|

市場調查報告書

商品編碼

1773322

肽基奈米材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Peptide-Based Nanomaterials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

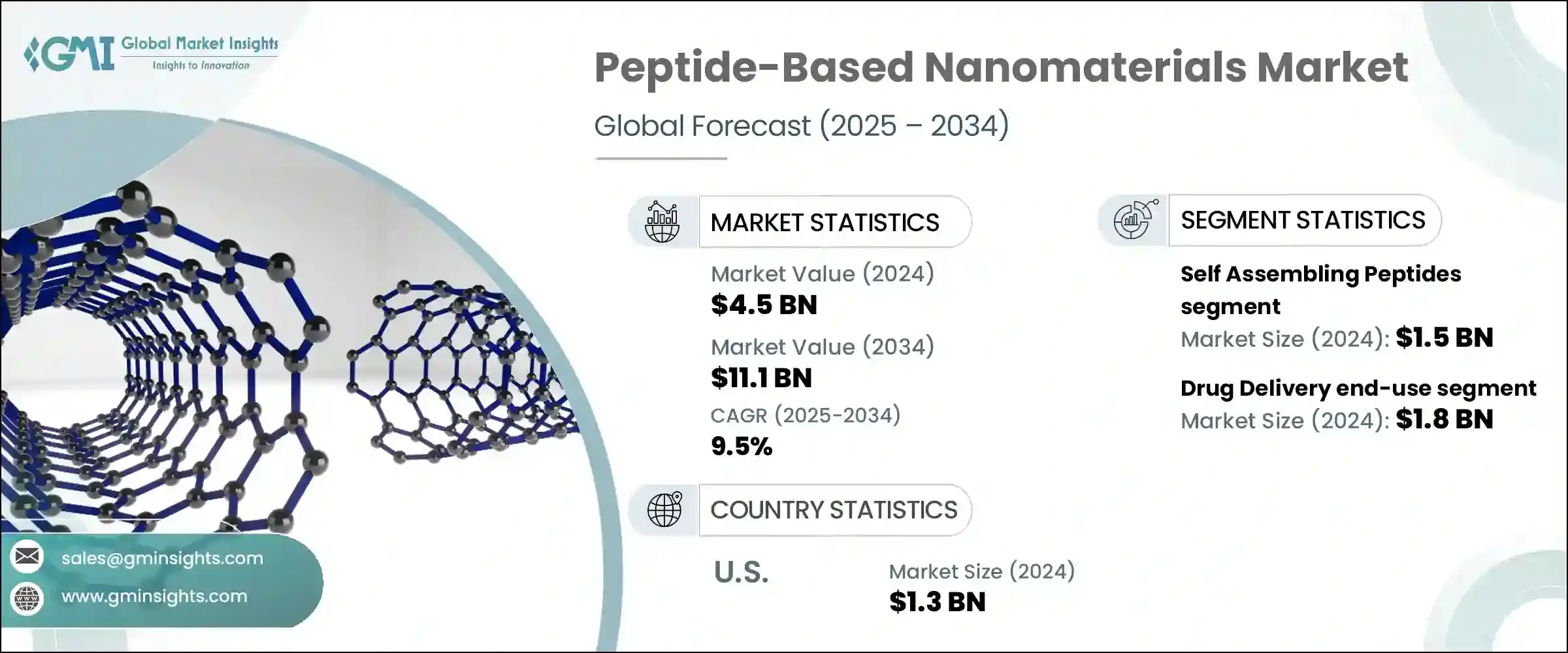

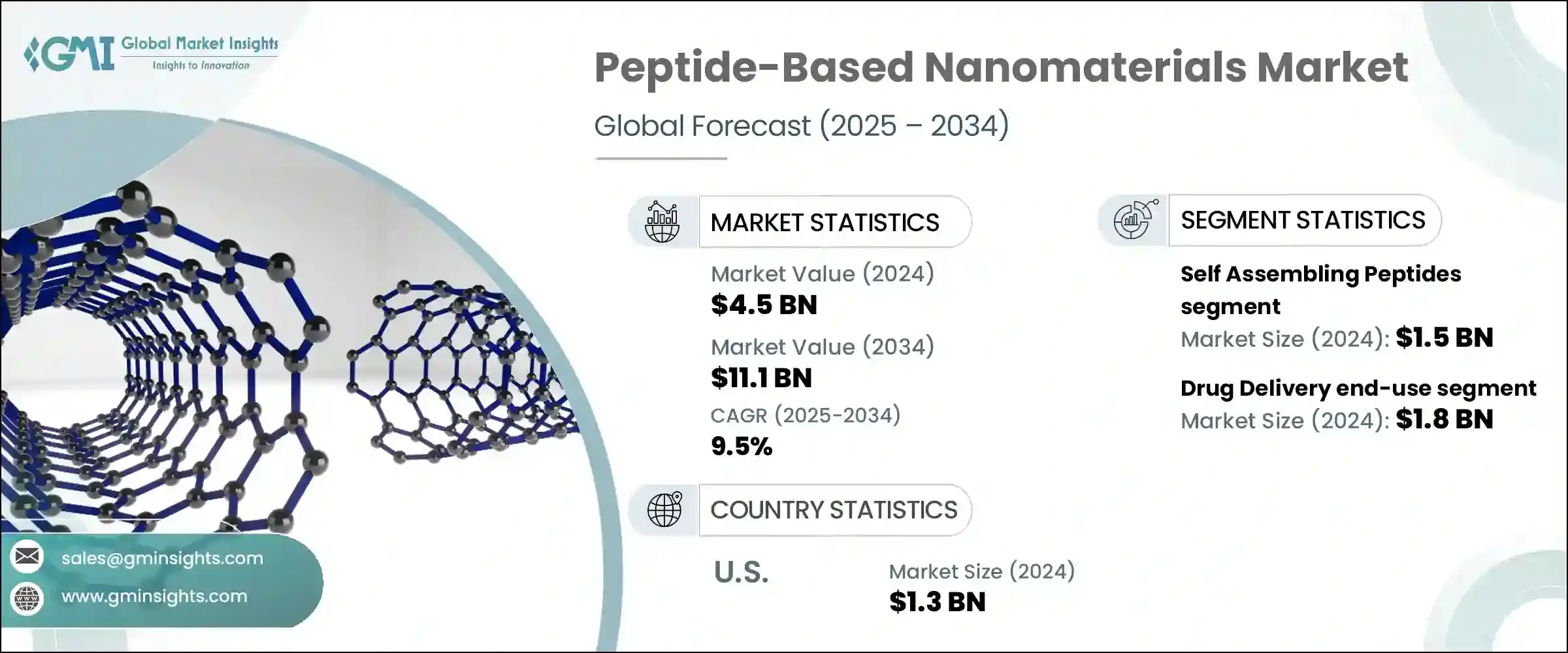

2024年,全球肽基奈米材料市場規模達45億美元,預計到2034年將以9.5%的複合年成長率成長,達到111億美元。隨著醫療產業向精準醫療和標靶治療轉型,該市場發展勢頭強勁。肽基奈米材料因其在藥物傳輸、成像、透皮治療和組織工程方面的多功能特性而備受關注。它們能夠作為生物相容性的藥物載體,並支持先進的治療平台,使其成為傳統療法的極具吸引力的替代方案。私人投資和政府資金的不斷增加正在加速奈米醫學的創新步伐。

全球醫療保健體係正在不斷發展,重新重視先進的醫療工具、生物響應材料和奈米級療法,這些療法療效更佳,副作用更少。對智慧藥物系統(尤其是能夠定位並最大程度減少對健康組織的暴露)的需求日益成長,極大地促進了這些技術的普及。此外,投資者和公共醫療機構對生物製藥創新的興趣日益濃厚,催生了專門的檢測系統、智慧型藥物配製方法和模組化奈米結構,旨在徹底改變疾病在分子層面的治療方式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 111億美元 |

| 複合年成長率 | 9.5% |

自組裝胜肽領域在2024年創造了15億美元的市場規模,預計到2034年將以8.7%的複合年成長率成長。該領域的普及得益於對控釋和定點遞送系統日益成長的需求。目前有超過300種肽基載體處於臨床前或臨床階段,標靶治療(尤其是癌症和基因治療)是關鍵的成長領域。研發人員正致力於開發生物相容性和可生物分解的胜肽奈米結構,以實現更安全的藥物運輸。創新如今正蔓延到診斷和分子影像等相關領域,這些領域正受到研究人員和監管機構的廣泛關注。

