|

市場調查報告書

商品編碼

1773331

工業爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Furnaces Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

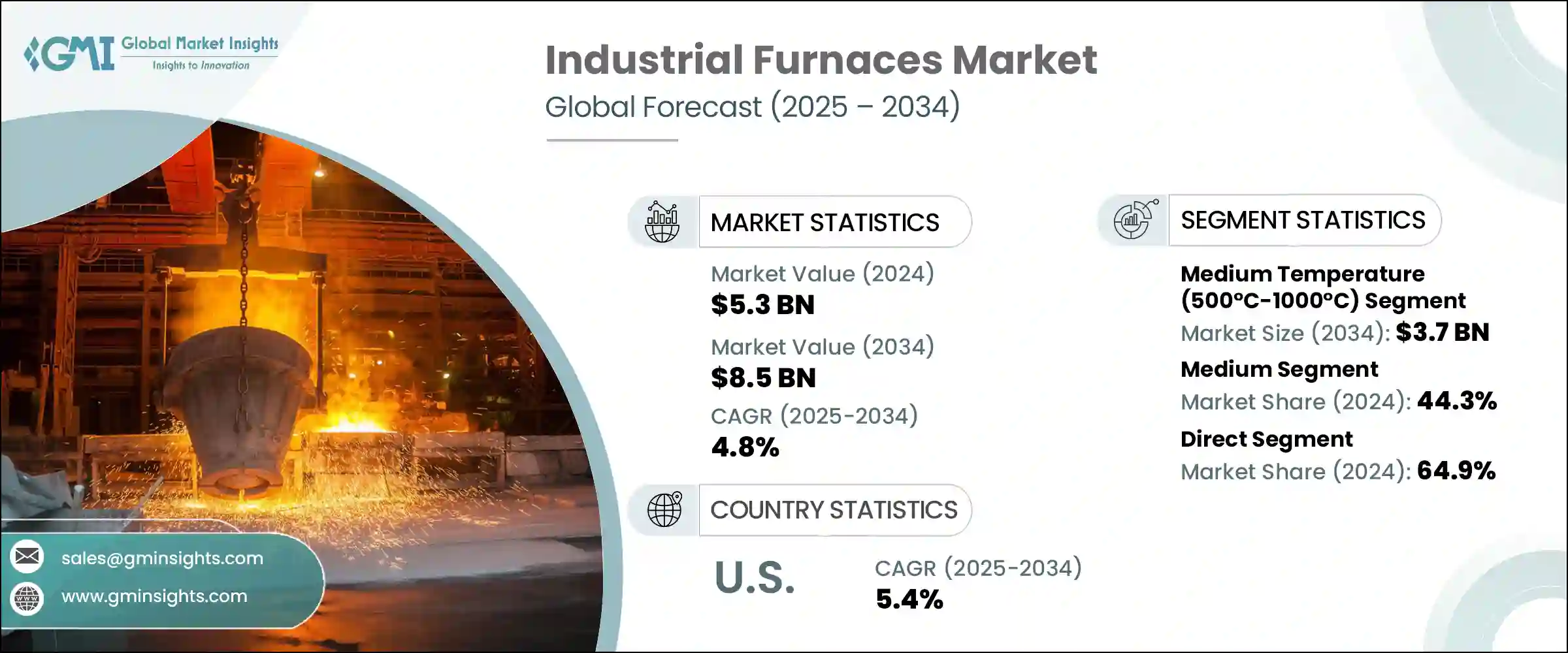

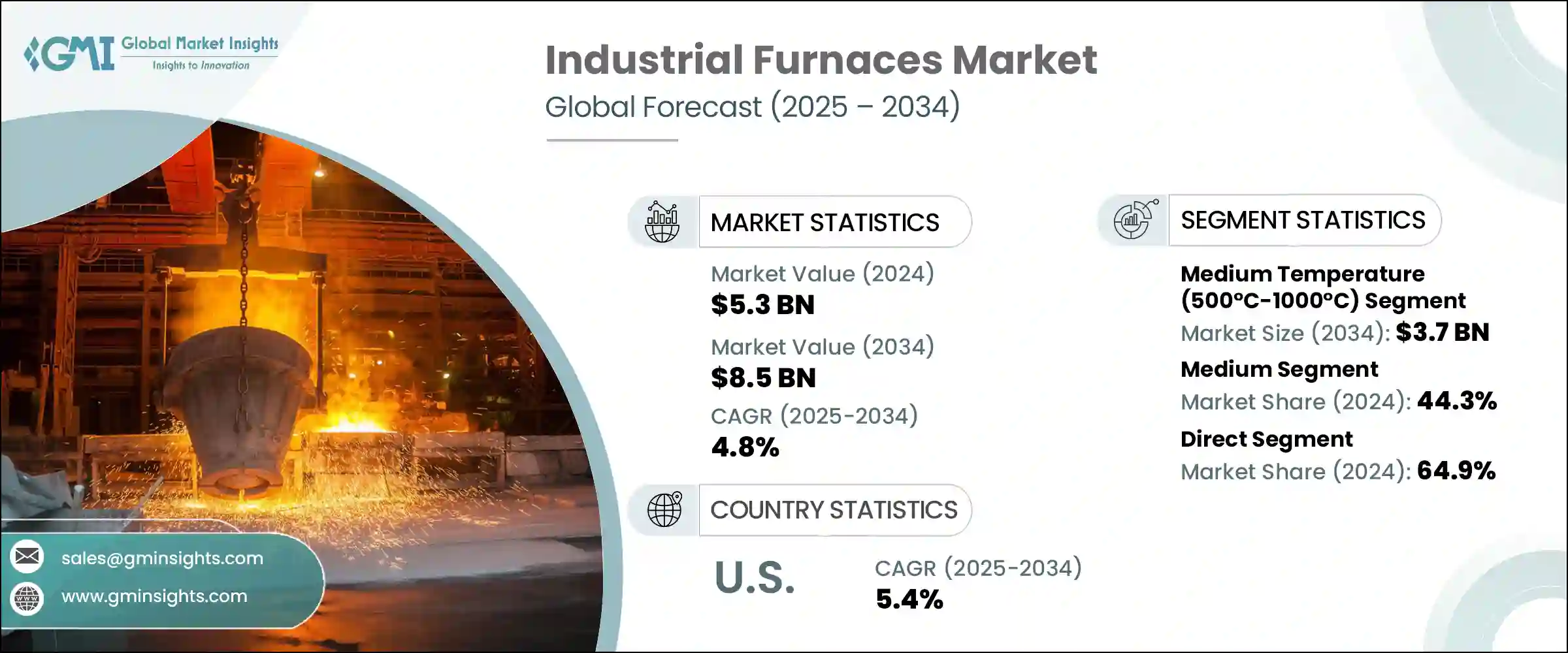

2024 年全球工業爐市場規模為 53 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長,達到 85 億美元。金屬和鋼鐵業是這一成長的關鍵貢獻者,因為工業爐對於熔煉、退火和回火等高溫製程至關重要,而這些製程是金屬成型和處理所必需的。基礎設施、汽車生產和工業發展的需求不斷成長,尤其是在中國、印度和美國等地區,這推動了對更有效率、更耐用的熔爐的需求。與傳統高爐相比,電弧爐 (EAF) 的排放量更低、能源效率更高,其應用日益廣泛是另一個重要趨勢。電弧爐目前約佔全球鋼鐵產量的 30%,進一步增加了全球對先進熔爐技術的需求。

除了日益重視脫碳之外,各行各業也擴大轉向替代加熱技術,例如氫焰和電弧,以減少碳足跡。這些替代方案被視為轉型為更永續的製造流程的關鍵解決方案。例如,氫焰是一種清潔的燃燒方式,僅排放水蒸氣,使其成為減少高溫製程排放的理想選擇。電弧爐 (EAF) 在鋼鐵生產中已經非常普及,其與傳統爐技術相比,其減少碳排放的能力也正在受到人們的探索。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 85億美元 |

| 複合年成長率 | 4.8% |

工業爐市場的中溫部分在2024年創收22億美元,預計2034年將達到37億美元。中溫爐工作溫度在500°C至1000°C之間,由於其多功能性和處理各種熱處理製程的能力,在全球市場仍佔據主導地位。由於其能夠加工金屬和合金,中溫爐廣泛應用於汽車、航太和電子製造等產業。

