|

市場調查報告書

商品編碼

1773264

內視鏡市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Endoscopy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

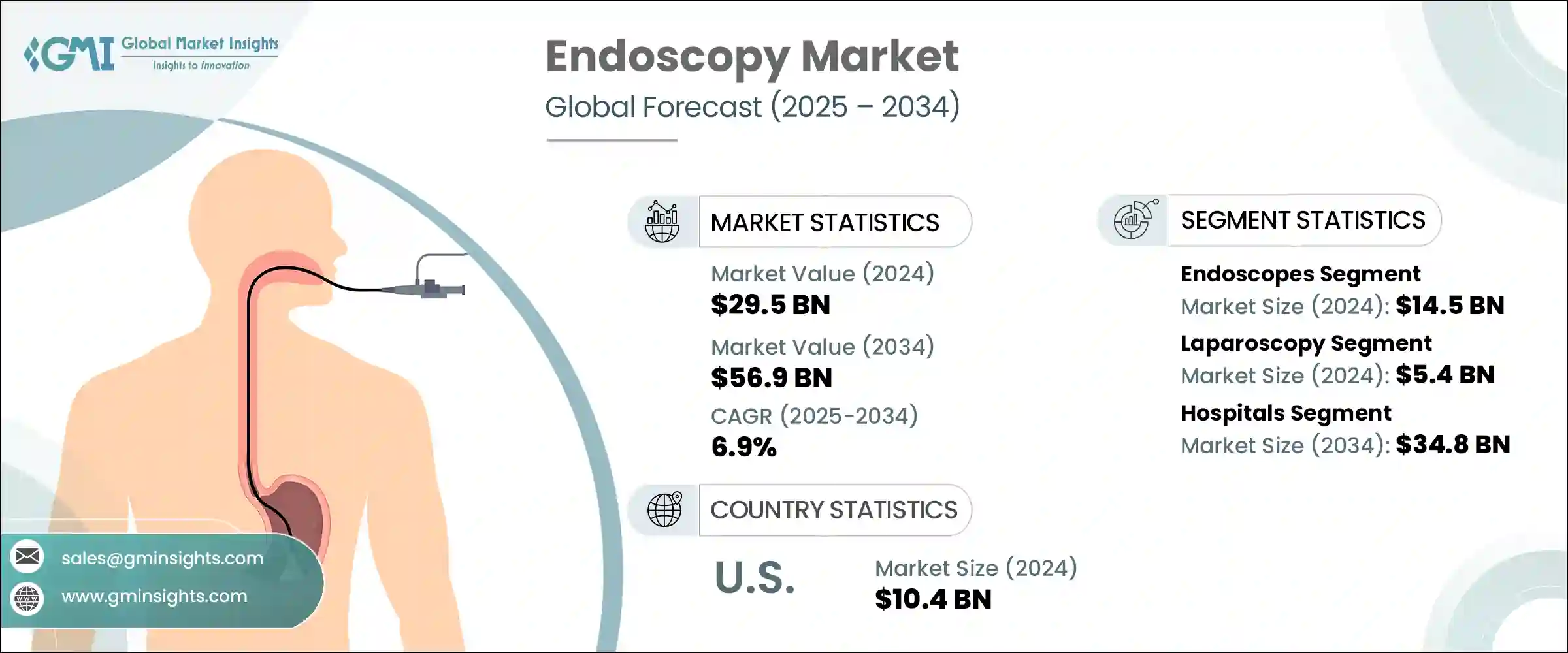

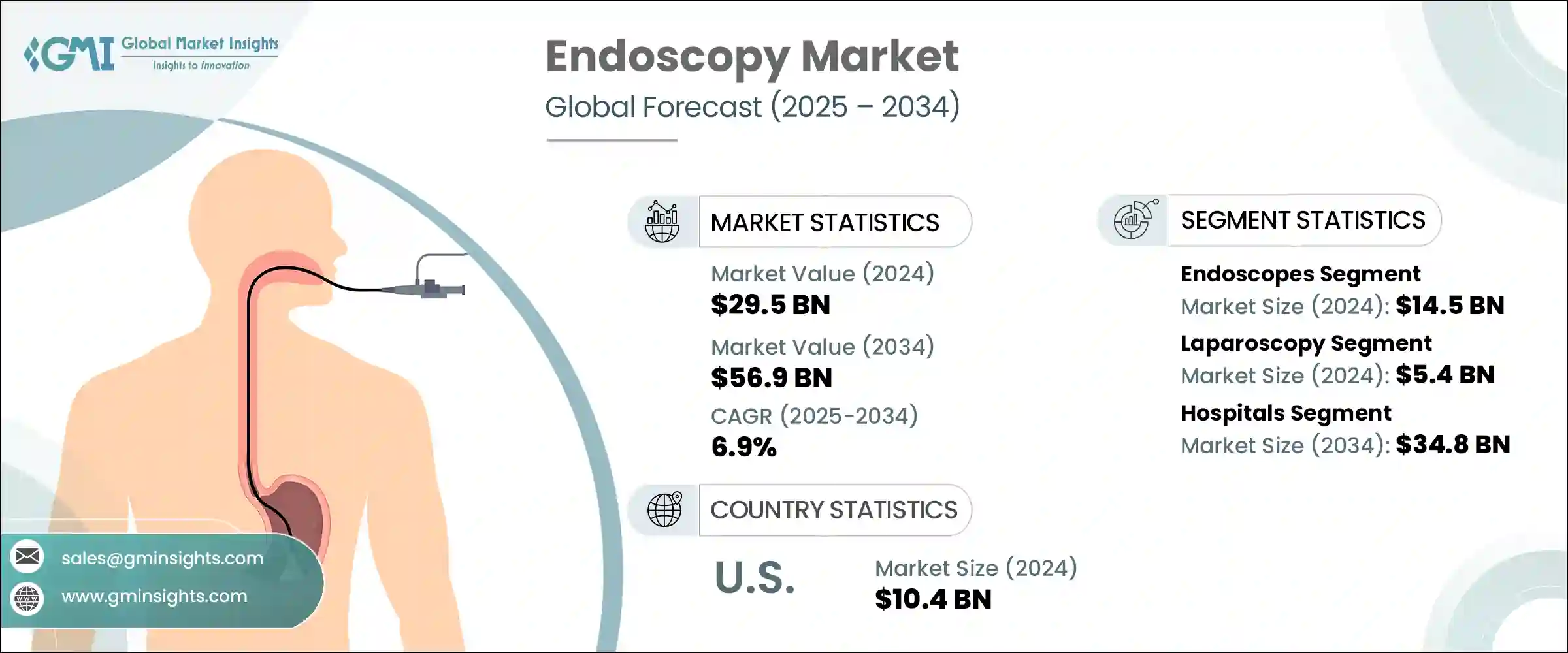

2024 年全球內視鏡市場價值為 295 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 569 億美元。市場成長受到醫學進步、醫療保健重點變化和全球疾病負擔增加等多種因素的影響。對微創治療方案的需求不斷成長,以及內視鏡在診斷和治療目的中的使用率增加,大大促進了市場擴張。由於醫療支出不斷成長、人口老化以及全球慢性病和胃腸道疾病發病率上升,市場正呈現持續成長動能。此外,向早期診斷的轉變和對預防保健的日益重視,導致公共和私人醫療機構都更多地採用內視鏡檢查程序。全球醫療保健系統都在投資先進的內視鏡技術,以支持準確的診斷、更快的患者康復和降低住院費用。

2024年,內視鏡市場佔最高佔有率,收入達145億美元。由於視覺清晰度、可操作性以及機器人和人工智慧等智慧功能的整合,對高性能成像和手術工具的需求持續成長。這些技術進步正在改變醫生進行內部檢查的方式,使診斷更快、更精準。