|

市場調查報告書

商品編碼

1773328

涵蓋作物種子品種市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cover Crop Seed Varieties Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

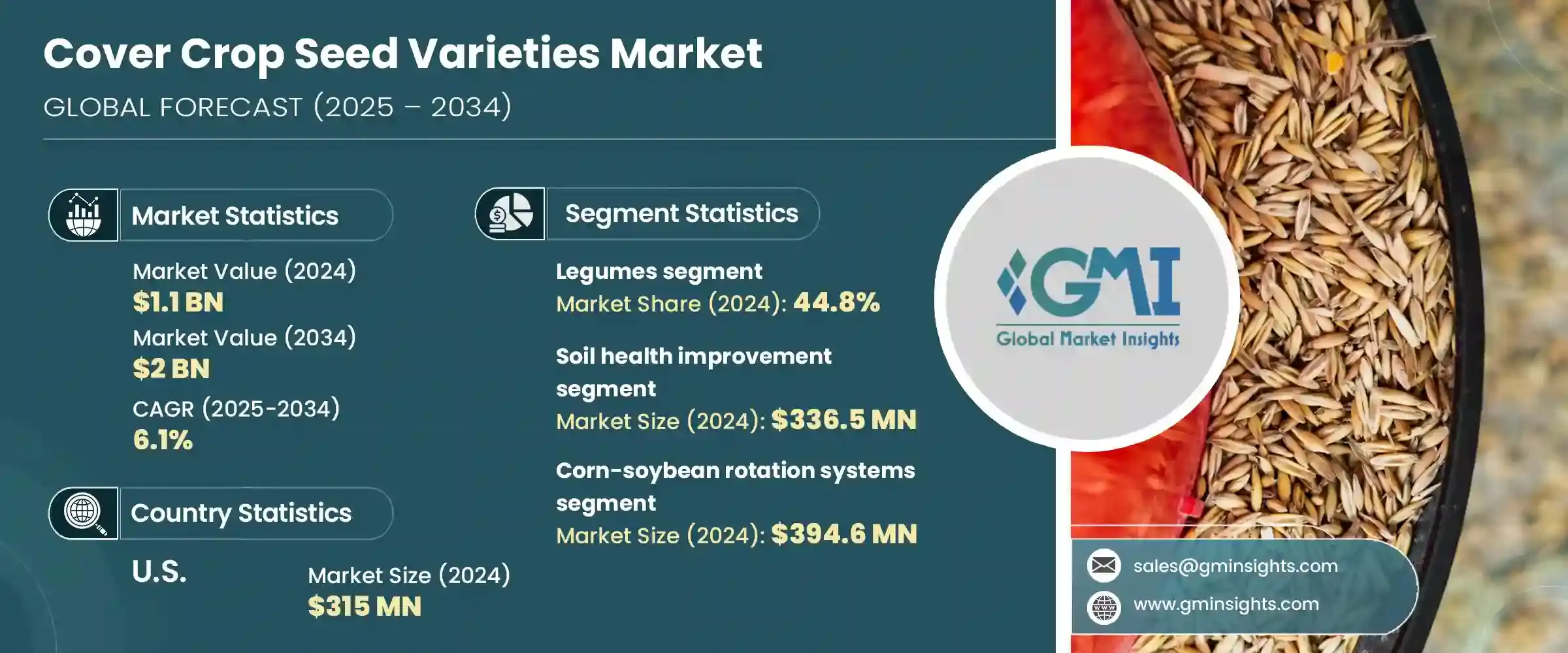

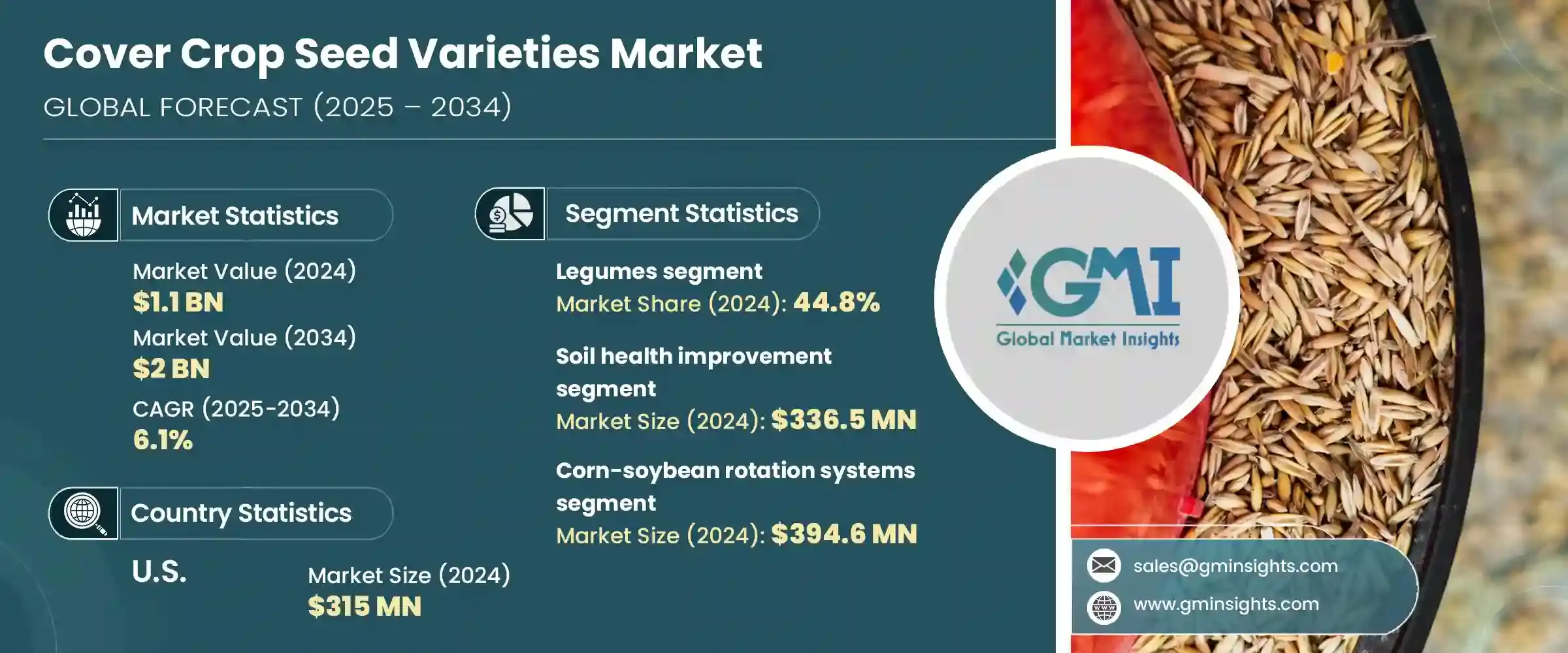

2024年,全球覆蓋作物種子品種市場價值11億美元,預計2034年將以6.1%的複合年成長率成長,達到20億美元。這一穩步上升趨勢主要得益於人們日益轉向永續農業以及土壤管理實踐日益重要的推動。隨著現代農業的不斷發展,覆蓋作物種子正成為改善土壤整體結構、促進養分循環、以及最大程度減少傳統耕作方式對環境造成破壞的重要工具。這些種子在提高土壤肥力、防止土壤侵蝕和自然控制雜草生長方面發揮關鍵作用——隨著農民努力在生產力和環境責任之間取得平衡,這些因素的重要性日益凸顯。

