|

市場調查報告書

商品編碼

1773329

汽車電動液壓動力轉向幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Electro-Hydraulic Power Steering Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

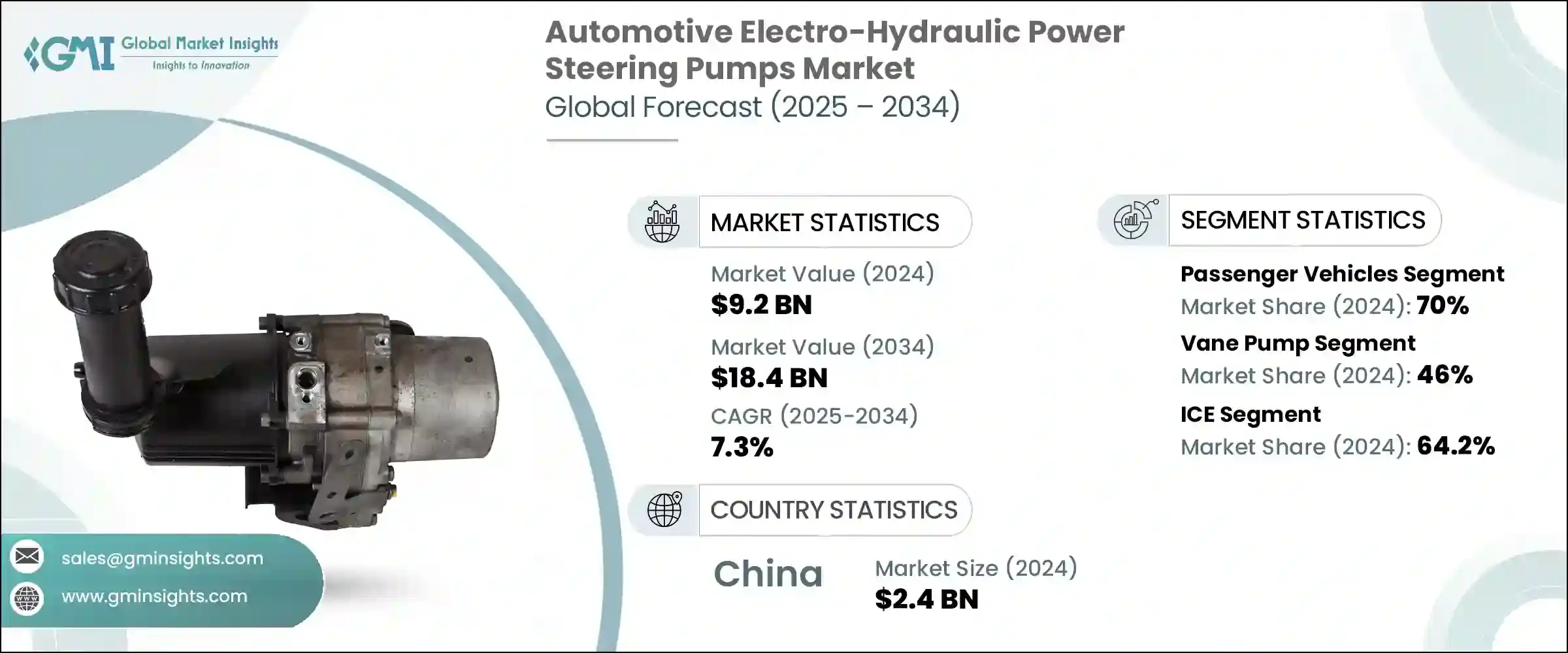

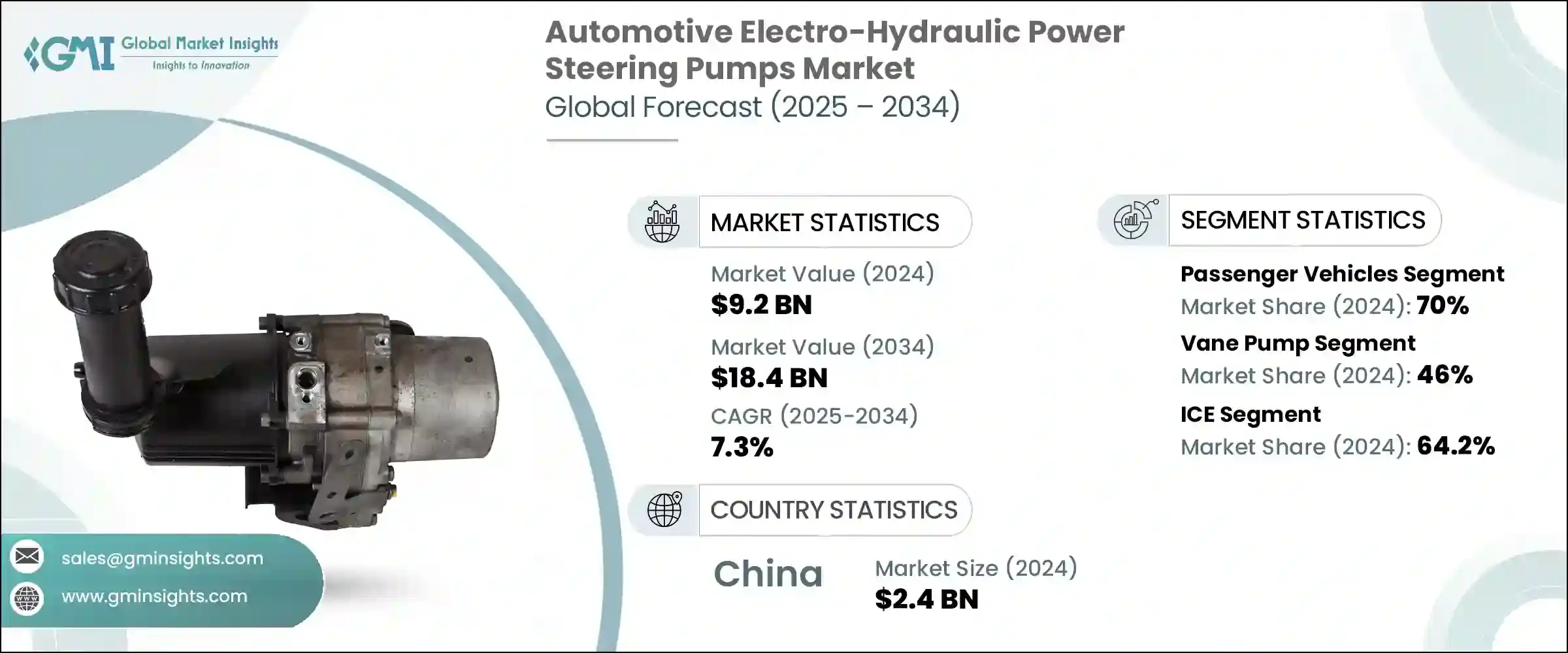

2024 年全球汽車電動液壓輔助轉向幫浦市場價值為 92 億美元,預計到 2034 年將以 7.3% 的複合年成長率成長,達到 184 億美元。這一強勁成長是由全球向節油和低排放汽車轉變的推動力。隨著汽車製造商力求滿足北美、歐洲和中國等地區日益嚴格的環保要求,電動液壓動力轉向幫浦系統正變得越來越重要。與傳統的液壓轉向系統不同,電動液壓動力轉向幫浦技術獨立於引擎運行,僅在需要時啟動。這顯著降低了引擎阻力並降低了油耗。其適應性結構使其非常適合混合動力和輕度混合動力汽車。即使在內燃機關閉(混合動力運轉中的常見情況)的情況下,該系統仍能保持完整的轉向能力,使其成為全電動轉向系統的經濟高效的替代方案。

隨著汽車製造商擴大將高級駕駛輔助功能融入車輛,他們需要更靈敏、更電子控制的轉向輸入。 EHPS 系統滿足了這項需求,即使在採用替代動力系統的車輛中也能確保安全性和精準性。其支援車道維持和防撞等自動化技術的能力,正推動其在各類車輛中的廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92億美元 |

| 預測值 | 184億美元 |

| 複合年成長率 | 7.3% |

乘用車市場佔了70%的市場佔有率,預計到2034年將以7.5%的複合年成長率成長。該市場的產量和需求規模使其成為EHPS成長的主要貢獻者。消費者對更佳操控性、更精緻的駕駛體驗和安全駕駛體驗的期望不斷提高,這促使汽車製造商更廣泛地整合EHPS系統。混合動力和電動乘用車尤其受益於該系統的兼容性和節能潛力,這鼓勵製造商在各種車型中使用EHPS。

葉片泵浦技術領域在2024年佔據46%的市場佔有率,預計到2034年將以8%的複合年成長率成長。這些泵浦因其能夠維持穩定的液壓油流量,從而確保穩定精準的轉向回饋而備受青睞。其設計特點是滑動葉片與泵殼始終保持接觸,從而提供平穩的性能和卓越的駕駛操控性。葉片泵浦也因其安靜的運作和低脈動而備受推崇,使其成為注重座艙舒適性和聲學最佳化的車輛設計的首選。

2024年,中國汽車電控液壓輔助轉向幫浦市場規模達24億美元,佔67%的市佔率。中國加速採用混合動力系統和節能汽車技術,推動了國內外汽車品牌對電控液壓輔助轉向幫浦系統的需求。隨著48V混合動力平台的日益普及,電控液壓輔助轉向幫浦解決方案正廣泛應用。全球一級供應商和本土企業在研發和區域化製造方面的大量投資,進一步鞏固了中國作為關鍵生產和創新中心的地位。 ADAS應用和智慧轉向技術的激增也推動了電控液壓動力轉向幫浦在高階和中階車型的應用。

積極參與全球汽車電動液壓輔助轉向幫浦市場的主要公司包括德爾福科技、採埃孚、羅伯特·博世、耐世特汽車、三菱電機、吉凱恩汽車、捷太格特、日本精工株式會社、現代摩比斯和天納克。為增強在汽車電動液壓輔助轉向幫浦市場的競爭優勢,各公司正在尋求以創新為主導的成長和策略夥伴關係。許多公司正在大力投資研發,以提高電動液壓動力轉向幫浦裝置的能源效率、尺寸和整合靈活性,以滿足原始設備製造OEM) 的要求。其他公司則與本地企業組成合資企業,以最佳化在快速成長的中國等經濟體的市場覆蓋率。簡化製造流程以實現在地化生產並降低成本是另一個突出的策略。各公司也正在擴展其產品組合,推出支援 48V 平台等高壓架構的系統。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對節油轉向系統的需求不斷成長

- 動力總成架構電氣化浪潮

- 與高級駕駛輔助系統 (ADAS) 的整合度不斷提高

- 輕型商用車(LCV)銷售成長

- 擴大新興市場的汽車生產

- 產業陷阱與挑戰

- 與傳統液壓泵相比系統成本較高

- 與全電動汽車架構的兼容性有限

- 市場機會

- 混合動力和輕度混合動力車的普及率不斷上升

- 輕型商用車(LCV)領域的擴張

- 本地化製造和區域生產擴張

- 透過策略合作夥伴關係和合資企業實現成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第6章:市場估計與預測:按泵浦分類,2021 - 2034 年

- 主要趨勢

- 葉片泵

- 齒輪泵浦

- 活塞泵

- 其他

第7章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第8章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車(EV)

- 混合

第9章:市場估計與預測:依組件,2021 - 2034

- 主要趨勢

- 泵浦單元

- 水庫

- 動力方向機油

- 控制單元

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Alltech Automotive

- Cardone Industries

- Delphi Technologies

- GDST Auto Parts

- GKN Automotive

- Hitachi Astemo

- Hyundai Mobis

- JTEKT

- Kartek

- MAPCO Autotechnik

- Maval Manufacturing

- Mitsubishi Electric

- Nexteer Automotive

- NSK Ltd.

- Robert Bosch

- SEAT

- Sheppard Steering

- Tenneco

- Turn One Steering

- ZF Friedrichshafen

The Global Automotive Electro-Hydraulic Power Steering Pumps Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 18.4 billion by 2034. This strong growth is being propelled by the worldwide shift toward fuel-saving and low-emission vehicles. As vehicle manufacturers aim to meet increasingly strict environmental mandates in regions like North America, Europe, and China, EHPS systems are becoming essential. Unlike conventional hydraulic steering, EHPS technology operates independently from the engine, turning on only when needed. This significantly cuts engine drag and lowers fuel use. Its adaptable structure makes it a strong fit for hybrid and mild hybrid vehicles. The system retains full steering capability even when the internal combustion engine is turned off-a common condition in hybrid operations, making it a cost-effective alternative to full electric steering systems.

