|

市場調查報告書

商品編碼

1773261

兒童智慧手錶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Kids Smartwatch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

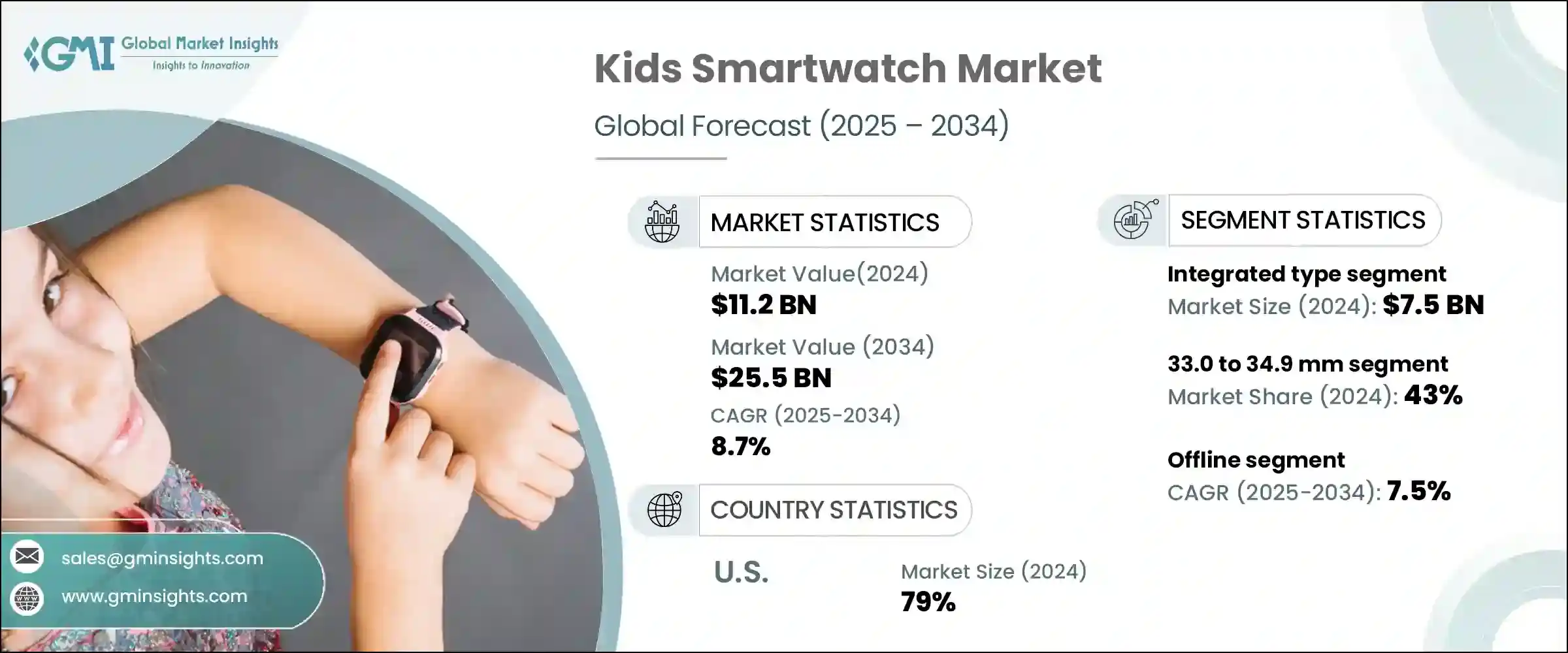

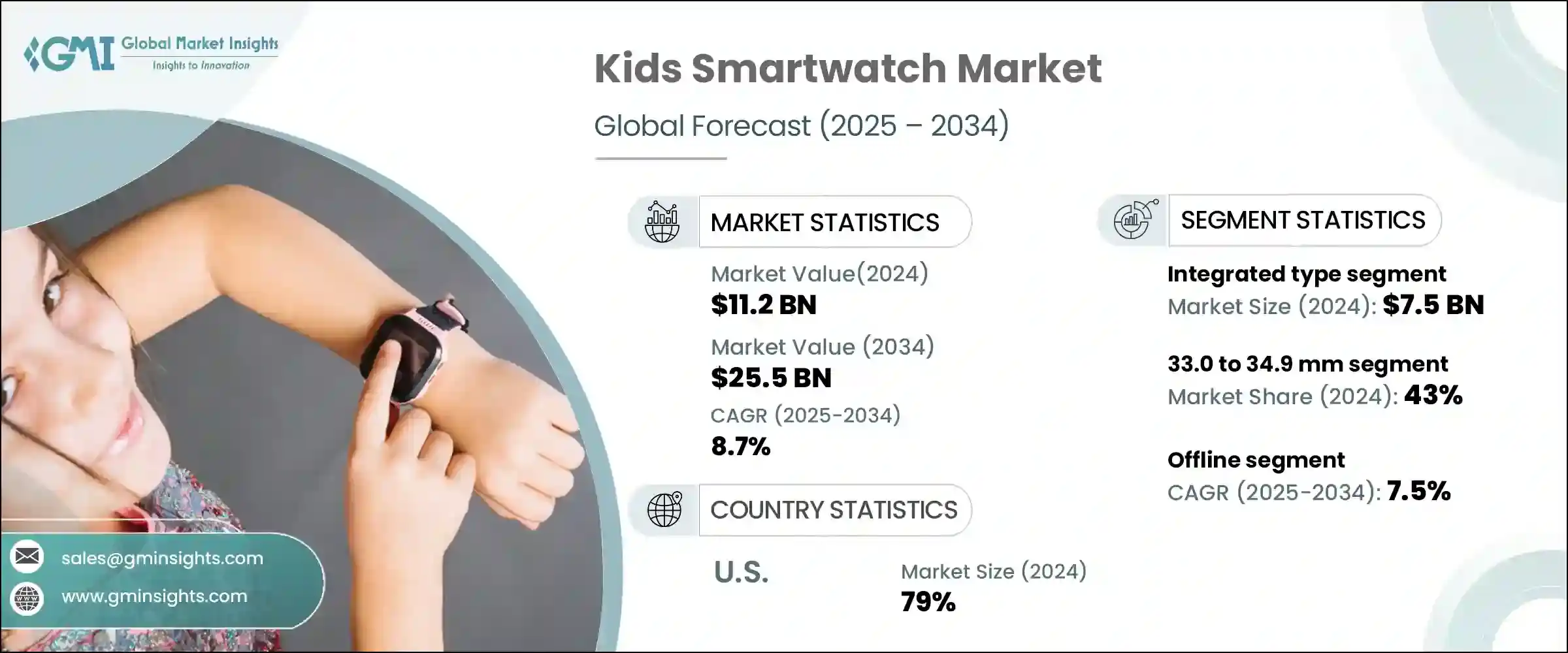

2024 年全球兒童智慧手錶市場規模為 112 億美元,預計到 2034 年將以 8.7% 的複合年成長率成長至 255 億美元。推動這一成長的因素包括家長對兒童安全和溝通需求的認知不斷提高。隨著家長越來越擔心給孩子使用智慧型手機,智慧手錶成為更安全、更可控的替代品。這些設備提供即時 GPS 追蹤、地理圍籬警報、SOS 功能和通話功能,讓照顧者無需完全授予網路存取權限即可保持聯繫。智慧育兒的興起以及對健康和活動追蹤工具日益成長的需求也促進了智慧手錶的普及。現在許多智慧手錶都整合了計步、睡眠監測和心率追蹤功能。這些好處不僅可以讓孩子保持參與,還可以鼓勵他們從小就養成健康的生活習慣。各公司持續開發兼具安全性、功能性和趣味性的解決方案。

