|

市場調查報告書

商品編碼

1773333

家禽養殖設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Poultry Farming Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

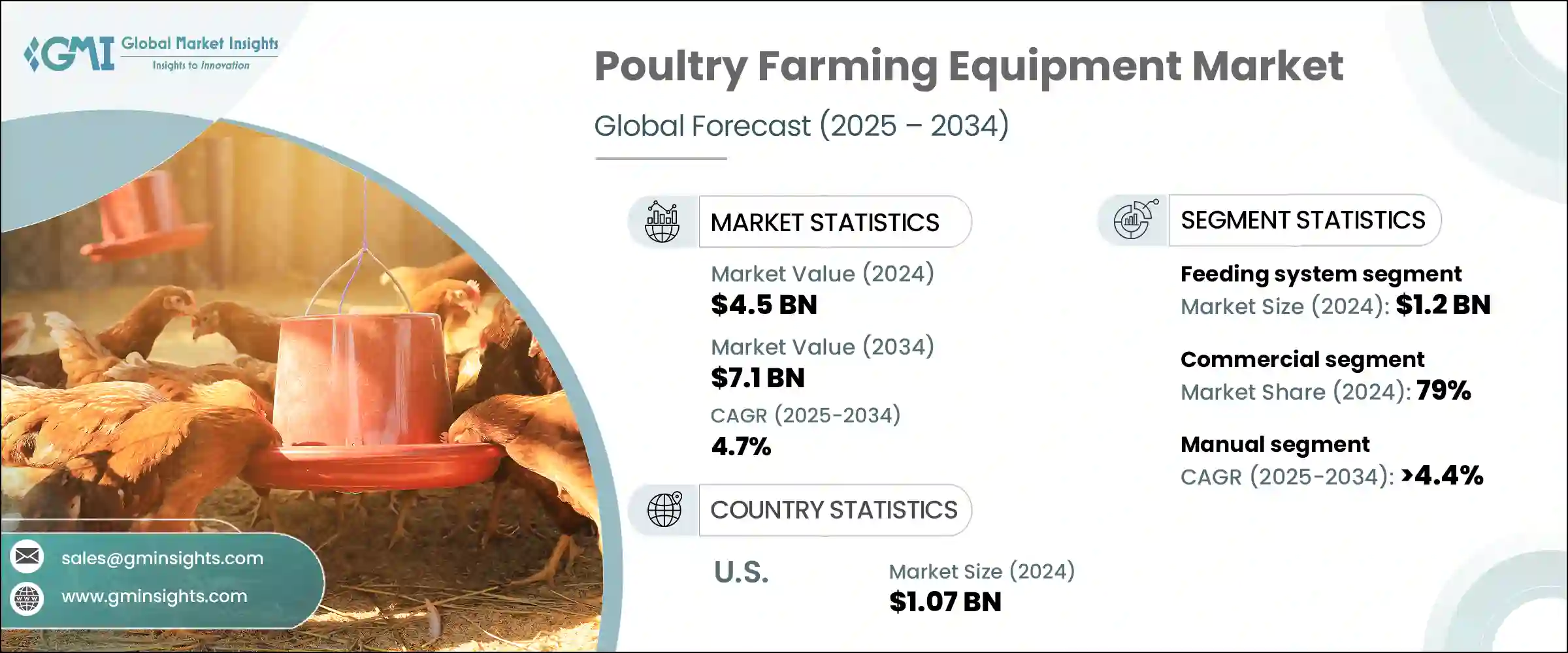