如今,緊湊、靈活、輕便的內視鏡更受專科醫生的青睞,因為它們可以觸及以前難以觸及的解剖區域。增強的可用性、減少的患者不適感以及卓越的臨床效果,正在鞏固內視鏡在常規診療中的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 295億美元 |

| 預測值 | 569億美元 |

| 複合年成長率 | 6.9% |

另一個因素是,人們越來越傾向於使用一次性內視鏡工具,這些工具在門診和門診環境中越來越受歡迎。這些設備有助於降低感染風險,並無需複雜的滅菌過程。尤其值得一提的是,一次性內視鏡因其成本效益高,並且能夠提高患者和醫生的安全性,在支氣管鏡檢查和泌尿外科領域越來越受歡迎。

全球癌症負擔日益加重,尤其是胃腸道癌症和大腸癌,推動了對內視鏡手術的需求,使其成為檢測、監測和治療的第一線解決方案。內視鏡技術廣泛用於腫瘤切除、切片採集和病情追蹤。隨著人們對早期癌症診斷益處的認知不斷加深,對先進內視鏡解決方案的需求持續激增。

在眾多應用中,腹腔鏡檢查的市值在2024年達到54億美元,預計在2025年至2034年期間的複合年成長率將達到6.5%。腹腔鏡等微創技術因其住院時間短、手術創傷小、恢復期快等優勢,正獲得更廣泛的認可。從膽囊切除術到減重手術,患者和外科醫生都明顯傾向於採用這些方法。隨著全球肥胖率的上升,減重手術的數量也在增加,這進一步刺激了對腹腔鏡器械的需求。隨著越來越多的從業者透過模擬程序以及與設備製造商的合作接受腹腔鏡培訓,熟練專業人員的供應量正在提高,這進一步推動了全球範圍內的腹腔鏡應用。

