|

市場調查報告書

商品編碼

1773325

可吸入生物製劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Inhalable Biologics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

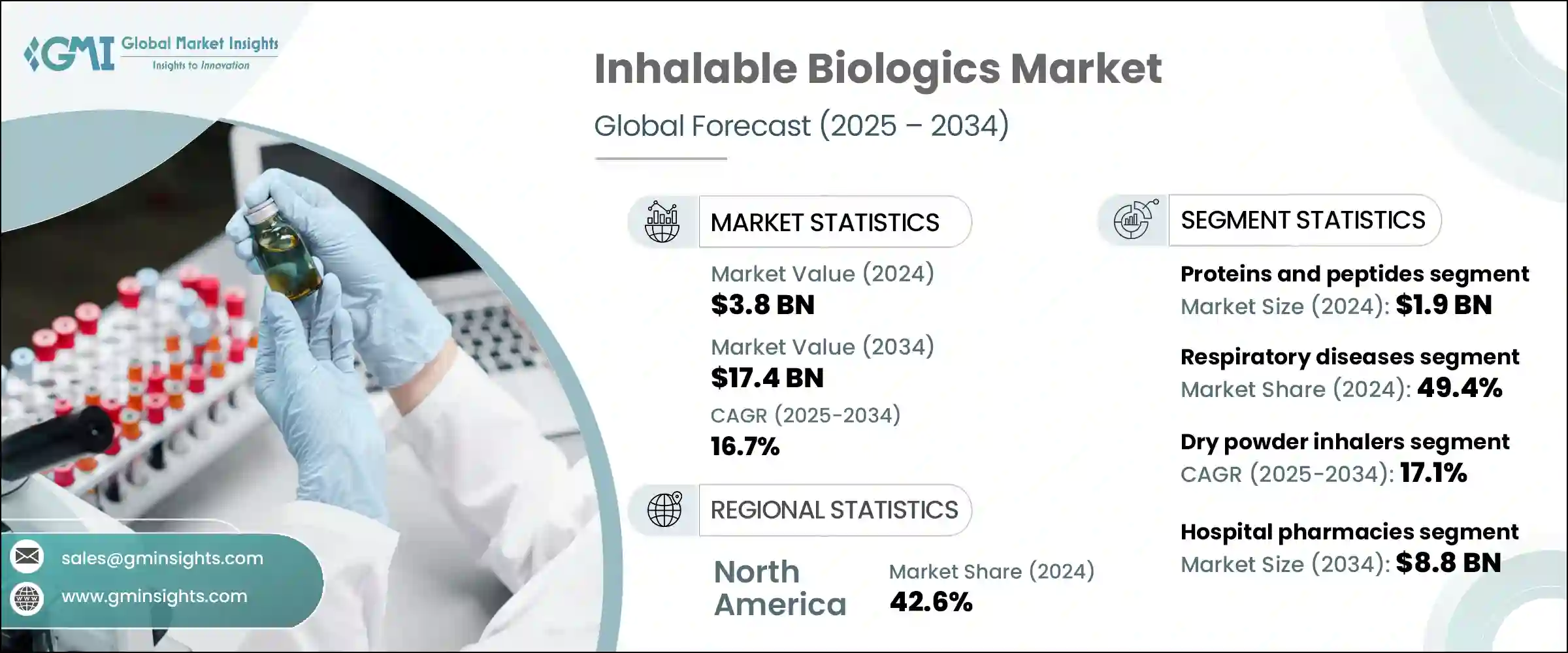

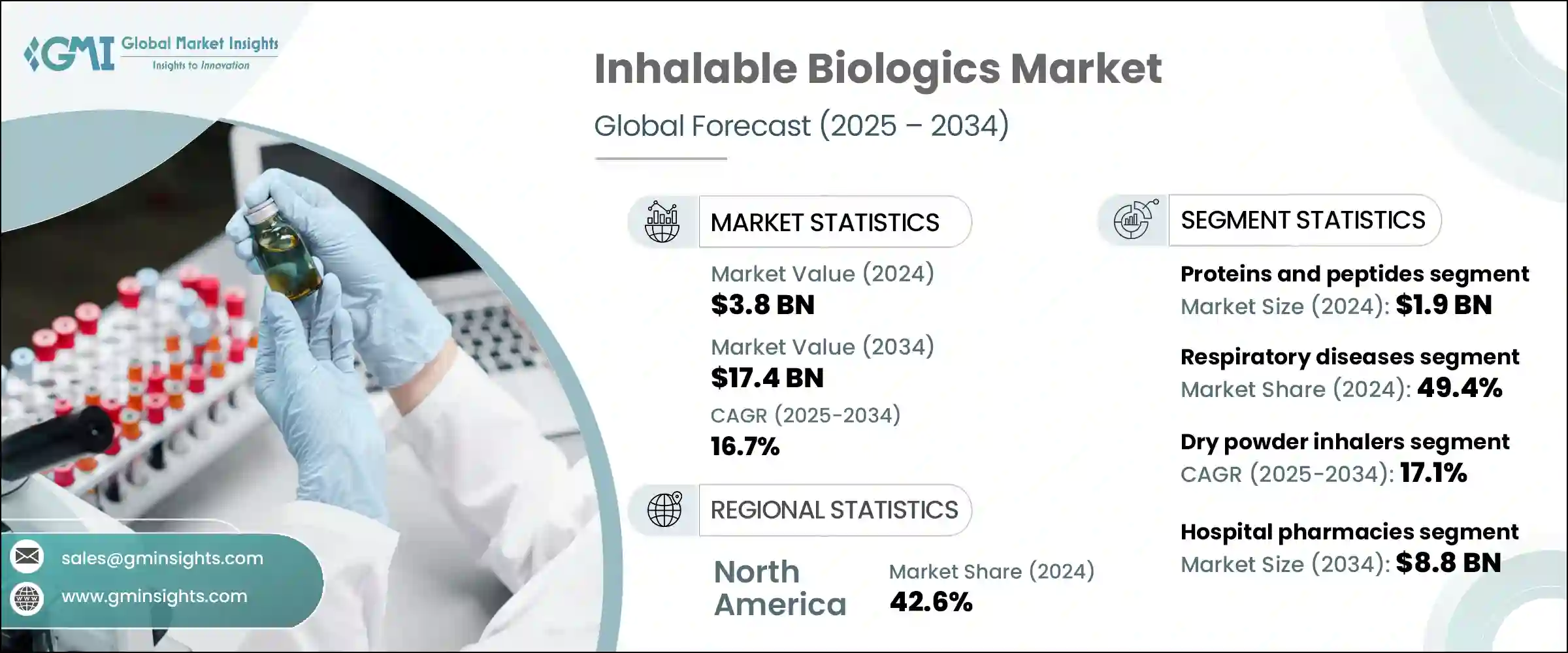

2024年,全球可吸入生物製劑市場規模達38億美元,預計到2034年將以16.7%的複合年成長率成長,達到174億美元。這一成長主要源自於慢性和急性呼吸道疾病發生率的上升,包括氣喘、囊性纖維化、慢性阻塞性肺病(COPD)和肺部感染。污染加劇、全球人口老化、菸草使用和遺傳易感性等因素加速了這些疾病的流行,加劇了對有效治療方案的需求。美國食品藥物管理局(FDA)和歐洲藥品管理局(EMA)等監管機構正積極支持可吸入性生物製劑的開發和核准,以滿足這些尚未滿足的醫療需求。

政府措施、公共部門與生物製藥公司之間的合作以及對研發的大量投入,透過提高這些療法的可及性和可負擔性,進一步促進了市場成長。所有這些因素共同為這個充滿活力的市場帶來了巨大的機會。可吸入生物製劑涵蓋了專為呼吸系統給藥而設計的生物製劑的研發、生產和給藥。這些療法透過各種設備給藥,例如乾粉吸入器 (DPI)、霧化器、軟霧吸入器和定量吸入器 (MDI)。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 38億美元 |

| 預測值 | 174億美元 |

| 複合年成長率 | 16.7% |

2024年,蛋白質和胜肽類藥物市場領先,估值達19億美元。這些生物分子因其高效力、特異性和吸入給藥時的生物有效性而備受青睞,為傳統注射提供了一種非侵入性替代方案。快速起效和局部治療能力使其在治療一系列慢性疾病(尤其是呼吸系統疾病和代謝性疾病)方面極具吸引力。它們在治療慢性阻塞性肺病、氣喘和囊性纖維化等疾病的療效持續推動了市場需求。此外,呼吸系統疾病的日益普及也持續推動了對可吸入蛋白質和胜肽類藥物的需求。