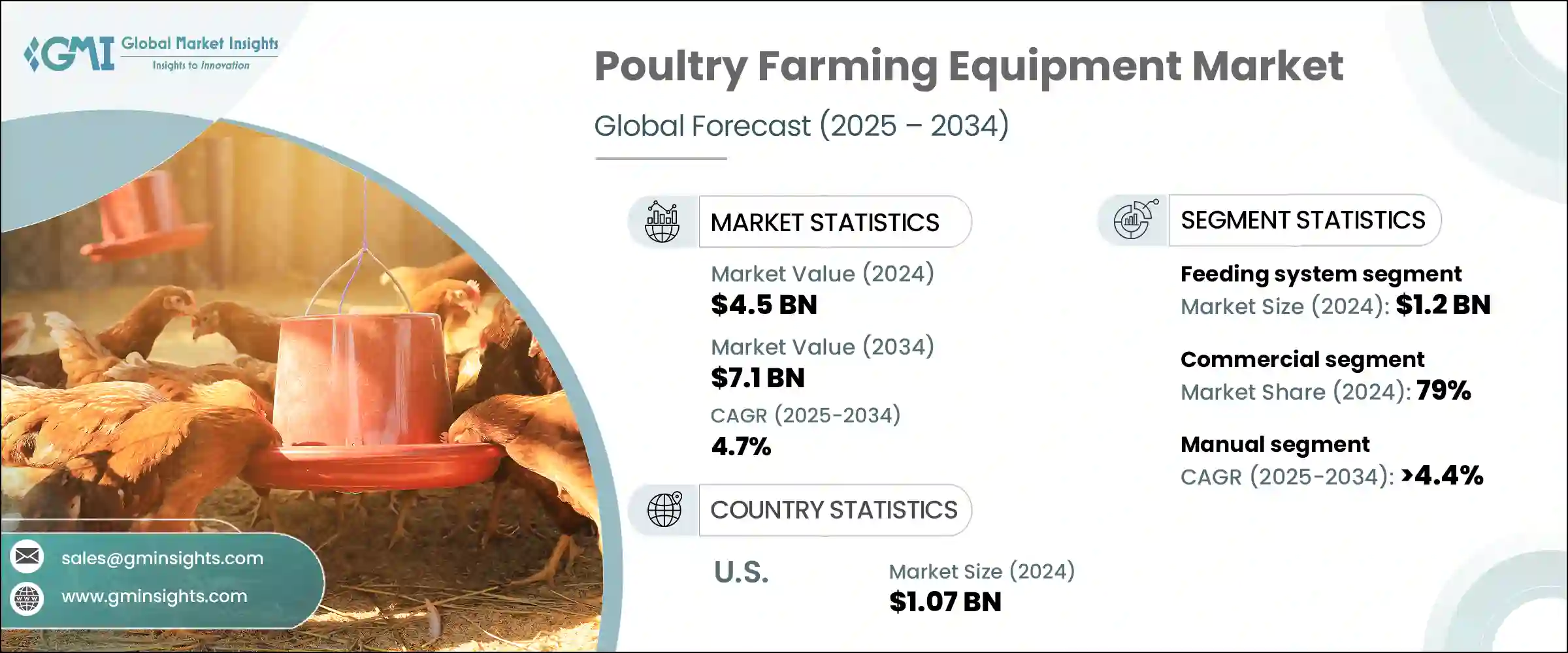

2024年,全球家禽養殖設備市場規模達45億美元,預計2034年將以4.7%的複合年成長率成長,達到71億美元。隨著消費者日益轉向高蛋白飲食,全球對雞蛋和肉類等家禽產品的需求持續成長。這種需求激增在發展中國家尤其突出,這些國家的收入成長和快速的城市化推動了家禽產品的消費。快餐連鎖店的影響力日益增強,以及即食家禽產品的供應日益豐富,促使生產商投資高效的養殖設備。

