- 11.12 Skyworks Solutions

- 11.13 Socionext Inc.

- 11.14 Sony Semiconductor Solutions

- 11.15 STMicroelectronics

- 11.16 Synaptics Inc.

- 11.17 Texas Instruments

- 11.18 Toshiba Electronic Devices & Storage Corporation