2024年,乾粉吸入器細分市場的複合年成長率為17.1%。乾粉吸入器(DPI)憑藉其卓越的穩定性,佔據了顯著的市場佔有率。生物製劑可在乾燥狀態下配製,無需像液體製劑那樣進行冷鏈儲存。這項特性使得乾粉吸入器對於以全球分銷為目標的製造商尤其有價值,包括冷藏基礎設施有限的地區。與霧化器和計量吸入器(MDI)相比,乾粉吸入器還提供了一種便捷、便攜且方便用戶使用的選擇,從而提高了患者的依從性,尤其是在慢性病的長期治療中。乾粉吸入器能夠將治療性生物製劑(例如單株抗體、疫苗和胜肽)輸送至肺部深處,從而增強了其治療效果,並支持其廣泛應用。

美國可吸入生物製劑市場規模在2024年達到14億美元,並以16.7%的複合年成長率穩定成長。美國日益嚴重的污染水平導致氣喘、過敏和鼻塞等呼吸系統疾病的發生率上升。消費者對空氣污染對呼吸系統健康的有害影響的認知不斷提高,這推動了對可吸入生物製劑作為預防和治療選擇的需求。美國食品藥物管理局(FDA)透過監管框架和激勵計畫(例如孤兒藥資格認定)鼓勵可吸入生物製劑的開發和核准,發揮關鍵作用。這種監管環境,加上不斷成長的患者需求和創新,正在推動美國市場的成長。

全球吸入式生物製劑市場的領導者包括阿斯特捷利康、Mannkind、United Therapeutics、Chiesi Pharmaceuticals、Merxin、勃林格殷格翰、Kamada Pharmaceuticals、Teva Pharmaceutical、艾伯維、康希諾生物和F-Hoffman Roche。這些關鍵企業持續推動全球創新和市場擴張。為了鞏固和提升市場地位,吸入式生物製劑領域的企業著重持續研發,致力於改善藥物傳遞技術和生物製劑製劑的穩定性。他們投資下一代吸入器設備,以最大限度地提高藥物沉積效率和患者依從性,同時最大限度地減少副作用。與監管機構、研究機構和醫療保健提供者的策略合作與夥伴關係有助於加快產品核准並擴大市場範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 呼吸系統疾病盛行率上升

- 非侵入性給藥方法越來越受歡迎

- 家庭和自我治療的需求不斷成長

- 吸入裝置和生物製劑的技術進步

- 產業陷阱與挑戰

- 某些可吸入生物製劑的穩定性和保存期限有限

- 開發和生產成本高

- 市場機會

- 新興市場對本地製造業的投資不斷增加

- 公私合作,提高可及性和可負擔性

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 未來市場趨勢

- 技術格局

- 當前的技術趨勢

- 新興技術

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 蛋白質和胜肽

- 疫苗

- 單株抗體

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 呼吸系統疾病

- 傳染病

- 糖尿病

第7章:市場估計與預測:按劑型,2021 年至 2034 年

- 主要趨勢

- 乾粉吸入器

- 定量吸入器

- 霧化器

- 軟霧吸入器

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- AstraZeneca

- Boehringer Ingelheim

- CanSino Biologics

- Chiesi Pharmaceuticals

- F-Hoffman Roche

- Kamada Pharmaceuticals

- Mannkind

- Merxin

- Teva Pharmaceutical

- United Therapeutics

The Global Inhalable Biologics Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 16.7% to reach USD 17.4 billion by 2034. This growth is largely driven by the rising incidence of both chronic and acute respiratory illnesses, including asthma, cystic fibrosis, chronic obstructive pulmonary disease (COPD), and pulmonary infections. Factors such as increasing pollution levels, an aging global population, tobacco use, and genetic predispositions are accelerating the prevalence of these conditions, thereby intensifying the need for effective therapeutic options. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are actively supporting the development and approval of inhalable biologics to meet these unmet medical needs.