數位商務平台的擴張也簡化了供應鏈,間接推動了對自動化、可擴展家禽養殖工具的需求。旨在提高營運效率和動物福利的現代技術正日益受到關注。創新解決方案正在實施,以平衡空間效率和自動化程度,支援更健康的禽類飼養條件和最佳化的飼餵系統。精準農業的趨勢和對更高生產力的追求,正在推動人們轉向更先進的設備解決方案。農場設施內更舒適的環境、更衛生的設施和更自動化的設施如今已成為成功家禽養殖的關鍵要素,並支持更永續、更有效率的家禽養殖生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 71億美元 |

| 複合年成長率 | 4.7% |

2024年,飼餵系統細分市場產值達12億美元,預計到2034年將以4.7%的複合年成長率成長。自動化飼餵解決方案正迅速被尋求簡化操作流程和減少人工的家禽生產商所採用。定時分配系統和精密設計的料斗的使用有助於農民控制飼料用量並最佳化生長結果。精準飼餵技術的發展正在促進這一類別的進一步需求。消費者對符合倫理飼養的家禽日益成長的關注,以及動物福利監管標準的不斷提高,正在推動現代籠養系統的普及。這些系統,加上對禽舍內高品質環境管理日益成長的需求,正在推動先進氣候控制技術的發展。

商業化養殖業在2024年佔據了79%的市場佔有率,預計2025年至2034年的複合年成長率將達到4.9%。全球對家禽產品的大量需求促使商業業者大力投資自動化養殖設備。這些先進的機器有助於降低勞動力成本,並使生產商能夠更有效率地滿足需求。隨著家禽成為各地區重要的蛋白質來源,商業化農場將生產力、一致性和衛生放在首位,從而持續依賴智慧且可擴展的解決方案。

歐洲家禽養殖設備市場在2024年創收8億美元,預計2034年將以4.2%的複合年成長率成長。該地區商業農場的擴張加速了對耐用、高容量的大規模設備管理營運的需求。政府的支持計畫和推動創新農業技術應用的政策措施也促進了市場擴張。這些激勵措施鼓勵生產商採用尖端機械來提高產量和效率,使他們能夠滿足家禽業不斷變化的需求。

引領產業發展的領導者包括SKA、青島華博、Hellmann Poultry、Potters Poultry、Valco Industries、Zucami Poultry Equipment、Texha、Officine Facco、PEP Poultry Equipment Plus、AGICO、Roxell、Big Dutchman、Hightop、Tecnotry Equipment Plus、AGICO、Roxell、Big Dutchman、Hightop、Tecnotry、Tecno。這些關鍵企業透過產品創新和策略成長,在推動市場發展方面發揮重要作用。為了鞏固其在家禽養殖設備行業的地位,頂級製造商正在積極擴展產品線,將自動化、節能和動物福利功能融入其設備中。與商業家禽農場的合作使企業能夠根據特定的營運需求客製化解決方案。研發投入促進了使用者友善和精準型技術的開發,從而改善了農場管理。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼-84369100)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 進料系統

- 澆水系統

- 籠養系統

- 蛋雞籠

- 肉雞籠

- 飼養籠

- 氣候控制系統

- 通風系統

- 暖氣系統

- 冷卻系統

- 孵化設備

- 雞蛋處理設備

- 其他(照明系統等)

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第7章:市場估計與預測:依家禽類型,2021 - 2034 年

- 主要趨勢

- 雞

- 鴨子

- 土耳其

- 其他(鵝、兔子等)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 家庭

- 商業的

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AGICO

- Big Dutchman

- Hellmann Poultry

- Hightop

- Officine Facco

- PEP Poultry Equipment Plus

- Potters Poultry

- Qingdao Huabo

- Roxell

- SKA

- Tavsan

- Tecno Poultry Equipment

- Texha

- Valco Industries

- Zucami Poultry Equipment

The Global Poultry Farming Equipment Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 7.1 billion by 2034. Demand for poultry products like eggs and meat continues to rise worldwide as consumers increasingly shift toward protein-rich diets. This surge in demand is notably prominent in developing countries, where rising incomes and rapid urbanization are driving the consumption of poultry products. The growing influence of fast-food chains and increased availability of ready-to-eat poultry items are compelling producers to invest in high-efficiency farming equipment.

