|

市場調查報告書

商品編碼

1773316

層式碼垛機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Layer Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

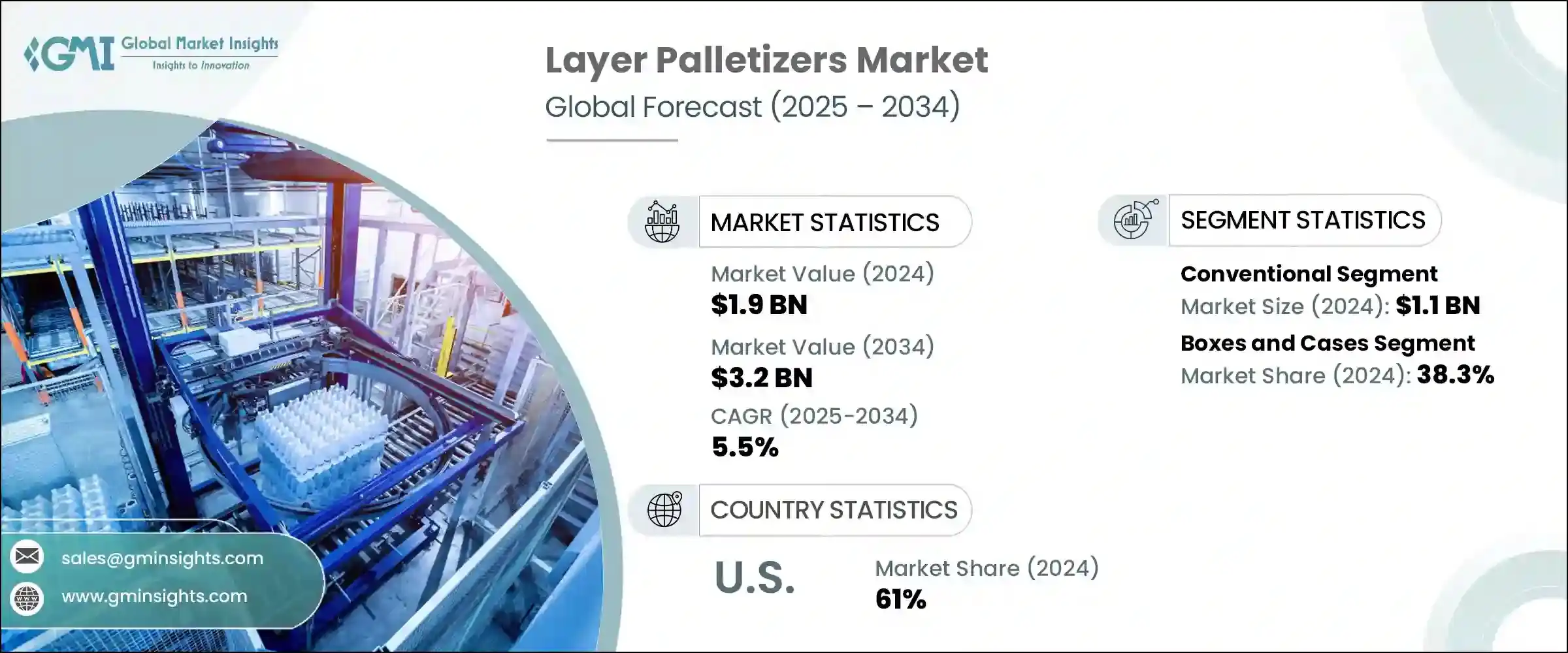

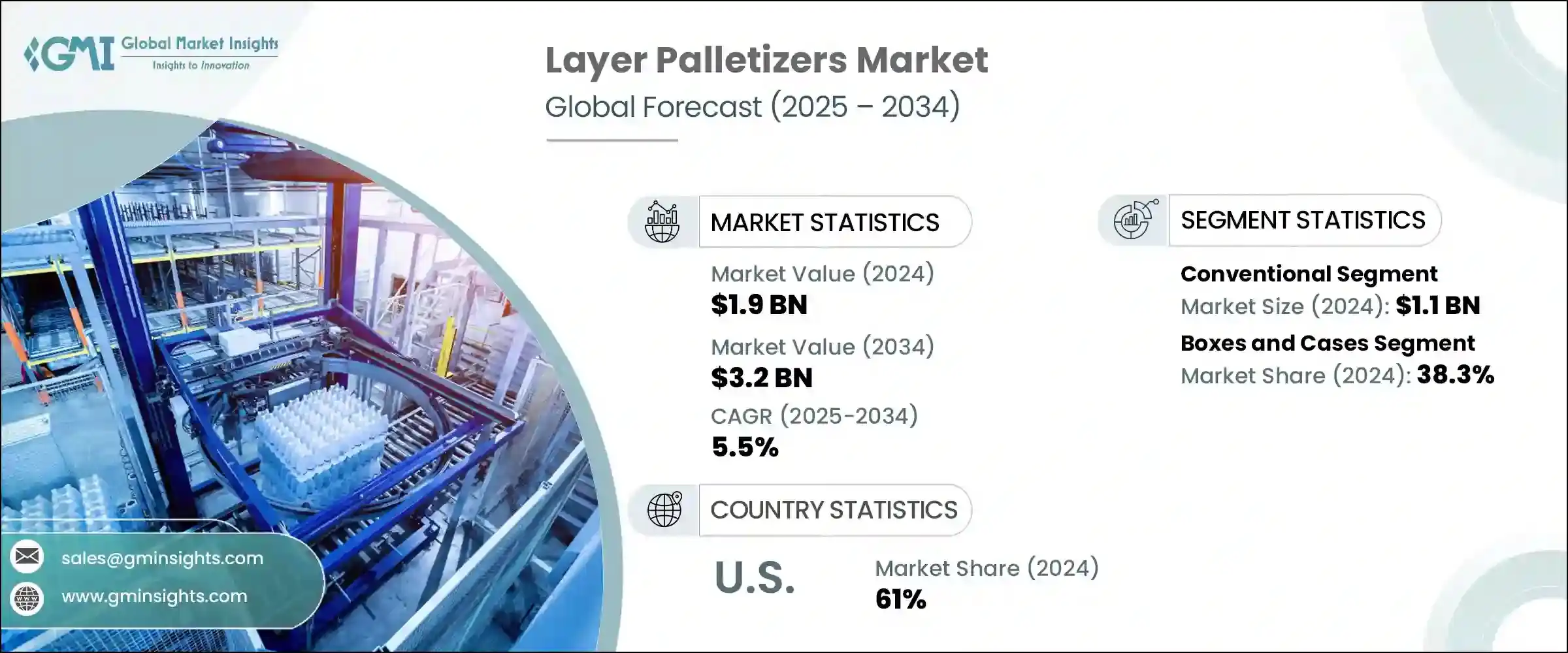

2024年,全球分層碼垛機市場規模達19億美元,預計到2034年將以5.5%的複合年成長率成長,達到32億美元。分層碼垛機在托盤上組織產品以實現高效運輸方面發揮著至關重要的作用,廣泛應用於物流、供應鏈和倉儲營運。近年來,自動化堆疊系統擴大取代倉庫和製造工廠中的手動堆疊方法,這得益於其能夠提高效率、減少產品損壞並減輕工人的體力負擔。

全球對自動化和營運效率日益成長的需求正推動著該市場的擴張。這些機器將箱子或袋子等物品小心地堆疊成整齊、穩定的層層結構,這對於簡化多個行業的配送、倉儲和運輸流程至關重要。主要的市場促進因素包括:勞動成本的上升、透過最大限度地減少人工操作來增強工作場所安全性,以及對生產線更高速度和更少錯誤的需求。製造商通常根據吞吐能力、對不同產品類型的適應性、設施佈局以及與現有輸送機和包裝系統的兼容性來評估碼垛機。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 5.5% |

