|

市場調查報告書

商品編碼

1773380

空心磚市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hollow Bricks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

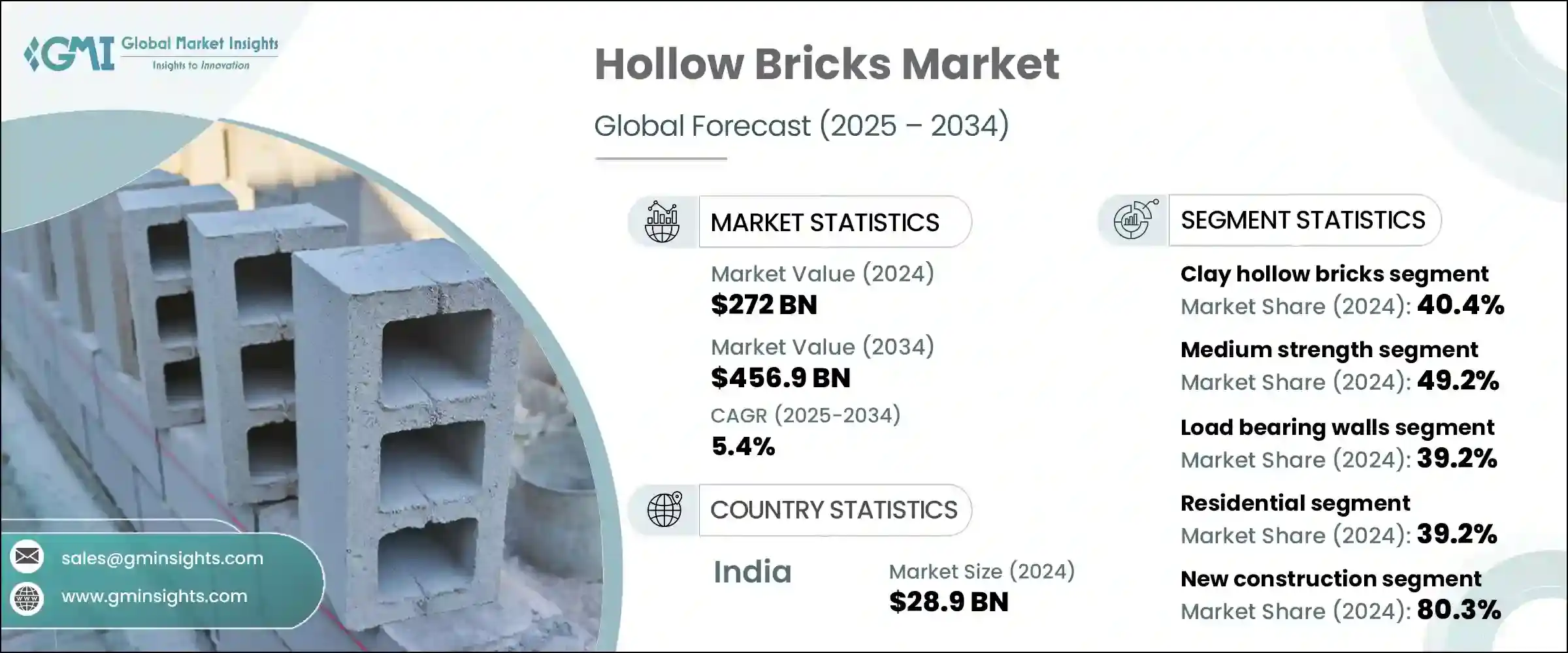

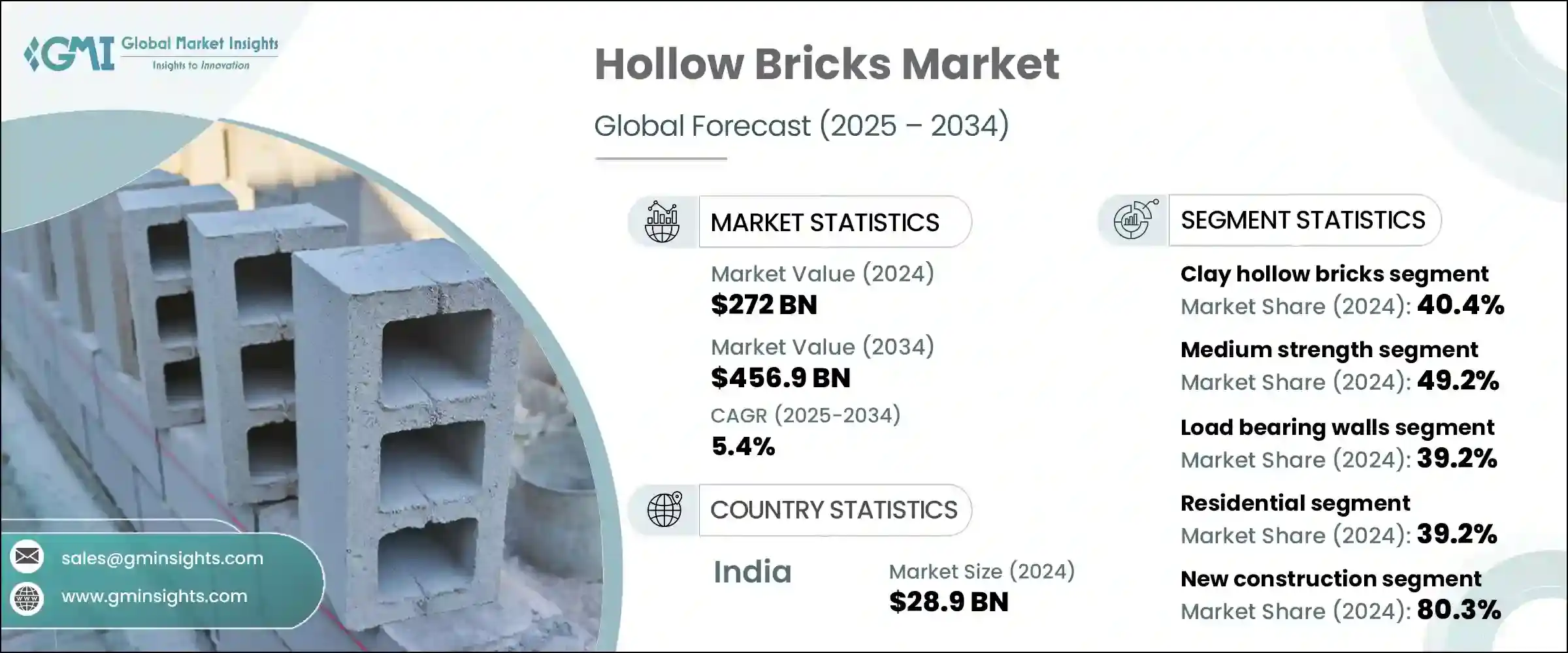

2024年,全球空心磚市場規模達2,720億美元,預計到2034年將以5.4%的複合年成長率成長,達到4,569億美元。隨著新建住宅和商業建築需求的不斷成長,尤其是在大都市和郊區,空心磚的需求量也顯著增加。空心磚易於安裝且經濟高效,是大型建築專案的理想選擇。政府支持的經濟適用房計畫也鼓勵使用經濟實惠且永續的建築材料,促進了這一成長趨勢。空心磚具有天然的隔熱和隔熱性能,節能高效。它還能幫助降低冷氣和供暖成本,這與人們對綠色建築和節能建築日益成長的關注相契合,因此成為具有環保意識的開發商的首選材料。

