|

市場調查報告書

商品編碼

1773266

醫用 X 光市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medical X-ray Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

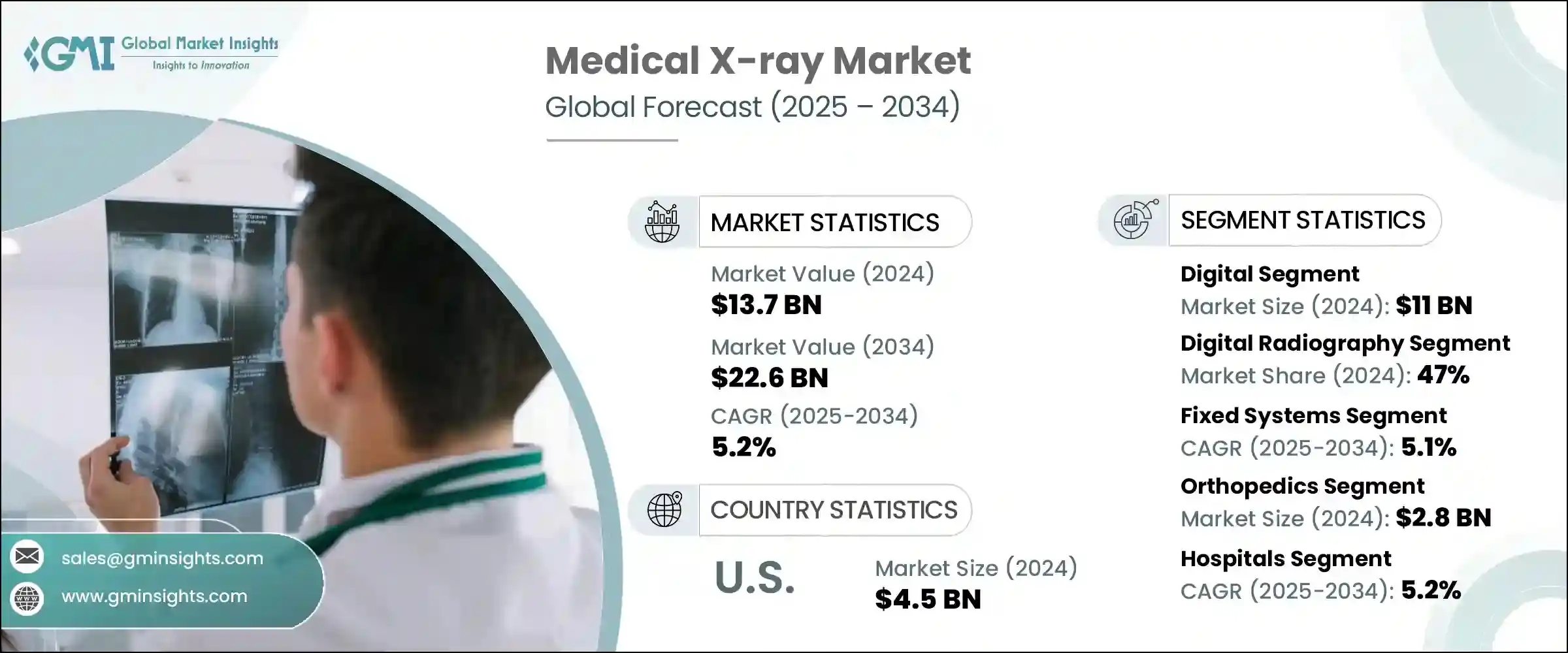

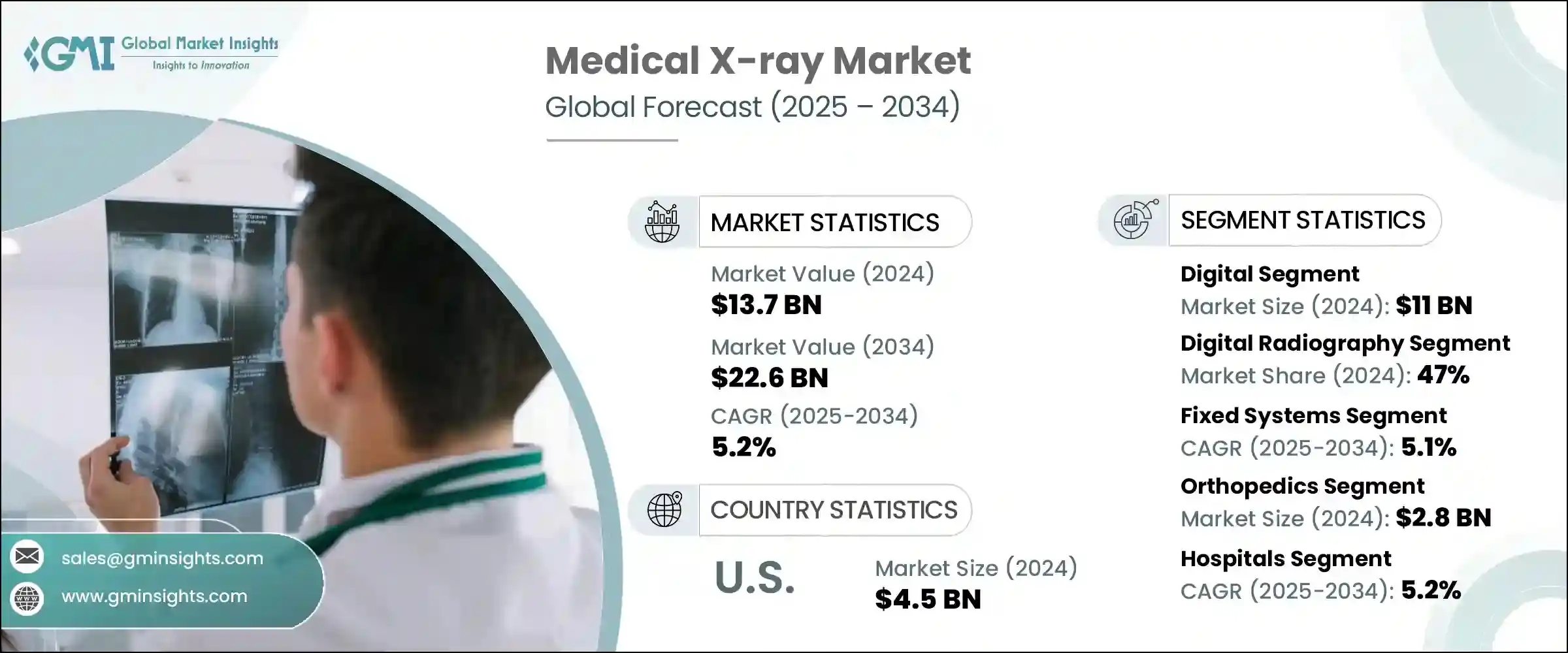

2024 年全球醫用 X 光市場規模為 137 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長,達到 226 億美元。對醫療 X 光設備的需求主要源自於癌症、心血管疾病、呼吸系統疾病、神經系統疾病和肌肉骨骼疾病等慢性疾病發生率的上升。隨著越來越多的患者需要對這些疾病進行早期和準確的診斷,醫用 X 光機已成為必不可少的診斷工具。 X 光影像有助於檢測骨骼、器官和組織中的腫瘤、骨折和異常情況。全球人口的成長和老化也導致對診斷影像的需求增加,尤其是對老年患者與年齡相關的疾病的需求。這些因素共同推動了市場擴張。

此外,醫用X光在診斷各種慢性病和其他醫療問題方面發揮著至關重要的作用。它們能夠提供人體內部結構(例如骨骼、器官和軟組織)的高解析度影像,這對於識別骨折、腫瘤、感染以及各器官的異常至關重要。這些詳細的影像有助於醫生評估損傷或疾病的嚴重程度,監測正在進行的治療,並在必要時規劃手術干預。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 137億美元 |

