|

市場調查報告書

商品編碼

1773362

傳統碼垛機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Conventional Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

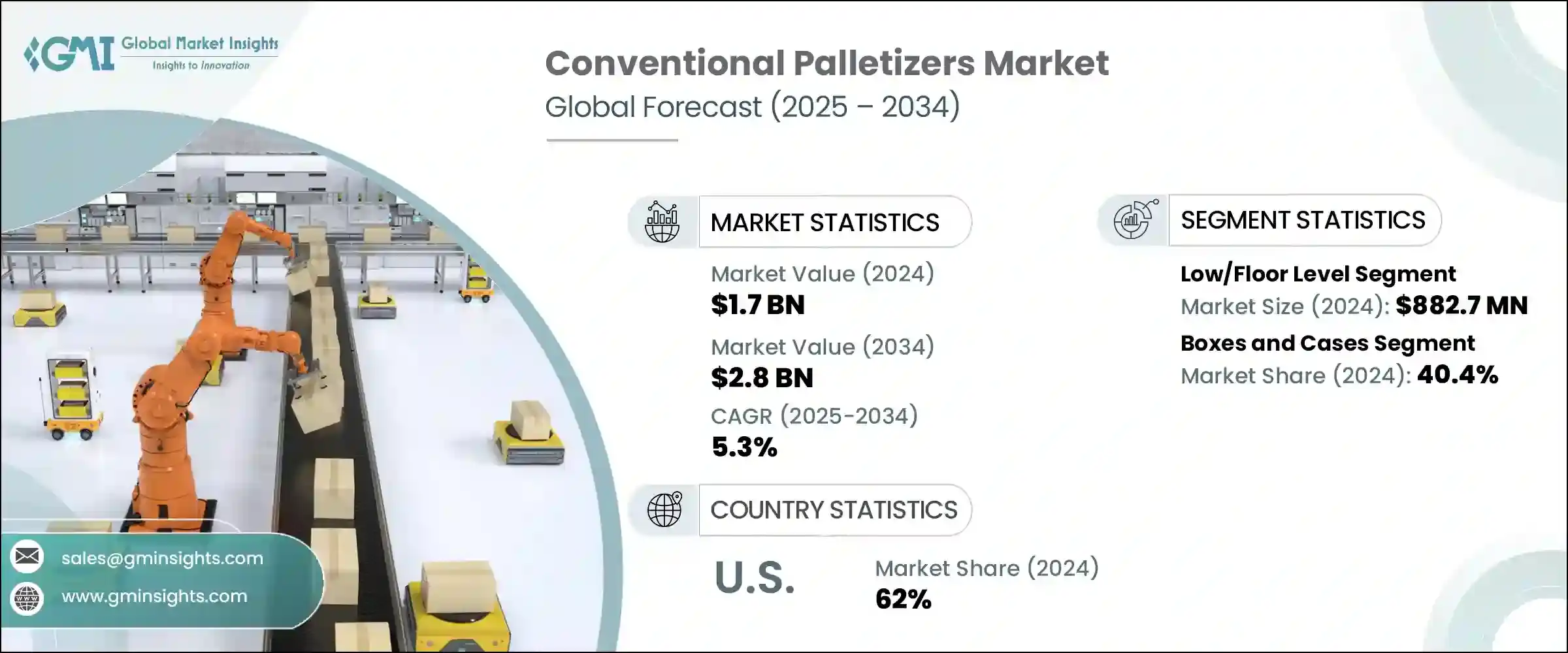

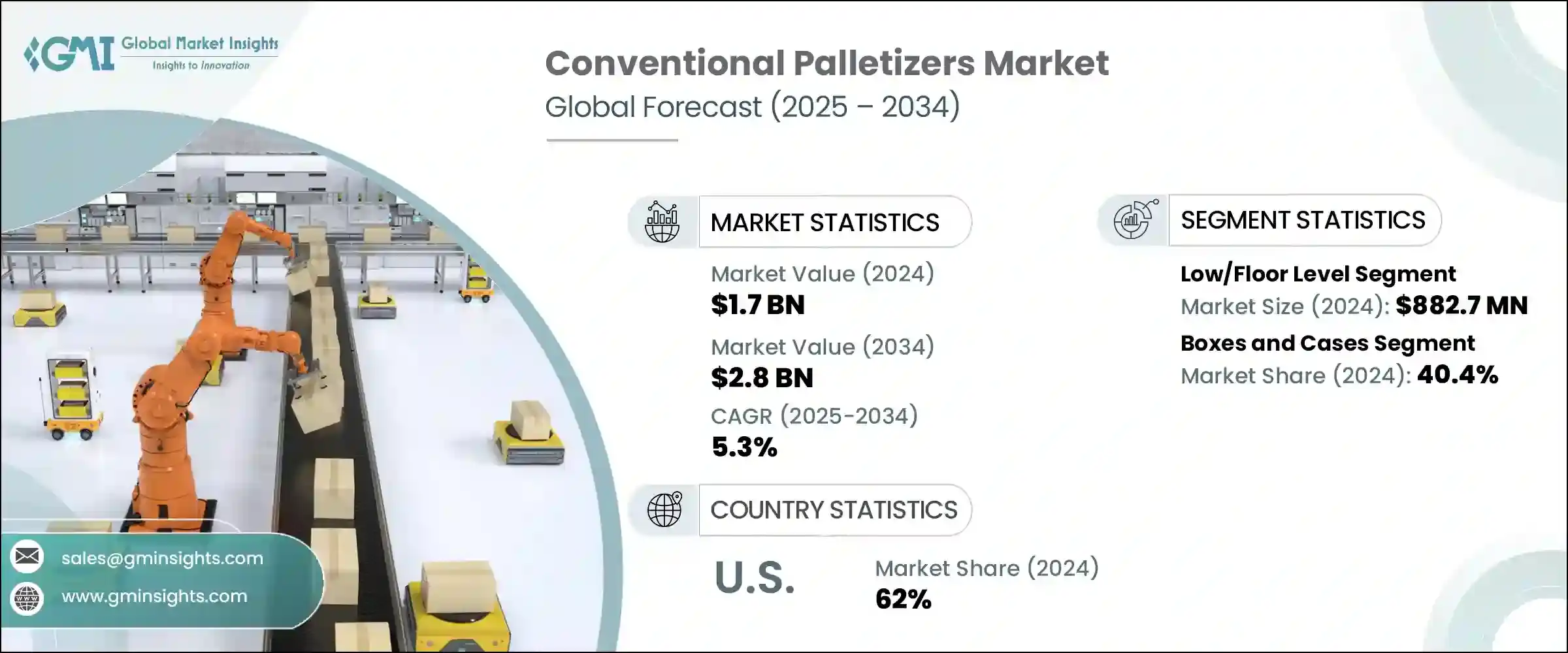

2024 年全球傳統碼垛機市場規模達 17 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 28 億美元。各行各業對精簡包裝和物流流程的需求激增是該市場的主要驅動力之一。隨著電子商務的持續成長和全球供應鏈的日益複雜,製造環境中對自動堆疊系統的需求也越來越明顯。在將箱子或袋子運送到配送中心之前,需要對其進行一致性處理時,這些系統尤其重要。雖然在配送中心,機器人替代品通常更適合處理各種產品,但傳統碼垛機在工業環境中仍然能夠有效地高速均勻地堆疊產品。

傳統堆疊系統可在滿托盤和空托盤之間無縫切換,無需中斷生產,從而提高包裝線效率。此功能可保持工作流程穩定,並最大限度地減少停機時間。與其他解決方案相比,這些機器採用緊湊封閉的碼垛機構,佔用空間更小。佔地面積的減少也消除了安裝大型安全護欄的需要,使其成為優先考慮空間最佳化的設施的理想選擇。以大量連續生產而聞名的食品飲料產業,高度依賴這些機器來處理乳製品、零食和罐頭食品等產品。由於易腐爛貨物需要快速處理和交付,傳統碼垛機能夠保持與快節奏生產需求相符的輸出速度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 5.3% |