此外,許多智慧手表現在都具備與智慧型手機無縫配對的功能,讓父母能夠遠端監控和管理孩子的使用情況,同時賦予孩子一定程度的獨立性。這種連接功能讓父母能夠接收即時更新、控制應用程式存取權限、設定使用限制,並在緊急情況下快速回應,同時又不會限制孩子探索和互動的自由。透過與智慧型手機整合,這些設備完美融合了安全性、便利性和自主性,滿足了現代育兒需求,同時支持孩子日益成長的責任感和自我表達能力。這種遠端監管功能也讓父母安心,即使不在身邊也能安心無虞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 112億美元 |

| 預測值 | 255億美元 |

| 複合年成長率 | 8.7% |

2024年,整合式智慧手錶市場規模達75億美元,預計到2034年複合年成長率將達到8.9%。這些智慧手錶內建蜂窩連接,可獨立運行,是尋求與孩子進行穩定即時溝通的家長的理想之選。配備SIM卡的裝置無需配對手機即可實現語音通話、簡訊、緊急功能和位置共享。雲端同步、自動更新和聯絡人限制等增強的安全功能正在推動注重安全的家庭採用這些智慧手錶。

33 至 34.9 毫米螢幕尺寸在 2024 年佔據 43% 的市場佔有率,預計到 2034 年將保持 8.9% 的強勁複合年成長率。這尺寸實現了最佳平衡:足夠大,足以支援 GPS 追蹤、視訊通話、健身監測和互動應用等核心功能,同時又足夠小巧,可以舒適地戴在孩子的手腕上,不會顯得笨重或突兀。其設計使其堅固耐用,並配備更大的電池,從而延長了兩次充電之間的使用時間。家長們更青睞這個尺寸,因為它在提升安全性的同時,也為學校和遊玩場所提供了實用性。

