|

市場調查報告書

商品編碼

1773336

硫化固體橡膠市場機會、成長動力、產業趨勢分析及2025-2034年預測Vulcanised Solid Rubber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

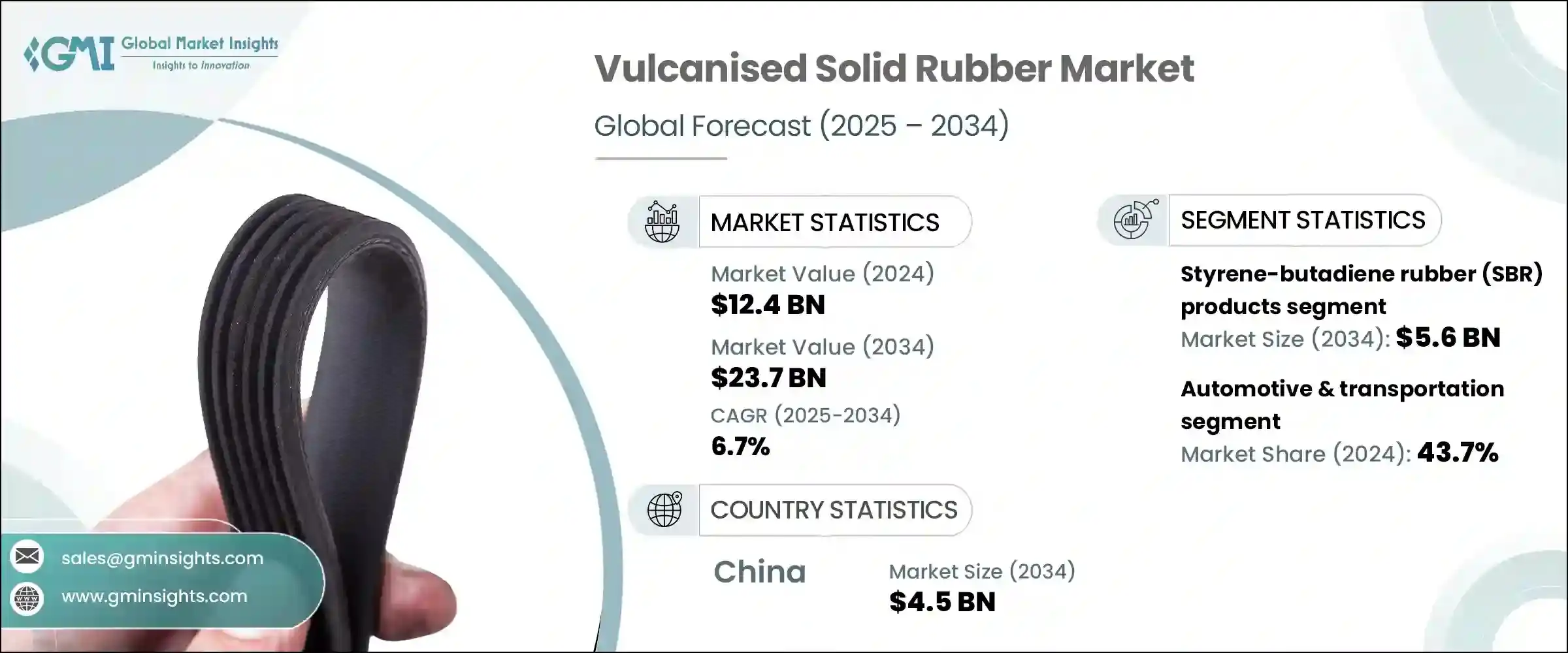

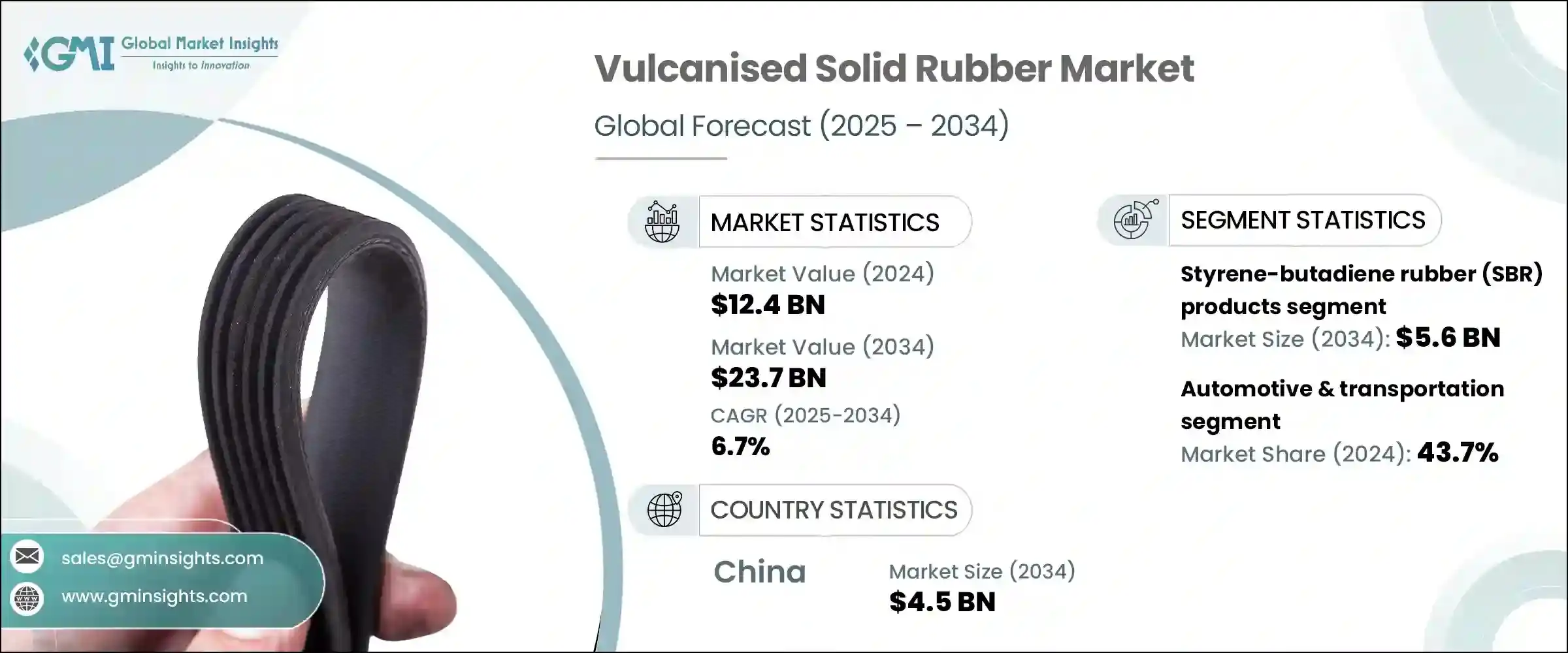

2024年,全球硫化固體橡膠市場規模達124億美元,預計到2034年將以6.7%的複合年成長率成長,達到237億美元。這一成長趨勢主要得益於汽車和建築業消費的成長,尤其是在歐洲等成熟地區和中國等快速發展的經濟體。硫化固體橡膠以其卓越的耐候性、高耐用性和高彈性,持續受到市場關注,成為各種工業應用中必備的材料。全球各行各業越來越依賴其在密封、減震、防護墊和耐用地板系統方面的卓越性能。其在高機械應力和各種環境因素下的穩健性能,確保了成熟和新興工業市場對其需求的持續成長。

