|

市場調查報告書

商品編碼

1773366

綿羊及山羊設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sheep and Goat Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

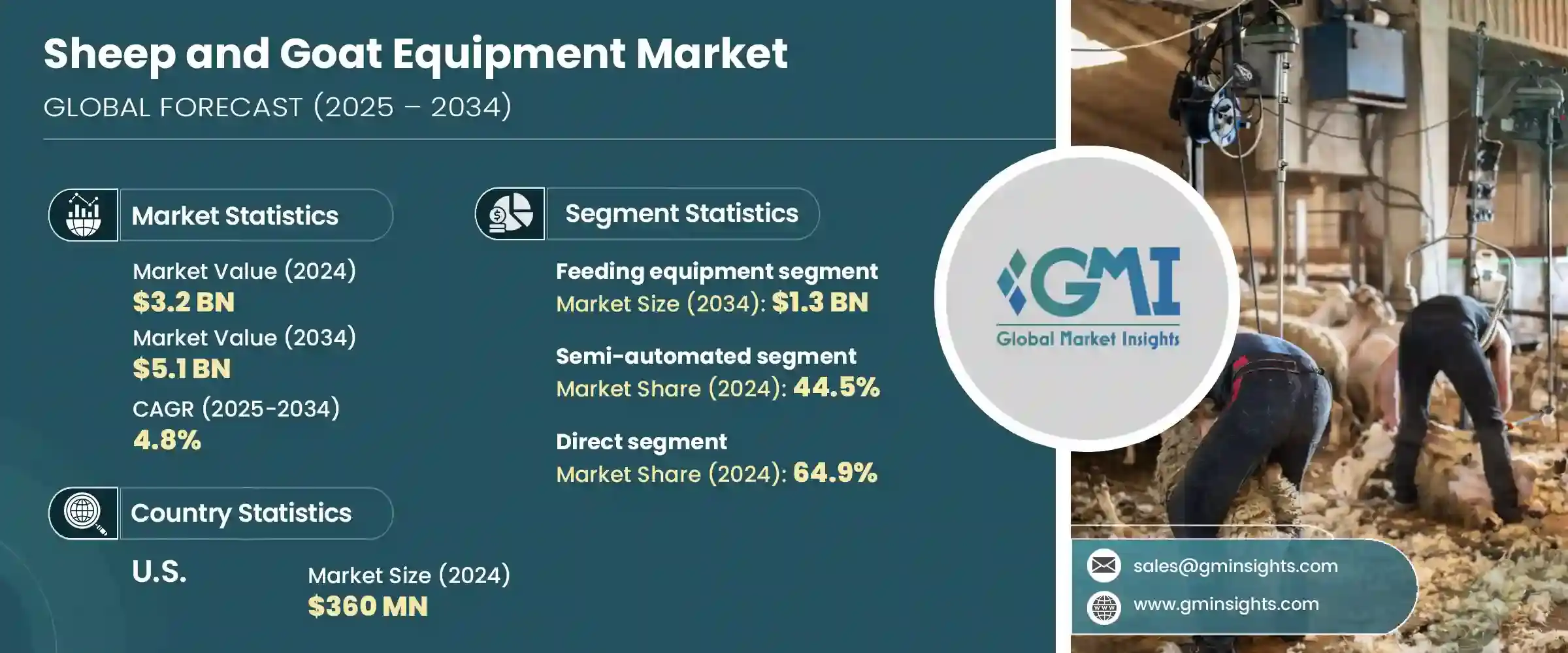

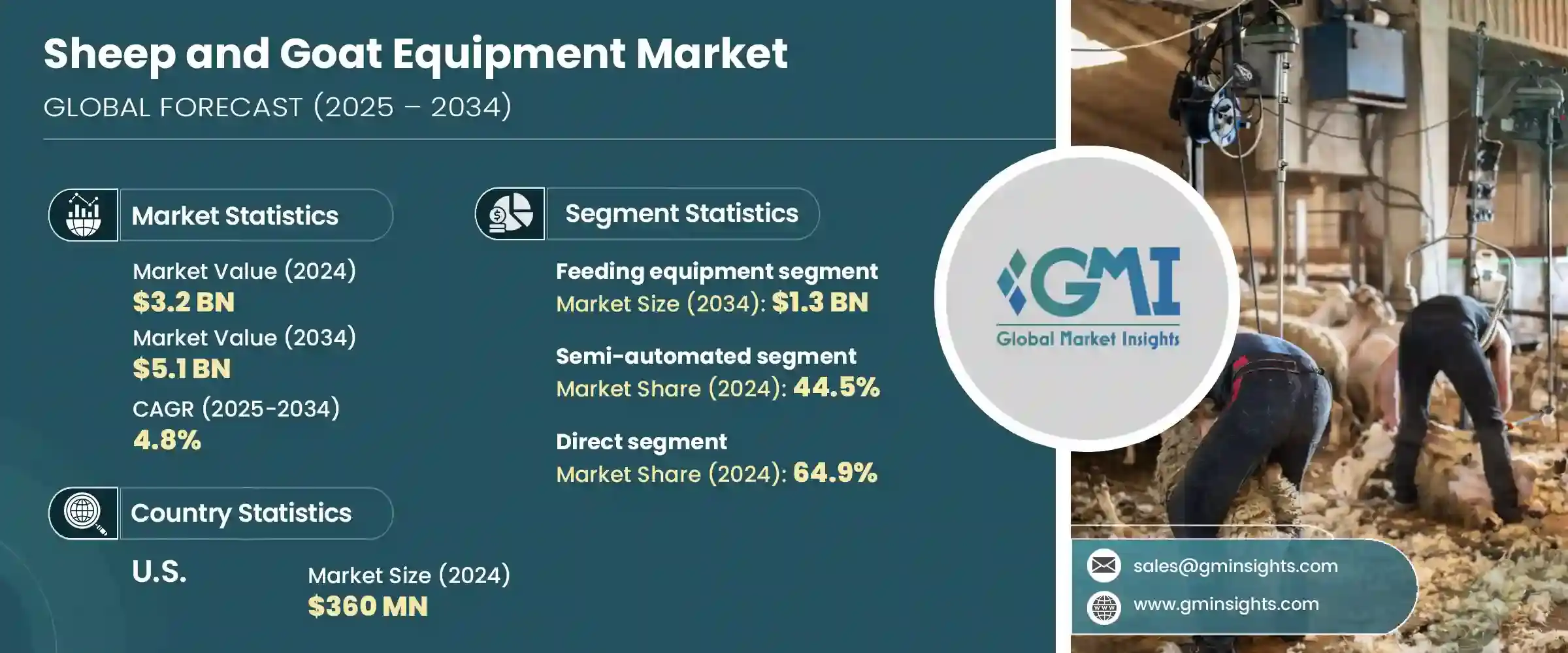

2024年,全球綿羊和山羊設備市場價值32億美元,預計2034年將以4.8%的複合年成長率成長,達到51億美元。隨著農業實踐的不斷現代化和更有效率的牲畜管理方法的採用,該行業正在經歷重大轉型。越來越多的農民開始尋求創新的設備解決方案,以提高生產力並減少對體力勞動的依賴。隨著簡化日常營運的需求日益成長,機械化餵食工具、先進的剪毛系統和精密監測設備等設備正成為畜牧場的重要組成部分。

