|

市場調查報告書

商品編碼

1773374

攜帶式燈市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Portable Lamp Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

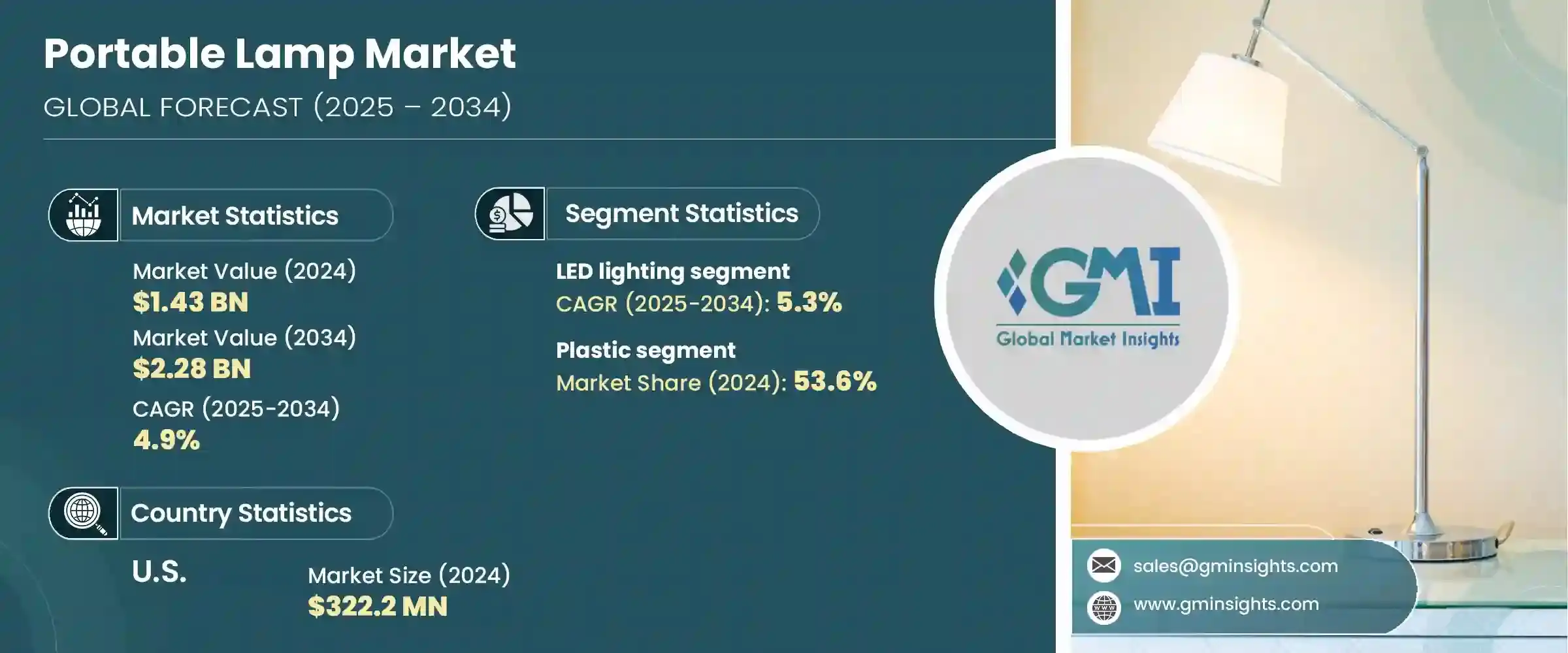

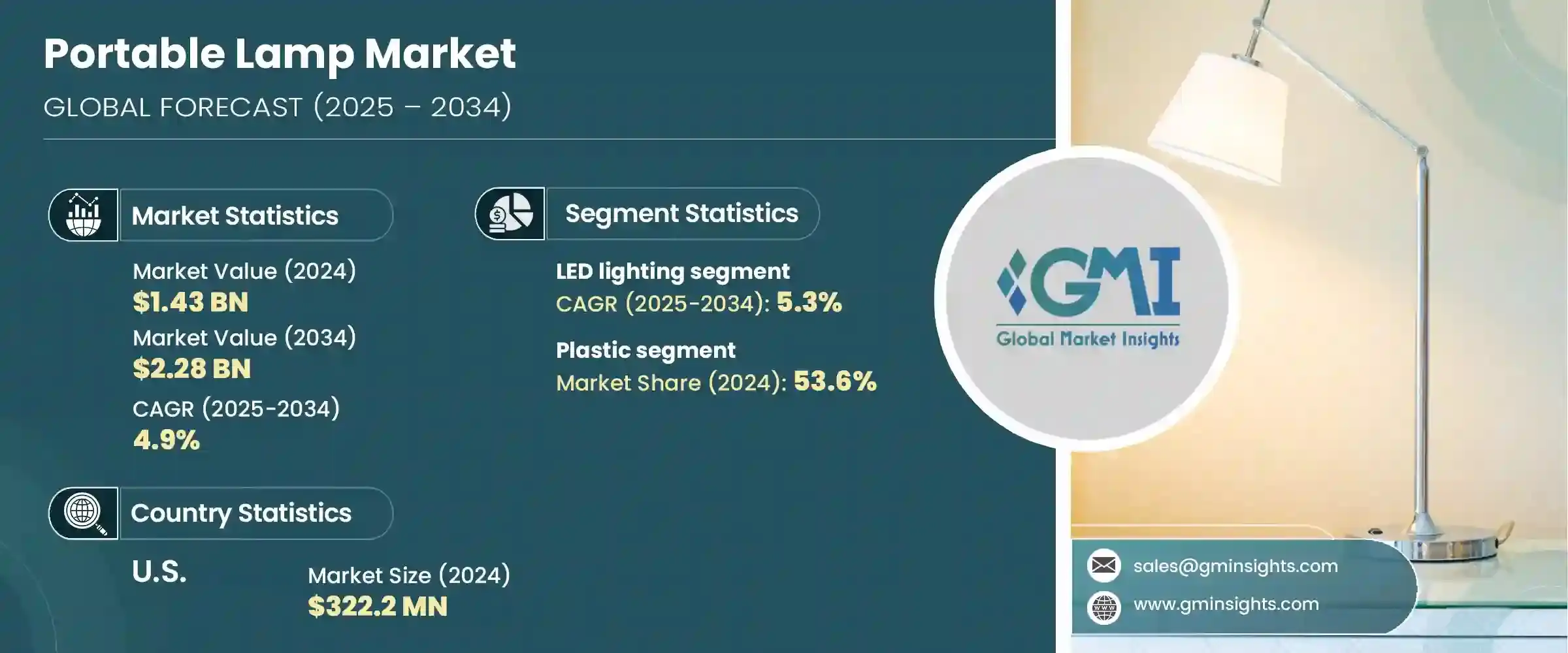

2024 年全球攜帶式燈具市場價值為 14.3 億美元,預計到 2034 年將以 4.9% 的複合年成長率成長至 22.8 億美元。對節省空間的照明選擇和使用者友善設計的需求不斷成長,推動著市場成長。如今,消費者在家庭和辦公室環境中都優先考慮靈活性、行動性和緊湊型解決方案。城市生活,尤其是宿舍和公寓等較小的居住空間,繼續擴大對多功能和可移動照明光源的需求。攜帶式燈具因其無需永久安裝即可適應不同環境的能力而備受關注。無論是無線還是插入式,這些燈具都非常適合書桌、床頭櫃、露台等有限空間環境,甚至可以在旅途中使用。模組化無線照明趨勢很受歡迎,為需要靈活照明的現代快節奏生活方式提供了便利。

當代消費者注重便利客製化和高效實用的習慣,也在這個市場的演變中扮演重要角色。如今的消費者尋求的照明解決方案不僅要滿足功能性需求,還要符合他們的個人美學和充滿活力的生活方式。對亮度、色溫或位置可輕鬆調節的燈具的需求,反映了人們對緊湊型多功能產品的日益成長的期望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14.3億美元 |

