|

市場調查報告書

商品編碼

1773377

製程工廠燃氣渦輪機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Process Plants Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

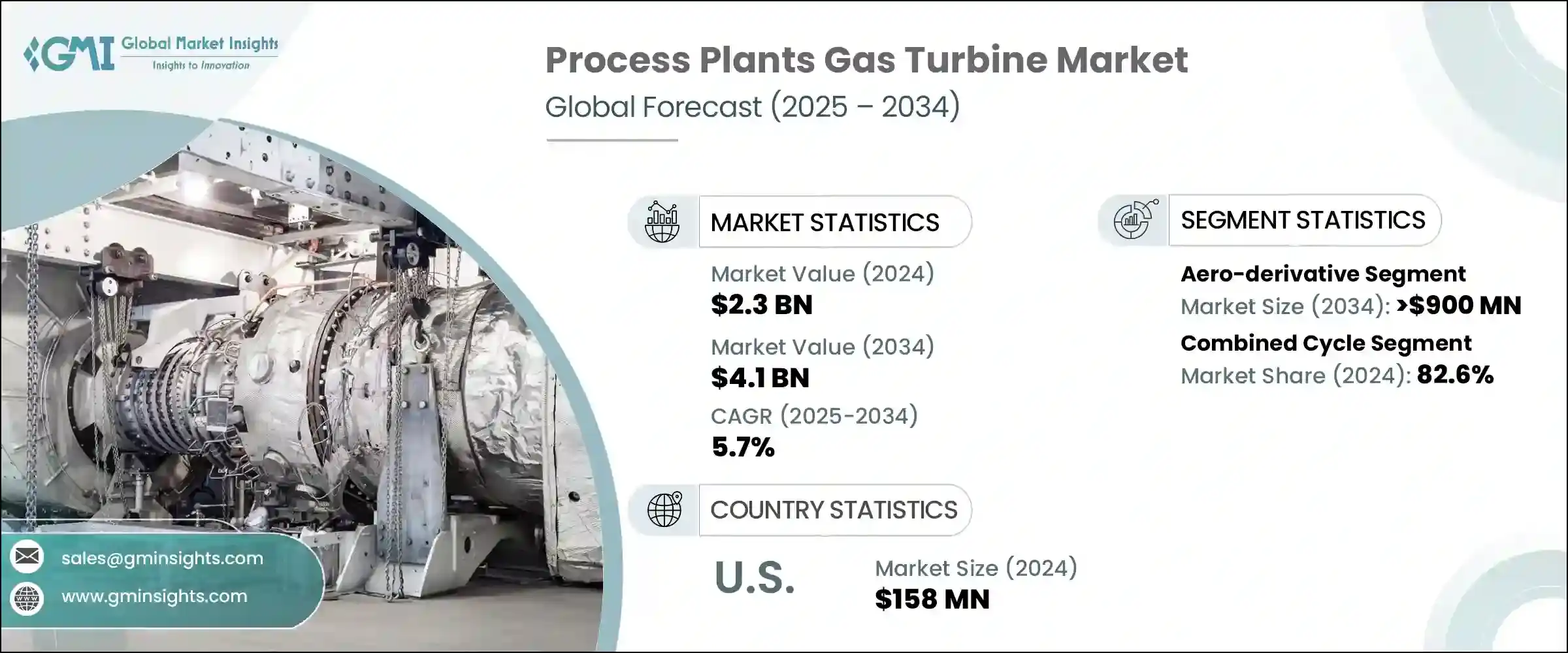

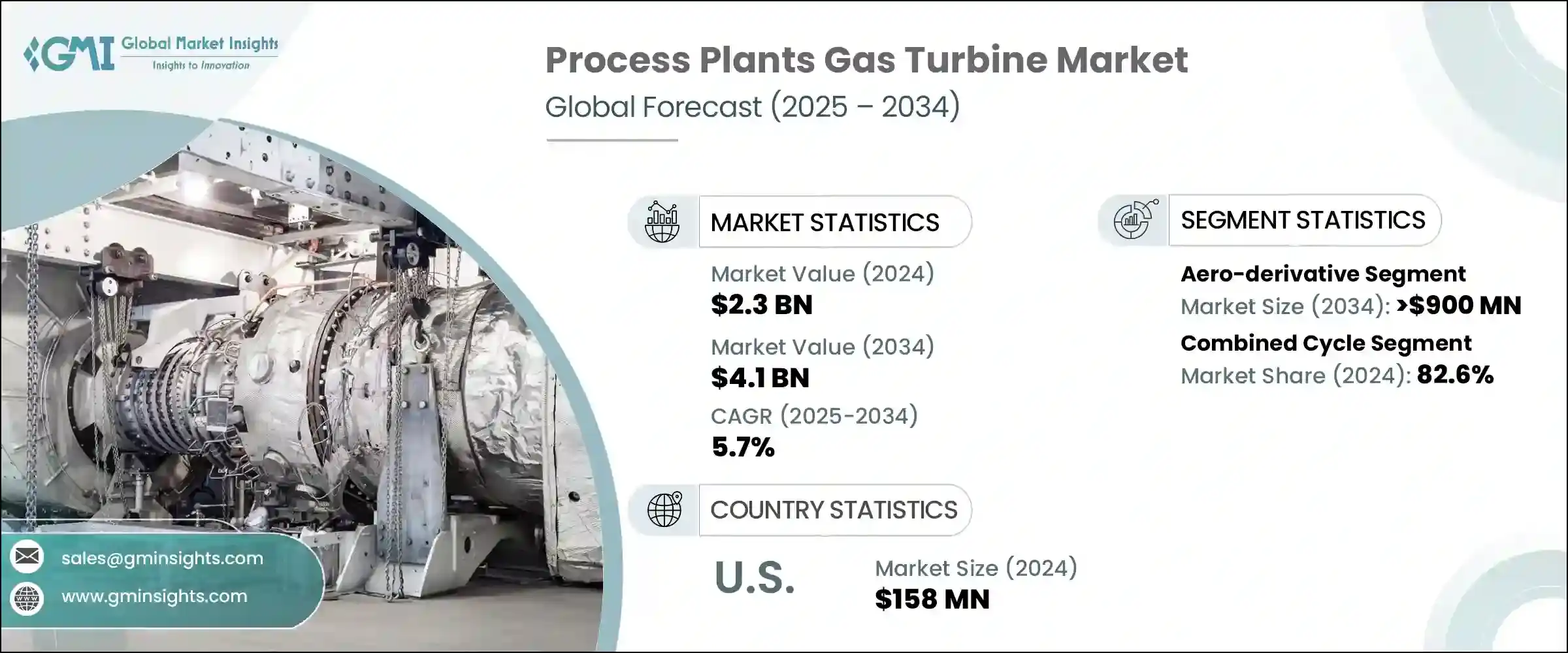

2024年,全球製程工廠燃氣渦輪機市場規模達23億美元,預計到2034年將以5.7%的複合年成長率成長,達到41億美元。製程工業擴大選擇燃氣渦輪機進行現場發電,以減少對不可靠電網基礎設施的依賴,尤其是在電力頻繁中斷的地區。這些燃氣渦輪機在自備電廠的應用日益廣泛,它們支援不間斷運作並防止生產損失,直接促進了市場擴張。這些系統通常用於熱電聯產 (CHP) 裝置,可同時發電和產生蒸汽,從而提高工廠整體效率。這種雙重功能是推動燃氣渦輪機在工業設施中廣泛應用的關鍵因素。

中小型製程設施正在推動對緊湊型模組化透平機組的需求,這些機組可快速部署,並減少大規模土木工程的需求。透平機組也被部署在臨時或偏遠的場所,包括移動化學品或管道作業,這些場所無法使用傳統的基礎設施。這些透平機組直接整合到製造過程中,為機械系統提供動力,或為水泥、玻璃和石化等行業的專用功能提供熱能。廢氣產生的熱量擴大被用於乾燥、煅燒或蒸汽裂解,為製程工業帶來額外的效率效益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 41億美元 |

| 複合年成長率 | 5.7% |