| 預測值 | 226億美元 |

| 複合年成長率 | 5.2% |

此外,X光技術在早期診斷中不可或缺,它使醫療保健提供者能夠在問題發展成更嚴重的健康風險之前發現它們。 X光技術的非侵入性特性和提供精確結果的能力使其成為準確診斷和有效治療計劃不可或缺的工具。隨著數位X光系統的進步,影像清晰度和診斷能力不斷提高,使醫生更容易做出明智的病患照護決策。

受數位系統技術創新的推動,數位X光領域在2024年創造了110億美元的市場規模。數位X光設備提供卓越的成像能力,解析度高、對比度更高,這對於精準診斷至關重要。其快速擷取和處理影像的能力顯著縮短了患者的等待時間。此外,人工智慧成像解決方案等技術進步正在提高診斷效率和結果的一致性。這些特性促進了數位X光技術在醫療機構中的廣泛應用。在放射影像學方面,數位系統日益普及,這主要得益於其與現代IT基礎設施的整合,從而改善了資料管理和可訪問性。

預計到2034年,醫院產業的複合年成長率將達到5.2%。無論是在發展中地區或已開發地區,醫院數量的成長都受到人口成長、慢性病盛行率上升以及醫學影像技術的進步等因素的推動。這些因素共同推動了新建醫院和現有醫療機構對先進醫用X光系統的需求。此外,中東、非洲和亞太等地區醫療基礎設施的不斷擴張,也加速了先進醫用X光技術在醫院環境中的應用。