就最終用戶而言,醫院在2024年佔據主導地位,預計到2034年將達到348億美元。醫院擴大配備最先進的內視鏡系統,以滿足日益成長的診斷和外科手術需求。這些機構受益於政策激勵和保險覆蓋,這些政策和保險覆蓋促進了內視鏡在早期疾病檢測中的應用,尤其是在胃腸道和癌症篩檢中。醫院不斷升級其基礎設施,以改善患者治療效果,同時最佳化營運成本。內視鏡檢查可以減少長期住院的需求,這與此目標高度契合。對員工培訓和技術更新的投資確保醫院在適應內視鏡檢查最新發展的同時,保持高標準的護理。

美國內視鏡市場持續成長,從2021年的92億美元成長至2024年的104億美元。預計2025年至2034年期間的複合年成長率將達到6.1%。慢性病的高發生率以及對精準診斷工具的需求是推動這一成長的主要動力。越來越多的患者被診斷出患有胃腸道疾病,這促使人們需要更先進、侵入性更低的解決方案。隨著醫療保健提供者尋求在保持成本效益的同時改善手術效果,美國市場也在不斷發展。

競爭格局由創新、合作夥伴關係和產品多元化決定。史賽克公司、奧林巴斯公司、波士頓科學公司、卡爾史托斯公司和美敦力公司等公司佔了約42%-45%的市場。這些產業領導者正在積極投資整合人工智慧、機器人技術和先進影像技術的下一代內視鏡平台,以提升臨床表現。策略合作與收購仍然是擴大全球影響力、鞏固其在不斷發展的醫療器材領域地位的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球老年人口不斷成長

- 引進技術先進的內視鏡

- 胃腸道疾病、癌症和其他慢性疾病發生率上升

- 微創手術的需求不斷增加

- 產業陷阱與挑戰

- 發展中國家缺乏熟練的醫生和內視鏡醫師

- 市場機會

- 一次內視鏡需求不斷成長

- 整合人工智慧和資料分析激增

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 報銷場景

- 波特的分析

- PESTEL分析

- 差距分析

- 價值鏈分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 消費者行為分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 內視鏡

- 硬內視鏡

- 軟性內視鏡

- 膠囊內視鏡

- 可視化系統

- 內視鏡超音波

- 氣腹機

- 其他產品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 腹腔鏡檢查

- 胃腸內視鏡檢查

- 胃鏡

- 大腸鏡檢查

- 乙狀結腸鏡檢查

- 十二指腸鏡檢查

- 其他胃腸內視鏡檢查

- 關節鏡檢查

- 耳鼻喉內視鏡檢查

- 肺內視鏡檢查

- 婦產科

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B Braun

- Boston Scientific

- CONMED

- COOK MEDICAL

- FUJIFILM

- HOYA

- INTUITIVE

- Johnson & Johnson

- KARL STORZ

- Medtronic

- OLYMPUS

- RICHARD WOLF

- Smith & Nephew

- Stryker

The Global Endoscopy Market was valued at USD 29.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 56.9 billion by 2034. Market growth is being shaped by a combination of medical advancements, changing healthcare priorities, and rising disease burdens across the globe. The rising demand for less invasive treatment options and increased utilization of endoscopy for both diagnostic and therapeutic purposes are contributing significantly to market expansion. The market is witnessing consistent momentum due to growing healthcare spending, aging populations, and the rising incidence of chronic and gastrointestinal illnesses worldwide. Moreover, a shift toward early diagnosis and the growing focus on preventive care have led to higher adoption of endoscopic procedures in both public and private healthcare settings. Healthcare systems across the globe are investing in advanced endoscopic technologies that support accurate diagnostics, faster patient recovery, and lower hospitalization costs.

In 2024, the endoscopes segment accounted for the highest market share, generating USD 14.5 billion in revenue. The demand for high-performance imaging and procedural tools continues to accelerate, driven by improvements in visual clarity, maneuverability, and integration of smart features like robotics and AI. These technological advancements are transforming how physicians perform internal examinations, enabling quicker and more precise diagnoses. Compact, flexible, and lightweight endoscopes are now preferred by specialists for reaching anatomical areas that were previously inaccessible. Enhanced usability, reduced patient discomfort, and superior clinical outcomes are strengthening the position of endoscopes in routine practice.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.5 Billion |

| Forecast Value | $56.9 Billion |

| CAGR | 6.9% |

Another contributing factor is the growing preference for single-use and disposable endoscopic tools, which are becoming popular in outpatient and ambulatory settings. These devices help limit the risk of infection and eliminate the need for complex sterilization processes. Single-use endoscopes, in particular, are gaining traction in bronchoscopy and urology due to their cost-efficiency and ability to improve safety for both patients and practitioners.

