|

市場調查報告書

商品編碼

1773347

商用車電子服務工具 (EST) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Vehicle Electronic Service Tools (EST) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

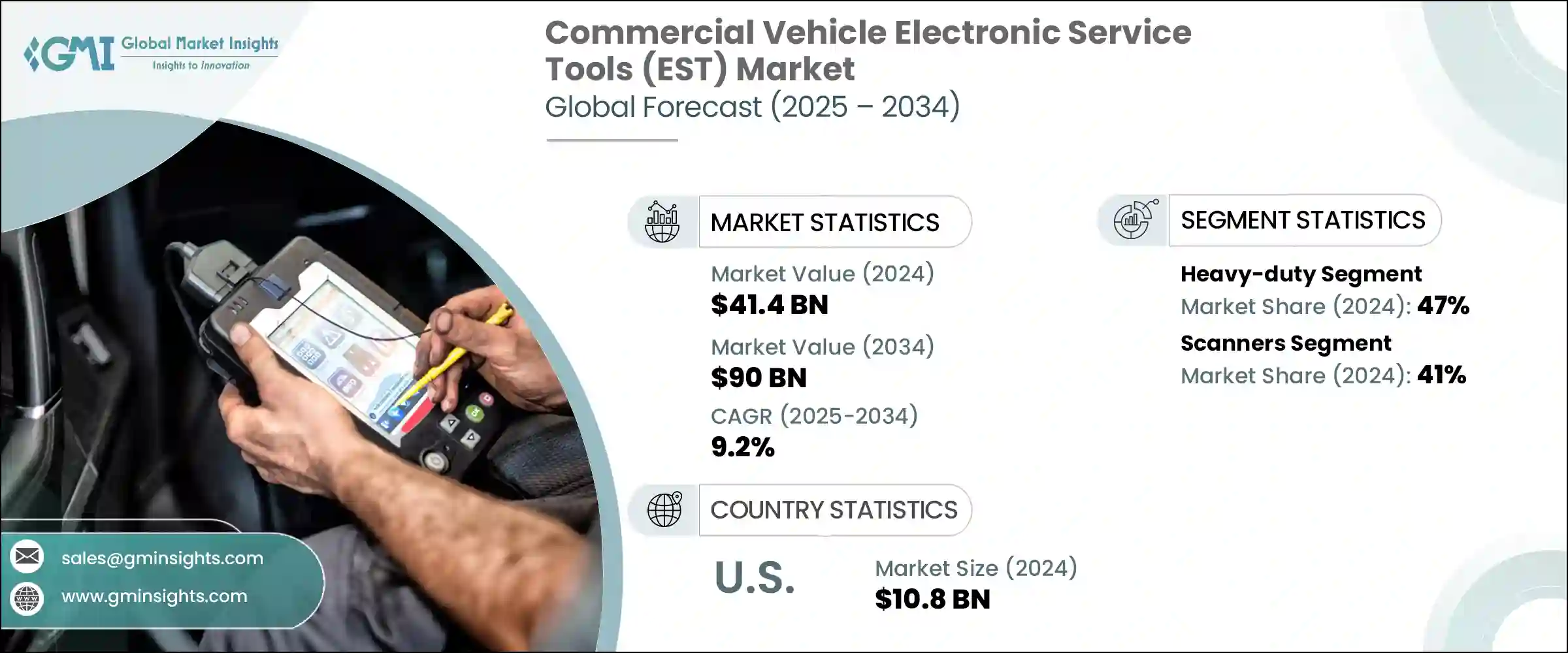

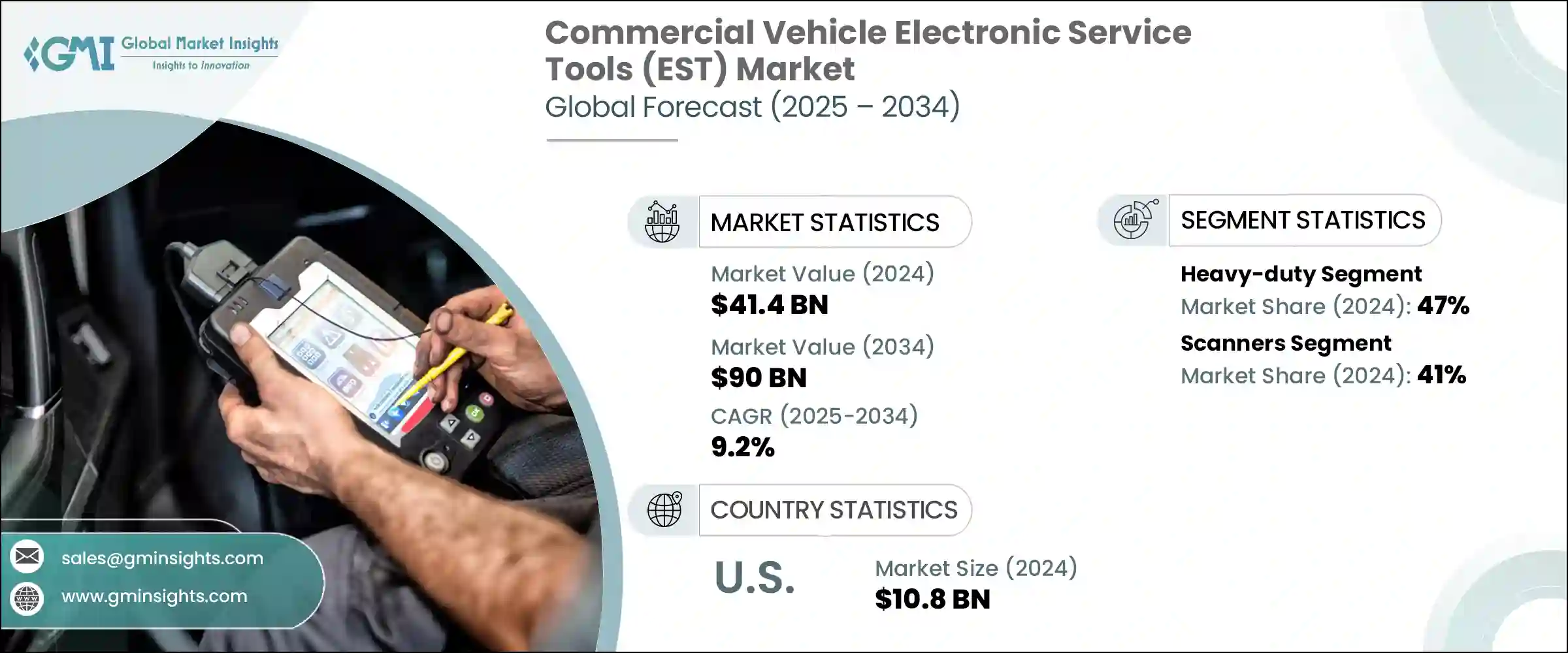

2024 年全球商用車電子服務工具市場價值為 414 億美元,預計到 2034 年將以 9.2% 的複合年成長率成長,達到 900 億美元。引擎控制單元 (ECU)、遠端資訊處理系統和駕駛輔助技術等先進電子設備迅速融入商用車,顯著增加了對高科技診斷工具的需求。隨著傳統機械維修逐漸不足,車隊營運商和服務中心正在採用先進的電子工具進行即時診斷、軟體更新和精確的故障檢測。這些工具有助於減少車輛停機時間、最佳化車隊性能並提高維護效率。隨著電子商務、物流和供應鏈產業蓬勃發展,全球商用車數量不斷成長,對定期診斷和維護的需求也日益增加。

車隊管理人員越來越依賴基於電子服務工具的預測性維護解決方案,以最大限度地減少停機時間並最佳化資源配置。這一趨勢尤其重要,因為商用車輛因長時間運行而磨損加劇,尤其是在物流、建築和長途貨運等行業。這些車輛的持續運作給零件帶來了額外的壓力,從而加速了頻繁維護和及時診斷的需求。隨著車隊需求的不斷成長,服務提供者和工具製造商正在尋找重大機遇,引入創新解決方案,以最佳化維護計劃並延長車輛使用壽命。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 414億美元 |

| 預測值 | 900億美元 |

| 複合年成長率 | 9.2% |

2024年,重型車輛市場佔了47%的佔有率。這一成長得益於全球物流中重型車輛使用量的不斷成長,即時資料和遠端診斷對於確保營運效率、法規合規性和快速解決問題至關重要。隨著物流業越來越依賴先進技術來改善車隊管理,對專用電子服務工具的需求持續激增。這些工具有助於監控車輛的關鍵參數,例如油耗、引擎性能和駕駛員行為,從而改善車隊營運,最大限度地減少停機時間,並保持監管標準,尤其是在跨境運輸領域。