隨著生產者認知到自動化系統在飼餵流程一致性、節省勞力密集工作時間以及提升動物福利方面的優勢,其應用也日益廣泛。農場主們正致力於最佳化資源配置,尤其是在牲畜飼料佔據營運成本很大一部分的情況下。設備中的技術整合不僅有助於減少飼料浪費和人工成本,還能透過早期疾病檢測和行為追蹤,更好地管理動物的健康。這些創新正在重塑畜牧業的管理方式,推動市場在未來十年持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 4.8% |

就設備類型而言,飼餵設備佔據主導地位,2024年該細分市場價值達8億美元。預計該類別將穩定成長,到2034年將達到13億美元。飼料管理設備需求持續強勁,因為它有助於生產商減少飼料損失並提高配送效率。自動分配器、精準餵食器和其他飼餵工具因其能夠促進動物更健康的生長並最大限度地減少飼料浪費而備受青睞,而飼料浪費仍然是畜牧業營運成本中最高的環節之一。

基於操作模式的市場數據顯示,半自動化設備在2024年約佔全球營收佔有率的44.5%。預計該細分市場在預測期內的複合年成長率將達到4.4%。這些系統對尋求在自動化和手動控制之間取得平衡的中型和大型農場主越來越有吸引力。它們能夠提高運行速度、提供穩定的性能並減少對人工的依賴,使其成為一種高效的替代方案,尤其是在農業勞動力短缺的地區。