| 預測值 | 22.8億美元 |

| 複合年成長率 | 4.9% |

配備模組化組件、USB 充電、可折疊燈臂或可拆卸底座的攜帶式燈具在注重多功能性和現代設計的消費者中尤其受歡迎。隨著用戶越來越期望家居產品能夠與室內裝飾和技術生態系統相得益彰,製造商也開始優先考慮智慧功能、簡約設計以及緊湊靈活的外形。這些不斷變化的偏好正在重塑攜帶式燈具市場,使其朝著更具互動性、以用戶為中心的創新方向發展。

2024年,LED照明市場規模達8.497億美元,預計2025年至2034年的複合年成長率為5.3%。 LED燈的節能特性、長壽命和耐用性使其成為消費者的首選。 LED不僅有助於降低能源成本,而且使用壽命顯著長於傳統白熾燈,從而降低了更換頻率。對於偏好低維護照明的製造商和終端用戶而言,LED燈是理想之選。輕巧纖薄的LED燈設計尤其引人注目,滿足了消費者對便攜性、美觀度和效率的需求。如今,大多數LED攜帶式燈都配備了可調光設置、可調色溫以及智慧家居整合功能,使其能夠適應各種環境和行動用例。

2024年,塑膠材料佔了53.6%的市場佔有率,預計2025年至2034年的複合年成長率將達到5.3%。塑膠憑藉其經濟實惠、經久耐用和用途廣泛等優勢,在攜帶式照明領域正發揮巨大的推動作用。與陶瓷、玻璃或金屬等替代材料相比,塑膠使製造商能夠以更低的生產成本,嘗試更具創新性的形狀、設計和飾面。其輕巧的特性也使消費者更容易在各種場合(包括家庭、辦公室、戶外空間以及旅行中)攜帶、調整和存放燈具。這種材料的易用性和製造可擴展性使其在大眾市場中廣受歡迎。