掃描器細分市場在2024年佔據41%的市場佔有率,預計到2034年將以11.1%的複合年成長率成長。診斷掃描儀的不斷發展使其在診斷複雜車輛系統方面更加靈活和高效。無線通訊功能、觸控螢幕介面和即時資料流等新技術的進步,使這些工具成為維修廠和服務中心不可或缺的工具。現在,它們提供更多功能,包括ECU編程、系統測試和雙向控制,從而提高了技術人員的工作效率和服務準確性,進一步推動了其普及。

美國商用車電子服務工具 (EST) 市場佔有 83% 的主導地位,2024 年市場規模達 108 億美元。美國龐大且多樣化的商用車輛隊伍持續推動著該產業的需求,尤其是在長途貨運、配送和建築等產業。美國完善的汽車售後市場基礎設施,包括廣泛的獨立維修廠網路、 OEM授權服務中心和車隊維護設施,為電子服務工具的成長奠定了堅實的基礎。

商用車電子服務工具市場的主要參與者包括 Bendix、Bosch、Continental AG、Cummins、Daimler Trucks、Knorr-Bremse、Navistar、PACCAR、Snap-on 和 Volvo。各公司為鞏固其市場地位而採取的關鍵策略包括持續開發可與最新汽車技術無縫整合的先進診斷工具。各公司也專注於擴大其產品範圍,以滿足從重型卡車到小型市政車輛等各種車型的需求。此外,他們正在與原始設備製造商 (OEM) 和車隊營運商建立合作夥伴關係,以確保工具與新車型的兼容性,同時優先投資研發以增強工具功能,例如將人工智慧和機器學習融入預測性診斷。此外,許多公司正專注於擴大其全球影響力,尤其是在新興市場,以利用不斷成長的車隊和物流行業。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 商用車產量上升

- 遠端資訊處理和車隊管理的日益普及

- 預測性和預防性維護的需求不斷成長

- 人工智慧與資料分析的整合

- 產業陷阱與挑戰

- 初期投資成本高

- 網路安全風險

- 市場機會

- 符合排放法規

- 車隊數位化舉措

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 輕型

- 中型

- 重負

第6章:市場估計與預測:按工具,2021 - 2034 年

- 主要趨勢

- 掃描儀

- 分析器

- 系統專用工具

- 遠端資訊處理

第7章:市場估計與預測:依商業模式,2021 - 2034 年

- 主要趨勢

- 購買

- 基於訂閱

- 按使用付費

第8章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- 藍牙

- 無線上網

- USB

- 蜂巢

- 雲

第9章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 故障檢測與診斷

- 預測性和預防性維護

- 效能監控和校準

- 維修和保養服務

- 車輛追蹤和遠端資訊處理服務

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Autel Intelligent Technology

- Bendix

- Bosch

- Cojali USA

- Continental AG

- Cummins

- Daimler Trucks

- Delphi Technologies

- Denso

- Knorr-Bremse

- Meritor

- Navistar

- Noregon Systems

- PACCAR

- Snap-on

- Tech Mahindra

- TEXA

- Valeo

- Volvo Group

- ZF Friedrichshafen

The Global Commercial Vehicle Electronic Service Tools Market was valued at USD 41.4 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 90 billion by 2034. The rapid integration of advanced electronics into commercial vehicles, including engine control units (ECUs), telematics systems, and driver-assistance technologies, has significantly increased the demand for high-tech diagnostic tools. With traditional mechanical servicing becoming inadequate, fleet operators and service centers are adopting advanced electronic tools to provide real-time diagnostics, software updates, and precise fault detection. These tools help reduce vehicle downtime, optimize fleet performance, and enhance maintenance efficiency. As the global commercial vehicle fleet grows, driven by the boom in e-commerce, logistics, and supply chain sectors, the need for regular diagnostics and maintenance is intensifying.