分銷管道在決定產品可及性和服務品質方面發揮關鍵作用。 2024年,直銷通路佔據市場主導地位,佔有率約64.9%。這種模式使製造商能夠直接與最終用戶互動,從而實現更好的設備客製化,並有機會滿足特定的農業需求。它還支援即時回饋收集,使製造商能夠根據不斷變化的市場動態調整其產品。直銷通路也有利於物流,確保更快的交付和更順暢的庫存流動,尤其是在季節性需求高峰期間。

從區域來看,美國在全球市場中佔有強勁地位,2024 年市場規模達 3.6 億美元。預計 2025 年至 2034 年期間,美國畜牧業的複合年成長率將達到 5.1%。受現代化農業基礎設施以及肉類、牛奶和羊毛需求不斷成長的推動,美國畜牧業持續擴張。根據美國農業實踐客製化的高性能設備的供應,極大地促進了該行業的上升趨勢。

在鼓勵永續農業和畜牧業管理創新的政策支持下,北美整體也正在穩步發展。對負責任的資源利用和農業設備數位化整合的重視,正在鞏固該地區在全球市場的地位。

在這個不斷發展的市場中,製造商專注於提供節能系統、增強耐用性和客製化功能,以滿足綿羊和山羊養殖戶的多樣化需求。此外,他們也越來越重視售後服務和區域支援基礎設施。在新興市場,對具成本效益且可靠的設備的需求日益成長,例如餵料器、圍欄裝置、電子識別 (EID) 秤和移動處理系統。這些優先事項將繼續影響主要產業參與者的策略方向,幫助他們擴展產品組合,滿足全球畜牧業的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021-2034

- 主要趨勢

- 餵料設備

- 飼料攪拌機

- 飼料分配器

- 乾草餵料器

- 礦物質飼料

- 搬運設備

- 門和麵板

- 滑槽

- 分類系統

- 裝卸坡道

- 剪切設備

- 電動剪

- 手動剪板機

- 剪切平台

- 其他

- 稱重設備

- 數位牲畜秤

- 平台秤

- 移動稱重系統

- 攜帶式重量箱

- 步行稱重系統

- 其他

- 修剪設備

- 蹄修整器

- 羊毛剪

- 電動剪

- 其他

- 澆水設備

- 自動飲水器

- 水槽

- 水過濾系統

- 其他

- 養殖設備

- 人工授精工具

- 超音波機器

- 羊羔圍欄

- 發熱量檢測裝置

- 其他

- 健康管理設備

- 疫苗槍

- 淋水設備

- 醫療用品儲存

- 其他

第6章:市場估計與預測:依營運模式,2021-2034 年

- 主要趨勢

- 手動設備

- 半自動化設備

- 全自動設備

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 個體農戶

- 合作社

- 商業化農業經營

- 屠宰場

- 研究設施

- 其他

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第10章:公司簡介

- Allflex Livestock Intelligence

- Arrowquip

- Gallagher

- Heiniger

- IAE

- Kerbl

- Lister Shearing

- Premier 1 Supplies

- Priefert

- Ritchie Agricultural

- Stockpro

- Sydell Inc.

- Te Pari Products

- Tru-Test (Datamars)

- WOPA

The Global Sheep and Goat Equipment Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 5.1 billion by 2034. The industry is undergoing a major transformation as farming practices continue to modernize and adopt more efficient methods for managing livestock. Farmers are increasingly turning to innovative equipment solutions that improve productivity and reduce the reliance on manual labor. With the growing need to streamline daily operations, equipment like mechanized feeding tools, advanced shearing systems, and precision monitoring devices is becoming an essential component of livestock farms.

The adoption of automated systems is rising as producers recognize the benefits of consistency in feeding routines, time savings in labor-intensive tasks, and enhanced animal welfare. Farmers are focusing on optimizing their resources, especially as livestock feed accounts for a large portion of operational expenses. Technological integration in equipment is not only helping reduce feed waste and labor costs but also supports better health management of animals through early disease detection and behavioral tracking. These innovations are reshaping how livestock operations are managed, pushing the market toward consistent growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 4.8% |

In terms of equipment type, feeding equipment held a dominant position, with the segment valued at USD 800 million in 2024. This category is projected to grow steadily and reach USD 1.3 billion by 2034. Equipment designed for feed management continues to see strong demand as it helps producers reduce feed loss and improve distribution efficiency. Automatic dispensers, precision feeders, and other feeding tools are being preferred due to their ability to support healthier animal growth and minimize feed waste, which remains one of the highest operational costs in livestock farming.

