|

市場調查報告書

商品編碼

1773358

脫脂奶粉市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Skimmed Milk Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

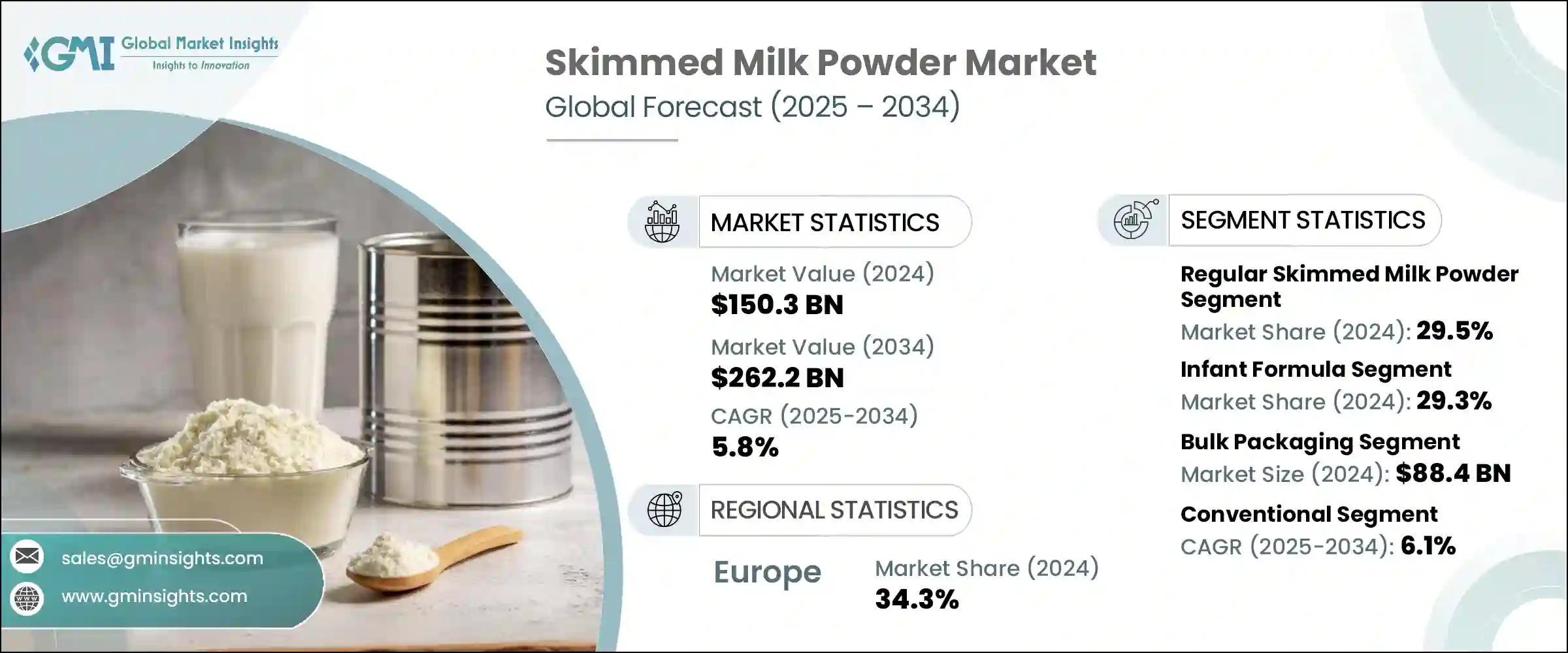

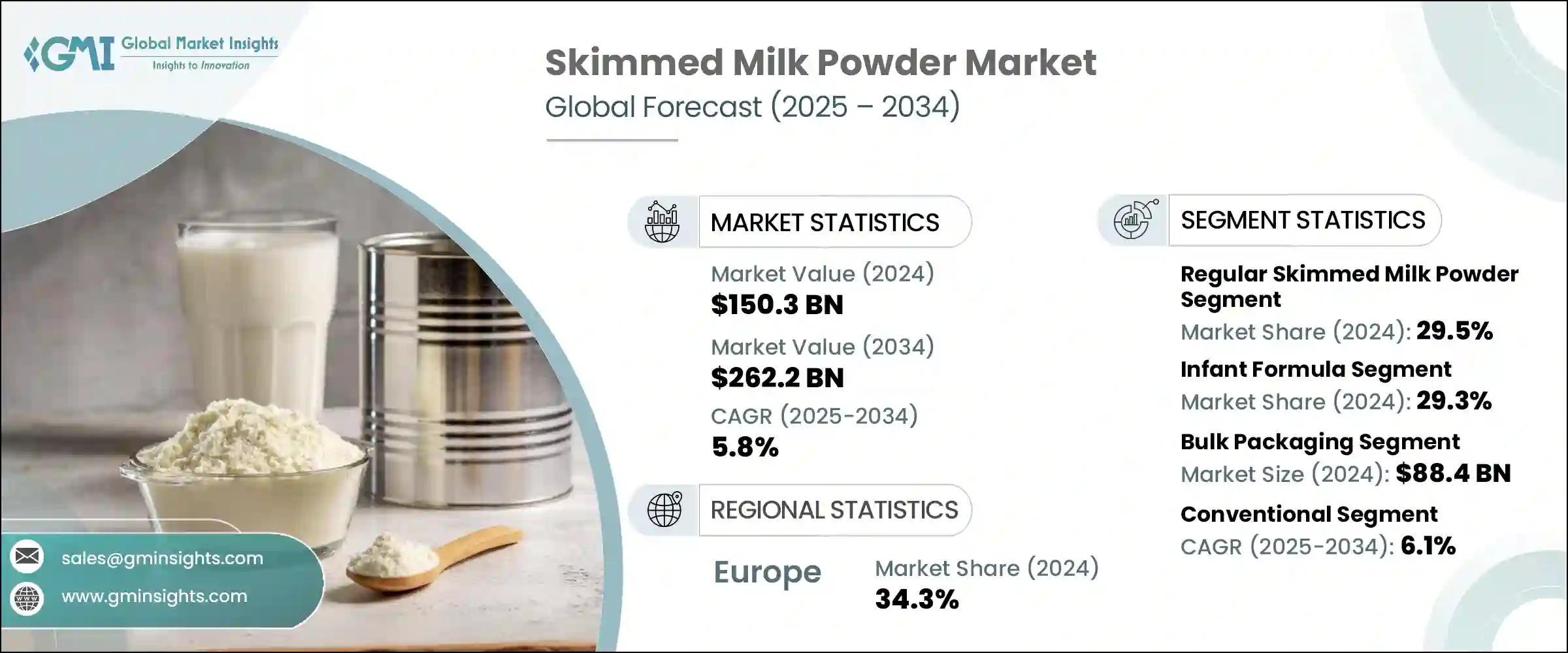

2024年,全球脫脂奶粉市場規模達1,503億美元,預計到2034年將以5.8%的複合年成長率成長,達到2,622億美元。人們對健康食品選擇的意識不斷增強,對優質乳蛋白的需求不斷成長,以及嬰兒營養、烘焙食品和糖果等行業需求的不斷成長,這些因素持續推動著市場擴張。噴霧乾燥製程的改進有助於提高產品品質和貨架穩定性,為國際貿易創造了巨大的機會。儘管乳製品價格波動、政策變化和貿易動態影響了定價策略和生產計劃,但長期市場前景仍然穩健。

競爭格局相對有限,為新製造商進入和擴大規模提供了大量尚未開發的潛力。新興市場正在穩步養成富含蛋白質的飲食習慣,這進一步支持了長期成長。市場參與者也不斷發展,採用更清潔的加工技術和注重環保的生產方式,以滿足全球永續發展的期望。即使在供應挑戰和價格不確定性的背景下,全球對乳製品功能性成分日益成長的需求確保了脫脂奶粉將繼續在乳製品行業的發展中發揮至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1503億美元 |

