|

市場調查報告書

商品編碼

1773372

儲存架市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Storage Rack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

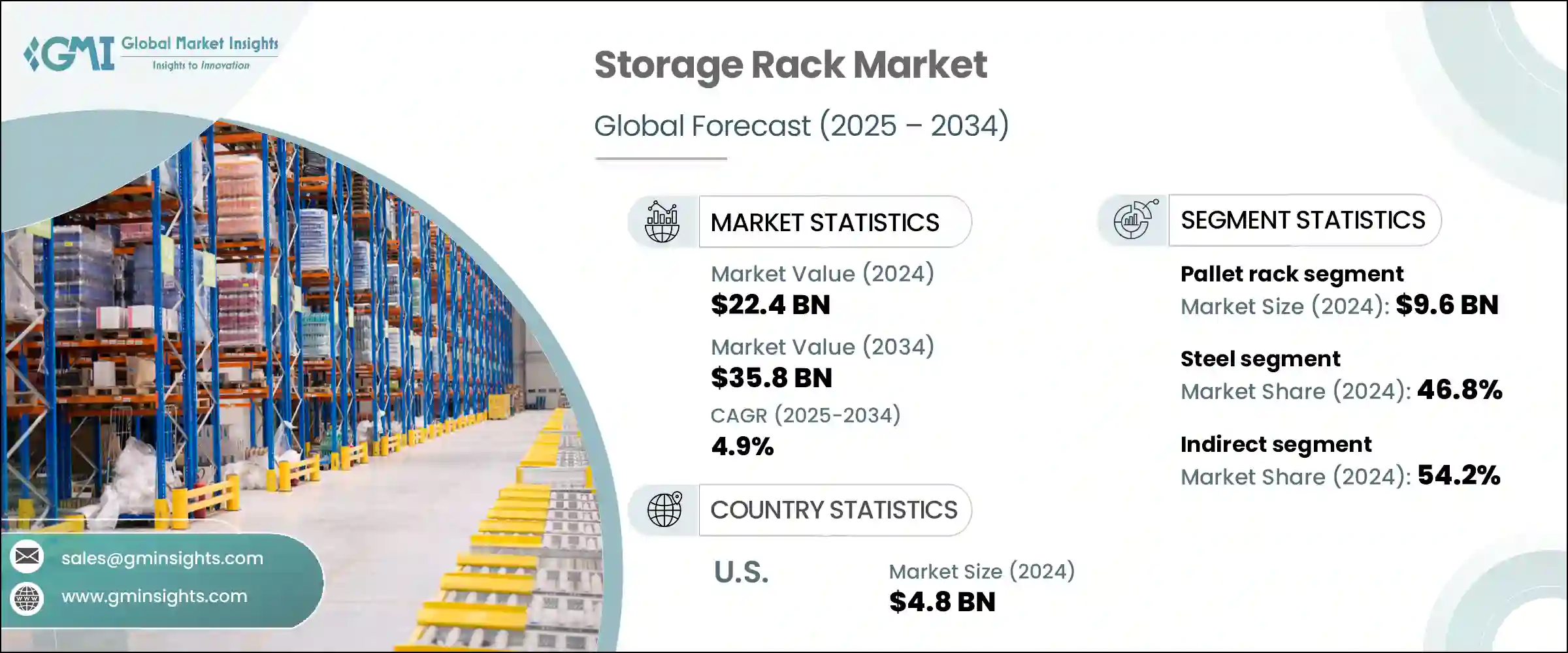

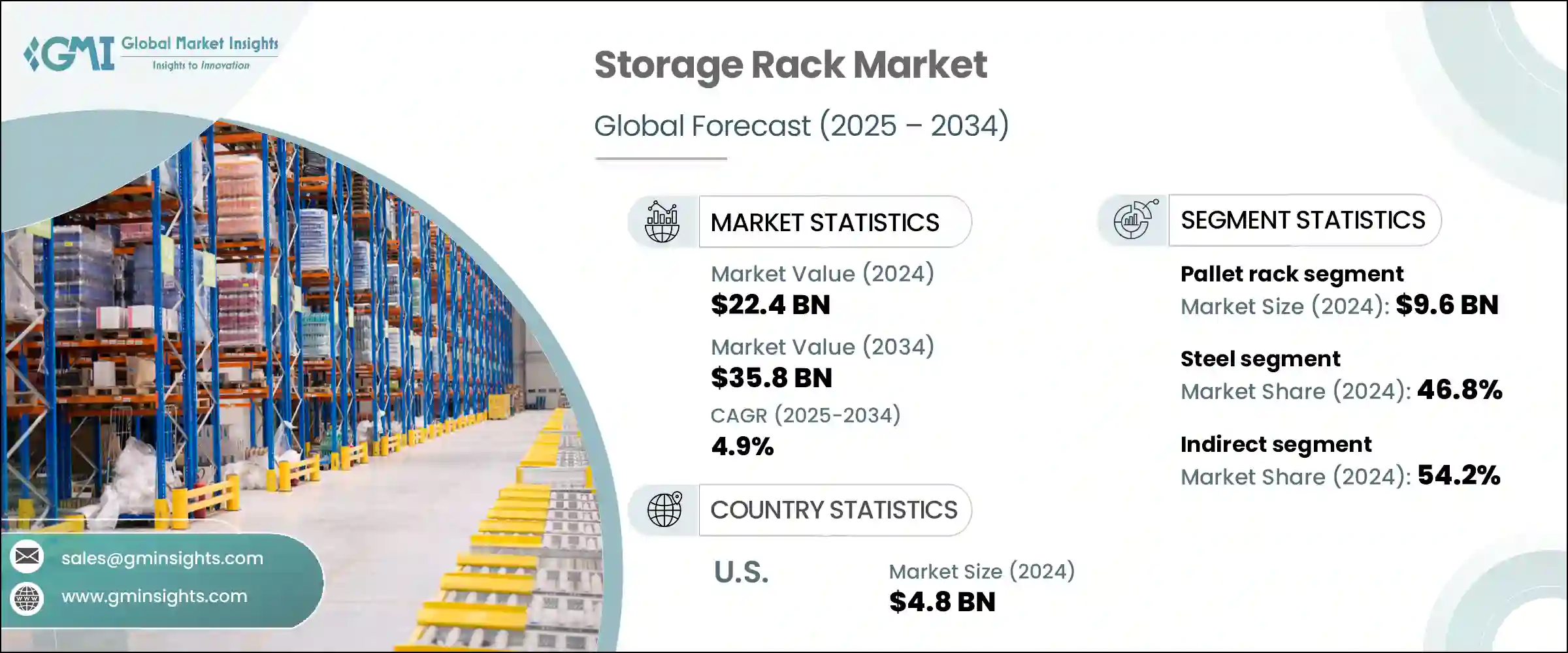

2024年,全球倉儲貨架市場規模達224億美元,預計到2034年將以4.9%的複合年成長率成長,達到358億美元。城市配送中心對高效、節省空間解決方案的需求不斷成長,推動了這一成長。由於城市中心面臨營運成本上升和空間受限的問題,企業紛紛轉向高密度貨架、模組化貨架和夾層結構來最佳化儲存。電子商務的擴張,尤其是在快速商務領域的擴張,加速了快速訂單揀選和庫存週轉的需求。為了滿足這一需求,倉庫正在採用能夠與機器人揀選和自動儲存與檢索系統等自動化系統無縫協作的貨架。

隨著物流工作流程和配送時間的變化,倉儲基礎設施也在快速發展,企業優先考慮能夠提高營運速度和靈活性的貨架系統。城市配送中心正在採用窄巷道貨架、移動式貨架和垂直佈局。模組化趨勢也十分強勁,企業青睞可調節、可擴展的儲存解決方案,這些解決方案能夠隨著庫存需求的變化而發展。自動化、智慧倉儲趨勢以及適合快節奏配送環境的經濟高效的設計解決方案的採用,共同推動市場的轉型。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 224億美元 |

| 預測值 | 358億美元 |

| 複合年成長率 | 4.9% |

2024年,托盤貨架市場貢獻了96億美元的市場規模,預計到2034年將以5.3%的複合年成長率成長。由於其適應性強、經濟價值高且相容於多個行業,托盤貨架仍是市場上應用最廣泛的貨架。托盤貨架設計用於水平存放托盤庫存,並採用多層垂直結構,可提高倉庫效率,並適應不同的庫存重量和容量。托盤貨架的應用範圍涵蓋物流、食品飲料、零售、製藥和汽車等關鍵行業,使其成為傳統和現代倉庫模式的必備設備。

