|

市場調查報告書

商品編碼

1773320

手術室設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Operating Room Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

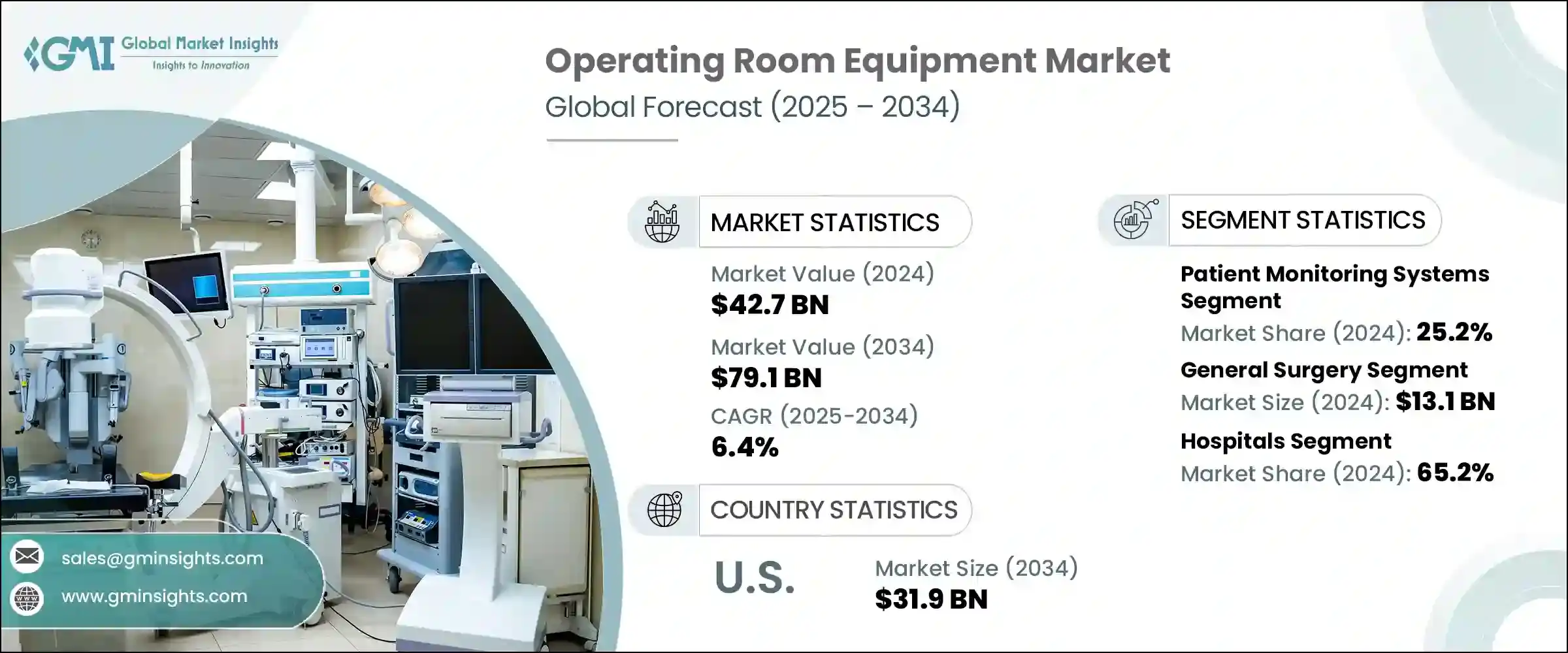

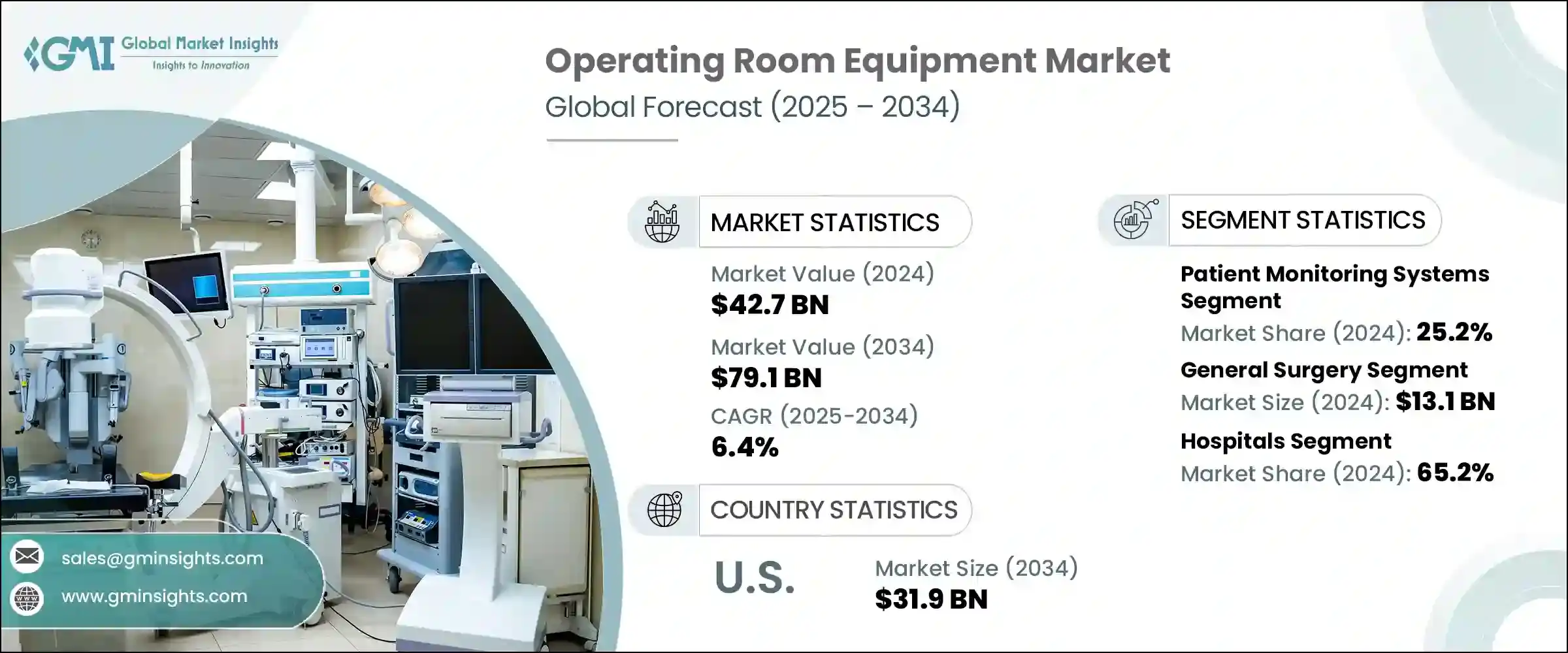

2024 年全球手術室設備市場價值為 427 億美元,預計到 2034 年將以 6.4% 的複合年成長率成長至 791 億美元。該市場涵蓋用於促進安全有效外科手術的各種基本工具、機器、系統和基礎設施。由於全球骨科疾病、癌症和心臟病等慢性疾病負擔加重,手術數量穩定上升,這顯著加速了市場擴張。對醫療基礎設施現代化的日益重視以及向技術更先進的外科手術技術的轉變是關鍵的成長動力。醫院正在投資下一代解決方案,以提高手術的精確度、安全性和效率,特別是對於複雜病例。現代手術室如今融合了機器人系統、整合手術室平台和影像技術,以最大限度地減少侵入性並改善治療效果。

這些系統提供的增強視覺化和精準資料有助於做出更明智的臨床決策並加快患者康復,這與擴大優質醫療服務覆蓋範圍的更廣泛目標相一致。這些先進技術使外科醫生和醫務人員能夠即時監測生命徵象和內部結構,顯著改善手術效果並降低併發症發生的可能性。高清成像、整合軟體平台和人工智慧分析技術有助於實現更精準的診斷和手術規劃。這種洞察力不僅可以降低手術的侵入性,還可以縮短住院時間,最大限度地降低再入院率,並支持個人化的術後照護。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 427億美元 |

| 預測值 | 791億美元 |

| 複合年成長率 | 6.4% |

在各類產品中,病患監護系統在2024年的市佔率為25.2%。外科醫生和麻醉師高度依賴這些系統在手術過程中即時追蹤生命徵象,例如血氧飽和度、心電圖和血壓。心臟、神經和器官移植等高風險手術的需求強勁,準確性和持續反饋至關重要。配備警報設定和資料趨勢分析功能的先進監護設備正被廣泛採用,以確保患者安全並支援時間敏感環境下的臨床決策。隨著手術程序日益複雜,可靠的術中監護有助於減少併發症並改善手術效果,從而推動對高性能監護解決方案的需求。