預計到2034年,重型燃氣渦輪機市場的複合年成長率將達到5.5%。這些燃氣渦輪機廣泛安裝在重工業環境中,例如鋼鐵廠、水泥廠和石化廠,這些地方的基載電力需求持續成長。燃氣渦輪機與熱電聯產解決方案的整合支援同時輸送電力和熱能,為大型工業中心提供高效的能源循環,並鞏固該市場的長期成長。

預計到2034年,開式循環燃氣渦輪機市場的複合年成長率將達到5.5%。這類配置因其快速啟動能力而備受青睞,適合尖峰負載和備用應用。電力供應不穩定的產業正在轉向開式循環燃氣渦輪機,以確保營運安全並防止電力中斷,這將繼續增強市場活力。

2024年,美國製程工廠燃氣渦輪機市場規模達1.58億美元。美國對工業電氣化的重視以及對老化聯合循環資產進行現代化改造的需求,正推動燃氣渦輪機與再生能源的整合。環保機構的監管措施正在進一步加速化肥和化學製造等領域老舊燃氣渦輪系統的更換,從而推動美國燃氣渦輪機的普及。

全球製程工廠燃氣渦輪機市場的主要參與者包括 MAN Energy Solutions、三菱重工、西門子能源、貝克休斯、勞斯萊斯、GE Vernova 等。製程工廠燃氣渦輪機市場的領先公司專注於產品最佳化、擴大在地化製造和深化特定應用客製化。研發投資旨在開發排放更低、燃料靈活性更高、模組化程度更高的渦輪機。許多參與者正積極與 EPC 承包商和製程工廠營運商建立合作夥伴關係,以提供交鑰匙渦輪機套件和長期服務協議。為了滿足不斷變化的工業需求,製造商正在將數位診斷和預測性維護功能整合到渦輪機平台中。擴大在亞太和中東等地區的生產足跡仍然是一項戰略重點。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 50 千瓦