農民正在將覆蓋作物作為輪作系統和保護性耕作的有效組成部分。這些種子有助於保持土壤水分,提高有機質含量,並促進農田生物多樣性。隨著氣候變遷成為持續挑戰,新型種子技術正在透過開發抗旱抗病品種來應對這些問題,尤其是在乾旱地區。此外,精準農業的進步使得覆蓋作物的策略性部署成為可能,從而提高耕作效率和產量。對永續生產力的追求正鼓勵人們採用覆蓋作物種子作為可靠的解決方案,在保持產量的同時滿足環境目標。因此,無論是小規模農民還是商業農民,都對覆蓋作物市場越來越感興趣,他們希望將環保方法融入自己的經營中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 6.1% |

2024年,豆類作物佔據了全球作物市場的主導地位,佔據了44.8%的全球收入佔有率,預計到2034年將以6%的複合年成長率成長。這些種子因其能夠透過微生物活動自然固定大氣中的氮,從而顯著減少對合成肥料的依賴而受到青睞。豆類種子發芽迅速、適應各種氣候條件以及改善土壤結構的能力,使其成為希望採用低影響農業系統的農民的實際選擇。這些優勢共同促進了產量的提高和土壤品質的改善,進一步鞏固了該領域在市場上的主導地位。

黑麥、燕麥和大麥等禾本科植物也因其在地面覆蓋、土壤穩定和雜草抑制方面的優勢而佔據了相當大的市場佔有率。雖然這些品種本身並非主要的氮素貢獻者,但它們在生產生質能和保護土壤表面方面發揮關鍵作用。這些作物通常與豆科植物配合使用,以達到富集養分和控制侵蝕的目的。蕓薹屬植物,包括具有深根系統的品種,用於土壤鬆土和病蟲害防治。然而,它們的市場佔有率仍然低於豆科植物和禾本科植物,主要是因為它們的效益更具針對性,並且取決於特定的土壤條件和病蟲害動態。

從應用角度來看,土壤健康改良領域脫穎而出,成為產業領先領域,2024 年市場規模達 3.365 億美元,預計到 2034 年複合年成長率將達到 6.2%。人們對再生農業的日益關注,促使農民擴大投資於能夠增加有機質含量、促進微生物活性並增強土壤結構完整性的覆蓋作物種子品種。由於這些作物能夠固土並減少徑流,它們有助於直接防止養分流失,並提高農田的長期生存力。此外,它們在固氮和固碳方面的天然作用有助於減少對化學投入的需求,同時帶來增強生物多樣性和改善水滲透等生態效益。

就最終用途而言,玉米-大豆輪作系統在2024年的價值為3.946億美元,預計到2034年將以6.4%的複合年成長率達到最高。這些系統在大規模農業區廣泛實施,因其在保持土壤肥力的同時打破病蟲害循環的能力而備受青睞。覆蓋作物擴大被納入這些輪作中,以減少氮流失、防止水土流失和抑制雜草生長。覆蓋作物與保護措施的兼容性,使其成為注重長期永續性和產量可靠性的生產者的首選。

從區域來看,美國在北美市場處於領先地位,2024 年的估值為 3.15 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長。美國的優勢可以歸因於其大規模的農業經營、早期採用永續農業實踐,以及透過激勵措施和監管框架促進環境管理的政策支持。生產者意識的提高以及消費者對永續來源食品需求的不斷成長,也促進了全國覆蓋作物種植的快速成長。

全球覆蓋作物種子品種市場的領導公司包括拜耳作物科學、科迪華公司、先正達集團、KWS穀物公司和Green Cover Seed公司。這些公司不斷擴大產品組合,並利用強大的分銷網路來滿足全球農民不斷變化的需求,進一步塑造這一不斷成長的市場的發展軌跡。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 更重視永續農業