低位/地面碼垛機市場在2024年創造了8.827億美元的市場規模。這些機器採用地面輸送系統,將貨物排列整齊並旋轉成排,然後將其推入托盤層。與從上方裝載的高層碼垛機不同,地面碼垛機無需垂直移動。這項特點縮短了裝載時間,提高了操作簡便性,使其更有效率,並適用於各種規模的生產車間。

2024年,紙盒和紙箱細分市場佔據了40.4%的市場。這些系統尤其適用於處理紙箱和矩形包裝等統一的容器。其堅固的結構使其適合精確堆垛,從而實現高速操作並最大程度地減少誤差。無論是食品、電子產品、藥品或個人護理用品,紙盒和紙箱憑藉其保護性、易於標識和堆疊效率,仍然是各行各業的主流包裝形式。從事大規模生產的製造商傾向於使用速度快、精度高的碼垛系統,尤其是在統一性和包裝量要求高的情況下。

2024年,美國傳統碼垛機市場佔有62%的佔有率。為了抵消不斷上漲的勞動力成本和勞動力短缺,美國製造商加大了對傳統碼垛系統的投資。這些系統可以自動化高強度和重複性的工作,從而提高安全性和生產力,同時降低員工流失率。自動化的推動也與更廣泛的經濟趨勢息息相關,包括製造業的成長和線上零售通路的擴張,這些都刺激了對高效能生產線終端設備的需求。

引領全球傳統碼垛機市場的關鍵公司包括 Columbia Machine Inc.、Okura Yusoki、ROBOPAC、MSK Covertech、Premier Tech、KUKA AG、SIPA SpA、Signode Industrial Group LLC、OCME Srl、Brenton Engineering、PAYPER SA、Concetti SpA、BWBWal Group LLC、OCME Srl、Brenton Engineering、PAYPER SA、Concetti SpA、BWBWible Systems Systems、Baelx 和無錫包裝有限公司。傳統碼垛機市場的公司正在透過多樣化其設備供應來鞏固其市場地位,以滿足食品、製藥和物流等不同行業的需求。他們還整合了可程式邏輯控制器 (PLC)、人機介面 (HMI) 和模組化設計等更智慧的技術,以提高操作靈活性。透過擴展售後服務和提供維護支持,這些參與者正在提高客戶保留率和系統壽命。與系統整合商和包裝自動化公司的策略合作使製造商能夠提供完整的交鑰匙解決方案,從而為客戶增加價值。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 電子商務和物流的成長

- 食品和飲料行業的需求不斷成長

- 勞動成本增加以及各行業採用自動化

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 產品變化的靈活性有限

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 進階

- 低/地板水平

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 盒子和箱子

- 袋子和麻袋

- 托盤和板條箱

- 其他

第7章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 消費品

- 電子商務與物流

- 其他

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Baust & Co GmbH

- Brenton Engineering

- BW Flexible Systems

- Columbia Machine Inc

- Concetti SpA

- KUKA AG

- MSK Covertech

- OCME Srl

- Okura Yusoki

- PAYPER SA

- Premier Tech

- ROBOPAC

- Signode Industrial Group LLC

- SIPA SpA

- Wuxi Taiyang Packaging Technology Co Ltd

The Global Conventional Palletizers Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.8 billion by 2034. The surge in demand for streamlined packaging and logistics operations across various industries is one of the primary drivers for this market. As e-commerce continues to grow and global supply chains become increasingly complex, the need for automated palletizing systems in manufacturing environments has become more pronounced. These systems are particularly important where consistent handling of cases or bags is essential before they are transported to distribution hubs. While robotic alternatives are commonly favored for varied product assortments in fulfillment centers, conventional palletizers remain highly effective for uniform product stacking at high speeds in industrial settings.