The market based on operation mode shows that semi-automated equipment accounted for approximately 44.5% of the global revenue share in 2024. This segment is expected to expand at a CAGR of 4.4% during the forecast period. These systems are becoming increasingly attractive to mid-scale and large-scale farmers who seek to strike a balance between automation and manual control. Their ability to offer improved operational speed, consistent performance, and reduced dependence on manual labor makes them an efficient alternative, especially in regions facing agricultural workforce shortages.

Distribution channels play a key role in determining product accessibility and service quality. In 2024, the direct distribution segment dominated the market with a share of around 64.9%. This model allows manufacturers to engage directly with end users, enabling better customization of equipment and providing the opportunity to address specific farming needs. It also supports real-time feedback collection, allowing manufacturers to adapt their offerings based on changing market dynamics. The direct channel also benefits logistics, ensuring quicker deliveries and smoother inventory flow, particularly during seasonal demand spikes.

Regionally, the United States held a strong presence in the global landscape, with the market valued at USD 360 million in 2024. The country is expected to see growth at a CAGR of 5.1% between 2025 and 2034. The U.S. livestock sector continues to expand, bolstered by modern farming infrastructure and rising demand for meat, milk, and wool. The availability of high-performance equipment tailored to U.S. farming practices contributes significantly to the industry's upward trajectory.

North America as a whole is also witnessing steady progress, supported by policies that encourage sustainable agriculture and innovations in livestock management. The emphasis on responsible resource use and digital integration in farm equipment is strengthening the region's position in the global market.

In this evolving market, manufacturers are concentrating on offering energy-efficient systems, enhanced durability, and tailored features that cater to the diverse requirements of sheep and goat farmers. There is also an increasing emphasis on after-sales services and regional support infrastructure. In emerging markets, demand is growing for cost-effective yet reliable equipment such as feeders, fencing units, electronic identification (EID) scales, and mobile handling systems. These priorities continue to shape the strategic direction of key industry participants as they expand their portfolios and cater to the needs of the global livestock community.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Operation mode

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistic

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Feeding equipment

- 5.2.1 Feed mixers

- 5.2.2 Feed dispensers

- 5.2.3 Hay feeders

- 5.2.4 Mineral feeders

- 5.3 Handling equipment

- 5.3.1 Gates and panels

- 5.3.2 Chutes

- 5.3.3 Sorting systems

- 5.3.4 Loading ramps

- 5.4 Shearing equipment

- 5.4.1 Electric shears

- 5.4.2 Manual shears

- 5.4.3 Shearing platforms

- 5.4.4 Others

- 5.5 Weighing equipment

- 5.5.1 Digital livestock scales

- 5.5.2 Platform scales

- 5.5.3 Mobile weighing systems

- 5.5.4 Portable weight crates

- 5.5.5 Walk-through weighing systems

- 5.5.6 Others

- 5.6 Trimming equipment

- 5.6.1 Hoof trimmers

- 5.6.2 Wool shears

- 5.6.3 Electric clippers

- 5.6.4 Others

- 5.7 Watering equipment

- 5.7.1 Automatic waterers

- 5.7.2 Water troughs

- 5.7.3 Water filtration systems

- 5.7.4 Others

- 5.8 Breeding equipment

- 5.8.1 Artificial insemination tools

- 5.8.2 Ultrasound machines

- 5.8.3 Lambing pens

- 5.8.4 Heat detection devices

- 5.8.5 Others

- 5.9 Health management equipment

- 5.9.1 Vaccination guns

- 5.9.2 Drenching equipment

- 5.9.3 Medical supplies storage

- 5.9.4 Others

Chapter 6 Market Estimates & Forecast, By Operation Mode, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual equipment

- 6.3 Semi-automated equipment

- 6.4 Fully automated equipment

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual farmers

- 7.3 Cooperatives

- 7.4 Commercial farming operations

- 7.5 Slaughterhouses

- 7.6 Research facilities

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trend

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 UAE

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Allflex Livestock Intelligence

- 10.2 Arrowquip

- 10.3 Gallagher

- 10.4 Heiniger

- 10.5 IAE

- 10.6 Kerbl

- 10.7 Lister Shearing

- 10.8 Premier 1 Supplies

- 10.9 Priefert

- 10.10 Ritchie Agricultural

- 10.11 Stockpro

- 10.12 Sydell Inc.

- 10.13 Te Pari Products

- 10.14 Tru-Test (Datamars)

- 10.15 WOPA