2024年,藥物遞送應用領域的市場價值達18億美元,佔39.3%,預計到2034年,複合年成長率將達到6.1%。製藥和生物科技產業是主要的終端用戶,它們在開發安全、個人化的遞送平台方面投入了大量資金。約60%的生物技術公司已在早期研究階段採用了基於胜肽的系統。除製藥業外,由於監管方面的利好,醫療設備製造商和研究機構對胜肽的接受度也在不斷提高。化妝品和食品產業也在探索生物活性胜肽,這為新進者的市場擴張創造了機會。

美國肽基奈米材料市場在2024年創收13億美元,預計複合年成長率為9.1%,到2034年將達到29.3%。憑藉著雄厚的研發投入和完善的生物製藥生態系統,美國在肽基奈米材料開發領域處於領先地位。超過35%的奈米醫學相關專利來自美國,顯示其研發強度高、技術實力強。美國國內製造業發展強勁,並有FDA批准的臨床試驗和強力的個人化醫療措施作為後盾,減少了對進口解決方案的依賴。

影響肽基奈米材料市場的關鍵參與者包括 Genscript Biotech Corporation、PolyPeptide Group、Anika Therapeutics, Inc.、PeptiDream Inc. 和 Bachem Holding AG。為了保持競爭力,肽基奈米材料市場的公司優先投資可擴展的研發,並注重治療的多功能性和法規遵循。與製藥公司、學術機構和臨床研究組織的策略合作有助於加速產品開發流程。許多公司也利用先進的胜肽合成技術來提高生產能力,以滿足日益成長的全球需求。隨著各公司加強其新型奈米材料的專利組合,智慧財產權保護成為關注的重點。此外,市場參與者正在將其應用範圍從藥物傳輸擴展到診斷、再生醫學和藥妝品領域。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 自組裝胜肽

- 胜肽兩親物

- 胜肽聚合物偶聯物

- 胜肽奈米顆粒混合物

- 環肽奈米結構

- 其他

第6章:市場估計與預測:依奈米結構形態,2021-2034

- 主要趨勢

- 奈米纖維和奈米管

- 奈米球和囊泡

- 水凝膠和支架

- 奈米粒子

- 2D奈米片和薄膜

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 藥物輸送

- 標靶癌症治療

- 基因和核酸遞送

- 其他藥物傳輸應用

- 組織工程與再生醫學

- 生物感測與診斷

- 抗菌應用

- 生物影像與治療診斷學

- 其他應用

第8章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 製藥和生物技術

- 醫療保健和醫療器械

- 研究與學術機構

- 化妝品和個人護理

- 食品與農業

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Ferring Pharmaceuticals

- 3D Matrix Medical Technology

- Nanovesicular (NVS) Technologies

- CellMark Medical

- Nanomatrix Therapeutics

- Anika Therapeutics, Inc.

- Nanoviricides, Inc.

- Peptron, Inc.

- Ambiopharm, Inc.

- Bachem Holding AG

- PolyPeptide Group

- Nanosphere Health Sciences, Inc.

- Peptide Solutions, LLC

- PeptiDream Inc.

- Genscript Biotech Corporation

- Peptisyntha (Solvay Group)

- Pepscan

- Nanopartz Inc.

- CPC Scientific Inc.

- Advanced Peptides

The Global Peptide-Based Nanomaterials Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 11.1 billion by 2034. This market is gaining momentum as the medical industry shifts towards precision medicine and targeted therapy. Peptide-based nanomaterials are gaining attention due to their multifunctional capabilities in drug delivery, imaging, transdermal therapeutics, and tissue engineering. Their ability to act as biocompatible drug carriers and support advanced treatment platforms has made them an attractive alternative to traditional therapies. Increasing private investments and government funding are accelerating the pace of innovation in nanomedicine.

Healthcare systems globally are evolving with a renewed emphasis on advanced medical tools, biologically responsive materials, and nanoscale therapeutics that offer improved efficacy with fewer side effects. The rising demand for smart drug systems, particularly those that can localize and minimize exposure to healthy tissue, is contributing significantly to the adoption of these technologies. In addition, increased interest from investors and public healthcare agencies in biopharmaceutical innovation is giving rise to specialized detection systems, intelligent drug formulation methods, and modular nanostructures aimed at revolutionizing how diseases are treated at the molecular level.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 billion |

| Forecast Value | $11.1 billion |

| CAGR | 9.5% |

The self-assembling peptides segment generated USD 1.5 billion in 2024 and is forecast to grow at a CAGR of 8.7% through 2034. The popularity of this segment is driven by the growing demand for controlled-release and site-specific delivery systems. With more than 300 peptide-based carriers in either preclinical or clinical stages, targeted therapeutics-especially for cancer and gene therapy-are key growth areas. Developers are focusing on formulating peptide nanostructures that are biocompatible and biodegradable, allowing for safer drug transport. Innovations are now spilling over into adjacent fields such as diagnostics and molecular imaging, which are seeing interest from both researchers and regulatory stakeholders.