2024年,歐洲醫用X光市場規模達38億美元。這一成長主要得益於慢性病發病率的上升以及該地區各國政府持續改善醫療基礎設施的努力。此外,X光技術的進步,尤其是數位和攜帶式系統的進步,將進一步推動歐洲市場的成長。該地區主要市場參與者的存在也增強了歐洲的競爭優勢。在該地區營運的公司正在積極投資創新解決方案,並不斷升級其產品,從而促進市場的整體擴張。

全球醫用X光市場的主要參與者包括愛克發-吉華集團、艾倫格斯醫療系統、佳能、銳珂醫療、登士柏西諾德、富士軟片控股公司、通用電氣醫療科技、豪洛捷、荷蘭皇家飛利浦、柯尼卡美能達、Midmark、東軟醫療系統、普朗醫療設備、三星皇家飛利浦、柯尼卡美能達、Midmark、東軟醫療系統、普朗醫療設備、三星、三星醫療公司、三星西門)眾多電子公司。為了鞏固其在競爭激烈的醫用X光市場中的地位,各公司正專注於多項策略舉措。他們大力投資研發,旨在為市場帶來先進的影像解決方案,例如具有人工智慧功能的數位X光系統,可提高診斷的準確性。

此外,各公司正優先考慮將其產品與IT基礎設施整合,以實現更好的資料存取、儲存和管理。許多公司也正在開發攜帶式和無線X光系統,為醫療保健提供者提供更大的靈活性和便利性。透過數位射線成像解決方案降低成本,無需傳統的膠片沖洗,是吸引注重成本的機構的另一項策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 已開發國家診斷影像技術的進步

- 全球慢性病盛行率不斷上升

- 診斷成像程序的數量不斷增加

- 醫療 X 光檢查的報銷情況

- 產業陷阱與挑戰

- 高輻射暴露的風險

- 安裝醫學影像設備的成本高昂

- 市場機會

- 擴大使用低劑量X光技術來最大限度地減少輻射暴露,同時保持高影像品質。

- 對人工智慧整合 X 光系統的需求不斷增加,以增強影像解釋能力並減少診斷錯誤。

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 數位的

- 模擬

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 底片放射照相術

- 電腦放射成像

- 數位射線照相術

第7章:市場估計與預測:按便攜性,2021 - 2034

- 主要趨勢

- 固定系統

- 攜帶式系統

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 牙科

- 口內成像

- 口外成像

- 獸醫

- 腫瘤學

- 骨科

- 心臟病學

- 神經病學

- 其他獸醫應用

- 乳房X光檢查

- 胸部

- 心血管

- 骨科

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 越南

- 韓國

- 泰國

- 大洋洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 埃及

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Agfa-Gevaert Group

- Allengers Medical Systems

- Canon

- Carestream Health

- Dentsply Sirona

- Fujifilm Holdings Corporation

- GE HealthCare Technologies

- Hologic

- Koninklijke Philips NV

- Konica Minolta

- Midmark

- Neusoft Medical Systems

- Perlong Medical Equipment

- Samsung Electronics

- Shimadzu

- Siemens Healthineers

- Trivitron Healthcare

The Global Medical X-ray Market was valued at USD 13.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 22.6 billion by 2034. The demand for medical X-ray devices is primarily driven by the rising prevalence of chronic diseases, including cancer, cardiovascular issues, respiratory conditions, neurological disorders, and musculoskeletal problems. As more patients require early and precise diagnoses for these conditions, medical X-ray machines have become an essential diagnostic tool. X-ray imaging helps detect tumors, fractures, and abnormalities in bones, organs, and tissues. The growing and aging global population is also contributing to the rise in the need for diagnostic imaging, particularly for age-related conditions in elderly patients. These factors combine to fuel the market's expansion.

Additionally, medical X-rays play a vital role in diagnosing a wide range of chronic conditions and other medical issues. They provide high-resolution images of the body's internal structures, such as bones, organs, and soft tissues, which are essential for identifying fractures, tumors, infections, and abnormalities in various organs. These detailed images help physicians assess the severity of injuries or diseases, monitor ongoing treatments, and plan surgical interventions if necessary.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 Billion |

| Forecast Value | $22.6 Billion |

| CAGR | 5.2% |

Furthermore, X-ray technology is indispensable in early detection, allowing healthcare providers to identify problems before they develop into more serious health risks. Its non-invasive nature and ability to deliver precise results make it an indispensable tool for accurate diagnosis and effective treatment planning. With advancements in digital X-ray systems, image clarity, and diagnostic capabilities continue to improve, making it easier for doctors to make informed decisions about patient care.