The rising global burden of cancer, particularly gastrointestinal and colorectal cancers, is driving the need for endoscopic procedures as a frontline solution for detection, monitoring, and treatment. Endoscopic techniques are widely used for tumor removal, biopsy collection, and condition tracking. As awareness about the benefits of early cancer diagnosis grows, the demand for advanced endoscopy solutions continues to surge.

Among the various applications, laparoscopy held a market value of USD 5.4 billion in 2024 and is projected to grow at a CAGR of 6.5% between 2025 and 2034. Minimally invasive techniques like laparoscopy are gaining broader acceptance due to their association with shorter hospital stays, lower surgical trauma, and faster recovery periods. Patients and surgeons alike are showing a clear preference for these approaches in procedures ranging from gallbladder removal to bariatric surgeries. With the increasing rate of obesity worldwide, the number of weight-loss surgeries is rising, further supporting the demand for laparoscopic instruments. As more practitioners receive training in laparoscopy through simulation programs and partnerships with device manufacturers, the availability of skilled professionals is improving, which further drives adoption on a global scale.

In terms of end users, hospitals held the dominant position in 2024 and are projected to reach USD 34.8 billion by 2034. Hospitals are increasingly equipped with state-of-the-art endoscopic systems to meet the rising demand for diagnostics and surgical procedures. These institutions benefit from policy incentives and insurance coverage that promote the adoption of endoscopy for early disease detection, especially in cases of gastrointestinal and cancer screenings. Hospitals are continuously upgrading their infrastructure to enhance patient outcomes while optimizing operational costs. Endoscopy procedures, which reduce the need for extended hospital stays, align well with this objective. Investments in staff training and technology updates ensure that hospitals maintain high standards of care while adapting to the latest developments in endoscopic procedures.

The endoscopy market in the United States has shown consistent growth, rising from USD 9.2 billion in 2021 to USD 10.4 billion in 2024. It is expected to grow at a CAGR of 6.1% from 2025 to 2034. The high prevalence of chronic diseases and the need for precise diagnostic tools are major drivers behind this growth. An increasing number of patients are being diagnosed with gastrointestinal disorders, prompting the need for more advanced and less invasive solutions. The U.S. market continues to evolve as healthcare providers seek to improve procedural outcomes while maintaining cost efficiency.

The competitive landscape is defined by innovation, partnerships, and product diversification. Companies like Stryker Corporation, Olympus Corporation, Boston Scientific, Karl Storz, and Medtronic command approximately 42%-45% of the market share. These industry leaders are actively investing in next-gen endoscopic platforms that integrate AI, robotics, and advanced imaging to elevate clinical performance. Strategic collaborations and acquisitions remain key tactics for broadening global reach and strengthening their position in the evolving medical device landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population globally

- 3.2.1.2 Introduction of technologically advanced endoscopes

- 3.2.1.3 Rising incidences of gastrointestinal disorders, cancer and other chronic conditions

- 3.2.1.4 Increasing demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled physicians and endoscopists in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for disposable or single-use endoscopes

- 3.2.3.2 Surge in integrated AI and data analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Reimbursement scenario

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Gap analysis

- 3.9 Value chain analysis

- 3.10 Future market trends

- 3.11 Technology and innovation landscape

- 3.11.1 Current technological trends

- 3.11.2 Emerging technologies

- 3.12 Patent Landscape

- 3.13 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By Region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Endoscopes

- 5.2.1 Rigid endoscopes

- 5.2.2 Flexible endoscopes

- 5.2.3 Capsule endoscopes

- 5.3 Visualization systems

- 5.4 Endoscopic ultrasound

- 5.5 Insufflator

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Laparoscopy

- 6.3 GI endoscopy

- 6.3.1 Gastroscopy

- 6.3.2 Colonoscopy

- 6.3.3 Sigmoidoscopy

- 6.3.4 Duodenoscopy

- 6.3.5 Other GI endoscopies

- 6.4 Arthroscopy

- 6.5 ENT endoscopy

- 6.6 Pulmonary endoscopy

- 6.7 Obstetrics/Gynecology

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Boston Scientific

- 9.3 CONMED

- 9.4 COOK MEDICAL

- 9.5 FUJIFILM

- 9.6 HOYA

- 9.7 INTUITIVE

- 9.8 Johnson & Johnson

- 9.9 KARL STORZ

- 9.10 Medtronic

- 9.11 OLYMPUS

- 9.12 RICHARD WOLF

- 9.13 Smith & Nephew

- 9.14 Stryker