中容量爐市場在2024年佔據44.3%的市場佔有率,預計到2034年將以4.4%的複合年成長率成長。這類爐尤其適用於需要頻繁溫度循環和中等吞吐量的中型工業應用。機械製造、汽車零件生產和鑄造廠等行業依靠中溫爐進行持續的品質控制並滿足生產要求。

2024年,美國工業爐市場規模達7億美元,預計2034年將以5.4%的複合年成長率維持強勁成長。憑藉先進的製造能力和節能爐技術的日益普及,美國將繼續引領北美工業爐市場。金屬加工廠、航太工廠和汽車產業正在推動對新型高效工業爐的需求,因為這些產業致力於減少排放並提高生產力。北美,尤其是美國、加拿大和墨西哥,憑藉其成熟的製造業基礎和對永續生產實踐的重視,在全球市場佔有重要佔有率。

工業爐市場的主要參與者包括 Harper International、SECO/WARWICK SA、Tenova SpA、Despatch Industries、Carbolite Gero、Lindberg/MPH、Gasbarre Thermal Processing Systems、Nabertherm GmbH、Inductotherm Group、Sur Combustion, Inc.、ABB、Ipsen Corporation、ABductotherm Group、Sur Combustion, Inc.、ABB、Ipsen ABL、VelUm.工業爐市場的公司正在採取多項關鍵策略來鞏固其市場地位。其中一項主要策略是專注於技術創新,例如開發更節能、更永續的爐子。

企業正在大力投資研發,以提高電弧爐 (EAF) 的性能,並探索氫焰等替代方案,以實現脫碳目標。此外,這些企業正致力於透過與汽車、航太和金屬加工等關鍵產業的製造商建立策略合作夥伴關係和協作,擴大其全球影響力。另一項策略是提供客製化解決方案,以滿足不同行業的特定需求,增強其市場吸引力並確保長期的客戶關係。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS 代碼 - 8417)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依熔爐類型,2021-2034

- 主要趨勢

- 電爐

- 瓦斯爐

- 燃油爐

- 煤炭爐

- 感應爐

- 電弧爐

- 其他

第6章:市場估計與預測:依溫度,2021-2034 年

- 主要趨勢

- 低溫(500°C以下)

- 中溫(500度C-1000度C)

- 高溫(1000°C以上)

第7章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 小的

- 中等的

- 大的

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 汽車

- 航太

- 有色金屬

- 化工和石化

- 石油和天然氣

- 食品和飲料

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第 11 章:公司簡介

- ABB

- ANDRITZ AG

- Carbolite Gero

- Despatch Industries

- Gasbarre Thermal Processing Systems

- Harper International

- Inductotherm Group

- Ipsen International GmbH

- Lindberg/MPH

- Nabertherm GmbH

- Nutec Bickley

- SECO/WARWICK SA

- Surface Combustion, Inc.

- Tenova SpA

- Wisconsin Oven Corporation

The Global Industrial Furnaces Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 8.5 billion by 2034. The metal and steel industries are key contributors to this growth, as industrial furnaces are essential for high-temperature processes such as melting, annealing, and tempering, which are required for shaping and treating metals. Rising demand for infrastructure, automotive production, and industrial development, particularly in regions like China, India, and the U.S., is driving the need for more efficient and durable furnaces. The increasing adoption of electric arc furnaces (EAFs), which offer lower emissions and higher energy efficiency compared to traditional blast furnaces, is another important trend. EAFs now account for approximately 30% of global steel production, further increasing the demand for advanced furnace technologies worldwide.