Fleet managers are increasingly relying on predictive maintenance solutions, powered by electronic service tools, to minimize downtime and improve resource allocation. This trend is especially critical as commercial vehicles experience increased wear and tear from extended operational hours, particularly in industries like logistics, construction, and long-haul trucking. The continuous operation of these vehicles puts added pressure on components, accelerating the need for frequent maintenance and timely diagnostics. With the growing demands on fleets, service providers and tool manufacturers are finding significant opportunities to introduce innovative solutions that can optimize maintenance schedules and enhance vehicle longevity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.4 Billion |

| Forecast Value | $90 Billion |

| CAGR | 9.2% |

In 2024, the heavy-duty vehicle segment held a 47% share. This growth is driven by the increasing use of heavy-duty vehicles in global logistics, where real-time data and remote diagnostics are vital for ensuring operational efficiency, regulatory compliance, and quick problem resolution. As the logistics industry becomes more reliant on advanced technologies to improve fleet management, the demand for specialized electronic service tools continues to surge. These tools help monitor key vehicle parameters, such as fuel consumption, engine performance, and driver behavior, thus enhancing fleet operations, minimizing downtime, and maintaining regulatory standards, especially in cross-border transportation.

The scanners segment held a 41% share in 2024 and is expected to grow at a CAGR of 11.1% through 2034. The continuous evolution of diagnostic scanners has made them more versatile and efficient in diagnosing complex vehicle systems. New advancements, such as wireless communication capabilities, touchscreen interfaces, and live data streaming, have made these tools indispensable in workshops and service centers. They now offer more functionalities, including ECU programming, system tests, and bi-directional controls, which enhance technician productivity and service accuracy, further driving their adoption.

United States Commercial Vehicle Electronic Service Tools (EST) Market held a dominant 83% share and generated USD 10.8 billion in 2024. The vast and varied commercial vehicle fleet in the U.S. serves as a constant driver for demand in this sector, particularly in industries like long-haul trucking, delivery, and construction. The country's well-established automotive aftermarket infrastructure, including a wide network of independent workshops, OEM-authorized service centers, and fleet maintenance facilities, provides a solid foundation for the growth of electronic service tools.

Key players in the Commercial Vehicle Electronic Service Tools Market include Bendix, Bosch, Continental AG, Cummins, Daimler Trucks, Knorr-Bremse, Navistar, PACCAR, Snap-on, and Volvo. Key strategies that companies are adopting to strengthen their position in the market include the continuous development of advanced diagnostic tools that integrate seamlessly with the latest vehicle technologies. Companies are also focusing on expanding their product offerings to cater to a wide range of vehicle types, from heavy-duty trucks to smaller municipal vehicles. Additionally, partnerships with OEMs and fleet operators are being pursued to ensure tool compatibility with new vehicle models, while investment in research and development is a priority to enhance tool capabilities, such as incorporating artificial intelligence and machine learning for predictive diagnostics. Furthermore, many companies are focusing on expanding their global presence, particularly in emerging markets, to capitalize on the growing fleet and logistics sectors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Tool

- 2.2.4 Business Model

- 2.2.5 Connectivity

- 2.2.6 Application

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising commercial vehicle production

- 3.2.1.2 Growing adoption of telematics & fleet management

- 3.2.1.3 Rising demand for predictive and preventive maintenance

- 3.2.1.4 Integration of AI & data analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Cybersecurity risk

- 3.2.3 Market opportunities

- 3.2.3.1 Emission regulation compliance

- 3.2.3.2 Fleet digitalization initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Light duty

- 5.3 Medium-duty

- 5.4 Heavy-duty

Chapter 6 Market Estimates & Forecast, By Tool, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Scanners

- 6.3 Analyzers

- 6.4 System-specific tools

- 6.5 Telematics

Chapter 7 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Purchase

- 7.3 Subscription-based

- 7.4 Pay-per-use

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Bluetooth

- 8.3 Wi-Fi

- 8.4 USB

- 8.5 Cellular

- 8.6 Cloud

Chapter 9 Market Estimates & Forecast, By Application, 2021- 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Fault detection & diagnostics

- 9.3 Predictive & preventive maintenance

- 9.4 Performance monitoring & calibration

- 9.5 Repair & maintenance services

- 9.6 Vehicle tracking & telematics service

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021- 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Autel Intelligent Technology

- 12.2 Bendix

- 12.3 Bosch

- 12.4 Cojali USA

- 12.5 Continental AG

- 12.6 Cummins

- 12.7 Daimler Trucks

- 12.8 Delphi Technologies

- 12.9 Denso

- 12.10 Knorr-Bremse

- 12.11 Meritor

- 12.12 Navistar

- 12.13 Noregon Systems

- 12.14 PACCAR

- 12.15 Snap-on

- 12.16 Tech Mahindra

- 12.17 TEXA

- 12.18 Valeo

- 12.19 Volvo Group

- 12.20 ZF Friedrichshafen