In 2024, the drug delivery application segment held a market value of USD 1.8 billion, representing a 39.3% share and growing at a CAGR of 6.1% through 2034. The pharmaceutical and biotech sectors are the major end-users, heavily investing in developing safe, personalized delivery platforms. Around 60% of biotechnology firms have already incorporated peptide-based systems during early research phases. Beyond pharma, uptake is also growing among healthcare equipment manufacturers and research institutes due to favorable regulatory developments. The cosmetics and food industries are also exploring bioactive peptides, creating opportunities for market expansion among newer entrants.

United States Peptide-Based Nanomaterials Market generated USD 1.3 billion in 2024 and is projected to grow at a CAGR of 9.1%, accounting for 29.3% by 2034. With significant R&D expenditure and a well-established biopharma ecosystem, the US stands as a leader in peptide-based nanomaterials development. More than 35% of nanomedicine-related patents originate from the US, indicating high research intensity and technological capability. Domestic manufacturing is robust, backed by FDA-approved clinical trials and strong initiatives around personalized medicine, reducing reliance on imported solutions.

Key players shaping the Peptide-Based Nanomaterials Market include Genscript Biotech Corporation, PolyPeptide Group, Anika Therapeutics, Inc., PeptiDream Inc., and Bachem Holding AG. To maintain competitiveness, companies in the peptide-based nanomaterials market are prioritizing investments in scalable R&D, focusing on therapeutic versatility and regulatory compliance. Strategic collaborations with pharmaceutical firms, academic institutions, and clinical research organizations help accelerate product development pipelines. Many are also enhancing their production capabilities with advanced peptide synthesis technologies to meet rising global demand. Intellectual property protection is a key focus, as companies strengthen their patent portfolios for novel nanomaterials. Further, market players are expanding their application reach beyond drug delivery into diagnostics, regenerative medicine, and cosmeceuticals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO Perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Self assembling peptides

- 5.3 Peptide amphiphiles

- 5.4 Peptide polymer conjugates

- 5.5 Peptide nanoparticle hybrids

- 5.6 Cyclic peptide nanostructures

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Nanostructure Morphology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nanofibers & nanotubes

- 6.3 Nanospheres & vesicles

- 6.4 Hydrogels & scaffolds

- 6.5 Nanoparticles

- 6.6 2d nanosheets & films

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Drug delivery

- 7.2.1 targeted cancer therapeutics

- 7.2.2 gene & nucleic acid delivery

- 7.2.3 other drug delivery applications

- 7.3 Tissue engineering & regenerative medicine

- 7.4 Biosensing & diagnostics

- 7.5 Antimicrobial applications

- 7.6 Bioimaging & theranostics

- 7.7 Other applications

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology

- 8.3 Healthcare & medical devices

- 8.4 Research & academic institutions

- 8.5 Cosmetics & personal care

- 8.6 Food & agriculture

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Ferring Pharmaceuticals

- 10.2 3D Matrix Medical Technology

- 10.3 Nanovesicular (NVS) Technologies

- 10.4 CellMark Medical

- 10.5 Nanomatrix Therapeutics

- 10.6 Anika Therapeutics, Inc.

- 10.7 Nanoviricides, Inc.

- 10.8 Peptron, Inc.

- 10.9 Ambiopharm, Inc.

- 10.10 Bachem Holding AG

- 10.11 PolyPeptide Group

- 10.12 Nanosphere Health Sciences, Inc.

- 10.13 Peptide Solutions, LLC

- 10.14 PeptiDream Inc.

- 10.15 Genscript Biotech Corporation

- 10.16 Peptisyntha (Solvay Group)

- 10.17 Pepscan

- 10.18 Nanopartz Inc.

- 10.19 CPC Scientific Inc.

- 10.20 Advanced Peptides