2024年,美國攜帶式燈具市場規模達3.222億美元,預計2025年至2034年期間的複合年成長率將達到5.2%。該地區消費者的偏好正轉向智慧、多用途和節能的照明產品。具備應用程式相容性、語音啟動和亮度可調功能的燈具正日益受到青睞。 DIY的理念和對家居美學日益成長的關注,進一步加速了人們對兼具視覺吸引力和實用性的照明產品的需求。此外,遠距辦公模式的轉變也增加了對個人化照明設備的需求,這些設備可以延長家庭辦公時間。該地區不斷發展的線上零售生態系統也在提供更多款式和功能的攜帶式燈具方面發揮著至關重要的作用。

塑造攜帶式燈具產業格局的領先企業包括 Cree Lighting、IKEA、Feit Electric、歐司朗、Acuity Brands、Wipro Consumer Lighting、松下、Havells India、通用電氣照明、Zumtobel Group、Thorn Lighting、羅格朗、Signify、Syska LED 和 Cooper Lighting。為了鞏固自身地位,攜帶式燈具市場的公司正在強調設計、材料選擇和智慧技術整合的創新。

許多企業正在擴展其產品線,包括基於LED的模組化照明解決方案,並配備語音控制和應用程式同步等智慧功能。製造商正在投資永續材料和節能技術,以滿足注重環保的消費者偏好。各公司也專注於價格實惠且時尚的產品設計,以吸引日益壯大的城市和年輕消費者群體。策略合作夥伴關係、直接面對消費者的銷售模式以及在電商通路的強大影響力,正在提升品牌知名度和市場覆蓋率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對靈活緊湊照明解決方案的需求不斷成長

- 戶外和旅遊活動的成長

- 採用智慧和可充電燈

- 電池限制和頻繁充電的需求

- 低階市場價格競爭激烈

- 產業陷阱與挑戰

- 電池限制和頻繁充電的需求

- 低階市場價格競爭激烈

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- LED照明

- 金屬鹵化物照明

- 白熾燈

- 螢光燈

- 其他(鹵素等)

- 主要趨勢

- 引領

- CFL(緊湊型螢光燈)

- 鹵素

- 白熾燈

第6章:市場估計與預測:依電源分類,2021 - 2034 年

- 主要趨勢

- 電池供電

- 可充電(USB/太陽能)

- 電動(有線)

- 混合動力(電池+太陽能)

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 金屬

- 木頭

- 玻璃

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 室內的

- 住宅(臥室、客廳等)

- 商業(旅館、辦公室、圖書館)

- 戶外的

- 露營

- 花園/露台

- 緊急使用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 家庭

- 商業的

- 飯店業

- 教育機構

- 工業(工地、緊急使用)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Acuity Brands

- Cooper Lighting

- Cree Lighting

- Feit Electric

- GE Lighting

- Havells India

- IKEA

- Legrand

- OSRAM

- Panasonic

- Signify

- Syska LED

- Thorn Lighting

- Wipro Consumer Lighting

- Zumtobel Group

The Global Portable Lamp Market was valued at USD 1.43 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 2.28 billion by 2034. Rising demand for space-saving lighting options and user-friendly designs is fueling market growth. Consumers today prioritize flexibility, mobility, and compact solutions in both home and office setups. Urban living, particularly in smaller residential spaces such as dormitories and apartments, continues to amplify the need for versatile and movable lighting sources. Portable lamps are gaining attention due to their ability to adapt to different environments without permanent installation. Whether cordless or plug-in, these lamps are ideal for limited-space settings like desks, bedside tables, patios, and even for on-the-go use. The trend toward modular, cordless lighting is popular, offering convenience for modern, fast-paced lifestyles that require flexible illumination.

Contemporary consumer habits that emphasize easy customization and efficient utility are also playing a significant role in this market's evolution. Today's buyers are seeking lighting solutions that not only serve functional needs but also align with their personal aesthetics and dynamic lifestyles. The demand for lamps that can be easily adjusted in brightness, color temperature, or positioning reflects the growing expectation for products that offer multi-purpose use in compact formats.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.43 Billion |

| Forecast Value | $2.28 Billion |

| CAGR | 4.9% |

Portable lamps with modular components, USB charging, foldable arms, or detachable bases are becoming especially popular among consumers who value versatility and modern design. As users increasingly expect home products to complement both interior decor and technological ecosystems, manufacturers are prioritizing smart features, minimalist design, and compact, adaptable forms. These evolving preferences are reshaping the portable lamp market toward more interactive, user-centered innovation.