Conventional palletizing systems improve packaging line efficiency by enabling seamless transitions between filled and empty pallets without disrupting production. This capability keeps the workflow steady and minimizes idle time. Compared to alternative solutions, these machines require less floor space thanks to their compact and enclosed stacking mechanisms. The reduced footprint also eliminates the need for expansive safety barriers, making them ideal for facilities where space optimization is a priority. The food and beverage sector, known for its high-volume continuous production, relies heavily on these machines to handle products like dairy, snacks, and canned goods. With perishable goods requiring quick processing and delivery, conventional palletizers are trusted to maintain output speeds that align with fast-paced production demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.3% |

The low/floor-level palletizer segment generated USD 882.7 million in 2024. These machines operate on a floor-level conveyor system that aligns and rotates items into rows before pushing them into pallet layers. Unlike their high-level counterparts, which load from above, floor-level units eliminate the need for vertical movement during stacking. This feature reduces load time and increases operational simplicity, making them more efficient and accessible across production floors of varying sizes.

In 2024, the boxes and cases segment held a 40.4% share. These systems are particularly effective at handling uniform containers such as cartons and rectangular packages. Their rigid form makes them suitable for precise stacking, allowing for high-speed operations with minimal error. Whether it's food, electronics, pharmaceuticals, or personal care items, boxes, and cases remain a dominant packaging format across industries due to their protective nature, ease of branding, and stacking efficiency. Manufacturers dealing in mass production turn to palletizing systems that offer speed and accuracy, especially where uniformity and packaging volume are high.

United States Conventional Palletizers Market held a 62% share in 2024. The need to offset rising labor costs and workforce shortages has prompted manufacturers in the country to increase investments in conventional palletizing systems. These systems automate physically intense and repetitive tasks, thereby improving safety and productivity while reducing employee turnover. The push for automation is also tied to broader economic trends, including manufacturing growth and the expansion of online retail channels, which are all fueling demand for high-efficiency end-of-line equipment.

Key companies leading the Global Conventional Palletizers Market include Columbia Machine Inc., Okura Yusoki, ROBOPAC, MSK Covertech, Premier Tech, KUKA AG, SIPA SpA, Signode Industrial Group LLC, OCME Srl, Brenton Engineering, PAYPER SA, Concetti SpA, BW Flexible Systems, Baust & Co. GmbH, and Wuxi Taiyang Packaging Technology Co. Ltd. Companies in the conventional palletizers market are strengthening their market position by diversifying their equipment offerings to cater to various industry requirements, including food, pharmaceuticals, and logistics. They are also integrating smarter technologies such as programmable logic controllers (PLCs), human-machine interfaces (HMIs), and modular designs to enhance operational flexibility. By expanding after-sales services and providing maintenance support, these players are improving customer retention and system longevity. Strategic collaborations with system integrators and packaging automation firms allow manufacturers to offer complete turnkey solutions, increasing value to clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Increased labor costs and adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 High level

- 5.3 Low/floor level

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Boxes and cases

- 6.3 Bags and sacks

- 6.4 Trays and crates

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 E-commerce and logistics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution channel, 2021 – 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baust & Co GmbH

- 10.2 Brenton Engineering

- 10.3 BW Flexible Systems

- 10.4 Columbia Machine Inc

- 10.5 Concetti SpA

- 10.6 KUKA AG

- 10.7 MSK Covertech

- 10.8 OCME Srl

- 10.9 Okura Yusoki

- 10.10 PAYPER SA

- 10.11 Premier Tech

- 10.12 ROBOPAC

- 10.13 Signode Industrial Group LLC

- 10.14 SIPA SpA

- 10.15 Wuxi Taiyang Packaging Technology Co Ltd