The expansion of digital commerce platforms is also simplifying the supply chain, indirectly pushing the demand for automated, scalable poultry farming tools. Modern technologies designed to improve operational efficiency and animal welfare are gaining traction. Innovative solutions are being implemented to balance space efficiency and automation, supporting healthier bird-rearing conditions and optimized feeding systems. The trend toward precision farming and the push for higher productivity is reinforcing the shift toward more advanced equipment solutions. Enhanced comfort, sanitation, and automation within farming facilities are now becoming essential components of successful poultry operations, supporting a more sustainable and efficient poultry farming ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 4.7% |

In 2024, the feeding system segment generated USD 1.2 billion in 2024 and is anticipated to grow at a 4.7% CAGR throughout 2034. Automatic feeding solutions are rapidly being adopted by poultry producers looking to streamline operations and reduce manual labor. The use of timed distribution systems and precision-engineered hoppers is helping farmers control feed portions and optimize growth outcomes. Developments in precision feeding technologies are fostering further demand in this category. Increasing consumer concern for ethically raised poultry and growing regulatory standards around animal welfare are pushing the adoption of modern cage systems. These systems, combined with the increasing demand for high-quality environmental management within poultry houses, are driving the growth of advanced climate control technologies.

The commercial farming sector held a 79% share in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The global appetite for poultry products in large volumes pushes commercial operators to invest heavily in automated farming equipment. These advanced machines help reduce labor expenses and allow producers to meet demand more efficiently. As poultry becomes a key protein source across regions, commercial farms are prioritizing productivity, consistency, and hygiene, driving the continued reliance on smart and scalable solutions.

Europe Poultry Farming Equipment Market generated USD 0.8 billion in 2024 and is projected to grow at a CAGR of 4.2% through 2034. The expansion of commercial farms across the region is accelerating demand for durable and high-capacity equipment management operations at scale. Government support programs and policy initiatives promoting the adoption of innovative agricultural technology are also contributing to market expansion. These incentives are encouraging producers to embrace cutting-edge machinery to improve yield and efficiency, enabling them to cater to the evolving demands of the poultry sector.

Leading companies shaping the industry include SKA, Qingdao Huabo, Hellmann Poultry, Potters Poultry, Valco Industries, Zucami Poultry Equipment, Texha, Officine Facco, PEP Poultry Equipment Plus, AGICO, Roxell, Big Dutchman, Hightop, Tecno Poultry Equipment, and Tavsan. These key players are playing an instrumental role in pushing the market forward through product innovation and strategic growth. To enhance their position in the poultry farming equipment industry, top manufacturers are actively expanding product lines by integrating automation, energy efficiency, and animal welfare features into their equipment. Partnerships and collaborations with commercial poultry farms allow companies to tailor solutions to specific operational needs. Investment in R&D enables the development of user-friendly and precision-based technologies to improve farm management.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By equipment type

- 2.2.3 By mode of operation

- 2.2.4 By poultry type

- 2.2.5 By end use

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-84369100)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Feeding system

- 5.3 Watering system

- 5.4 Cage system

- 5.4.1 Layer cage

- 5.4.2 Broiler cage

- 5.4.3 Breeder cage

- 5.5 Climate control system

- 5.5.1 Ventilation system

- 5.5.2 Heating system

- 5.5.3 Cooling system

- 5.6 Incubation equipment

- 5.7 Egg handling equipment

- 5.8 Others (lighting system etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Poultry Type, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Chicken

- 7.3 Duck

- 7.4 Turkey

- 7.5 Others (geese, rabbit etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AGICO

- 11.2 Big Dutchman

- 11.3 Hellmann Poultry

- 11.4 Hightop

- 11.5 Officine Facco

- 11.6 PEP Poultry Equipment Plus

- 11.7 Potters Poultry

- 11.8 Qingdao Huabo

- 11.9 Roxell

- 11.10 SKA

- 11.11 Tavsan

- 11.12 Tecno Poultry Equipment

- 11.13 Texha

- 11.14 Valco Industries

- 11.15 Zucami Poultry Equipment