該材料能夠承受溫度波動並提供可靠的隔熱性能,使其成為注重長壽命和高韌性的製造環境中的首選材料。隨著全球基礎設施支出反彈,尤其是在東南亞和中東部分地區,越來越多的專案開始採用工業級橡膠解決方案,以實現長期效率。同時,汽車產業的持續轉型——尤其是向電動車和混合動力車的轉變——預計將進一步增強對隔音、減震和增強熱管理材料的需求。因此,硫化固態橡膠擴大被應用於先進的汽車設計中,從而推動了產業創新和零件整合的蓬勃發展。這些不斷變化的需求促使供應商透過提供更永續、性能導向和應用針對性的下一代橡膠配方來適應市場變化,從而進一步推動市場發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 124億美元 |

| 預測值 | 237億美元 |

| 複合年成長率 | 6.7% |

就產品類型而言,丁苯橡膠 (SBR) 繼續佔據全球市場主導地位。該細分市場在 2024 年創造了 29 億美元的收入,預計到 2034 年將成長至 56 億美元,複合年成長率為 6.9%。 SBR 的受歡迎程度源自於其成本效益和卓越的機械性能,尤其是在高摩擦和高磨損應用中。其耐磨性和老化穩定性使其非常適合用於墊圈、密封件、皮帶和工業墊等零件。此外,該材料與天然橡膠完美融合,提高了其在汽車、鞋類和建築等不同行業的適應性。這種相容性不僅增強了其物理性能,還拓寬了其用途範圍,鞏固了其在市場上的主導地位。

按應用細分,汽車和運輸業在 2024 年佔據全球硫化固體橡膠市場的最大佔有率,收入貢獻率為 43.7%。該行業的領先地位得益於硫化橡膠零件在需要耐熱性、耐油性和耐應力性的汽車部件中的廣泛應用。這些特性使該材料非常適合用於引擎支架、車身底部護板、地板襯裡和噪音控制系統。隨著電動車的發展勢頭強勁,該行業對橡膠在非結構性但關鍵部件(例如噪音、振動和聲振粗糙度 (NVH) 降低系統)中的依賴日益明顯。電動車對更安靜的座艙和隔熱性能的需求正在推動橡膠配方的創新,並擴大其在新移動平台上的相關性。

從地區來看,中國已成為主要貢獻者,2024年創造了23億美元的收入,預計到2034年將達到45億美元,複合年成長率為6.9%。中國強大的市場地位得益於其龐大的生產能力和持續向創新製造業轉型。儘管原料成本不斷上漲,但本土生產商仍在加緊研發高性能橡膠化合物,以滿足全球市場的品質期望。中國強調自力更生和技術進步,促進了增值橡膠產品的廣泛應用,增強了其在國際舞台上的競爭力。此外,國內消費持續穩定成長,支撐了內需並推動了長期成長機會。

全球硫化固體橡膠產業仍高度整合,前五大市場參與者佔據了超過40%的市場。這些公司透過垂直整合、全面的產品供應和廣泛的製造網路來保持競爭優勢。領先的企業正在大力投資研發先進的生物基橡膠化合物,這些化合物揮發性有機化合物 (VOC) 含量低,能夠在嚴苛條件下維持更長的使用壽命。策略性收購也在塑造市場方面發揮著重要作用,主要公司透過有針對性地收購利基複合生產商以及與區域生產商建立合資企業來擴大其業務範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計數據

(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 天然橡膠(NR)產品

- 丁苯橡膠(SBR)產品

- 丁二烯橡膠(BR)產品

- 三元乙丙橡膠(EPDM)產品

- 丁腈橡膠(NBR)產品

- 氯丁橡膠(CR)產品

- 矽橡膠製品

- 其他特殊橡膠製品

第6章:市場估計與預測:依硬度等級,2021 - 2034 年

- 主要趨勢

- 柔軟(硬度 30-50)

- 中等(硬度 50-70)

- 硬(硬度 70-90)

- 超硬(硬度 90+)