In 2024, the LED lighting segment accounted for USD 849.7 million and is projected to rise at a CAGR of 5.3% from 2025 to 2034. The energy-saving nature of LED lights, combined with long life spans and durability, makes them a top choice among buyers. LEDs not only help cut energy costs but also last significantly longer than traditional incandescent options, reducing the frequency of replacements. This makes them ideal for manufacturers and end-users who prefer low-maintenance lighting options. Lightweight and slim LED lamp designs have become particularly appealing, supporting consumer demand for portability, aesthetic appeal, and efficiency. Most LED portable lamps now come equipped with dimmable settings, tunable color temperatures, and smart-home integration, making them adaptable for various environments and mobile use cases.

The plastic material segment captured a 53.6% share in 2024 and is forecasted to grow at a CAGR of 5.3% from 2025 to 2034. Plastic is driving substantial momentum in the portable lighting space due to its affordability, durability, and versatility. Compared to alternatives like ceramic, glass, or metal, plastic allows manufacturers to experiment with more innovative shapes, designs and finishes at lower production costs. Its lightweight properties also make it easier for consumers to carry, reposition, and store their lamps across a variety of settings, including homes, offices, outdoor spaces, and while traveling. This material's ease of use and manufacturing scalability contribute to its popularity in mass-market segments.

United States Portable Lamp Market was valued at USD 322.2 million in 2024 and is expected to grow at a CAGR of 5.2% between 2025 and 2034. Consumer preferences in the region are shifting toward smart, multi-use, and energy-efficient lighting products. Lamps that offer app compatibility, voice activation, and customizable brightness are gaining strong traction. The do-it-yourself mindset and a rising focus on home aesthetics further accelerate demand for visually appealing, functional lighting options. Additionally, a shift toward remote working has increased the need for personalized lighting setups that support extended home office hours. The growing online retail ecosystem in the region also plays a crucial role in offering access to a wider variety of portable lamp styles and features.

Leading players shaping the Portable Lamp Industry landscape include Cree Lighting, IKEA, Feit Electric, OSRAM, Acuity Brands, Wipro Consumer Lighting, Panasonic, Havells India, GE Lighting, Zumtobel Group, Thorn Lighting, Legrand, Signify, Syska LED, and Cooper Lighting. To strengthen their position, companies in the portable lamp market are emphasizing innovation in design, material selection, and smart technology integration.

Many are expanding their product lines to include LED-based and modular lighting solutions with smart features such as voice control and app syncing. Manufacturers are investing in sustainable materials and energy-efficient technologies to align with eco-conscious consumer preferences. Companies are also focusing on affordable yet stylish product designs that appeal to the growing base of urban and younger customers. Strategic partnerships, direct-to-consumer sales models, and a strong presence in e-commerce channels are enhancing brand visibility and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Light technology

- 2.2.5 Power source

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for flexible and compact lighting solutions

- 3.2.1.2 Growth in outdoor and travel activities

- 3.2.1.3 Smart & rechargeable lamp adoption

- 3.2.1.4 Battery limitations and frequent recharging needs

- 3.2.1.5 Intense price competition in the low-end segment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Battery limitations and frequent recharging needs

- 3.2.2.2 Intense price competition in the low-end segment

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 LED lighting

- 5.3 Metal halide lighting

- 5.4 Incandescent lighting

- 5.5 Fluorescent lighting

- 5.6 Others (halogen, etc.)

- 5.7 Market Estimates & Forecast, By Light Technology, 2021 - 2034, (USD Million) (Thousand Units)

- 5.8 Key trends

- 5.9 LED

- 5.10 CFL (Compact Fluorescent Lamps)

- 5.11 Halogen

- 5.12 Incandescent

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Battery-powered

- 6.3 Rechargeable (USB/solar)

- 6.4 Electric-powered (corded)

- 6.5 Hybrid (battery + solar)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Metal

- 7.4 Wood

- 7.5 Glass

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Indoor

- 8.2.1 Residential (bedrooms, living rooms, etc.)

- 8.2.2 Commercial (hotels, offices, libraries)

- 8.3 Outdoor

- 8.3.1 Camping

- 8.3.2 Garden/patio

- 8.3.3 Emergency use

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Households

- 9.3 Commercial

- 9.4 Hospitality

- 9.5 Educational institutions

- 9.6 Industrial (worksite, emergency use)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Acuity Brands

- 12.2 Cooper Lighting

- 12.3 Cree Lighting

- 12.4 Feit Electric

- 12.5 GE Lighting

- 12.6 Havells India

- 12.7 IKEA

- 12.8 Legrand

- 12.9 OSRAM

- 12.10 Panasonic

- 12.11 Signify

- 12.12 Syska LED

- 12.13 Thorn Lighting

- 12.14 Wipro Consumer Lighting

- 12.15 Zumtobel Group