|

市場調查報告書

商品編碼

1773321

棉花加工設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Cotton Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

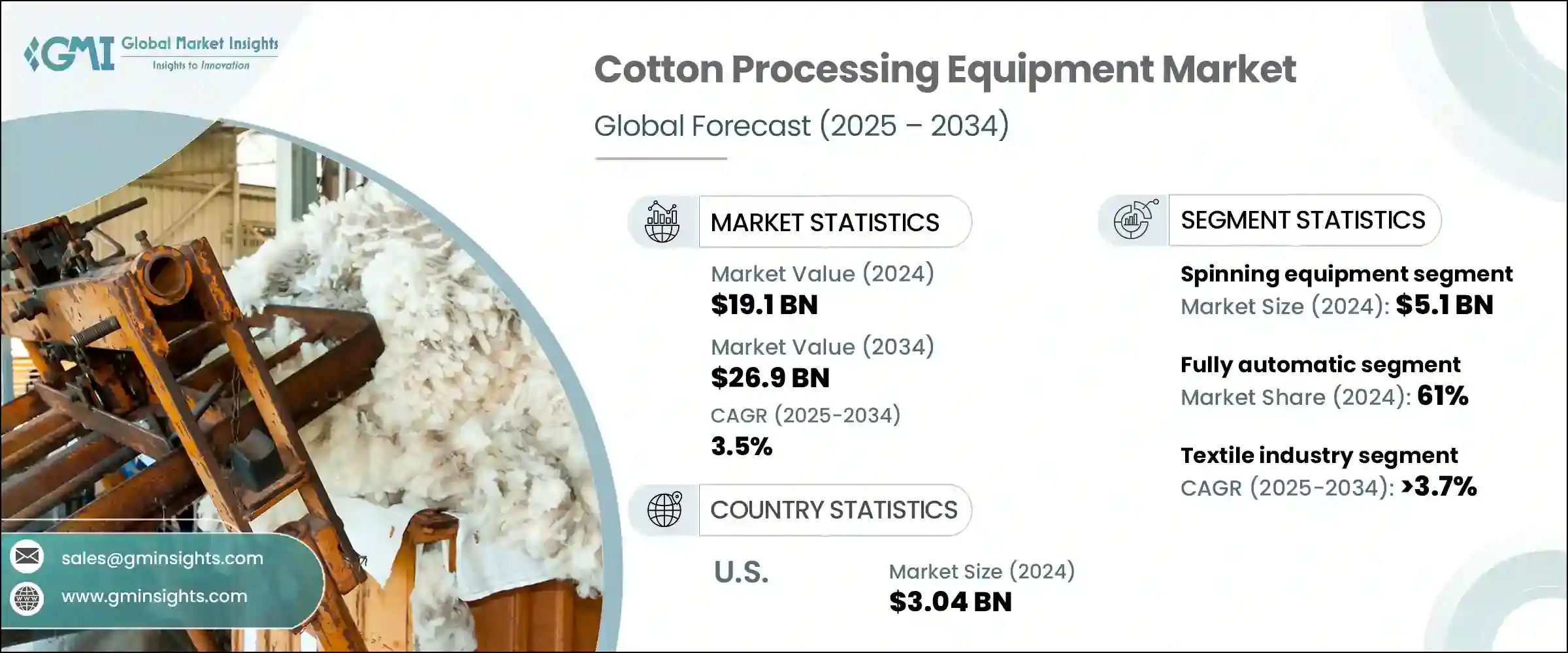

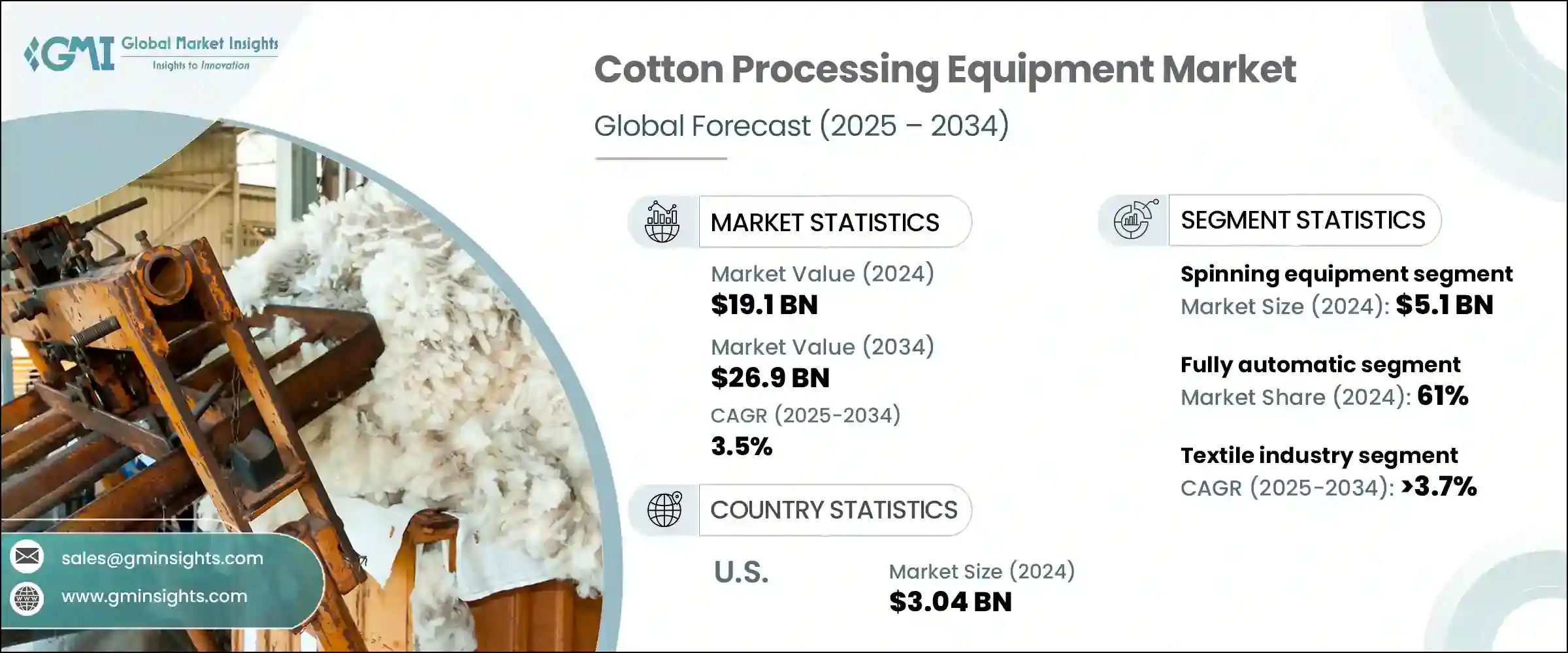

2024年,全球棉花加工設備市場規模達191億美元,預計到2034年將以3.5%的複合年成長率成長,達到269億美元。這一成長主要得益於對棉質服裝和紡織品的需求不斷成長,以及尖端加工技術的日益普及。棉花仍然是紡織業的重要原料,全球人口的成長以及可支配收入的提高,顯著增加了對優質紡織品的需求。

這種日益成長的需求促使製造商透過部署先進的棉花加工設備來提升產能和效率。各公司正投入資源進行研發,以期為市場帶來減少材料浪費、提高生產效率並確保加工棉花品質始終如一的解決方案。此外,向自動化和永續製造的轉變正在塑造棉花加工業務的格局,推動對符合環境目標的智慧技術的投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 191億美元 |

| 預測值 | 269億美元 |

| 複合年成長率 | 3.5% |

在各類設備中,紡紗設備領域脫穎而出,2024 年市場價值將超過 51 億美元。預計該領域在預測期內的複合年成長率將達到 4.1%。由於人們對自動化、高效和高速紡紗系統的關注度日益提高,該領域正經歷著強勁的發展勢頭。製造商擴大整合高速紡杯、先進的環錠紡紗錠子和數位化工具等功能,以最佳化生產。

這些技術實現了即時監控、預測性維護和紗線產量的提高,從而減少了故障,並提高了營運效率。數位轉型的重視,加上對永續性的需求,正在推動大型生產設施紡紗系統的變革。這種轉變也重塑了勞動力模式,減少了對體力勞動的依賴,同時在技術支援和設備維護方面創造了新的職位。

從操作模式來看,全自動機械在2024年佔據了約61%的市場佔有率,預計在2025年至2034年期間的複合年成長率將達到3.7%。全自動棉花加工系統的吸引力在於其能夠提供高精度輸出,同時顯著降低操作失誤。對於希望提高生產力並降低勞動成本的大型製造商而言,這些機器至關重要。

物聯網、機器學習和即時資料分析等智慧技術的融合正在增強這些系統的功能和輸出品質。隨著企業尋求實施智慧製造策略,預計主要製造中心對全自動系統的偏好將進一步增強。相較之下,手動機械在規模較小的本地化市場中仍然具有重要意義,尤其是在成本受限或先進基礎設施獲取管道有限的地區。

從應用角度來看,紡織業仍是棉花加工設備的主要消費產業,預計在預測期內複合年成長率將超過3.7%。全球服裝和家居產業的持續成長,對棉質產品的需求強勁。消費者對環保和天然纖維的偏好顯著提升,也推動了時尚和室內裝潢市場對棉花的消費。

除了服裝之外,醫療產業也正在成為高品質棉製品(包括紗布、繃帶和外科用品)的穩定消費者。醫療機構對衛生和感染控制的日益重視,增強了對支持生產無菌耐用材料的先進棉花加工系統的需求。這一趨勢促使製造商採用針對醫療領域需求的精密加工機械。

從區域來看,美國繼續主導北美市場,佔據該地區83%的佔有率,預計到2024年將達到30.4億美元。美國是棉花及棉製品進出口的主要樞紐,受益於其作為重要樞紐的地位。隨著對現代紡織解決方案的需求不斷成長,以及技術升級機械的普及,美國棉花加工設備市場正在持續成長。美國企業正專注於投資先進的系統,以提高效率並適應不斷變化的行業標準。致力於基礎設施現代化和在最大程度降低環境影響的情況下提高產量,正在推動對智慧機械的需求。

該領域的主要參與者正在持續投資於技術升級和合作夥伴關係,以向客戶推出更有效、更靈活的解決方案。這些策略不僅改善了產品供應,也提升了製造商在全球價值鏈中的競爭力。隨著客戶期望的不斷變化以及對智慧環保解決方案的持續推動,棉花加工設備市場預計將在未來幾年保持強勁成長勢頭。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 軋棉設備

- 刀輥杜松子酒

- 麥卡蒂杜松子酒

- 鋸木廠

- 清潔設備

- 原棉清理機

- 棉絨清潔機

- 梳理設備

- 蓋板梳理機

- 羅拉梳理機

- 高產量梳理機

- 紡紗設備

- 環錠紡紗

- 轉杯紡

- 緊密紡

- 噴射紡紗

- 織造設備

- 整理機

- 其他(分類等)

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第7章:市場估計與預測:依產能,2021 - 2034

- 主要趨勢

- 容量低

- 中等容量

- 高容量

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 紡織業

- 醫療和外科

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Abel

- Continental Eagle

- Giannitsa Ginning Mills

- Kimbell Gin Machinery

- Lummus

- Mitsun

- Multipro Machines

- Muratec

- Rieter

- Sando Tech

- Saurer

- Savio

- Suntech Textile Machinery

- Tongda Group

- Trutzschler

The Global Cotton Processing Equipment Market was valued at USD 19.1 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 26.9 billion by 2034. This growth is primarily fueled by increasing demand for cotton-based apparel and textiles, along with the growing adoption of cutting-edge processing technologies. Cotton continues to be a vital raw material in the textile sector, and the growing global population, coupled with higher disposable incomes, has significantly increased the need for quality textiles.

This heightened demand is prompting manufacturers to enhance production capacity and efficiency through the deployment of advanced cotton processing equipment. Companies are channeling resources into R&D initiatives to bring to market solutions that reduce material waste, improve productivity, and ensure the consistent quality of processed cotton. Additionally, the rising shift toward automation and sustainable manufacturing is shaping the landscape of cotton processing operations, driving investments in smart technologies that align with environmental goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.1 Billion |

| Forecast Value | $26.9 Billion |

| CAGR | 3.5% |

Among the various equipment types, the spinning equipment segment stood out with a market value exceeding USD 5.1 billion in 2024. It is anticipated to grow at a CAGR of 4.1% through the forecast period. This segment is experiencing strong momentum due to the rising focus on automated, efficient, and high-speed spinning systems. Manufacturers are increasingly integrating features like high-speed rotors, advanced ring spindles, and digital tools to optimize production.

