|

市場調查報告書

商品編碼

1773273

獸醫即時診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Point of Care Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

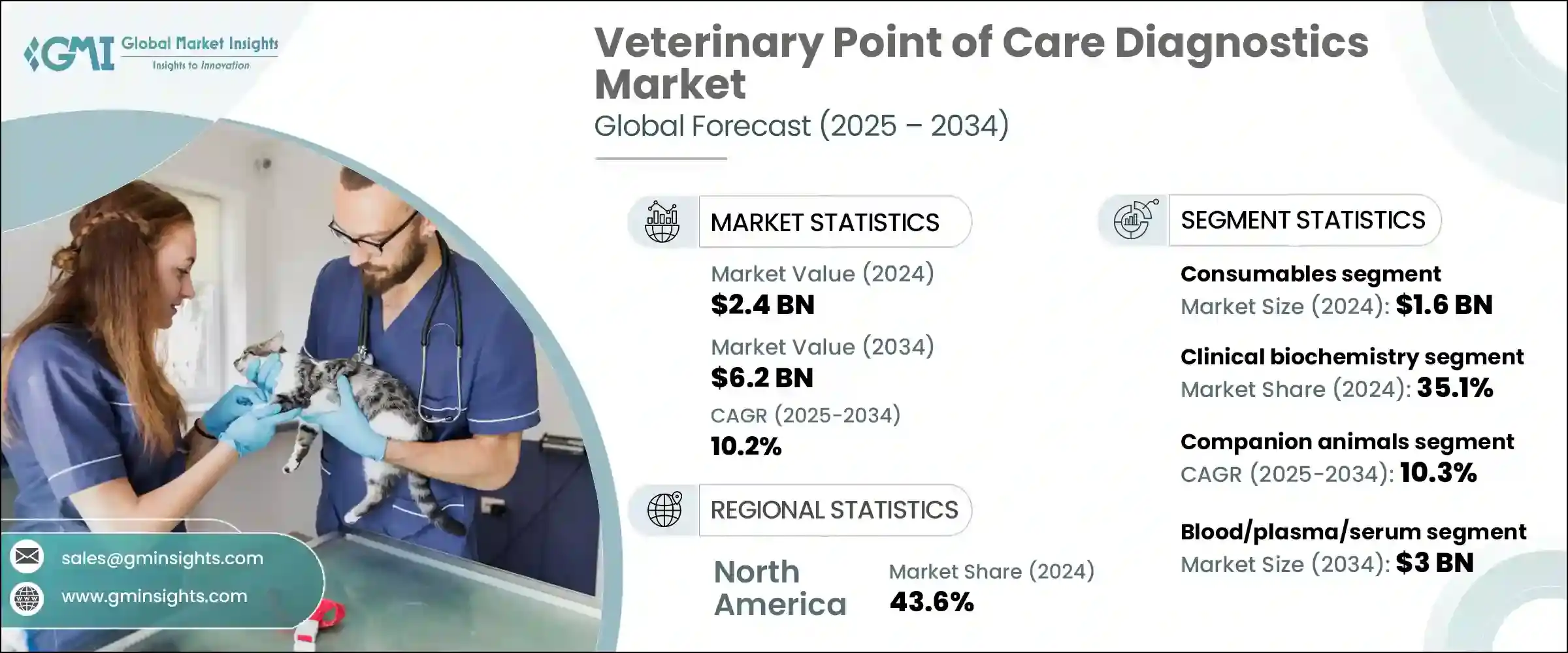

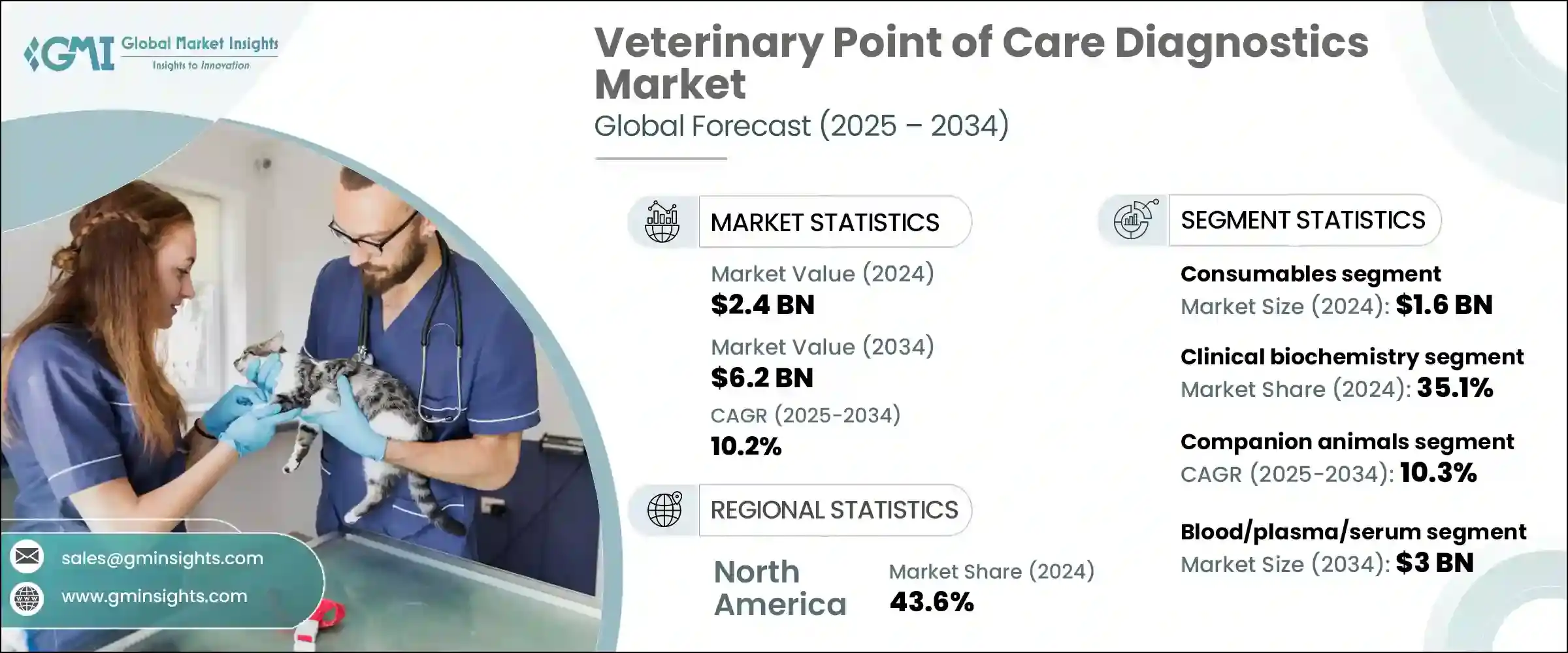

2024年,全球獸醫師即時診斷市場規模達24億美元,預計2034年將以10.2%的複合年成長率成長,達到62億美元。這一成長反映了動物傳染病發病率的上升,以及人們對跨物種人畜共通傳染病日益成長的擔憂。隨著寵物飼養量和牲畜數量的成長,對快速現場檢測的需求也日益成長。診所和實驗室正在部署先進的診斷工具,這些工具不僅能快速檢測結果,而且便於攜帶,這在一定程度上得益於人工智慧和物聯網平台,它們提高了準確性,並簡化了動物健康管理。