這些磚塊有助於調節室內溫度和噪音水平,使建築物在氣候變遷多端、噪音水平較高的城市環境中更加舒適。其結構減少了對砂漿的需求,並最大限度地減少了對高強度材料的需求,從而降低了整體建築成本。輕質特性使運輸和組裝更快、更有效率,尤其是在勞動力和預算緊張的情況下。此外,模組化和預製建築技術的日益普及,進一步增加了對空心磚的需求,因為它們與現代建築實踐相容,並有助於加快專案進度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2720億美元 |

| 預測值 | 4569億美元 |

| 複合年成長率 | 5.4% |

2024年,黏土空心磚市場佔有40.4%的佔有率。隨著建築業轉向高強度輕質材料,各種類型黏土磚的需求持續成長。粘土基磚仍然是主流選擇,尤其是在低層建築中,因為它們供應廣泛且製造程序經濟高效。粘土磚的熱工性能和強度特性使其在農村和發展中城市地區廣泛應用,尤其是在新興經濟體,因為這些地區對材料的可負擔性和可獲得性至關重要。

2024年,承重牆領域使用的空心磚貢獻了39.2%的市佔率。這些牆體是現代建築設計的基本組成部分,為住宅和商業項目提供耐用性和必要的結構支撐。雖然承重應用占主導地位,但由於其易用性和輕質特性,空心磚在非承重內牆中的使用也顯著成長。空心磚日益普及,這與不斷變化的設計需求息息相關,這些需求傾向於在新建築中實現更快的安裝速度和多樣化的佈局選擇。