In addition to the rising focus on decarbonization, industries are increasingly turning to alternative heating technologies like hydrogen flames and electric arcs to reduce their carbon footprint. These alternatives are seen as key solutions in the transition to more sustainable manufacturing processes. Hydrogen flames, for example, offer a clean burning option that emits only water vapor, making them an attractive choice for reducing emissions in high-temperature processes. Electric arc furnaces (EAFs), already popular in steel production, are also being explored for their ability to reduce carbon emissions compared to traditional furnace technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 4.8% |

The medium-temperature segment of the industrial furnaces market generated USD 2.2 billion in 2024 and is expected to reach USD 3.7 billion by 2034. Medium-temperature furnaces, which operate between 500°C and 1000°C, remain a dominant segment in the global market due to their versatility and ability to handle various heat-treatment processes. These furnaces are widely used across industries, from automotive and aerospace to electronics manufacturing, due to their ability to process metals and alloys.

The medium-capacity segment accounted for a 44.3% share in 2024 and is expected to grow at a CAGR of 4.4% through 2034. These furnaces are particularly favored for mid-sized industrial applications that require frequent temperature cycling and moderate throughput. Industries such as machinery manufacturing, auto parts production, and foundries rely on medium-temperature furnaces for consistent quality control and fulfilling production requirements.

United States Industrial Furnaces Market was valued at USD 700 million in 2024, with projections showing strong growth at a CAGR of 5.4% through 2034. The U.S. continues to lead the North American industrial furnaces market due to its advanced manufacturing capabilities and the increasing adoption of energy-efficient furnace technologies. Metal processing plants, aerospace workshops, and the automotive industry are driving demand for new, high-efficiency industrial furnaces, as these sectors work to reduce emissions and improve productivity. North America, particularly the U.S., Canada, and Mexico, holds a significant share of the global market due to the region's mature manufacturing base and focus on sustainable production practices.

Key players in the Industrial Furnaces Market include Harper International, SECO/WARWICK S.A., Tenova S.p.A., Despatch Industries, Carbolite Gero, Lindberg/MPH, Gasbarre Thermal Processing Systems, Nabertherm GmbH, Inductotherm Group, Surface Combustion, Inc., ABB, Ipsen International GmbH, Wisconsin Oven Corporation, Nutec Bickley, and ANDRITZ AG. Companies in the industrial furnaces market are adopting several key strategies to strengthen their position. One of the main approaches is focusing on technological innovation, such as the development of more energy-efficient and sustainable furnaces.

Companies are investing heavily in research and development to improve the performance of electric arc furnaces (EAFs) and explore alternatives like hydrogen flames to meet decarbonization targets. Additionally, these companies are working on expanding their global footprint through strategic partnerships and collaborations with manufacturers in key industries, such as automotive, aerospace, and metal processing. Another strategy is offering customized solutions to meet the specific needs of various industries, enhancing their market appeal and ensuring long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Furnace type

- 2.2.3 Temperature

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 8417)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Furnace Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric furnaces

- 5.3 Gas furnaces

- 5.4 Oil furnaces

- 5.5 Coal furnaces

- 5.6 Induction furnaces

- 5.7 Arc furnaces

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Temperature, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low temperature (Below 500°C)

- 6.3 Medium temperature (500°C - 1000°C)

- 6.4 High temperature (Above 1000°C)

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Small

- 7.3 Medium

- 7.4 Large

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Non-Ferrous metals

- 8.5 Chemical and petrochemical

- 8.6 Oil and gas

- 8.7 Food and beverage

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 ANDRITZ AG

- 11.3 Carbolite Gero

- 11.4 Despatch Industries

- 11.5 Gasbarre Thermal Processing Systems

- 11.6 Harper International

- 11.7 Inductotherm Group

- 11.8 Ipsen International GmbH

- 11.9 Lindberg/MPH

- 11.10 Nabertherm GmbH

- 11.11 Nutec Bickley

- 11.12 SECO/WARWICK S.A.

- 11.13 Surface Combustion, Inc.

- 11.14 Tenova S.p.A.

- 11.15 Wisconsin Oven Corporation