The digital X-ray segment generated USD 11 billion in 2024 driven by technological innovations in digital systems. Digital X-ray devices offer superior imaging capabilities with high resolution and better contrast, critical for accurate diagnoses. Their ability to quickly capture and process images significantly reduces patient waiting times. Furthermore, advancements like AI-powered imaging solutions are increasing the efficiency and consistency of diagnostic results. These features contribute to the widespread adoption of digital X-ray technology across healthcare facilities. In terms of radiography, digital systems have become increasingly popular, mainly due to their integration with modern IT infrastructure, which improves data management and accessibility.

The hospital segment is expected to grow at a CAGR of 5.2% through 2034. The growth in the number of hospitals, both in developing and developed regions, is being driven by factors such as population growth, the increasing prevalence of chronic diseases, and advancements in medical imaging technologies. These factors are collectively fueling the demand for state-of-the-art medical X-ray systems, both in newly built hospitals and within existing healthcare facilities. Additionally, the expanding healthcare infrastructure in regions like the Middle East, Africa, and Asia Pacific is accelerating the adoption of advanced medical X-ray technologies in hospital settings.

Europe Medical X-ray market was valued at USD 3.8 billion in 2024. This growth can be attributed to the rising incidence of chronic diseases and the ongoing efforts by governments in the region to improve healthcare infrastructure. Additionally, advancements in X-ray technology, particularly in digital and portable systems, will further drive market growth in Europe. The presence of major market players in the region also strengthens Europe's competitive edge. Companies operating in the region are actively investing in innovative solutions and continuously upgrading their offerings, contributing to the overall expansion of the market.

The key players in the Global Medical X-ray market include a diverse range of companies such as Agfa-Gevaert Group, Allengers Medical Systems, Canon, Carestream Health, Dentsply Sirona, Fujifilm Holdings Corporation, GE Healthcare Technologies, Hologic, Koninklijke Philips N.V., Konica Minolta, Midmark, Neusoft Medical Systems, Perlong Medical Equipment, Samsung Electronics, Shimadzu, Siemens Healthineers, and Trivitron Healthcare. To solidify their position in the competitive medical X-ray market, companies are focusing on several strategic initiatives. They are heavily investing in research and development to bring advanced imaging solutions to the market, such as digital X-ray systems with AI capabilities that enhance diagnostic accuracy.

Additionally, companies are prioritizing the integration of their products with IT infrastructure, allowing for better data accessibility, storage, and management. Many players are also developing portable and wireless X-ray systems to offer greater flexibility and convenience to healthcare providers. Cost reduction through digital radiography solutions, which eliminate the need for traditional film processing, is another strategy being employed to appeal to cost-conscious institutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Market scope and definitions

- 1.3 Research design

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Portability

- 2.2.5 Application

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in diagnostic imaging in developed countries

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Presence of reimbursement for medical x-ray procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of high radiation exposure

- 3.2.2.2 High cost associated with installation of medical imaging modalities

- 3.2.3 Market opportunities

- 3.2.3.1 Growing use of low-dose X-ray technologies to minimize radiation exposure while maintaining high image quality.

- 3.2.3.2 Increasing demand for AI-integrated X-ray systems to enhance image interpretation and reduce diagnostic errors.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital

- 5.3 Analog

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Film-based radiography

- 6.3 Computed radiography

- 6.4 Digital radiography

Chapter 7 Market Estimates and Forecast, By Portability, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Fixed systems

- 7.3 Portable systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dental

- 8.2.1 Intraoral imaging

- 8.2.2 Extraoral imaging

- 8.3 Veterinary

- 8.3.1 Oncology

- 8.3.2 Orthopedics

- 8.3.3 Cardiology

- 8.3.4 Neurology

- 8.3.5 Other veterinary applications

- 8.4 Mammography

- 8.5 Chest

- 8.6 Cardiovascular

- 8.7 Orthopedics

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Vietnam

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Oceania

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Egypt

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agfa-Gevaert Group

- 11.2 Allengers Medical Systems

- 11.3 Canon

- 11.4 Carestream Health

- 11.5 Dentsply Sirona

- 11.6 Fujifilm Holdings Corporation

- 11.7 GE HealthCare Technologies

- 11.8 Hologic

- 11.9 Koninklijke Philips N.V.

- 11.10 Konica Minolta

- 11.11 Midmark

- 11.12 Neusoft Medical Systems

- 11.13 Perlong Medical Equipment

- 11.14 Samsung Electronics

- 11.15 Shimadzu

- 11.16 Siemens Healthineers

- 11.17 Trivitron Healthcare