2024年,鋼材市場佔比達46.8%,繼續保持其作為倉儲貨架主要材料的領先地位,預計2025年至2034年的複合年成長率將達到5.4%。其高強度重量比、長壽命和高成本效益使其成為大型倉儲和工業應用的理想選擇。鋼製貨架廣泛應用於重型倉儲環境,可承載大量密集的庫存。製造業、零售業和電子商務等行業依賴鋼製貨架,因為它們能夠處理散裝物料、簡化操作流程,並承受重型設備的使用而不會對結構造成損害。

2024年,美國倉儲貨架市場規模達48億美元,預計2034年將以5.5%的複合年成長率成長。這一成長源自於美國電子商務的快速擴張、倉庫機器人的普及以及自動化系統的廣泛應用。工業部門、物流供應商和大型零售商推動了需求成長。此外,製藥和食品供應鏈中冷鏈基礎設施的建設也促進了市場擴張。該地區高昂的勞動力成本進一步刺激了對高密度倉儲的投資,以提高生產力並減少人工操作。美國仍然是該地區的主導市場,其次是墨西哥和加拿大。

倉儲貨架產業的領導企業包括 Interlake Mecalux、Dematic、卡迪斯集團、豐田自動織布機、Constructor Group、Gonvarri Material Handling、AK Material Handling Systems、SSI Schaefer、Ridg-U-Rak、Mecalux、Daifuku、Arpac、North American Steel Equipment、AR Racking 和 Junghn。倉儲貨架市場的頂尖企業正專注於數位整合、產品創新和營運效率,以增強競爭優勢。

許多公司正在投資開發相容自動化的貨架系統,以支援機器人技術、自動化倉庫系統 (AS/RS) 和先進的倉庫軟體平台。客製化也是關鍵,製造商提供模組化設計,以滿足不同的空間限制和儲存需求。與物流公司和供應鏈營運商建立策略合作夥伴關係有助於擴大客戶網路並簡化配送流程。此外,企業正在建立更強大的本地供應鏈和區域製造中心,以縮短交貨時間並快速適應不斷變化的市場需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 城市倉儲和微型配送中心

- 擴大物流與供應鏈網路

- 自動化倉儲的興起

- 冷藏和食品物流的成長

- 產業陷阱與挑戰

- 現有設施的空間和結構限制

- 市場缺乏標準化

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼73269099)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 托盤架

- 駛入式/駛過式貨架

- 懸臂式貨架

- 其他

第6章:市場估計與預測:依承載力,2021 - 2034 年

- 主要趨勢

- 輕型

- 中型

- 重負

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鋼

- 鋁

- 塑膠

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 零售與電子商務

- 汽車與製造業

- 食品和飲料

- 倉儲與物流

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- AK Material Handling Systems

- AR Racking

- Arpac

- Constructor Group

- Daifuku

- Dematic

- Gonvarri Material Handling

- Interlake Mecalux

- Jungheinrich

- Kardex Group

- Mecalux

- North American Steel Equipment

- Ridg-U-Rak

- SSI Schaefer

- Toyota Industries

The Global Storage Rack Market was valued at USD 22.4 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 35.8 billion by 2034. Increasing demand for efficient, space-saving solutions in urban fulfillment hubs is fueling this growth. As urban centers face rising operational costs and space limitations, businesses are turning to high-density racking, modular shelving, and mezzanine-based structures to optimize storage. The expansion of e-commerce, especially in the quick commerce segment, has accelerated the need for rapid order picking and inventory turnover. To support this, warehouses are adopting racks that work seamlessly with automation systems like robotic picking and automated storage and retrieval systems.