| 預測值 | 2622億美元 |

| 複合年成長率 | 5.8% |

2024年,普通脫脂奶粉市場佔了29.5%的市場佔有率,市場規模達444億美元。其強勁的市場地位源自於其價格實惠和用途廣泛,對工業和消費領域都極具吸引力。即溶奶粉旨在快速溶解,是家庭常用的奶粉。高熱量和中熱量奶粉因其加工耐受性而非常適合工業食品行業;低熱量奶粉則吸引了那些尋求加工程度較低、更天然的奶粉的消費者。

散裝包裝佔據市場主導地位,佔58.8%,2024年市場規模達884億美元。這種偏好源於其成本效益、更便捷的物流和更少的材料浪費,這些都與大規模用戶的需求相契合。零售包裝持續專注於消費者的便利性,提供可重複密封和品牌化包裝等功能,以提升貨架吸引力。在這兩個領域,品牌擴大採用環保包裝設計,以應對日益成長的環境問題和監管壓力。

2024年,歐洲脫脂奶粉市場佔有34.3%的佔有率。該地區的主導地位得益於其成熟的乳製品行業、強大的出口基礎設施和先進的加工能力。歐洲生產商受益於嚴格的品質標準、廣泛的研發投入以及支持全球穩定供應的有利貿易協定。該地區在烘焙、嬰兒配方奶粉和糖果應用方面也表現出強勁的需求,進一步刺激了國內消費。此外,永續乳牛養殖實踐的廣泛採用和噴霧乾燥技術的進步有助於提高生產效率和產品一致性。

