|

市場調查報告書

商品編碼

1773365

海藻萃取物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Seaweed Extracts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

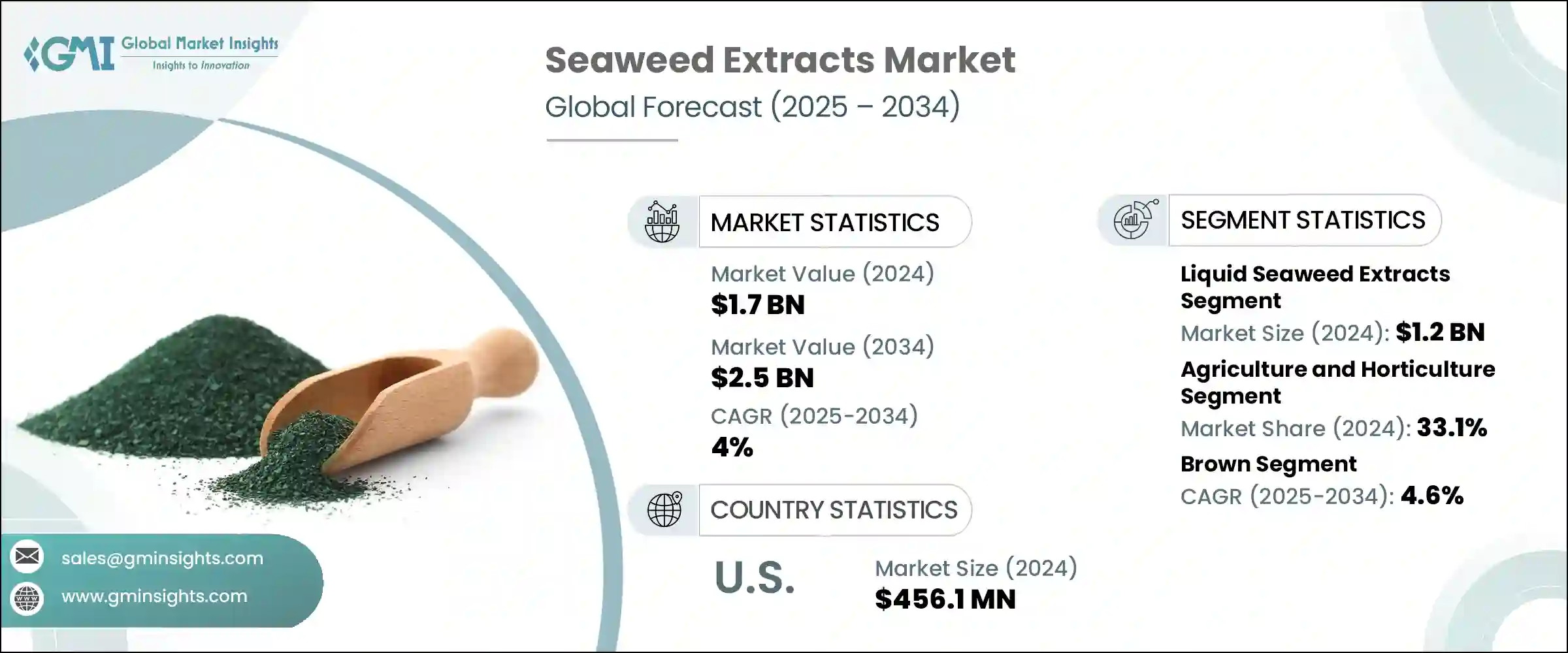

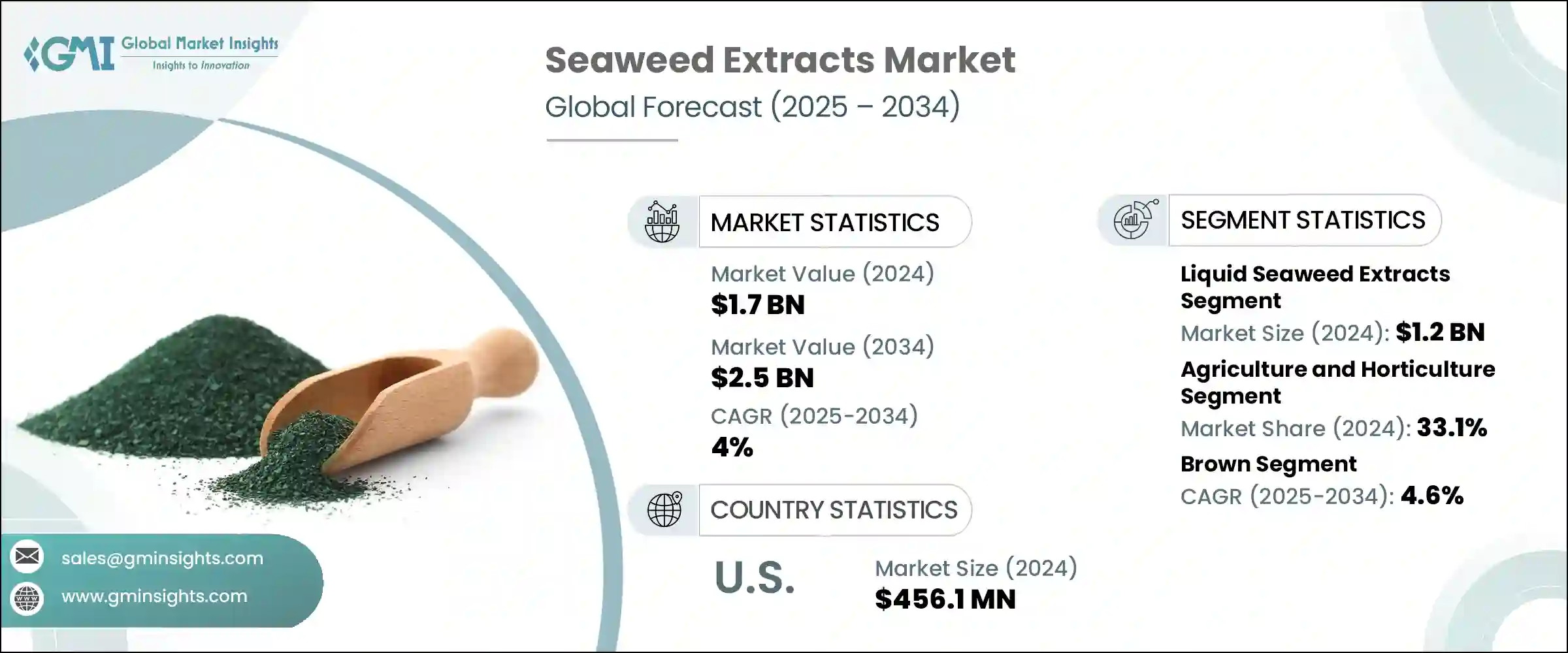

2024年,全球海藻萃取物市場規模達17億美元,預計2034年將以4%的複合年成長率成長,達到25億美元。這一成長主要源於個人護理、食品、製藥和農業等領域對有機、永續和生物基產品的需求激增。這些源自海洋的濃縮物富含微量元素和天然生長激素,因其多種功效而備受認可——從增強植物抗逆力到在加工食品中用作天然增稠劑,再到在化妝品中提供抗氧化特性。隨著消費者日益追求清潔標籤和環保產品,海藻萃取物因其多功能性和積極的永續性特徵而備受關注,使其成為天然配方和農業投入品中的寶貴成分。

海藻萃取物可作為植物生物刺激素和天然土壤改良劑,改善養分吸收和土壤通氣。海藻萃取物提供可溶性粉末和薄片等易於使用的形態,可提供多功能有機解決方案,與傳統和有機農業實踐無縫銜接。這些形態易於處理、儲存和混合,是大規模農業和小型園藝作業的理想選擇。除了作為有效的土壤改良劑外,它們還能提供鉀、鎂和鐵等必需的微量元素,這些元素對植物生長和抗逆性至關重要。其天然的螯合特性可提高土壤中養分的生物可利用性,提高吸收效率並改善植物的整體健康。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 4% |

2024年,海藻萃取物市場的液體製劑板塊產值達12億美元。其易於施用和快速吸收的特性使其成為各種農業實踐的首選,特別適用於葉面噴施和土壤改良。由於其一致性高、製備時間短且與標準灌溉系統相容,這些製劑深受農民青睞。液體海藻在提高作物抗逆性、養分吸收和產量方面的有效性,進一步推動了其廣泛應用,尤其是在精準農業和有機種植方法中。

2024年,農業和園藝領域佔比33.1%,預計2034年將以4.3%的複合年成長率成長。隨著種植者擴大轉向永續投入,海藻萃取物作為天然生物刺激素和土壤改良劑越來越受到青睞。同時,在食品和飲料領域,卡拉膠和瓊脂等海藻衍生化合物作為合成添加劑的清潔標籤替代品,需求旺盛。它們能夠改善醬汁、乳製品替代品和即食產品的質地、黏度和保存期限,這進一步鞏固了它們在配方改良和植物性產品中的關鍵作用。

2024年,美國海藻萃取物市場產值達4.561億美元。該地區的成長主要源於農業、食品、化妝品和醫藥領域的需求。人們對有機農業和作物抗逆性的認知不斷提高,推動了生物刺激素市場的採用。同時,食品中清潔標籤成分的興起以及天然化妝品的興起,也促進了海藻增稠劑、穩定劑以及抗氧化劑和抗炎劑等護膚成分的使用。

海藻萃取物市場的主要參與者包括Algaia SA、杜邦公司、Roullier Group、Gelymar SA和嘉吉公司。領先的公司正在加大研發投入,以開發針對特定終端市場的高純度標準化萃取物。他們正在與農業合作社、食品製造商和護膚品牌建立合作夥伴關係,將海藻萃取物整合到新的生物和生態產品中。企業還透過實施永續採購計劃和獲得符合清潔標籤和有機標準的認證來增強可追溯性。此外,擴大生產能力並在主要海藻養殖區附近建立設施,可確保供應的可靠性和成本效益。企業利用策略性收購和合資企業來實現產品組合的多元化,將藻類生物刺激素與互補性投入結合。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 液態海藻萃取物

- 粉狀海藻萃取物

- 薄片和顆粒

- 其他形式

第6章:市場估計與預測:按應用 2021 - 2034

- 主要趨勢

- 農業和園藝

- 食品和飲料

- 動物飼料

- 化妝品和個人護理

- 藥品和營養保健品

- 其他工業用途

第7章:市場估計與預測:按海藻來源,2021 - 2034 年

- 主要趨勢

- 褐藻

- 紅海藻

- 綠色海藻

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第9章:公司簡介

- Acadian Seaplants Limited

- Algaia SA

- Cargill, Inc.

- CP Kelco (JM Huber Corporation)

- DuPont de Nemours, Inc.

- Gelymar SA

- Qingdao Gather Great Ocean Algae Industry Group

- Roullier Group

- Seasol International

The Global Seaweed Extracts Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 2.5 billion by 2034. This growth is driven by a surge in demand for organic, sustainable, and bio-based products across sectors such as personal care, food, pharmaceuticals, and agriculture. These marine-derived concentrates, rich in trace elements and natural growth hormones, have gained recognition for their multifunctional benefits-from enhancing plant resilience to serving as natural thickeners in processed foods and offering antioxidant properties in cosmetics. As consumers increasingly seek clean-label and eco-conscious products, seaweed extracts have attracted attention for their versatility and positive sustainability profile, positioning them as a valuable ingredient in natural formulations and farming inputs.

Seaweed extracts serve as plant biostimulants and natural soil enhancers, improving nutrient uptake and soil aeration. Available in user-friendly forms such as soluble powders and flakes, seaweed extracts provide versatile organic solutions that integrate seamlessly with traditional and organic farming practices. These formats are easy to handle, store, and mix, making them ideal for large-scale agricultural use as well as smaller horticultural operations. In addition to acting as effective soil conditioners, they supply essential trace minerals like potassium, magnesium, and iron, which play a vital role in plant development and stress tolerance. Their natural chelating properties enhance the bioavailability of nutrients in the soil, improving uptake efficiency and overall plant health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4% |

Liquid formulations segment in the seaweed extracts market generated USD 1.2 billion in 2024. Their ease of application and rapid absorption have made them a preferred option across a range of agricultural practices, particularly for foliar spraying and soil enhancement. Farmers favor these formulations due to their uniform consistency, reduced preparation time, and compatibility with standard irrigation systems. The effectiveness of liquid seaweed in improving crop resilience, nutrient uptake, and yield further drives its widespread use, especially in precision farming and organic cultivation methods.

The agriculture and horticulture segment accounted for a 33.1% share in 2024 and is projected to grow at a CAGR of 4.3% through 2034. As growers increasingly shift toward sustainable inputs, seaweed extracts have gained traction as natural biostimulants and soil conditioners. Meanwhile, in the food and beverage sector, seaweed-derived compounds such as carrageenan and agar are experiencing strong demand as clean-label alternatives to synthetic additives. Their ability to deliver texture, viscosity, and shelf-life improvements in sauces, dairy substitutes, and ready-to-eat products reinforces their critical role in reformulated and plant-based offerings.

United States Seaweed Extracts Market generated USD 456.1 million in 2024. Growth in the region is driven by demand across agriculture, food, cosmetics, and pharmaceuticals. Increasing awareness around organic farming and stress resilience in crops has fueled adoption in biostimulant markets. Meanwhile, the shift toward clean-label ingredients in food and the rise in natural cosmetics have boosted the use of seaweed-based thickeners, stabilizers, and skincare beneficials like antioxidants and anti-inflammatories.

Major players operating in the Seaweed Extracts Market include Algaia S.A., DuPont de Nemours, Inc., Roullier Group, Gelymar S.A., and Cargill, Inc. Leading firms are boosting their R&D investments to develop high-purity, standardized extracts tailored for specific end-markets. They're forming partnerships with agricultural cooperatives, food manufacturers, and skincare brands to integrate seaweed extracts into new bio- and eco-based products. Companies are also enhancing traceability by implementing sustainable sourcing programs and obtaining certifications to meet clean-label and organic standards. In addition, expanding production capacity and establishing facilities near major seaweed farming regions ensures supply reliability and cost efficiency. Firms leverage strategic acquisitions and joint ventures to diversify product portfolios-combining algal biostimulants with complementary inputs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Seaweed source

- 2.3 TAM analysis, 2025-2034

- 2.4 Cxo perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid seaweed extracts

- 5.3 Powdered seaweed extracts

- 5.4 Flakes and granules

- 5.5 Other forms

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Agriculture and horticulture

- 6.3 Food & beverages

- 6.4 Animal feed

- 6.5 Cosmetics & personal care

- 6.6 Pharmaceuticals & nutraceuticals

- 6.7 Other industrial uses

Chapter 7 Market Estimates and Forecast, By Seaweed Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Brown seaweed

- 7.3 Red seaweed

- 7.4 Green seaweed

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants Limited

- 9.2 Algaia S.A.

- 9.3 Cargill, Inc.

- 9.4 CP Kelco (J.M. Huber Corporation)

- 9.5 DuPont de Nemours, Inc.

- 9.6 Gelymar S.A.

- 9.7 Qingdao Gather Great Ocean Algae Industry Group

- 9.8 Roullier Group

- 9.9 Seasol International