技術進步,尤其是機器人技術、人工智慧 (AI) 和工業物聯網 (IIoT) 領域的技術進步,正在推動市場向前發展。現代分層碼垛機擁有更高的靈活性,能夠處理各種尺寸和形狀的產品,並可無縫整合到現有生產線中。這種適應性確保製造商能夠以更高的精度和更少的停機時間滿足不斷變化的需求。

傳統層式碼垛機市場在2024年創造了11億美元的市場規模。這些系統透過逐層堆疊板條箱和紙箱等貨物來建造托盤貨物,並由上游的傳送帶系統在放置前對包裹進行對齊。傳統碼垛機尤其適用於中小型生產設施,並滿足多通路市場的需求。透過利用這些先進的系統實現碼垛流程的自動化,企業可以解決勞動力短缺問題,減少停機時間,並滿足各行各業日益成長的需求。

2024年,紙箱和紙盒細分市場佔據38.3%的市場。由於紙箱形狀和硬度均勻,層式碼垛機尤其適合處理標準化的矩形或方形紙箱。紙箱和紙盒可滿足食品飲料、消費品、製藥和電子商務等行業的眾多包裝需求。其一致的形狀和可堆疊性使其能夠快速、精確、穩定地形成托盤,這對於高效的供應鏈至關重要。

2024年,美國層式碼垛機市場佔有61%的佔有率。高昂的勞動成本加上碼垛等重複性任務的勞動力短缺,是推動美國需求的主要因素。製造業、物流業和蓬勃發展的電子商務產業大力推動工業自動化,促進了自動碼垛技術的廣泛應用。美國公司大力投資這些系統,以提高效率、增加產量並維持一致的產品處理標準。此外,北美市場的成長得益於眾多知名碼垛機製造商和技術供應商的存在,他們不斷創新並增強產品供應。

影響全球層碼垛機市場的關鍵參與者包括 Korber AG、BW flexible Systems、Scott Automation、Premier Tech、PHS Innovate、Segbert Palletizing and Automation、COSMAPACK、TRAPO GmbH、Honeywell International Inc、SMB、Brolla、TMI、Mollers Packaging Technology GmbH、Concetti Sping Technology GmbH、ConcettiA 和 Rane。為了鞏固市場地位,層碼垛機產業的公司非常注重創新和客製化,開發針對不同產業需求和生產規模的解決方案。他們投資於整合尖端機器人技術、人工智慧和工業物聯網 (IIoT) 功能,以提高系統靈活性和效率。與原始設備製造商 (OEM) 和包裝解決方案提供商的合作使他們能夠提供可無縫融入現有生產線的綜合交鑰匙系統。公司還優先透過策略合作夥伴關係、在地化製造和強大的服務網路擴大全球影響力,以滿足全球客戶的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 電子商務和物流的成長

- 食品和飲料行業的需求不斷成長

- 各行各業採用自動化

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 產品變化的靈活性有限

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 傳統的

- 低/地板水平

- 進階

- 機器人

第6章:市場估計與預測:按產能,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 盒子和箱子

- 袋子和麻袋

- 托盤和板條箱

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 消費品

- 電子商務與物流

- 化學品和材料

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Brolla

- BW Flexible Systems

- Concetti SpA

- COSMAPACK

- Honeywell International Inc

- Korber AG

- KUKA AG

- Mollers Packaging Technology GmbH

- PHS Innovate

- Premier Tech

- Scott Automation

- Segbert Palletizing and Automation

- SMB

- TMI

- TRAPO GmbH

The Global Layer Palletizers Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 3.2 billion by 2034. Layer palletizers play a crucial role in organizing products on pallets for efficient transport, with widespread applications across logistics, supply chain, and storage operations. Over recent years, automated palletizing systems have increasingly replaced manual methods in warehouses and manufacturing facilities, driven by their ability to enhance efficiency, reduce product damage, and lessen physical strain on workers.