隨著獸醫護理服務可及性的提升以及寵物保險覆蓋率的不斷上升,這些趨勢增強了人們對即時診斷的信心,並加速了市場成長。隨著越來越多的寵物主人重視預防性護理和早期疾病檢測,他們越來越依賴即時診斷技術來更快地做出治療決策。這種日益成長的需求促使獸醫診所和醫院投資先進的攜帶式診斷工具,這些工具能夠提供準確、即時的結果,避免外部實驗室檢測帶來的延誤。此外,這些工具的便利性和可靠性也增強了人們對優質護理的認知,使寵物主人更願意定期進行獸醫體檢和健康監測,從而推動整個獸醫診斷行業的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 10.2% |

2024年,獸醫師即時診斷市場的耗材市場規模達16億美元。這些耗材包括卡盒、試劑、檢測試劑盒和檢測試劑,是每個即時診斷程序的必需品,需要頻繁補充。隨著檢測量的攀升,這種持續的需求支撐著可靠的經常性收入。隨著診所和醫院的擴張,對攜帶式、易於使用的耗材的需求也隨之成長,這些耗材能夠立即獲得結果並減少等待時間,寵物主人和專業人士對此非常欣賞。

臨床生物化學領域在2024年佔據35.1%的市場佔有率,這得益於其在評估代謝、器官功能、感染和發炎方面的核心作用。此領域的檢測包括肝臟、腎臟、電解質、葡萄糖和敗血症生物標記。其在獸醫診所和實驗室的廣泛應用凸顯了其在及時診斷和治療中的重要性,尤其是在緊急和慢性疾病中。

2024年,歐洲獸醫即時診斷市場規模達6.058億美元,未來可望維持強勁成長。在各國政府針對人畜共通傳染病和牲畜疾病的措施的支持下,人們對快速動物診斷的認知不斷提高,這正在加速其應用。由於微流體技術、免疫測定和攜帶式分子檢測領域的創新,以及診斷公司和獸醫組織之間的合作,歐洲市場正在快速發展。

獸醫即時診斷市場的主要公司包括愛德士實驗室 (IDEXX Laboratories)、通用電氣醫療 (GE Healthcare)、碩騰 (Zoetis)、賽默飛世爾科技 (Thermo Fisher Scientific)、邁瑞 (Mindray)、生物梅里埃 (BioMerieux)、安泰克 (Antech)、富士雅萊索諾賽特 (SFUJ3A)、SFUJ看到歐萊索諾賽特 (EFUserJ3S)、SFUJ看到歐萊索諾賽特 (SFUJ.S. Diagnostics)、朗道實驗室 (Randox Laboratories)、銳珂醫療 (Carestream Health)、百勝 (Esaote)、NeuroLogica、Biotangents、維克 (Virbac) 和伍德利設備 (Woodley Equipment)。診斷供應商正在透過產品創新、擴大合作夥伴關係和策略定價來鞏固其市場地位。公司優先考慮研發,以提高檢測靈敏度、便攜性以及與人工智慧 (AI) 和雲端平台的整合。他們與獸醫診所、動物健康網路和政府機構結盟,以擴大分銷管道,並將解決方案嵌入標準護理方案中。將耗材與設備捆綁銷售並提供訂閱或試劑補充計劃,可在確保經常性收入的同時,保持臨床醫生的忠誠度。區域擴張以及與當地經銷商的合作,為不同市場提供客製化解決方案。此外,具有競爭力的價格、捆綁服務合約和保固計畫有助於實現產品差異化。對技術卓越性和客戶支援的雙重重視使參與者能夠在快速成長、結果驅動的行業中保持相關性並佔據佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對即時診斷的需求不斷增加

- 增加動物保健支出

- 動物疾病發生率上升

- 診斷技術的進步

- 產業陷阱與挑戰

- POC診斷設備及耗材成本高

- 熟練獸醫專業人員短缺

- 市場機會

- 伴侶動物擁有量和寵物人性化程度的提高

- 獸醫教育和培訓中擴大使用即時護理

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 技術格局

- 當前的技術趨勢

- 新興技術

- 2024年各國獸醫數量

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 耗材

- 儀器和設備

第6章:市場估計與預測:按測試類型,2021 年至 2034 年

- 主要趨勢

- 臨床生物化學

- 免疫診斷

- 分子診斷

- 血液學

- 尿液分析

- 其他測試類型

第7章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 伴侶動物

- 狗

- 貓

- 馬匹

- 其他伴侶動物

- 牲畜

- 牛

- 豬

- 家禽

- 其他牲畜

第8章:市場估計與預測:依樣本類型,2021 年至 2034 年

- 主要趨勢

- 血液/血漿/血清

- 尿

- 糞便

- 其他樣本類型

第9章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 傳染病

- 非傳染性疾病

- 遺傳和先天性疾病

- 後天健康狀況

- 其他應用

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 診斷實驗室

- 居家照護環境

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Antech

- BioMerieux

- Biotangents

- Carestream Health

- Esaote

- Eurolyser Diagnostica

- FUJIFILM SonoSite

- GE Healthcare

- IDEXX Laboratories

- Mindray

- NeuroLogica

- Randox Laboratories

- Thermo Fisher Scientific

- Virbac

- Woodley Equipment

- Zoetis

The Global Veterinary Point of Care Diagnostics Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 6.2 billion by 2034. The surge reflects increasing rates of infectious diseases in animals and the growing concern over zoonotic illnesses crossing between species. As pet ownership and livestock populations expand, the need for rapid, on-site testing has intensified. Clinics and labs are responding by deploying advanced diagnostic tools that boast quick results and portability, thanks in part to AI and IoT-enabled platforms that enhance accuracy and streamline animal health management.

Together with better access to veterinary care and rising pet insurance adoption, these trends are fueling confidence in point-of-care testing and accelerating market growth. As more pet owners prioritize preventive care and early disease detection, they are increasingly relying on rapid diagnostics available at the point of care for faster treatment decisions. This growing demand is encouraging veterinary clinics and hospitals to invest in advanced, portable diagnostic tools that provide accurate, real-time results without the delays of external lab testing. Additionally, the convenience and reliability offered by these tools are reinforcing the perception of quality care, making pet owners more willing to engage in regular veterinary checkups and health monitoring, thereby propelling sustained growth across the entire veterinary diagnostics sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 10.2% |

The consumables segment from the veterinary point-of-care diagnostics market generated USD 1.6 billion in 2024. They include cartridges, reagents, test kits, and assays-essential for each point-of-care procedure and necessitating frequent replenishment. This continuous requirement supports reliable recurring revenue as testing volumes climb. As clinics and hospitals expand, demand for portable and easy-use consumables grows, enabling immediate results and reduced waiting times, which pet owners and professionals appreciate.

The clinical biochemistry segment held a 35.1% share in 2024, driven by its central role in evaluating metabolism, organ function, infection, and inflammation. Tests in this segment include panels for liver, kidney, electrolytes, glucose, and sepsis biomarkers. Widespread adoption in veterinary clinics and labs underscores their importance in timely diagnosis and treatment, especially critical in emergency and chronic conditions.

Europe Veterinary Point of Care Diagnostics Market reached USD 605.8 million in 2024 and is poised for strong future growth. Rising awareness around rapid animal diagnostics, backed by government initiatives targeting zoonotic and livestock diseases, is accelerating adoption. Enhanced by innovations in microfluidics, immunoassays, and portable molecular testing, along with collaborations between diagnostic firms and veterinary organizations, the European market is advancing rapidly.

Key companies in the Veterinary Point of Care Diagnostics Market include IDEXX Laboratories, GE Healthcare, Zoetis, Thermo Fisher Scientific, Mindray, BioMerieux, Antech, FUJIFILM SonoSite, Eurolyser Diagnostics, Randox Laboratories, Carestream Health, Esaote, NeuroLogica, Biotangents, Virbac, Woodley Equipment. Diagnostic providers are strengthening their market foothold through product innovation, expanding partnerships, and strategic pricing. Companies prioritize R&D to enhance test sensitivity, portability, and integration with AI and cloud platforms. They forge alliances with veterinary clinics, animal health networks, and government agencies to expand distribution and embed solutions in standard care protocols. Bundling consumables with equipment and offering subscription or reagent-replenishment programs secures recurring revenues while maintaining clinician loyalty. Regional expansions and collaborations with local distributors enable customized solutions for diverse markets. Additionally, competitive pricing, bundled service contracts, and warranty schemes help differentiate offerings. A dual emphasis on technological excellence and customer support allows players to maintain relevance and capture share in a rapidly growing, outcome-driven sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Test type

- 2.2.4 Animal type

- 2.2.5 Sample type

- 2.2.6 Application

- 2.2.7 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for point of care diagnostics

- 3.2.1.2 Increasing animal healthcare expenditures

- 3.2.1.3 Rising prevalence of animal diseases

- 3.2.1.4 Advancements in diagnostics technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of POC diagnostic devices and consumables

- 3.2.2.2 Shortage of skilled veterinary professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising companion animal ownership and pet humanization

- 3.2.3.2 Growing use of point of care in veterinary education and training

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Number of veterinarians, by country, 2024

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments and devices

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.3 Immunodiagnostics

- 6.4 Molecular diagnostics

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other test types

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Swine

- 7.3.3 Poultry

- 7.3.4 Other livestock animals

Chapter 8 Market Estimates and Forecast, By Sample Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Blood/plasma/serum

- 8.3 Urine

- 8.4 Fecal

- 8.5 Other sample types

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Infectious diseases

- 9.3 Non-infectious conditions

- 9.4 Hereditary and congenital conditions

- 9.5 Acquired health conditions

- 9.6 Other applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals and clinics

- 10.3 Diagnostic labs

- 10.4 Home care settings

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Antech

- 12.2 BioMerieux

- 12.3 Biotangents

- 12.4 Carestream Health

- 12.5 Esaote

- 12.6 Eurolyser Diagnostica

- 12.7 FUJIFILM SonoSite

- 12.8 GE Healthcare

- 12.9 IDEXX Laboratories

- 12.10 Mindray

- 12.11 NeuroLogica

- 12.12 Randox Laboratories

- 12.13 Thermo Fisher Scientific

- 12.14 Virbac

- 12.15 Woodley Equipment

- 12.16 Zoetis