主要的產業領導者包括菲仕蘭康柏尼、達能集團、愛氏晨曦、雀巢和恆天然合作集團。脫脂奶粉產業的領先公司正致力於擴大全球分銷網路,利用特定地區的飲食趨勢,並建立策略聯盟以提高供應鏈效率。對最先進的噴霧乾燥設備和自動化加工生產線的投資可以提高產品的一致性和產量。許多公司瞄準高成長地區,推出針對特定族群的強化或加值乳製品。永續性是一個中心主題,各大品牌紛紛採用更環保的能源和可回收包裝。透過符合全球營養標準並維持嚴格的品質控制,這些公司正在確保多元化消費者群體的長期信任和品牌忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 普通脫脂奶粉

- 即溶脫脂奶粉

- 高溫脫脂奶粉

- 中火脫脂奶粉

- 低熱脫脂奶粉

- 有機脫脂奶粉

- 強化脫脂奶粉

- 維生素強化

- 礦物質強化

- 富含蛋白質

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 嬰兒配方奶粉

- 烘焙和糖果

- 麵包和烘焙食品

- 蛋糕和糕點

- 糖果產品

- 其他烘焙應用

- 乳製品

- 復原乳

- 優格和發酵產品

- 乳酪生產

- 冰淇淋和冷凍甜點

- 加工食品

- 即食食品

- 湯和醬汁

- 肉製品

- 其他加工食品

- 飲料

- 蛋白質飲料

- 營養飲料

- 咖啡和茶增白劑

- 其他飲料應用

- 營養補充品

- 蛋白質補充劑

- 運動營養

- 臨床營養

- 動物飼料

- 其他

- 化妝品和個人護理

- 製藥應用

- 工業應用

第7章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 散裝包裝

- 25公斤袋

- 50公斤袋

- 大袋(500-1000公斤)

- 其他散裝包裝

- 零售包裝

- 小袋裝(100g-500g)

- 中包裝(1kg-5kg)

- 罐頭和罐子

- 其他零售包裝

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- B2B(企業對企業)

- 食品製造商

- 嬰兒配方奶粉製造商

- 麵包店和糖果店

- 餐飲業

- 其他B2B頻道

- B2C(企業對消費者)

- 超市和大賣場

- 便利商店

- 網路零售

- 專賣店

- 其他B2C頻道

第9章:市場估計與預測:依性質,2021 - 2034 年

- 主要趨勢

- 傳統的

- 有機的

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Fonterra Co-operative Group Limited

- Nestle SA

- Danone SA

- Arla Foods amba

- FrieslandCampina

- Lactalis Group

- Dairy Farmers of America (DFA)

- Saputo Inc.

- Glanbia plc

- Sodiaal Union

- Hochdorf Swiss Nutrition Ltd.

- Euroserum

- Dairygold Co-operative Society Limited

- Interfood Holding BV

- Synlait Milk Limited

- Westland Milk Products

- Murray Goulburn Co-operative

- Amul (Gujarat Cooperative Milk Marketing Federation)

- Yili Group

- Mengniu Dairy Company

The Global Skimmed Milk Powder Market was valued at USD 150.3 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 262.2 billion by 2034. The rising awareness around healthier food choices, the push for high-quality dairy proteins, and increasing demand in sectors like infant nutrition, baked goods, and confectionery continue to drive market expansion. Improvements in spray-drying processes have helped enhance product quality and shelf stability, creating strong opportunities for international trade. Although dairy price fluctuations, policy shifts, and trade dynamics have impacted pricing strategies and production planning, the long-term market outlook remains solid.

The competitive landscape is relatively limited, offering plenty of untapped potential for new manufacturers to enter and scale. Emerging markets are steadily adopting protein-rich dietary habits, which further support long-term growth. Market players are also evolving with cleaner processing technologies and environmentally conscious manufacturing to meet global sustainability expectations. Even amid supply challenges and pricing uncertainties, the rising global appetite for dairy-based functional ingredients ensures that skimmed milk powder will continue to play a vital role in the evolution of the dairy sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $150.3 Billion |

| Forecast Value | $262.2 Billion |

| CAGR | 5.8% |

The regular skimmed milk powder segment held a significant 29.5% share in 2024, with a market size of USD 44.4 billion. Its strong position stems from affordability and versatility, which appeal to both industrial and consumer applications. Instant variants are designed for fast solubility and are favored in household use. High-heat and medium-heat varieties serve the industrial food sector well, thanks to their processing tolerance, low-heat versions attract consumers looking for less processed options with more natural qualities.

Bulk packaging segment dominated the market with a 58.8% share and USD 88.4 billion in 2024. This preference is driven by its cost-efficiency, better-handling logistics, and reduced material waste, which align well with the needs of large-scale users. Retail packages continue to focus on consumer convenience, offering features like resealability and branded formats to boost shelf appeal. Across both segments, brands are increasingly adopting eco-conscious packaging designs that align with rising environmental concerns and regulatory pressures.