The growing global demand for automation and operational efficiency is fueling the expansion of this market. These machines carefully stack items such as boxes or bags into neat, stable layers, a process vital for streamlined distribution, storage, and transport across multiple industries. Key market drivers include rising labor expenses, an increased focus on workplace safety by minimizing manual handling, and the need for production lines to operate with greater speed and fewer errors. Manufacturers typically evaluate palletizers based on throughput capacity, adaptability to different product types, facility layout, and compatibility with existing conveyor and packaging systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.5% |

Technological advancements, especially in robotics, artificial intelligence (AI), and the Industrial Internet of Things (IIoT), are propelling the market forward. Modern layer palletizers boast enhanced flexibility, handling diverse product sizes and shapes while integrating seamlessly into existing production lines. This adaptability ensures manufacturers can meet evolving demands with greater precision and less downtime.

The conventional layer palletizers segment generated USD 1.1 billion in 2024. These systems build pallet loads by stacking goods such as crates and boxes layer by layer, with an upstream conveyor system aligning packages before placement. Conventional palletizers are particularly well-suited to small and medium-sized production facilities and meet the requirements of multi-channel markets. By automating the palletizing process with these advanced systems, businesses can address labor shortages, reduce downtime, and satisfy rising demand across sectors.

In 2024, the boxes and cases segment held a 38.3% share. Layer palletizers are especially effective for handling standardized rectangular or square cartons due to their uniform shape and rigidity. Boxes and cases serve numerous packaging needs across industries such as food and beverages, consumer goods, pharmaceuticals, and e-commerce. Their consistent shape and stackability enable fast, precise, and stable pallet formation, which is essential for efficient supply chains.

U.S. Layer Palletizers Market held a 61% share in 2024. High labor costs combined with workforce shortages for repetitive tasks such as palletizing are major factors driving demand in the U.S. A strong push towards industrial automation across manufacturing, logistics, and the booming e-commerce sector has encouraged widespread adoption of automated palletizing technologies. Companies in the U.S. invest heavily in these systems to boost efficiency, increase output, and maintain consistent product handling standards. Moreover, North America's market growth benefits from the presence of numerous established palletizer manufacturers and technology providers who continuously innovate and enhance product offerings.

Key players shaping the Global Layer Palletizers Market include Korber AG, BW Flexible Systems, Scott Automation, Premier Tech, PHS Innovate, Segbert Palletizing and Automation, COSMAPACK, TRAPO GmbH, Honeywell International Inc, SMB, Brolla, TMI, Mollers Packaging Technology GmbH, Concetti SpA, and Rane. To solidify their market positions, companies in the layer palletizers industry focus heavily on innovation and customization, developing solutions tailored to diverse industry needs and production scales. They invest in integrating cutting-edge robotics, AI, and IIoT capabilities to enhance system flexibility and efficiency. Collaborations with original equipment manufacturers (OEMs) and packaging solution providers allow them to offer comprehensive turnkey systems that seamlessly fit into existing lines. Firms also prioritize expanding their global footprint through strategic partnerships, localized manufacturing, and robust service networks to support customer requirements worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.2.1 Low/Floor level

- 5.2.2 High level

- 5.3 Robotic

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Boxes and cases

- 7.3 Bags and sacks

- 7.4 Trays and crates

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceuticals

- 8.4 Consumer goods

- 8.5 E-commerce and logistics

- 8.6 Chemicals and materials

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Brolla

- 10.2 BW Flexible Systems

- 10.3 Concetti SpA

- 10.4 COSMAPACK

- 10.5 Honeywell International Inc

- 10.6 Korber AG

- 10.7 KUKA AG

- 10.8 Mollers Packaging Technology GmbH

- 10.9 PHS Innovate

- 10.10 Premier Tech

- 10.11 Scott Automation

- 10.12 Segbert Palletizing and Automation

- 10.13 SMB

- 10.14 TMI

- 10.15 TRAPO GmbH