印度空心磚市場佔82%的市場佔有率,2024年市場規模達289億美元。快速的城市發展、廣泛的建築活動以及公共基礎設施和住房計劃的強勁勢頭,推動了印度空心磚市場的領先地位。印度強大的製造業生態系統和充足的高強度原料供應,進一步鞏固了其市場主導地位。此外,小城市和二線市場的日益普及也擴大了國內消費基礎。同時,旨在推廣永續和節能建築材料的政策措施,也進一步加速了各地區的空心磚使用。

一些最具影響力的空心磚行業參與者包括 Xella Group、H+H International A/S、UltraTech Cement Ltd、Biltech Building Elements Limited 和 Wienerberger AG。這些公司正透過產品創新和在關鍵地區的策略佈局,積極推動市場發展。為了鞏固其在空心磚市場的地位,領先的製造商正在運用多種成長策略。這些策略包括建立區域製造中心以降低物流成本並提高配送效率,投資自動化生產以在保持一致性的同時擴大產量,以及推出具有更高強度和熱性能的先進產品。與房地產開發商和建築公司的合作也被證明能夠有效推動空心磚的普及。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 不斷發展的建築業

- 更加重視能源效率

- 成本效益和減少材料使用

- 卓越的隔熱和隔音性能

- 產業陷阱與挑戰

- 來自替代建築材料的競爭

- 波動的強度等級價格

- 區域建築規範合規性

- 品質控制和一致性問題

- 市場機會

- 環保空心磚的開發

- 新興市場的擴張

- 製造業的技術進步

- 與現代建築技術的融合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 黏土空心磚

- 混凝土空心砌塊

- 粉煤灰空心磚

- AAC(加氣混凝土)空心砌塊

- 其他

第6章:市場估計與預測:依強度等級,2021 年至 2034 年

- 主要趨勢

- 低強度

- 中等強度

- 高強度

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 承重牆

- 外部承重牆

- 內部承重牆

- 其他

- 非承重牆

- 隔間牆

- 填充牆

- 其他

- 基金會

- 柱子和支柱

- 過樑和橫樑

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 住宅

- 獨棟住宅

- 多戶建築

- 經濟適用房

- 其他

- 商業的

- 辦公大樓

- 零售空間

- 飯店業

- 醫療保健設施

- 教育機構

- 其他

- 工業的

- 生產設施

- 倉庫

- 其他

- 基礎設施

- 其他

第9章:市場估計與預測:按建築類型,2021 - 2034 年

- 主要趨勢

- 新建築

- 翻新和改造

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 分銷商和批發商

- 家居裝飾店

- 網路零售

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- AERCON AAC

- Biltech Building Elements Limited

- Eco Green Products Pvt. Ltd

- Fusion Blocks

- H+H International A/S

- Infra.Market

- Jindal Mechno Bricks Private Limited

- Magicrete Building Solutions Pvt. Ltd

- MRF Bricks

- NICBM

- Paver India

- SOLBET

- UltraTech Cement Ltd

- Wienerberger AG

- Xella Group

The Global Hollow Bricks Market was valued at USD 272 billion in 2024 and is estimated to grow at a CAGR of 5.4 % to reach USD 456.9 billion by 2034. The rising demand for new residential and commercial structures, particularly in metropolitan and suburban areas, is significantly boosting the need for hollow bricks. Their ease of installation and cost-effectiveness make them an ideal choice for large-scale construction projects. Government-backed affordable housing initiatives have also contributed to this upward trend by encouraging the use of economical and sustainable building materials. Hollow bricks provide natural insulation against heat and cold, making them energy efficient. Their ability to help reduce cooling and heating costs aligns with the growing focus on green buildings and energy-efficient construction, making them preferred material among environmentally conscious developers.

These bricks help regulate indoor temperatures and noise levels, making buildings more comfortable in urban environments with fluctuating climates and higher sound levels. Their structure reduces the need for excess mortar and minimizes the demand for high-strength materials, which cuts down overall construction costs. Lightweight properties make transportation and assembly faster and more resource-efficient, especially where labor and budgets are tight. Moreover, the growing adoption of modular and prefabricated construction techniques is further increasing the demand for hollow bricks due to their compatibility with modern construction practices and their contribution to accelerated project timelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $272 Billion |

| Forecast Value | $456.9 Billion |

| CAGR | 5.4% |

In 2024, the clay hollow bricks segment held a 40.4% share. The demand for these bricks continues to rise across various material types as the construction industry shifts toward high-strength yet lightweight options. Clay-based variants remain a dominant choice, particularly in low-rise developments, due to their wide availability and cost-efficient manufacturing processes. Their thermal performance and strength properties support their widespread use in both rural and developing urban regions, especially in emerging economies where affordability and access to materials are critical.