- 政府激勵措施和環境法規

- 有機和生態友善農業的需求不斷成長

- 產業陷阱與挑戰

- 種子採購的初始成本高

- 小農戶意識有限

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按作物類型

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依作物類型,2021-2034

- 主要趨勢

- 豆類

- 深紅色的三葉草

- 紅三葉草

- 毛苕子

- 奧地利冬豌豆

- 其他豆類品種

- 草類

- 黑麥

- 燕麥

- 冬小麥

- 大麥

- 小黑麥

- 一年生黑麥草

- 其他草種

- 蕓薹屬植物

- 白蘿蔔

- 芥菜品種

- 蘿蔔

- 其他蕓薹屬品種

- 其他覆蓋作物

- 蕎麥

- 向日葵

- 法塞莉亞

- 混合物種

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 土壤健康改善

- 侵蝕控制和土壤保護

- 營養管理與固氮

- 雜草抑制和管理

- 碳封存和氣候效益

- 牲畜飼料和放牧

- 增強生物多樣性和創造棲息地

第7章:市場估計與預測:依最終用途系統,2021-2034

- 主要趨勢

- 玉米-大豆輪作制度

- 棉花生產系統

- 蔬菜和特殊作物系統

- 有機農業經營

- 牲畜整合系統

- 保護儲備計畫申請

- 其他種植制度

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Bayer Crop Science

- Corteva Inc.

- Syngenta Group

- KWS Cereals

- Green Cover Seed

- Kings AgriSeeds

- GO Seed

- Troy Cover Seed

- GS3 Quality Seed

- Walnut Creek Seeds

- Stokes Seeds

- CoverCress Inc

- Benson Hill

- Cibus

The Global Cover Crop Seed Varieties Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 2 billion by 2034. This steady upward trend is largely fueled by the increasing shift toward sustainable agriculture and the growing importance of soil management practices. As modern farming continues to evolve, cover crop seeds are becoming vital tools in improving overall soil structure, supporting nutrient cycling, and minimizing environmental damage caused by traditional farming methods. These seeds play a pivotal role in enhancing soil fertility, preventing erosion, and naturally managing weed growth-factors that are gaining relevance as farmers strive to balance productivity with environmental responsibility.

Farmers are turning to cover crops as an effective part of crop rotation systems and conservation tillage. These seeds help retain moisture in the soil, improve organic content, and foster biodiversity on farmlands. With climate variability becoming a persistent challenge, newer seed technologies are addressing these concerns by developing drought- and disease-resistant varieties, particularly for regions with arid conditions. Additionally, advancements in precision agriculture are enabling more strategic deployment of cover crops to improve farming efficiency and outcomes. The push toward sustainable productivity is encouraging the adoption of cover crop seeds as a reliable solution to meet environmental targets while maintaining output. As a result, the market is seeing growing interest from both small-scale and commercial farmers who want to integrate eco-friendly methods into their operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2 Billion |

| CAGR | 6.1% |

In 2024, legumes dominated the market by crop type, securing 44.8% of the global revenue share, and are anticipated to grow at a CAGR of 6% through 2034. These seeds are favored for their ability to naturally fix atmospheric nitrogen through microbial activity, significantly reducing the reliance on synthetic fertilizers. Their fast germination, adaptability across diverse climates, and ability to improve soil structure make them a practical choice for farmers aiming to adopt low-impact agricultural systems. These benefits collectively contribute to improved yields and enhanced soil quality, further strengthening the segment's stronghold in the market.

Grasses, such as rye, oats, and barley, also hold a significant portion of the market due to their performance in ground coverage, soil stabilization, and weed suppression. Although these varieties are not major nitrogen contributors on their own, they play a key role in producing biomass and protecting the soil surface. These crops are commonly used in tandem with legumes to achieve both nutrient enrichment and erosion control. Brassicas, which include species with deep-rooting systems, are used for soil decompaction and pest management. However, their share remains lower than legumes and grasses, mainly because their benefits are more specialized and dependent on specific soil conditions and pest dynamics.

By application, soil health improvement stood out as the leading segment with a market size of USD 336.5 million in 2024 and is poised to grow at a CAGR of 6.2% by 2034. The rising focus on regenerative agriculture has led farmers to increasingly invest in cover crop seed varieties that can boost organic matter, promote microbial activity, and enhance the structural integrity of soil. As these crops hold the soil in place and reduce runoff, they contribute directly to preventing nutrient loss and enhancing the long-term viability of farmland. Moreover, their natural role in nitrogen fixation and carbon sequestration helps reduce the need for chemical inputs while offering ecological benefits such as biodiversity enhancement and improved water infiltration.

