|

市場調查報告書

商品編碼

1773262

鑽孔機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Drilling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

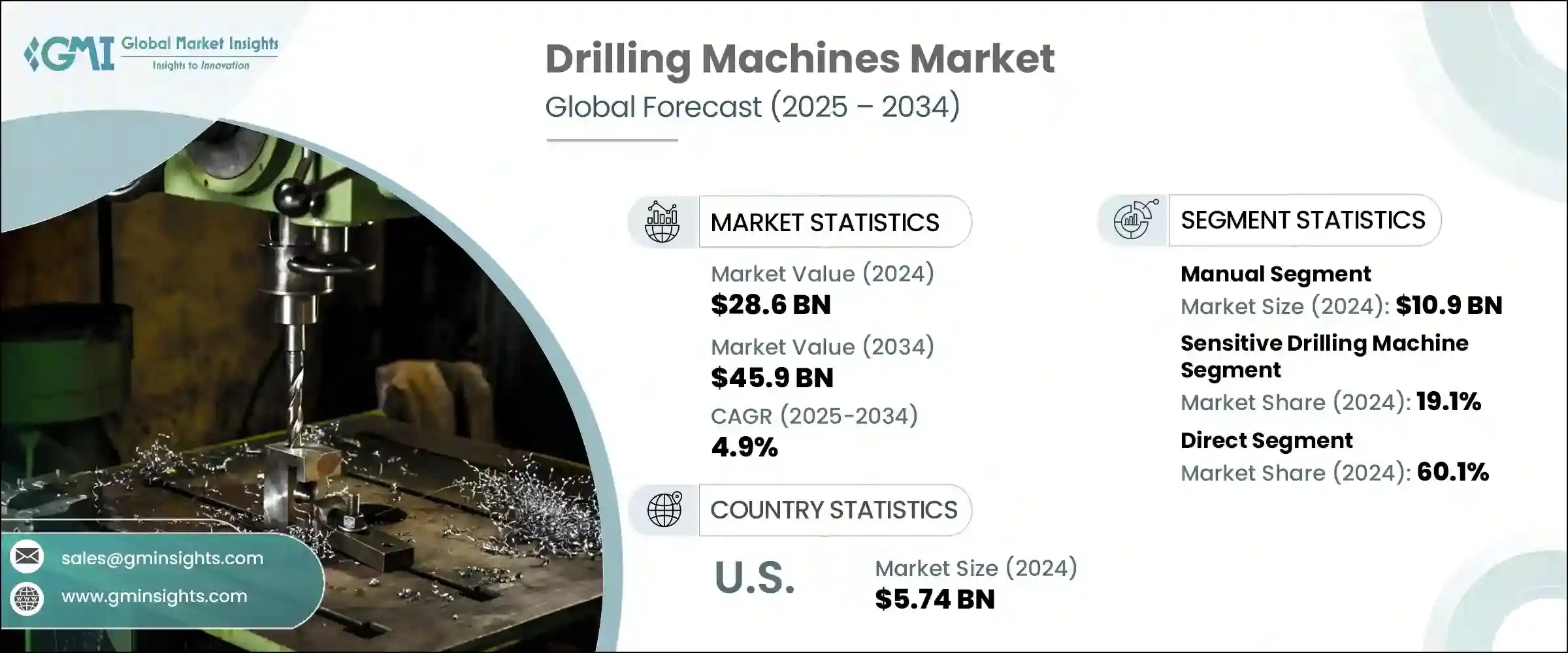

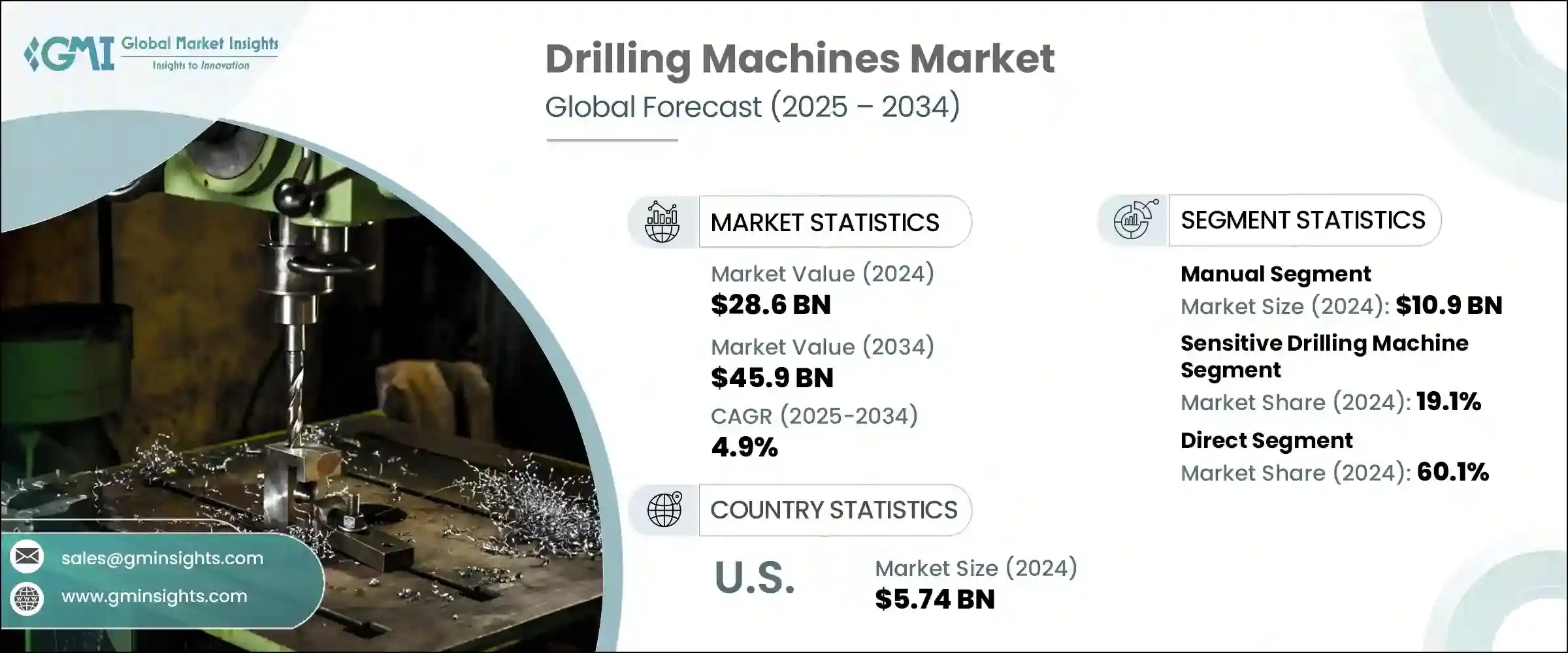

2024年,全球鑽孔機市場規模達286億美元,預計2034年將以4.9%的複合年成長率成長,達到459億美元。智慧製造的不斷發展和工業自動化的快速成長正在推動市場擴張。數控鑽孔機以其精準度和穩定的輸出而聞名,正成為智慧工廠環境中不可或缺的組件。隨著工業4.0和物聯網驅動系統在製造業的蓬勃發展,鑽孔機正透過即時效能監控、遠端系統診斷和預測性維護等智慧功能得到增強,這些功能有助於提高效率並減少停機時間。

建築業密集地區的需求也在成長,尤其是在工業化經濟體基礎建設和城市擴張的強勁推動下。這些趨勢促使當地製造商生產更緊湊、更經濟高效的機器,以滿足新興市場的獨特需求。各行業應用基礎的不斷擴大、先進技術的獲取管道的改善以及數位化製造生態系統投資的不斷增加,進一步推動了該行業的成長。這些因素共同重塑了鑽機在全球工業供應鏈中的使用方式,並推動了該行業穩步上升的發展軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 286億美元 |