第7章:市場估計與預測:按製造程序,2021 - 2034 年

- 主要趨勢

- 壓縮成型

- 傳遞模塑

- 射出成型

- 擠壓

- 壓延

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車與運輸

- 輪胎和輪胎部件

- 密封件和墊圈

- 隔振器和支架

- 軟管和皮帶

- 其他汽車零件

- 工業機械和設備

- 工業密封件和墊圈

- 傳送帶及部件

- 滾輪和輪子

- 隔振系統

- 其他工業應用

- 建築與基礎設施

- 橋樑支座和伸縮縫

- 隔震系統

- 防水密封產品

- 地板和鋪路材料

- 其他建築應用

- 電氣和電子產品

- 絕緣和電纜組件

- 連接器和密封件

- 其他電氣應用

- 醫療保健和醫療器械

- 醫用導管及組件

- 瓶塞和密封件

- 其他醫療應用

- 消費品

- 鞋類部件

- 體育用品

- 家居用品

- 其他消費應用

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Arlanxeo

- Bridgestone Corporation

- Continental AG

- Dow Inc.

- ExxonMobil Corporation

- Freudenberg Group

- Gates Corporation

- Goodyear Tire & Rubber Company

- JSR Corporation

- Kumho Petrochemical

- LANXESS AG

- Michelin

- Momentive Performance Materials Inc.

- NOK Corporation

- Parker Hannifin Corporation

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Trelleborg AB

- Wacker Chemie AG

- Zeon Corporation

The Global Vulcanised Solid Rubber Market was valued at USD 12.4 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 23.7 billion by 2034. This upward trend is largely fueled by rising consumption across the automotive and construction industries, particularly in well-established regions like Europe and rapidly advancing economies such as China. Vulcanised solid rubber continues to gain traction due to its impressive resistance to weathering, high durability, and elasticity, making it an essential material in a wide variety of industrial applications. Industries across the globe increasingly rely on it for its performance in sealing, vibration dampening, protective padding, and durable flooring systems. Its robust performance under high mechanical stress and exposure to various environmental factors ensures consistent demand across both mature and emerging industrial markets.

The material's ability to withstand temperature fluctuations and provide reliable insulation positions it as a preferred choice in manufacturing environments that require longevity and resilience. As infrastructure spending rebounds globally, especially across Southeast Asia and parts of the Middle East, more projects are turning to industrial-grade rubber solutions for long-term efficiency. Meanwhile, the ongoing transformation of the automotive sector-particularly the shift toward electric and hybrid mobility-is expected to further strengthen demand for materials that deliver noise insulation, vibration control, and enhanced thermal management. As a result, vulcanized solid rubber is increasingly being adopted in advanced vehicle designs, supporting a surge in innovation and component integration within the industry. These evolving requirements are prompting suppliers to adapt by offering next-generation rubber formulations that are more sustainable, performance-oriented, and application-specific, further driving the market's momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $23.7 Billion |

| CAGR | 6.7% |

In terms of product types, styrene-butadiene rubber (SBR) continues to dominate the global market landscape. This segment generated a revenue of USD 2.9 billion in 2024 and is forecasted to grow to USD 5.6 billion by 2034, registering a CAGR of 6.9% over the period. SBR's popularity is driven by its cost-efficiency and exceptional mechanical performance, especially in high-friction and wear-intensive applications. Its abrasion resistance and aging stability make it highly suitable for use in components such as gaskets, seals, belts, and industrial pads. Additionally, the material blends well with natural rubber, improving its adaptability across different industries like automotive, footwear, and construction. This compatibility not only enhances its physical properties but also broadens its range of use cases, reinforcing its dominance in the market.

When segmented by application, the automotive and transportation sector accounted for the largest share of the global vulcanized solid rubber market in 2024, with a revenue contribution of 43.7%. The sector's leadership is underpinned by the broad use of vulcanized rubber parts in vehicle components that demand heat resistance, oil tolerance, and stress durability. These characteristics make the material well-suited for use in engine mounts, underbody shields, floor liners, and noise-control systems. With electric vehicles gaining momentum, the industry's reliance on rubber for non-structural yet critical components such as noise, vibration, and harshness (NVH) reduction systems is becoming more pronounced. The need for quieter cabins and thermal insulation in EVs is fueling innovation in rubber formulations and expanding their relevance across new mobility platforms.