Hollow bricks used in the load-bearing walls segment contributed a 39.2% share in 2024. These walls are a fundamental part of modern building design, providing durability and essential structural support for residential and commercial projects alike. While load-bearing applications dominate, there is also notable growth in the use of hollow bricks in non-load-bearing interior walls due to their ease of use and lightweight nature. Their growing popularity is tied to evolving design needs that favor faster installation and versatile layout options in new buildings.

India Hollow Bricks Market held an 82% share and generated USD 28.9 billion in 2024. The country's leadership is driven by rapid urban growth, widespread construction activities, and the momentum created by public infrastructure and housing schemes. India's robust manufacturing ecosystem and ample availability of strength-class raw materials further strengthen its market dominance. Additionally, rising adoption in smaller cities and tier-two markets has broadened the domestic consumption base. Meanwhile, policy efforts aimed at promoting sustainable and energy-efficient building materials have further accelerated the use of hollow bricks across various regions.

Some of the most influential players shaping the Hollow Bricks Industry include Xella Group, H+H International A/S, UltraTech Cement Ltd, Biltech Building Elements Limited, and Wienerberger AG. These companies are actively contributing to the market's evolution through product innovation and strategic presence across key regions. To solidify their positions in the hollow bricks market, leading manufacturers are leveraging multiple growth strategies. These include setting up regional manufacturing hubs to reduce logistics costs and improve distribution efficiency, investing in automated production to scale output while maintaining consistency, and introducing advanced product variants with enhanced strength and thermal performance. Partnerships with real estate developers and construction firms have also proven effective in driving adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Strength Class

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.2.7 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing construction industry

- 3.2.1.2 Increasing focus on energy efficiency

- 3.2.1.3 Cost-effectiveness and reduced material usage

- 3.2.1.4 Superior thermal and acoustic insulation properties

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative building materials

- 3.2.2.2 Fluctuating Strength Class prices

- 3.2.2.3 Regional building code compliance

- 3.2.2.4 Quality control and consistency issues

- 3.2.3 Market opportunities

- 3.2.3.1 Development of eco-friendly hollow bricks

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 Technological advancements in manufacturing

- 3.2.3.4 Integration with modern construction techniques

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Clay hollow bricks

- 5.3 Concrete hollow blocks

- 5.4 Fly ash hollow bricks

- 5.5 AAC (Autoclaved Aerated Concrete) hollow blocks

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Strength Class, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Low strength

- 6.3 Medium strength

- 6.4 High strength

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Load bearing walls

- 7.2.1 External load bearing walls

- 7.2.2 Internal load bearing walls

- 7.2.3 Others

- 7.3 Non-load bearing walls

- 7.3.1 Partition walls

- 7.3.2 Infill walls

- 7.3.3 Others

- 7.4 Foundations

- 7.5 Columns and pillars

- 7.6 Lintels and beams

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.2.1 Single-family homes

- 8.2.2 Multi-family buildings

- 8.2.3 Affordable housing

- 8.2.4 Others

- 8.3 Commercial

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hospitality

- 8.3.4 Healthcare facilities

- 8.3.5 Educational institutions

- 8.3.6 Others

- 8.4 Industrial

- 8.4.1 Manufacturing facilities

- 8.4.2 Warehouses

- 8.4.3 Others

- 8.5 Infrastructure

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Construction Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 New construction

- 9.3 Renovation and retrofitting

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Distributors and wholesalers

- 10.4 Home improvement stores

- 10.5 Online retail

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 AERCON AAC

- 12.2 Biltech Building Elements Limited

- 12.3 Eco Green Products Pvt. Ltd

- 12.4 Fusion Blocks

- 12.5 H+H International A/S

- 12.6 Infra.Market

- 12.7 Jindal Mechno Bricks Private Limited

- 12.8 Magicrete Building Solutions Pvt. Ltd

- 12.9 MRF Bricks

- 12.10 NICBM

- 12.11 Paver India

- 12.12 SOLBET

- 12.13 UltraTech Cement Ltd

- 12.14 Wienerberger AG

- 12.15 Xella Group