| 預測值 | 459億美元 |

| 複合年成長率 | 4.9% |

隨著建築活動蓬勃發展,對能夠滿足大規模作業需求的重型鑽井解決方案的需求也日益成長。許多發展中市場正在經歷基礎設施升級的激增,這帶來了對堅固耐用、高效機器的持續需求。為此,製造商正致力於打造不僅耐用,而且能夠適應各種工況的設備。

2024年,手動鑽機的產值達到109億美元,預計到2034年將以3.8%的複合年成長率成長。儘管自動化程度激增,但手動鑽機憑藉其成本低、靈活性強和易用性,在許多行業中仍然必不可少。這些機器通常用於能源匱乏或熟練勞動力成本較低的地區。對於小型企業、移動車間和偏遠地區的工地來說,它們通常是首選,因為在這些地區,基本的鑽井作業已經足夠,而先進的系統尚不適用。它們的多功能性和對基本操作的適應性使其成為低度開發或基礎設施薄弱地區日常工業和建築任務的實用解決方案。

2024年,精密鑽孔機市場佔比19.1%,預計到2034年將以4.2%的複合年成長率成長。這類機器因其精度高、可靠性高以及適用於需要高精度的輕型應用而備受青睞。它們廣泛應用於空間有限且操作精細的場合。由於其結構緊湊、維護簡便,它們被廣泛應用於需要精細鑽孔和精細細節處理的領域。新興經濟體對精密製造的投資日益增多,推動了教育工作室、小型製造單位以及其他注重經濟實惠、高性能工具的產業對這些機器的需求。