Europe Skimmed Milk Powder Market held a 34.3% share in 2024. The region's dominance is driven by its well-established dairy industry, strong export infrastructure, and advanced processing capabilities. European producers benefit from robust quality standards, extensive R&D investments, and favorable trade agreements that support consistent global supply. The region also exhibits strong demand across bakery, infant formula, and confectionery applications, further fueling domestic consumption. Moreover, the widespread adoption of sustainable dairy farming practices and technological advancements in spray drying contribute to production efficiency and product consistency.

Key industry leaders include FrieslandCampina, Danone S.A., Arla Foods amba, Nestle S.A., and Fonterra Co-operative Group Limited. Leading companies in the skimmed milk powder industry are focusing on expanding global distribution networks, leveraging region-specific dietary trends, and forming strategic alliances to enhance supply chain efficiency. Investments in state-of-the-art spray drying facilities and automated processing lines allow for better consistency and increased output. Many firms are targeting high-growth regions by launching fortified or value-added dairy variants tailored for specific demographics. Sustainability is a central theme, with brands adopting greener energy sources and recyclable packaging. By aligning with global nutrition standards and maintaining strict quality control, these companies are ensuring long-term trust and brand loyalty across diversified consumer bases.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Regular skimmed milk powder

- 5.3 Instant skimmed milk powder

- 5.4 High heat skimmed milk powder

- 5.5 Medium heat skimmed milk powder

- 5.6 Low heat skimmed milk powder

- 5.7 Organic skimmed milk powder

- 5.8 Fortified skimmed milk powder

- 5.8.1 Vitamin fortified

- 5.8.2 Mineral fortified

- 5.8.3 Protein enriched

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Infant formula

- 6.3 Bakery & confectionery

- 6.3.1 Bread & baked goods

- 6.3.2 Cakes & Pastries

- 6.3.3 Confectionery products

- 6.3.4 Other bakery applications

- 6.4 Dairy products

- 6.4.1 Reconstituted milk

- 6.4.2 Yogurt & fermented products

- 6.4.3 Cheese production

- 6.4.4 Ice cream & frozen desserts

- 6.5 Processed foods

- 6.5.1 Ready-to-Eat meals

- 6.5.2 Soups & sauces

- 6.5.3 Meat products

- 6.5.4 Other processed foods

- 6.6 Beverages

- 6.6.1 Protein drinks

- 6.6.2 Nutritional beverages

- 6.6.3 Coffee & tea whiteners

- 6.6.4 Other beverage applications

- 6.7 Nutritional supplements

- 6.7.1 Protein supplements

- 6.7.2 Sports nutrition

- 6.7.3 Clinical nutrition

- 6.8 Animal feed

- 6.9 Others

- 6.9.1 Cosmetics & personal care

- 6.9.2 Pharmaceutical applications

- 6.9.3 Industrial applications

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Bulk packaging

- 7.2.1 25 kg bags

- 7.2.2 50 kg bags

- 7.2.3 Big bags (500-1000 kg)

- 7.2.4 Other bulk packaging

- 7.3 Retail packaging

- 7.3.1 Small pouches (100g-500g)

- 7.3.2 Medium packs (1kg-5kg)

- 7.3.3 Cans & tins

- 7.3.4 Other retail packaging

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 B2B (Business-to-Business)

- 8.2.1 Food manufacturers

- 8.2.2 Infant formula manufacturers

- 8.2.3 Bakeries & confectioneries

- 8.2.4 Foodservice industry

- 8.2.5 Other B2B channels

- 8.3 B2C (Business-to-Consumer)

- 8.3.1 Supermarkets & hypermarkets

- 8.3.2 Convenience stores

- 8.3.3 Online retail

- 8.3.4 Specialty stores

- 8.3.5 Other B2C channels

Chapter 9 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Conventional

- 9.3 Organic

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Fonterra Co-operative Group Limited

- 11.2 Nestle S.A.

- 11.3 Danone S.A.

- 11.4 Arla Foods amba

- 11.5 FrieslandCampina

- 11.6 Lactalis Group

- 11.7 Dairy Farmers of America (DFA)

- 11.8 Saputo Inc.

- 11.9 Glanbia plc

- 11.10 Sodiaal Union

- 11.11 Hochdorf Swiss Nutrition Ltd.

- 11.12 Euroserum

- 11.13 Dairygold Co-operative Society Limited

- 11.14 Interfood Holding B.V.

- 11.15 Synlait Milk Limited

- 11.16 Westland Milk Products

- 11.17 Murray Goulburn Co-operative

- 11.18 Amul (Gujarat Cooperative Milk Marketing Federation)

- 11.19 Yili Group

- 11.20 Mengniu Dairy Company