In terms of end use, corn-soybean rotation systems accounted for USD 394.6 million in 2024 and are forecasted to grow at the highest rate of 6.4% CAGR through 2034. These systems are widely practiced in large-scale agricultural regions and have gained traction for their ability to maintain soil fertility while breaking pest and disease cycles. Cover crops are increasingly being integrated into these rotations to reduce nitrogen loss, prevent erosion, and suppress weed populations. The compatibility of cover crops with conservation efforts makes this segment a preferred choice for producers focusing on long-term sustainability and yield reliability.

Regionally, the United States led the North American market, with a valuation of USD 315 million in 2024, expected to grow at a CAGR of 6.3% through 2034. The country's dominance can be attributed to its large-scale farming operations, early adoption of sustainable agricultural practices, and policy support through incentives and regulatory frameworks that promote environmental stewardship. Increasing awareness among producers and growing consumer demand for sustainably sourced food has also contributed to the rapid growth of cover crop adoption across the country.

Leading companies in the global cover crop seed varieties market include Bayer Crop Science, Corteva Inc., Syngenta Group, KWS Cereals, and Green Cover Seed. These players continue to expand their product portfolios and leverage strong distribution networks to meet the evolving needs of farmers worldwide, further shaping the trajectory of this growing market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crop type

- 2.2.3 Application

- 2.2.4 End use system

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing focus on sustainable agriculture

- 3.2.1.2 Government incentives and environmental regulations

- 3.2.1.3 Rising demand for organic and eco-friendly farming

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs for seed procurement

- 3.2.2.2 Limited awareness among smallholder farmers

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By crop type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Crop Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Legumes

- 5.2.1 Crimson clover

- 5.2.2 Red clover

- 5.2.3 Hairy vetch

- 5.2.4 Austrian winter pea

- 5.2.5 Other legume varieties

- 5.3 Grasses

- 5.3.1 Cereal rye

- 5.3.2 Oats

- 5.3.3 Winter wheat

- 5.3.4 Barley

- 5.3.5 Triticale

- 5.3.6 Annual ryegrass

- 5.3.7 Other grass varieties

- 5.4 Brassicas

- 5.4.1 Daikon radish

- 5.4.2 Mustard varieties

- 5.4.3 Turnips

- 5.4.4 Other brassica varieties

- 5.5 Other cover crops

- 5.5.1 Buckwheat

- 5.5.2 Sunflower

- 5.5.3 Phacelia

- 5.5.4 Mixed species blends

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Litres)

- 6.1 Key trend

- 6.2 Soil health improvement

- 6.3 Erosion control and soil conservation

- 6.4 Nutrient management and nitrogen fixation

- 6.5 Weed suppression and management

- 6.6 Carbon sequestration and climate benefits

- 6.7 Livestock forage and grazing

- 6.8 Biodiversity enhancement and habitat creation

Chapter 7 Market Estimates & Forecast, By End Use System, 2021-2034 (USD Billion) (Thousand Litres)

- 7.1 Key trends

- 7.2 Corn-soybean rotation systems

- 7.3 Cotton production systems

- 7.4 Vegetable and specialty crop systems

- 7.5 Organic farming operations

- 7.6 Livestock integration systems

- 7.7 Conservation reserve program applications

- 7.8 Other cropping systems

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Litres)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Bayer Crop Science

- 9.2 Corteva Inc.

- 9.3 Syngenta Group

- 9.4 KWS Cereals

- 9.5 Green Cover Seed

- 9.6 Kings AgriSeeds

- 9.7 GO Seed

- 9.8 Troy Cover Seed

- 9.9 GS3 Quality Seed

- 9.10 Walnut Creek Seeds

- 9.11 Stokes Seeds

- 9.12 CoverCress Inc

- 9.13 Benson Hill

- 9.14 Cibus