2024年,美國鑽機市值為57.4億美元,預計2025年至2034年期間的複合年成長率為4.7%。隨著美國持續投資現代製造實務並採用工業4.0技術,對自動化和智慧鑽機的需求正在顯著成長。國內生產能力的復甦,加上再生能源計畫的不斷擴展和老舊基礎設施的升級改造,正在刺激對各種鑽機系統的持續需求。美國也受惠於強大的供應鏈、強勁的研發投入以及對新技術的早期採用,這些因素支持了製造業、能源業和工業領域先進創新設備的整合。

鑽機市場的主要競爭對手包括 Cheto Corporation SA、Soilmec SpA、Minitool、日立建機有限公司、三菱重工有限公司、英格索蘭、山特維克、Epiroc AB、倉敷株式會社、瀋陽工具機有限公司、Beretta Srl P、ERLO 集團、Bauer Maschinen GmbH、羅伯特博世有限公司、Caterpillar、利勃海爾集團、德州宏信機床有限公司、瀋陽工具機股份有限公司、阿特拉斯科普柯和 Boart Longyear。為了鞏固市場地位,鑽機行業的領先公司正在推行各種策略,例如擴展其產品線,推出具有人工智慧整合、物聯網連接和自動化友善設計的下一代機器。此外,一些公司正在建立合作夥伴關係和合資企業,以進入新的地區並增強分銷能力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 工業自動化與智慧製造

- 不斷增加的基礎設施和建設項目

- 新興經濟體的都市化與工業化

- 產業陷阱與挑戰

- 某些終端使用產業採用緩慢

- 安全和操作隱患

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 靈敏鑽孔機

- 直立式鑽孔機

- 搖臂鑽床

- 排鑽孔機

- 深孔鑽床

- CNC鑽孔機

- 多軸鑽孔機

- 其他(磁力鑽孔機)

第6章:市場估計與預測:依自動化水平,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動化

- 全自動

第7章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 鑽孔

- 竊聽

- 锪孔

- 鉸孔

- 锪孔

- 其他(無聊、啄食、核心)

第8章:市場估計與預測:依結構,2021 - 2034 年

- 主要趨勢

- 固定的

- 便攜的

第9章:市場估計與預測:依電源分類,2021 - 2034 年

- 主要趨勢

- 電池供電

- 有線

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 金屬鑽孔

- 木材鑽孔

- 纖維和塑膠鑽孔

- 複合材料鑽孔

- 玻璃和陶瓷鑽孔

- 其他(醫療植入物和手術工具、PCB鑽孔(微鑽孔)等)

第 11 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 航太

- 重型設備

- 汽車

- 能源產業

- 軍事與國防

- 其他

第 12 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 13 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 14 章:公司簡介

- Atlas Copco

- Bauer Maschinen GmbH

- Beretta Srl P

- Boart Longyear

- Caterpillar

- Cheto Corporation SA

- Dezhou Hongxin Machine Tool Co Ltd

- Epiroc AB

- ERLO Group

- Hitachi Construction Machinery Ltd

- Ingersoll Rand

- KURAKI Co Ltd

- Liebherr Group

- Minitool

- Mitsubishi Heavy Industries ltd.

- Robert Bosch GmbH

- Sandvik AB

- Shenyang Machine Tool Co Ltd

- SMTCL

- Soilmec SpA

The Global Drilling Machines Market was valued at USD 28.6 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 45.9 billion by 2034. The ongoing evolution of smart manufacturing and rapid growth in industrial automation are fueling market expansion. CNC drilling machines, known for their precision and consistent output, are becoming essential components in smart factory environments. As Industry 4.0 and IoT-driven systems gain momentum across manufacturing industries, drilling machines are being enhanced with intelligent features such as real-time performance monitoring, remote system diagnostics, and predictive maintenance, all of which contribute to improved efficiency and reduced downtime.

Demand is also growing in construction-heavy regions, particularly due to robust infrastructure development and urban expansion in industrializing economies. These trends are influencing local manufacturers to produce more compact and cost-efficient machines that meet the unique needs of emerging markets. The industry's growth is further supported by the widening application base across sectors, improved access to advanced technology, and rising investment in digital manufacturing ecosystems. Combined, these dynamics are reshaping how drilling machines are used across global industrial supply chains and contributing to the sector's steady upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 4.9% |

With construction activities gaining momentum, there is a growing need for heavy-duty drilling solutions that can keep up with large-scale operations. Many developing markets are experiencing a surge in infrastructure upgrades, which is creating consistent demand for rugged, efficient machines. In response, manufacturers are focusing on building equipment that is not only durable but also adaptable to varying working conditions.