Government initiatives, partnerships between public sectors and biopharmaceutical companies, and substantial investments in research and development are further encouraging market growth by improving the accessibility and affordability of these treatments. Collectively, these elements are paving the way for significant opportunities within this dynamic market. Inhalable biologics encompass the creation, manufacturing, and delivery of biologic therapies specifically designed for respiratory administration. These therapies are delivered through a variety of devices such as dry powder inhalers (DPIs), nebulizers, soft mist inhalers, and metered dose inhalers (MDIs).

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $17.4 Billion |

| CAGR | 16.7% |

The proteins and peptides segment led the market in 2024, with a valuation of USD 1.9 billion. These biological molecules are favored for their high potency, specificity, and biological effectiveness when administered via inhalation, offering a non-invasive alternative to traditional injections. The rapid therapeutic onset and ability to provide localized treatment make proteins and peptides highly attractive for managing a range of chronic illnesses, particularly respiratory and metabolic disorders. Their efficacy in treating conditions like COPD, asthma, and cystic fibrosis has driven consistent demand. Additionally, the growing prevalence of respiratory ailments continues to fuel the need for inhalable proteins and peptides.

The dry powder inhalers segment held a 17.1% CAGR in 2024. DPIs enjoy significant market share due to their excellent stability, as biologics can be formulated in a dry state, avoiding the need for cold chain storage required by liquid formulations. This characteristic makes DPIs especially valuable for manufacturers targeting global distribution, including regions with limited refrigeration infrastructure. DPIs also offer a convenient, portable, and user-friendly option compared to nebulizers and MDIs, leading to improved patient adherence, especially for long-term treatment of chronic diseases. The capacity of DPIs to deliver therapeutic biologics deeply into the lungs-such as monoclonal antibodies, vaccines, and peptides-boosts their therapeutic effectiveness and supports their widespread adoption.

U.S. Inhalable Biologics Market accounted for USD 1.4 billion in 2024 and is growing steadily at a CAGR of 16.7%. The increasing pollution levels in the U.S. are contributing to a rise in respiratory problems like asthma, allergies, and nasal congestion. Heightened consumer awareness about air pollution's detrimental effects on respiratory health is driving demand for inhalable biologics as preventive and therapeutic options. The U.S. FDA plays a pivotal role by encouraging the development and approval of inhalable biologics through regulatory frameworks and incentive programs such as the Orphan Drug Designation. This regulatory environment, combined with growing patient demand and innovation, is propelling market growth in the country.

Leading companies competing in the Global Inhalable Biologics Market include AstraZeneca, Mannkind, United Therapeutics, Chiesi Pharmaceuticals, Merxin, Boehringer Ingelheim, Kamada Pharmaceuticals, Teva Pharmaceutical, AbbVie, CanSino Biologics, and F-Hoffman Roche. These key players continue to drive innovation and market expansion globally. To secure and enhance their market positions, companies in the inhalable biologics sector emphasize continuous research and development focused on improving drug delivery technologies and biologic formulation stability. They invest in next-generation inhaler devices that maximize drug deposition efficiency and patient compliance while minimizing side effects. Strategic collaborations and partnerships with regulatory agencies, research institutions, and healthcare providers help accelerate product approvals and expand market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Dosage form

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Increasing preference for non-invasive drug delivery methods

- 3.2.1.3 Growing demand for home-based and self-administered therapies

- 3.2.1.4 Technological advancements in inhalation devices and biologics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited stability and shelf-life of certain inhalable biologics

- 3.2.2.2 High development and production costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing investment in local manufacturing in emerging markets

- 3.2.3.2 Public-private partnerships for access and affordability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Technology landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proteins and peptides

- 5.3 Vaccines

- 5.4 Monoclonal antibodies

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Respiratory diseases

- 6.3 Infectious diseases

- 6.4 Diabetes

Chapter 7 Market Estimates and Forecast, By Dosage Form, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dry powder inhalers

- 7.3 Metered dose inhalers

- 7.4 Nebulizers

- 7.5 Soft mist inhalers

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Boehringer Ingelheim

- 10.4 CanSino Biologics

- 10.5 Chiesi Pharmaceuticals

- 10.6 F-Hoffman Roche

- 10.7 Kamada Pharmaceuticals

- 10.8 Mannkind

- 10.9 Merxin

- 10.10 Teva Pharmaceutical

- 10.11 United Therapeutics