Storage infrastructure is evolving rapidly alongside changes in logistics workflows and delivery timelines, with businesses prioritizing racking systems that boost operational speed and flexibility. Urban distribution centers are adopting narrow aisle racks, mobile shelving, and vertical layouts. The trend toward modularity is also strong, with businesses favoring adjustable and expandable storage solutions that can evolve with changing inventory demands. The market's transformation is being powered by a mix of adoption of automation, smart warehousing trends, and cost-efficient design solutions suited for fast-paced distribution environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.4 Billion |

| Forecast Value | $35.8 Billion |

| CAGR | 4.9% |

In 2024, the pallet racks segment contributed USD 9.6 billion and is projected to grow at a CAGR of 5.3% through 2034. These racks remain the most widely used in the market due to their adaptability, economic value, and compatibility across a range of sectors. Designed to store palletized inventory horizontally with multiple vertical tiers, pallet racks enhance warehouse efficiency and accommodate variable inventory weights and volumes. Their relevance spans key industries, including logistics, food and beverage, retail, pharma, and automotive, making them a staple in both traditional and modern warehouse formats.

The steel segment accounted for 46.8% share in 2024, maintaining its lead as the primary material of choice for storage racks, and is expected to grow at a CAGR of 5.4% from 2025 to 2034. Its high strength-to-weight ratio, longevity, and cost-efficiency make it ideal for large-scale warehousing and industrial applications. Steel racks are widely implemented in heavy-duty storage environments where they support large and dense inventory loads. Sectors like manufacturing, retail, and e-commerce rely on steel-based racks for their ability to handle bulk materials, streamline operations, and endure heavy equipment use without structural compromise.

U.S. Storage Rack Market was valued at USD 4.8 billion in 2024 and is anticipated to grow at a CAGR of 5.5% through 2034. This growth stems from the country's rapid e-commerce expansion, rising adoption of warehouse robotics, and widespread implementation of automation systems. Demand is driven by industrial sectors, logistics providers, and large-scale retailers. In addition, the development of cold chain infrastructure in pharma and food supply chains is contributing to market expansion. High labor costs in the region further incentivize investment in high-density storage to enhance productivity and reduce manual handling. The U.S. remains the dominant market in the region, followed by Mexico and Canada.

Leading players in the Storage Rack Industry include Interlake Mecalux, Dematic, Kardex Group, Toyota Industries, Constructor Group, Gonvarri Material Handling, AK Material Handling Systems, SSI Schaefer, Ridg-U-Rak, Mecalux, Daifuku, Arpac, North American Steel Equipment, AR Racking, and Jungheinrich. Top companies in the storage rack market are focusing on digital integration, product innovation, and operational efficiency to strengthen their competitive edge.

Many are investing in the development of automation-compatible racking systems to support robotics, AS/RS, and advanced warehouse software platforms. Customization is also key, with manufacturers offering modular designs tailored to different space constraints and storage requirements. Strategic partnerships with logistics firms and supply chain operators help expand client networks and streamline distribution. In addition, companies are building stronger local supply chains and regional manufacturing hubs to reduce delivery times and adapt quickly to shifting market demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Carrying capacity

- 2.2.4 Material

- 2.2.5 End use

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban warehousing & micro fulfillment centers

- 3.2.1.2 Expansion of logistics & supply chain networks

- 3.2.1.3 Rise in automated warehousing

- 3.2.1.4 Growth of cold storage & food logistics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Space & structural constraints in existing facilities

- 3.2.2.2 Lack of standardization across markets

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 73269099)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Pallet rack

- 5.3 Drive-in / drive-thru rack

- 5.4 Cantilever rack

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Carrying Capacity, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Light duty

- 6.3 Medium duty

- 6.4 Heavy duty

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Plastic

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Retail & e-commerce

- 8.3 Automotive & manufacturing

- 8.4 Food & beverage

- 8.5 Warehouse & logistics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AK Material Handling Systems

- 11.2 AR Racking

- 11.3 Arpac

- 11.4 Constructor Group

- 11.5 Daifuku

- 11.6 Dematic

- 11.7 Gonvarri Material Handling

- 11.8 Interlake Mecalux

- 11.9 Jungheinrich

- 11.10 Kardex Group

- 11.11 Mecalux

- 11.12 North American Steel Equipment

- 11.13 Ridg-U-Rak

- 11.14 SSI Schaefer

- 11.15 Toyota Industries