- > 50 千瓦至 500 千瓦

- > 500 千瓦至 1 兆瓦

- > 1 兆瓦至 30 兆瓦

- > 30 兆瓦至 70 兆瓦

- > 70 兆瓦至 200 兆瓦

- > 200 兆瓦

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 航改型

- 重負

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 開放式循環

- 複合循環

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 荷蘭

- 芬蘭

- 希臘

- 丹麥

- 羅馬尼亞

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 孟加拉

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 約旦

- 黎巴嫩

- 南非

- 奈及利亞

- 阿爾及利亞

- 肯亞

- 迦納

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

- 智利

第9章:公司簡介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy

- Destinus Energy

- Doosan

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- IHI Corporation

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Nanjing Turbine & Electric Machinery

- Rolls Royce

- Shanghai Electric Gas Turbine

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsilä

The Global Process Plants Gas Turbine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4.1 billion by 2034. Process industries are increasingly choosing gas turbines for on-site power generation to reduce dependence on unreliable grid infrastructure, particularly in areas with frequent power disturbances. The growing use of these turbines in captive power applications supports uninterrupted operations and safeguards against production losses, contributing directly to market expansion. These systems are commonly used in combined heat and power (CHP) setups, where they simultaneously generate electricity and steam, enhancing overall plant efficiency. This dual functionality is a critical factor driving gas turbine installations across industrial facilities.

Small and mid-sized process facilities are fueling demand for compact and modular turbine packages that offer rapid deployment and limit the need for extensive civil works. Turbines are also being deployed in temporary or remote sites, including mobile chemical or pipeline operations, where conventional infrastructure is not viable. These turbines are directly integrated into manufacturing processes to power mechanical systems or deliver heat energy for specialized functions in sectors such as cement, glass, and petrochemicals. The heat from exhaust gases is increasingly being utilized for drying, calcining, or steam cracking, offering added efficiency benefits to process industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.7% |

Heavy-duty gas turbines segment is forecasted to grow at a CAGR of 5.5% through 2034. These turbines are widely installed in heavy industrial environments such as steelworks, cement facilities, and petrochemical complexes, where base-load power demand is continuous. Their integration with cogeneration solutions supports the simultaneous delivery of electricity and thermal energy, providing an efficient energy loop at large industrial hubs and reinforcing long-term growth in this segment.

The open cycle segment is expected to grow at a CAGR of 5.5% through 2034. These configurations are favored for their ability to start rapidly, making them suitable for peak load and backup applications. Industries facing unstable power supply are turning to open-cycle gas turbines to secure operations and prevent power interruptions, which continues to strengthen market dynamics.

U.S. Process Plants Gas Turbine Market was valued at USD 158 million in 2024. The nation's focus on industrial electrification and the need to modernize aging combined cycle assets are encouraging the integration of gas turbines with renewable sources. Regulatory measures from environmental agencies are further accelerating the replacement of outdated turbine systems in segments such as fertilizers and chemical manufacturing, pushing U.S. adoption forward.

Key players in the Global Process Plants Gas Turbine Market include MAN Energy Solutions, Mitsubishi Heavy Industries, Siemens Energy, Baker Hughes, Rolls Royce, GE Vernova, and several others. Leading companies in the process plants gas turbine market are focused on product optimization, expanding localized manufacturing, and deepening application-specific customization. Investments in R&D are aimed at developing turbines with lower emissions, enhanced fuel flexibility, and greater modularity. Many players are actively forming partnerships with EPC contractors and process plant operators to offer turnkey turbine packages and long-term service agreements. To cater to evolving industrial demands, manufacturers are integrating digital diagnostics and predictive maintenance capabilities into turbine platforms. Expanding production footprints in regions such as Asia-Pacific and the Middle East also remains a strategic priority.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Bangladesh

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.5.16 Ghana

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes

- 9.3 Bharat Heavy Electricals

- 9.4 Capstone Green Energy

- 9.5 Destinus Energy

- 9.6 Doosan

- 9.7 Flex Energy Solutions

- 9.8 GE Vernova

- 9.9 Harbin Electric

- 9.10 IHI Corporation

- 9.11 Kawasaki Heavy Industries

- 9.12 MAN Energy Solutions

- 9.13 Mitsubishi Heavy Industries

- 9.14 Nanjing Turbine & Electric Machinery

- 9.15 Rolls Royce

- 9.16 Shanghai Electric Gas Turbine

- 9.17 Siemens Energy

- 9.18 Solar Turbines

- 9.19 Vericor

- 9.20 Wartsilä