In 2024, manual drilling machines generated USD 10.9 billion and are expected to grow at a CAGR of 3.8% through 2034. Despite the surge in automation, manual drilling equipment remains essential in many industries due to its lower cost, flexibility, and ease of use. These machines are frequently utilized in regions with limited access to energy or where skilled labor costs remain low. They are often the first choice for smaller businesses, mobile workshops, and remote worksites where basic drilling operations are sufficient and advanced systems are not yet feasible. Their multifunctional nature and adaptability for basic operations make them a practical solution for everyday industrial and construction tasks in less-developed or infrastructure-poor environments.

The sensitive drilling machines segment accounted for a 19.1% share in 2024 and is forecasted to grow at a CAGR of 4.2% through 2034. These machines are favored for their precision, reliability, and suitability for light-duty applications requiring high levels of accuracy. They are extensively used in operations where space is limited and delicate handling is crucial. Because of their compact structure and straightforward maintenance, they are widely adopted in fields requiring meticulous hole placement and fine detailing. Emerging economies are increasingly investing in precision manufacturing, driving the need for these machines in educational workshops, small-scale fabrication units, and other sectors prioritizing affordable, high-performance tools.

United States Drilling Machines Market was valued at USD 5.74 billion in 2024 and is projected to grow at a CAGR of 4.7% between 2025 and 2034. With the country's continued investment in modern manufacturing practices and adoption of Industry 4.0 technologies, the demand for automated and intelligent drilling machines is growing significantly. The resurgence of domestic production capacity, coupled with expanding renewable energy initiatives and efforts to upgrade outdated infrastructure, is spurring consistent demand for a range of drilling systems. The U.S. also benefits from a robust supply chain, strong R&D investment, and early adoption of new technologies, which supports the integration of sophisticated and innovative equipment across manufacturing, energy, and industrial segments.

Major companies competing in the Drilling Machines Market include Cheto Corporation SA, Soilmec S.p.A., Minitool, Hitachi Construction Machinery Ltd, Mitsubishi Heavy Industries Ltd., Ingersoll Rand, Sandvik AB, Epiroc AB, KURAKI Co Ltd, SMTCL, Beretta S.r.l. P, ERLO Group, Bauer Maschinen GmbH, Robert Bosch GmbH, Caterpillar, Liebherr Group, Dezhou Hongxin Machine Tool Co Ltd, Shenyang Machine Tool Co Ltd, Atlas Copco, and Boart Longyear. To strengthen their market position, leading companies in the drilling machines industry are pursuing strategies such as expanding their product lines with next-generation machines featuring AI integration, IoT connectivity, and automation-friendly designs. Partnerships and joint ventures are being formed to access new regions and enhance distribution capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation Level

- 2.2.4 Operation

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Structure

- 2.2.8 Power Source

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial automation and smart manufacturing

- 3.2.1.2 Rising infrastructure and construction projects

- 3.2.1.3 Urbanization and industrialization in emerging economies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Slow adoption in certain end use industries

- 3.2.2.2 Safety and operational hazards

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Sensitive drilling machine

- 5.3 Upright drilling machine

- 5.4 Radial drilling machine

- 5.5 Gang drilling machine

- 5.6 Deep hole drilling machine

- 5.7 CNC drilling machine

- 5.8 Multiple spindle drilling machine

- 5.9 Others (magnetic drilling machine)

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully Automated

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Hole drilling

- 7.3 Tapping

- 7.4 Counterboring

- 7.5 Reaming

- 7.6 Spot facing

- 7.7 Others (Boring, Peck, Core)

Chapter 8 Market Estimates & Forecast, By Structure, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Fixed

- 8.3 Portable

Chapter 9 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Battery powered

- 9.3 Corded

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Metal drilling

- 10.3 Wood drilling

- 10.4 Fiber & plastic drilling

- 10.5 Composite material drilling

- 10.6 Glass and ceramic drilling

- 10.7 Others (Medical implants & Surgical tools, PCB drilling (Micro drilling), etc.)

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Aerospace

- 11.3 Heavy equipment

- 11.4 Automotive

- 11.5 Energy industry

- 11.6 Military & defense

- 11.7 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Direct

- 12.3 Indirect

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Atlas Copco

- 14.2 Bauer Maschinen GmbH

- 14.3 Beretta S.r.l. P

- 14.4 Boart Longyear

- 14.5 Caterpillar

- 14.6 Cheto Corporation SA

- 14.7 Dezhou Hongxin Machine Tool Co Ltd

- 14.8 Epiroc AB

- 14.9 ERLO Group

- 14.10 Hitachi Construction Machinery Ltd

- 14.11 Ingersoll Rand

- 14.12 KURAKI Co Ltd

- 14.13 Liebherr Group

- 14.14 Minitool

- 14.15 Mitsubishi Heavy Industries ltd.

- 14.16 Robert Bosch GmbH

- 14.17 Sandvik AB

- 14.18 Shenyang Machine Tool Co Ltd

- 14.19 SMTCL

- 14.20 Soilmec S.p.A.