Regionally, China emerged as a leading contributor, generating USD 2.3 billion in revenue in 2024 and is expected to reach USD 4.5 billion by 2034, growing at a CAGR of 6.9%. The country's strong position is supported by its massive production capacity and ongoing shift towards innovation-led manufacturing. Despite rising raw material costs, local producers are ramping up efforts to develop high-performance rubber compounds that meet the quality expectations of global markets. China's emphasis on self-reliance and technological advancement is fostering greater adoption of value-added rubber products, enhancing its competitiveness on the international stage. Additionally, domestic consumption continues to rise steadily, supporting internal demand and driving long-term growth opportunities.

The global vulcanized solid rubber industry remains highly consolidated, with the top five market players accounting for over 40% of the total share. These companies maintain a competitive edge through vertical integration, comprehensive product offerings, and expansive manufacturing networks. Leading players are investing heavily in research and development to engineer advanced rubber compounds that are bio-based, low in volatile organic compounds (VOCs), and capable of withstanding longer life cycles under demanding conditions. Strategic acquisitions are also playing a significant role in shaping the market, with major companies expanding their footprint through targeted takeovers of niche compounders and joint ventures with regional producers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Natural rubber (NR) products

- 5.3 Styrene-butadiene rubber (SBR) products

- 5.4 Butadiene rubber (BR) products

- 5.5 Ethylene propylene diene monomer (EPDM) products

- 5.6 Nitrile rubber (NBR) products

- 5.7 Chloroprene rubber (CR) products

- 5.8 Silicone rubber products

- 5.9 Other specialty rubber products

Chapter 6 Market Estimates and Forecast, By Hardness Grade, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Soft (shore a 30-50)

- 6.3 Medium (shore a 50-70)

- 6.4 Hard (shore a 70-90)

- 6.5 Extra hard (shore a 90+)

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Compression molding

- 7.3 Transfer molding

- 7.4 Injection molding

- 7.5 Extrusion

- 7.6 Calendering

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.2.1 Tires & tire components

- 8.2.2 Seals & gaskets

- 8.2.3 Vibration isolators & mounts

- 8.2.4 Hoses & belts

- 8.2.5 Other automotive components

- 8.3 Industrial machinery & equipment

- 8.3.1 Industrial seals & gaskets

- 8.3.2 Conveyor belts & components

- 8.3.3 Rollers & wheels

- 8.3.4 Vibration isolation systems

- 8.3.5 Other industrial applications

- 8.4 Construction & infrastructure

- 8.4.1 Bridge bearings & expansion joints

- 8.4.2 Seismic isolation systems

- 8.4.3 Waterproofing & sealing products

- 8.4.4 Flooring & paving materials

- 8.4.5 Other construction applications

- 8.5 Electrical & electronics

- 8.5.1 Insulation & cable components

- 8.5.2 Connectors & seals

- 8.5.3 Other electrical applications

- 8.6 Healthcare & medical devices

- 8.6.1 Medical tubing & components

- 8.6.2 Stoppers & seals

- 8.6.3 Other medical applications

- 8.7 Consumer goods

- 8.7.1 Footwear components

- 8.7.2 Sporting goods

- 8.7.3 Household products

- 8.7.4 Other consumer applications

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arlanxeo

- 10.2 Bridgestone Corporation

- 10.3 Continental AG

- 10.4 Dow Inc.

- 10.5 ExxonMobil Corporation

- 10.6 Freudenberg Group

- 10.7 Gates Corporation

- 10.8 Goodyear Tire & Rubber Company

- 10.9 JSR Corporation

- 10.10 Kumho Petrochemical

- 10.11 LANXESS AG

- 10.12 Michelin

- 10.13 Momentive Performance Materials Inc.

- 10.14 NOK Corporation

- 10.15 Parker Hannifin Corporation

- 10.16 Shin-Etsu Chemical Co., Ltd.

- 10.17 Sumitomo Rubber Industries, Ltd.

- 10.18 Trelleborg AB

- 10.19 Wacker Chemie AG

- 10.20 Zeon Corporation