2024年,一般外科手術市場規模達131億美元,並將持續成為設備需求的主要驅動力。疝氣修補術、膽囊切除術和闌尾切除術等常規手術,為全球市場帶來了穩定的手術量。這種穩定的需求推動了對麻醉系統、手術台、高頻電刀和手術照明等手術室必需設備的持續投資。隨著醫院力求減少手術延誤並最佳化手術安排,提高手術室效率的壓力也隨之增加。普外科部門處理大量且持續時間不一的手術,因此尤其注重更換陳舊的基礎設施,並採用能夠快速處理手術並提高資源利用率的系統。

美國手術室設備市場在2024年創收174億美元,預計2034年將達到319億美元。美國高手術率的主要原因是人口老化以及肥胖、癌症和心血管疾病等常見的慢性疾病。不斷成長的手術需求迫使醫院系統和外科中心投資先進的手術室技術。從學術醫療中心到大型醫療網路,各類機構都投入大量資本預算來升級或擴展其手術基礎設施。這使他們能夠提高護理質量,減少手術等待時間,並跟上不斷發展的臨床標準。手術室環境的持續現代化持續推動美國市場強勁成長。

推動該行業發展的領導者企業包括潔定 (Getinge)、史賽克 (Stryker)、奧林巴斯 (Olympus)、美敦力 (Medtronic)、通用電氣醫療 (GE HealthCare)、飛利浦 (Philips)、卡爾·史托斯 (Karl Storz)、全錄輝 (Smith & Nephewewers)、西門子醫療 (Siemens HealthZ)、史維克美金芬妮 (Drkimmer) Biomet)、貝朗 (B. Braun)、強生 (Johnson & Johnson)、百特國際 (Baxter International) 與邁瑞 (Mindray)。為了保持強大的競爭優勢,手術室設備市場的公司正在採取一系列有針對性的策略,包括透過影像、整合和機器人技術的創新來擴展產品組合。許多公司專注於與醫院和外科中心合作,提供捆綁解決方案或交鑰匙手術室安裝服務。對微創工具和人工智慧系統研發的投資也有助於企業滿足日益成長的智慧手術環境需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創手術需求不斷成長

- 手術影像和機器人系統的技術進步

- 慢性病盛行率成長

- 擴大醫療保健基礎設施,特別是在新興經濟體

- 產業陷阱與挑戰

- 先進手術室技術帶來的高資本成本

- 缺乏熟練的專業人員

- 市場機會

- 門診手術中心不斷擴張

- 智慧手術室與互聯技術的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 定價分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 手術器械

- 麻醉設備

- 手術台

- 手術室燈

- 電外科手術裝置

- 病人監護系統

- 內視鏡設備

- 其他產品類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 一般外科

- 骨科手術

- 心血管外科

- 神經外科

- 婦科手術

- 耳鼻喉手術

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 學術和研究機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B. Braun

- Baxter International

- Dragerwerk

- GE HealthCare

- Getinge

- Johnson & Johnson

- Karl Storz

- Medtronic

- Mindray

- Olympus

- Philips

- Siemens Healthineers

- Smith & Nephew

- Stryker

- Zimmer Biomet

The Global Operating Room Equipment Market was valued at USD 42.7 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 79.1 billion by 2034. This market encompasses a broad range of essential tools, machines, systems, and infrastructure used to facilitate safe and effective surgical procedures. A steady rise in surgeries fueled by the global burden of chronic illnesses-such as orthopedic conditions, cancers, and heart diseases-is significantly accelerating market expansion. The increasing focus on healthcare infrastructure modernization and a shift toward more technologically advanced surgical techniques are key growth contributors. Hospitals are investing in next-generation solutions to enhance surgical precision, safety, and efficiency, particularly for complex cases. Modern surgical suites now incorporate robotic systems, integrated OR platforms, and imaging technologies to minimize invasiveness and improve outcomes.