These technologies are enabling real-time monitoring, predictive maintenance, and enhanced yarn output, leading to fewer breakdowns and better operational efficiency. The emphasis on digital transformation, coupled with the need for sustainability, is driving the evolution of spinning systems across large-scale production facilities. This transformation is also reshaping labor patterns, reducing the dependency on manual labor while simultaneously creating new roles in technical support and equipment maintenance.

In terms of operation mode, fully automatic machinery accounted for approximately 61% of the market share in 2024 and is forecast to grow at a CAGR of 3.7% between 2025 and 2034. The appeal of fully automatic cotton processing systems lies in their ability to deliver high-precision output while significantly lowering operational errors. These machines are proving essential for large-scale manufacturers aiming to enhance productivity while reducing labor costs.

The incorporation of intelligent technologies such as IoT, machine learning, and real-time data analytics is enhancing the functionality and output quality of these systems. As businesses seek to implement smart manufacturing strategies, the preference for fully automated systems is expected to intensify across key manufacturing hubs. In contrast, manual machinery continues to hold relevance in smaller, localized markets, particularly in regions where cost constraints or limited access to advanced infrastructure prevail.

On the basis of application, the textile industry remains the dominant consumer of cotton processing equipment and is expected to expand at a CAGR of over 3.7% during the forecast period. The continued growth of the global apparel and home furnishing sectors is generating strong demand for cotton-based products. A noticeable rise in consumer preference for eco-friendly and natural fibers is also propelling the consumption of cotton across both fashion and interior decor markets.

Beyond apparel, the medical sector is emerging as a consistent consumer of high-quality cotton products, including gauze, bandages, and surgical items. Increasing emphasis on hygiene and infection control in healthcare facilities has reinforced the need for advanced cotton processing systems that support the production of sterile and durable materials. This trend is encouraging manufacturers to adopt precision-based processing machinery tailored to the needs of the medical segment.

Regionally, the United States continues to dominate the North American market, holding 83% of the regional share and expected to reach USD 3.04 billion in 2024. The country benefits from being a major hub for both the import and export of cotton and cotton-related products. With growing demand for modern textile solutions and rising adoption of technologically upgraded machinery, the market for cotton processing equipment in the U.S. is experiencing consistent growth. Businesses in the country are focusing on investing in advanced systems that increase efficiency and align with shifting industry standards. Efforts to modernize infrastructure and boost output with minimal environmental impact are pushing demand for intelligent machinery.

Key players operating in this space are consistently investing in technological upgrades and collaborative partnerships to introduce more effective and adaptive solutions for customers. These strategies are not only improving product offerings but also enhancing the competitiveness of manufacturers across the global value chain. With evolving customer expectations and the steady push for smart, eco-conscious solutions, the cotton processing equipment market is poised to maintain a strong growth trajectory in the coming years.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By equipment type

- 2.2.3 By mode of operation

- 2.2.4 By capacity

- 2.2.5 By application

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Ginning equipment

- 5.2.1 Knife roller gin

- 5.2.2 Macarty gin

- 5.2.3 Saw gin

- 5.3 Cleaning equipment

- 5.3.1 Raw cotton cleaning machine

- 5.3.2 Cotton lint cleaner machines

- 5.4 Carding equipment

- 5.4.1 Flat carding machines

- 5.4.2 Roller carding machines

- 5.4.3 High-production carding machines

- 5.5 Spinning equipment

- 5.5.1 Ring spinning

- 5.5.2 Rotor spinning

- 5.5.3 Compact spinning

- 5.5.4 Air jet spinning

- 5.6 Weaving equipment

- 5.7 Finishing machines

- 5.8 Others (sorting etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity

- 7.3 Medium capacity

- 7.4 High capacity

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Textile industry

- 8.3 Medical & surgical

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abel

- 11.2 Continental Eagle

- 11.3 Giannitsa Ginning Mills

- 11.4 Kimbell Gin Machinery

- 11.5 Lummus

- 11.6 Mitsun

- 11.7 Multipro Machines

- 11.8 Muratec

- 11.9 Rieter

- 11.10 Sando Tech

- 11.11 Saurer

- 11.12 Savio

- 11.13 Suntech Textile Machinery

- 11.14 Tongda Group

- 11.15 Trutzschler