As automakers increasingly build advanced driver assistance features into vehicles, they require more responsive and electronically controlled steering inputs. EHPS systems meet this need while ensuring safety and precision, even in vehicles with alternative powertrains. Their ability to support automated technologies such as lane centering and collision avoidance is driving their widespread adoption across vehicle categories.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 7.3% |

The passenger vehicles segment held a 70% share and is expected to grow at a CAGR of 7.5% through 2034. The segment's scale in both production and demand makes it a major contributor to EHPS growth. Rising consumer expectations for better handling, refined ride quality, and safe driving experiences are motivating automakers to integrate EHPS systems more extensively. Hybrid and electric passenger vehicles, in particular, benefit from the system's compatibility and energy-saving potential, encouraging manufacturers to use EHPS across a wide spectrum of models.

The vane pump technology segment accounted for 46% share in 2024 and is projected to grow at a CAGR of 8% through 2034. These pumps are preferred for their ability to maintain a consistent flow of hydraulic fluid, ensuring steady and precise steering feedback. Their design features sliding vanes that stay in constant contact with the pump housing, delivering smooth performance and superior driver control. Vane pumps are also valued for their quiet operation and low pulsation, making them a preferred choice in vehicle designs that emphasize cabin comfort and acoustic refinement.

China Automotive Electro-Hydraulic Power Steering Pumps Market generated USD 2.4 billion in 2024 and held a 67% share. The country's accelerated adoption of hybrid systems and energy-conscious automotive technologies has pushed demand for EHPS systems across both domestic and international car brands. With a growing push for 48V hybrid platforms, EHPS solutions are seeing widespread integration. China's position as a key production and innovation hub is further reinforced by heavy investments from both global Tier-1 suppliers and local companies in research, development, and regionalized manufacturing. The surge in ADAS adoption and intelligent steering technologies is also bolstering EHPS implementation across premium and mid-tier vehicle categories.

Major companies actively participating in the Global Automotive Electro-Hydraulic Power Steering Pumps Market include Delphi Technologies, ZF Friedrichshafen, Robert Bosch, Nexteer Automotive, Mitsubishi Electric, GKN Automotive, JTEKT, NSK Ltd., Hyundai Mobis, and Tenneco. To strengthen their competitive edge in the automotive EHPS market, companies are pursuing innovation-led growth and strategic partnerships. Many are investing heavily in R&D to enhance the energy efficiency, size, and integration flexibility of EHPS units meeting OEM requirements. Others are forming joint ventures with local players to optimize market reach in fast-growing economies like China. Streamlining manufacturing processes to localize production and reduce costs is another prominent strategy. Companies are also expanding their product portfolios with systems that support higher-voltage architectures like 48V platforms.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Technology

- 2.2.4 Suspension

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for fuel-efficient steering systems

- 3.2.1.2 Surge in electrification of powertrain architectures

- 3.2.1.3 Rising integration with advanced driver-assistance systems (ADAS)

- 3.2.1.4 Increasing sales of light commercial vehicles (LCVs)

- 3.2.1.5 Expansion of vehicle production in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High system cost compared to traditional hydraulic pumps

- 3.2.2.2 Limited compatibility with fully electric vehicle architectures

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of hybrid and mild-hybrid vehicles

- 3.2.3.2 Expansion of the light commercial vehicle (LCV) segment

- 3.2.3.3 Localized manufacturing and regional production expansion

- 3.2.3.4 Growth through strategic partnerships and joint ventures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Pump, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Vane pump

- 6.3 Gear pump

- 6.4 Piston pump

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Sales channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Propulsions, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric Vehicles (EVs)

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Pump unit

- 9.3 Reservoir

- 9.4 Power steering fluid

- 9.5 Control unit

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Alltech Automotive

- 11.2 Cardone Industries

- 11.3 Delphi Technologies

- 11.4 GDST Auto Parts

- 11.5 GKN Automotive

- 11.6 Hitachi Astemo

- 11.7 Hyundai Mobis

- 11.8 JTEKT

- 11.9 Kartek

- 11.10 MAPCO Autotechnik

- 11.11 Maval Manufacturing

- 11.12 Mitsubishi Electric

- 11.13 Nexteer Automotive

- 11.14 NSK Ltd.

- 11.15 Robert Bosch

- 11.16 SEAT

- 11.17 Sheppard Steering

- 11.18 Tenneco

- 11.19 Turn One Steering

- 11.20 ZF Friedrichshafen