Enhanced visualization and accurate data through these systems support better clinical decisions and faster recovery, aligning with the broader goal of expanding universal access to quality care. These advanced technologies allow surgeons and medical staff to monitor vital signs and internal structures in real time, significantly improving procedural outcomes and reducing the likelihood of complications. High-definition imaging, integrated software platforms, and AI-powered analytics contribute to more precise diagnostics and surgical planning. This level of insight not only reduces the invasiveness of procedures but also shortens hospital stays, minimizes readmission rates, and supports tailored post-operative care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.7 Billion |

| Forecast Value | $79.1 Billion |

| CAGR | 6.4% |

Among various product categories, patient monitoring systems segment held a 25.2% share in 2024. Surgeons and anesthesiologists rely heavily on these systems for real-time tracking of vital signs like oxygen saturation, ECG, and blood pressure during surgical procedures. The demand is strong for high-risk surgeries such as cardiac, neurological, and organ transplants, where accuracy and continuous feedback are critical. Advanced monitoring devices equipped with alarm settings and data trend capabilities are being widely adopted to ensure patient safety and support clinical decision-making in time-sensitive environments. As surgical procedures become more complex, reliable intraoperative monitoring helps in reducing complications and improving surgical outcomes, thus boosting the demand for high-performance monitoring solutions.

The general surgery segment generated USD 13.1 billion in 2024 and continues to be a major driver of equipment demand. Routine procedures such as hernia repairs, gallbladder removals, and appendectomies contribute to a consistent procedural volume across global markets. This steady demand fuels recurring investments in essential operating room tools including anesthesia systems, surgical tables, electrosurgical units, and surgical lighting. As hospitals aim to reduce case delays and optimize surgical scheduling, there is greater pressure to enhance operating room productivity. General surgery departments, which handle a high volume of procedures with varying durations, are particularly focused on replacing outdated infrastructure and adopting systems that facilitate rapid case turnaround and better resource utilization.

U.S. Operating Room Equipment Market generated USD 17.4 billion in 2024 and is estimated to reach USD 31.9 billion by 2034. The country's high surgical procedure rate is primarily driven by its aging population and widespread chronic diseases such as obesity, cancer, and cardiovascular issues. The growing procedural demand has compelled hospital systems and surgical centers to invest in advanced operating room technologies. Institutions ranging from academic medical centers to large healthcare networks allocate significant capital budgets to upgrade or expand their surgical infrastructure. This enables them to improve care quality, reduce surgical wait times, and keep pace with evolving clinical standards. The consistent modernization of OR environments continues to drive robust growth across the U.S. market landscape.

Leading players contributing to the development of this industry include Getinge, Stryker, Olympus, Medtronic, GE HealthCare, Philips, Karl Storz, Smith & Nephew, Siemens Healthineers, Dragerwerk, Zimmer Biomet, B. Braun, Johnson & Johnson, Baxter International, and Mindray. To maintain a strong competitive edge, companies operating in the OR equipment market are adopting a range of targeted strategies. These include expanding product portfolios through innovation in imaging, integration, and robotic technologies. Many are focusing on partnerships with hospitals and surgical centers to offer bundled solutions or turnkey operating room installations. Investments in R&D for minimally invasive tools and AI-powered systems are also helping players meet the growing need for smart surgical environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By application

- 2.2.4 By end use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for minimally invasive surgeries

- 3.2.1.2 Technological advancements in surgical imaging and robotic systems

- 3.2.1.3 Growth in chronic disease prevalence

- 3.2.1.4 Expanding healthcare infrastructure, especially in emerging economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital costs associated with advanced operating room technologies

- 3.2.2.2 Lack of skilled professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Growing expansion of outpatient surgery centers

- 3.2.3.2 Integration of smart OR and connected technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical instruments

- 5.3 Anesthesia equipment

- 5.4 Operating tables

- 5.5 Operating room lights

- 5.6 Electrosurgical units

- 5.7 Patient monitoring systems

- 5.8 Endoscopy equipment

- 5.9 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 General surgery

- 6.3 Orthopedic surgery

- 6.4 Cardiovascular surgery

- 6.5 Neurosurgery

- 6.6 Gynecological surgery

- 6.7 ENT surgery

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B. Braun

- 9.2 Baxter International

- 9.3 Dragerwerk

- 9.4 GE HealthCare

- 9.5 Getinge

- 9.6 Johnson & Johnson

- 9.7 Karl Storz

- 9.8 Medtronic

- 9.9 Mindray

- 9.10 Olympus

- 9.11 Philips

- 9.12 Siemens Healthineers

- 9.13 Smith & Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet