|

市場調查報告書

商品編碼

1773271

住宅微型逆變器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Micro Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

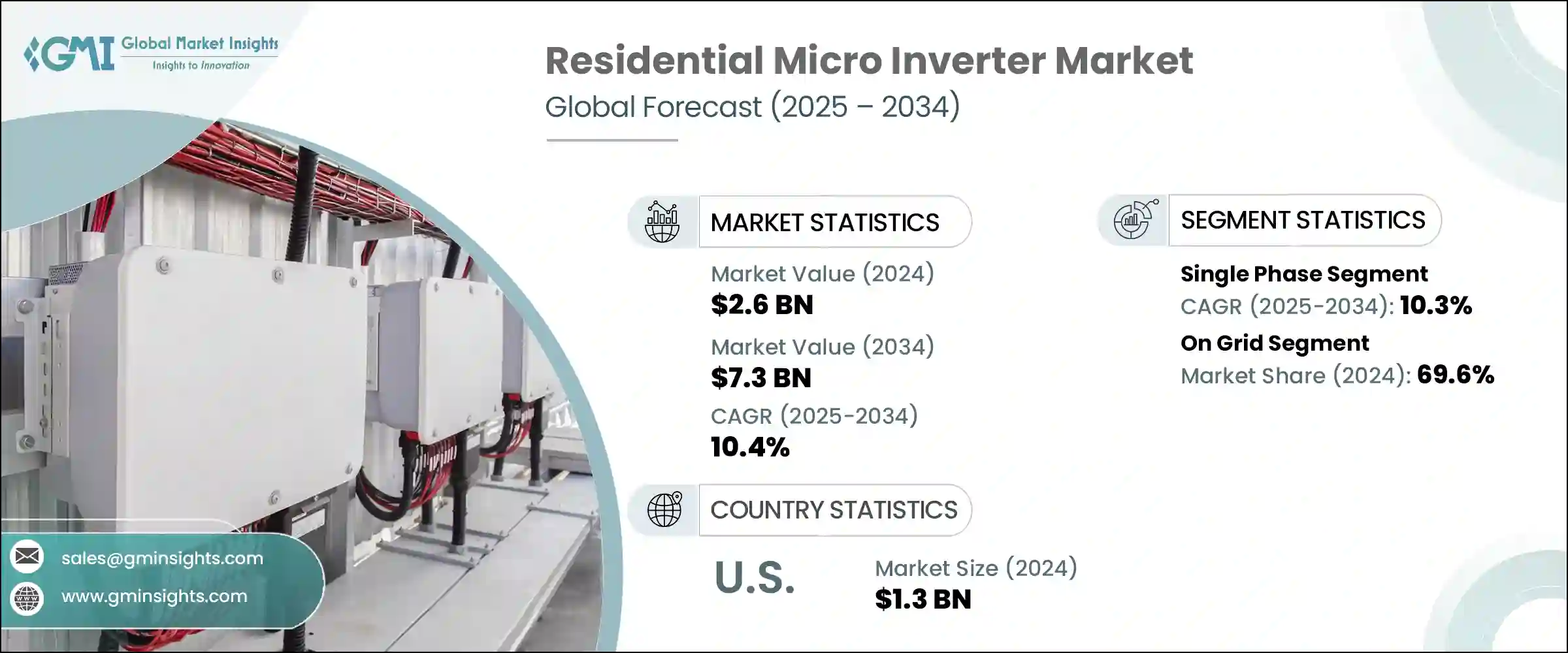

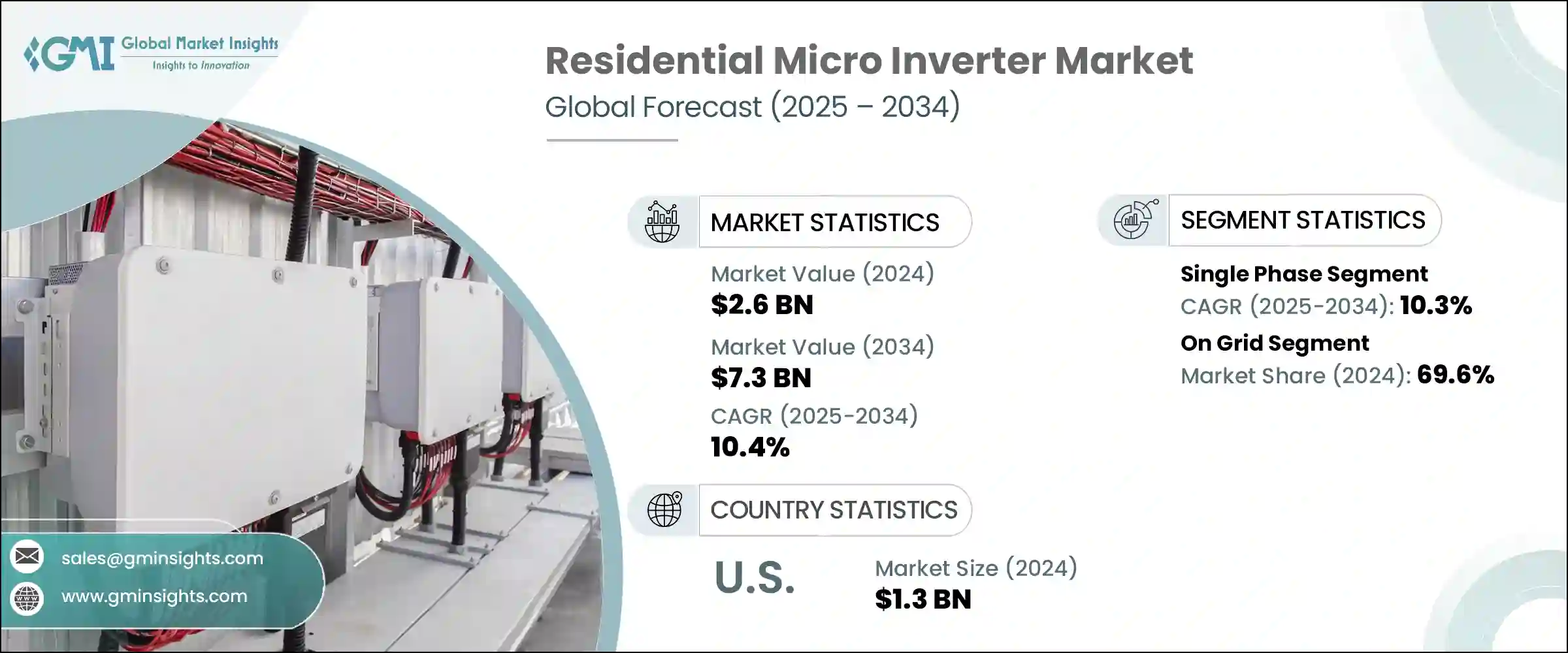

2024年,全球住宅微型逆變器市場規模達26億美元,預計2034年將以10.4%的複合年成長率成長,達到73億美元。人們對能源自給自足的興趣日益濃厚,以及對家庭用電控制的加強,推動了住宅微型逆變器解決方案的普及。隨著電費持續上漲,以及電網日益不穩定,越來越多的屋主開始投資可靠的太陽能屋頂系統。微型逆變器因其能夠提供穩定的性能,並在波動期間保持系統完整性而備受青睞。政府支持的獎勵計畫和家庭太陽能裝置融資管道的改善也促進了微型逆變器的普及,尤其是在政策支持推動光伏組件和微型逆變器等分散式能源發展的市場。

緊湊型模組化太陽能裝置日益成長的需求,推動了微型逆變器系統在住宅領域的部署。這些設備使屋主能夠追蹤每塊太陽能板的輸出,同時消除了集中式系統的脆弱性。對能源自主性和安全監管協調的日益重視,正在推動市場擴張。在新興經濟體中,隨著國家太陽能目標的實施,住宅屋頂安裝量不斷增加,微型逆變器的應用也正在加速。隨著這些趨勢的持續,微型逆變器正成為確保長期性能、靈活性和系統彈性的關鍵技術。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 10.4% |

預計到2034年,單相微型逆變器系統市場將以10.3%的複合年成長率成長。這些解決方案可在單一電池板層面提供效能最佳化,並透過持續創新和成本效益提升而不斷增強。消費者對將這些系統與家用電池儲能和智慧能源解決方案相結合的興趣,正推動其在住宅應用領域的擴張。智慧能源管理功能和遠端監控能力的進步預計將進一步推動成長。

獨立式住宅系統市場預計將在2025年至2034年間以14.1%的複合年成長率成長,這得益於偏遠地區對離網能源解決方案日益成長的偏好。尋求能源獨立的屋主,尤其是在電網不穩定的地區,正在選擇整合電池儲能的微型逆變器。這些系統使住宅能夠自主運行,並在電網中斷時提供備用電源,從而提高能源安全性和吸引力。

到2034年,亞太地區戶用微型逆變器市場規模將達到9億美元,這得益於戶用光電系統對智慧模組級能源管理的需求不斷成長。智慧電網系統的持續發展和服務欠缺地區的電氣化也推動了其部署。大眾對自給自足能源使用益處的認知不斷提高,以及最佳化整體系統輸出的能力不斷增強,正在增強整個地區的市場機會。

該行業的主要參與者包括森薩塔科技、禾邁、恩沃(浙江恩沃)、SMA Solar Technology、中智傑、Sparq Systems、Fimer Group、Yotta Energy、昱能電力系統、領能太陽能、寧波德業逆變科技、TSUNESS、Enphase Energy、古瑞瓦特新能源、奇力康電源和達方電子。為了鞏固市場地位,領先的家用微型逆變器公司正優先考慮技術差異化,透過持續研發智慧電網相容性、組件級性能最佳化和整合儲能解決方案。各公司正在擴展產品線,以滿足更廣泛的屋頂配置和能源需求。與太陽能板製造商、分銷商和公用事業提供者建立策略聯盟,可以提升市場准入和品牌定位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第6章:市場規模及預測:依連結性,2021 - 2034

- 主要趨勢

- 獨立

- 在電網上

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 波蘭

- 荷蘭

- 奧地利

- 英國

- 法國

- 西班牙

- 比利時

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

第8章:公司簡介

- Altenergy Power Systems

- Chilicon Power

- Chisageess

- Darfon Electronics

- Enphase Energy

- Envertech (Zhejiang Envertech)

- Fimer Group

- Growatt New Energy

- Hoymiles

- Lead Solar Energy

- NingBo Deye Inverter Technology

- Sensata Technologies

- SMA Solar Technology

- Sparq Systems

- TSUNESS

- Yotta Energy

The Global Residential Micro Inverter Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 7.3 billion by 2034. Rising interest in energy self-reliance and greater control over household electricity consumption is driving the adoption of residential microinverter solutions. As electricity costs continue to rise and utility grids face growing instability, more homeowners are investing in reliable solar rooftop systems. Microinverters are favored for their ability to deliver consistent performance and maintain system integrity during fluctuations. Government-backed incentive programs and improved access to financing for home solar installations are also encouraging adoption, especially in markets where policy support boosts distributed energy resources like PV modules and microinverters.

Growing demand for compact, modular solar installations is supporting the residential deployment of microinverter systems. These devices allow homeowners to track each panel's output while eliminating the vulnerability of a centralized system. Increasing emphasis on energy autonomy and regulatory alignment around safety is reinforcing market expansion. Adoption is accelerating in emerging economies where residential rooftop installations are rising in response to national solar targets. As these trends persist, microinverters are emerging as a critical technology to ensure long-term performance, flexibility, and system resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 10.4% |

Single phase microinverter systems segment is predicted to grow at a CAGR of 10.3% through 2034. These solutions offer performance optimization at the individual panel level and are being enhanced through continuous innovation and cost-efficiency improvements. Consumer interest in pairing these systems with home battery storage and smart energy solutions is fueling their expansion in residential applications. Advancements in intelligent energy management features and remote monitoring capabilities are expected to push growth further.

The standalone residential systems segment is poised to grow at a 14.1% CAGR between 2025 and 2034, supported by the growing preference for off-grid energy solutions in remote regions. Homeowners looking for energy independence, especially in areas with unreliable grid access, are opting for microinverters integrated with battery storage. These systems enable homes to operate autonomously and provide backup during grid outages, improving energy security and appeal.

Asia Pacific Residential Micro Inverter Market will reach USD 900 million by 2034, driven by greater demand for smart, module-level energy management in residential PV setups. Continued development of smart grid systems and electrification of underserved regions is also propelling deployment. Greater public awareness about the benefits of self-sufficient energy use and the ability to optimize overall system output are enhancing market opportunities across the region.

Key players operating across this industry landscape include Sensata Technologies, Hoymiles, Envertech (Zhejiang Envertech), SMA Solar Technology, Chisageess, Sparq Systems, Fimer Group, Yotta Energy, Altenergy Power Systems, Lead Solar Energy, NingBo Deye Inverter Technology, TSUNESS, Enphase Energy, Growatt New Energy, Chilicon Power, and Darfon Electronics. To solidify their market presence, leading residential micro inverter companies are prioritizing technology differentiation through continuous R&D in smart grid compatibility, panel-level performance optimization, and integrated storage solutions. Firms are expanding their product lines to cater to a wider range of rooftop configurations and energy demands. Strategic alliances with solar panel manufacturers, distributors, and utility providers improve market access and brand positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Triple phase

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 On grid

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.3.8 Spain

- 7.3.9 Belgium

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 Altenergy Power Systems

- 8.2 Chilicon Power

- 8.3 Chisageess

- 8.4 Darfon Electronics

- 8.5 Enphase Energy

- 8.6 Envertech (Zhejiang Envertech)

- 8.7 Fimer Group

- 8.8 Growatt New Energy

- 8.9 Hoymiles

- 8.10 Lead Solar Energy

- 8.11 NingBo Deye Inverter Technology

- 8.12 Sensata Technologies

- 8.13 SMA Solar Technology

- 8.14 Sparq Systems

- 8.15 TSUNESS

- 8.16 Yotta Energy