美國兒童智慧手錶市場佔79%的市場佔有率,2024年市場規模達34億美元。美國家長日益成長的安全疑慮以及對即時監控工具日益成長的興趣,促使智慧手錶迅速普及。這些設備被用作在現實和數位環境中管理兒童安全的有效解決方案。位置追蹤、家長控制和學校模式等功能與現代育兒價值觀相契合。美國家庭尤其青睞智慧科技、兒童專屬設計、家長安心的組合。美國家庭的高可支配收入、先進的電信基礎設施以及早期以科技為中心的生活方式,進一步支持了市場擴張。

兒童智慧手錶產業的知名企業包括 Tinitell、華為科技、偉易達集團、Garmin、騰訊控股、Xplora、Starmax Technology、Neptune Computer、Fitbit、蘋果、小米全球社區、Omate、Pebble、Precise Innovation 和 Contixo。企業為建立和維持兒童智慧手錶市場領導地位而採用的關鍵策略是創新、生態系統整合和兒童安全。領先品牌透過整合更先進的 GPS 系統、人工智慧健康監測和客製化的家長控制設置,不斷增強設備功能。許多公司還透過家庭特定功能提供與智慧型手機的無縫連接,創建一個允許父母全面監督溝通和活動的生態系統。與電信業者、學校和教育內容開發商建立策略合作夥伴關係有助於提高產品的知名度和實用性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 融合的

- 獨立

第6章:市場估計與預測:按螢幕尺寸,2021 - 2034 年

- 主要趨勢

- 最遠可達 32.9 毫米

- 33至34.9毫米

- 35至36.9毫米

- 37毫米以上

第7章:市場估計與預測:依形狀,2021 - 2034

- 主要趨勢

- 矩形的

- 圓形的

- 方塊

第8章:市場估計與預測:依相容性,2021 - 2034 年

- 安卓

- iOS

第9章:市場估計與預測:依連結性,2021 - 2034 年

- 藍牙

- 無線上網

- 近場通訊

- 其他

第10章:市場估計與預測:按電池壽命,2021 - 2034 年

- 最多 24 小時

- 最多 48 小時

- 最多 72 小時

第 11 章:市場估計與預測:按水位阻力,2021 年至 2034 年

- 防水的

- 不防水

第 12 章:市場估計與預測:按錶帶資料,2021 年至 2034 年

- 矽

- 塑膠

- 不銹鋼

- 其他(橡膠、尼龍等)

第13章:市場估計與預測:依價格,2021 - 2034 年

- 低(低於 25 美元)

- 中號(25-100美元)

- 高(100 美元以上)

第 14 章:市場估計與預測:按消費者群體分類,2021 年至 2034 年

- 男生

- 女孩

第 15 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司擁有的網站

- 離線

- 大型零售商店

- 專賣店

- 其他(獨立商店等)

第 16 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 17 章:公司簡介

- Apple

- Contixo

- Fitbit

- Garmin

- Huawei Technologies

- Neptune Computer

- Omate

- Pebble

- Precise Innovation

- Starmax Technology

- Tencent Holdings

- Tinitell

- VTech Holdings

- Xiaomi Global Community

- Xplora

The Global Kids Smartwatch Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 25.5 billion by 2034. This growth is being propelled by heightened parental awareness around child safety and communication needs. As concerns grow about giving young children smartphones, parents are turning to smartwatches as a safer, more controlled alternative. These devices provide real-time GPS tracking, geofencing alerts, SOS features, and calling functions, allowing caregivers to stay connected without granting full internet access. The rise of smart parenting and the growing demand for health and activity-tracking tools also contribute to their popularity. Many smartwatches now offer integrated step counting, sleep monitoring, and heart rate tracking features. These benefits not only keep children engaged but also encourage healthy lifestyle habits from an early age. Companies continue to develop solutions that blend security, functionality, and fun.

Additionally, many smartwatch models now feature seamless smartphone pairing, enabling parents to monitor and manage usage from a distance while allowing children a degree of independence. This connectivity lets parents receive real-time updates, control app access, set usage limits, and respond quickly in case of emergencies, all without restricting the child's freedom to explore and interact. By integrating with smartphones, these devices offer a perfect blend of safety, convenience, and autonomy, addressing modern parenting needs while supporting children's growing desire for responsibility and self-expression. This remote supervision capability also reassures parents, providing peace of mind even when they are not physically present.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $25.5 Billion |

| CAGR | 8.7% |

The integrated smartwatch segment generated USD 7.5 billion in 2024 and is forecast to grow at a CAGR of 8.9% by 2034. These smartwatches operate independently with built-in cellular connectivity, making them ideal for parents seeking robust, real-time communication with their children. Devices equipped with SIM cards allow voice calls, messaging, emergency features, and location sharing without requiring a paired phone. Enhanced security features such as cloud syncing, automatic updates, and contact limitations are driving adoption among safety-conscious families.

The 33 to 34.9 mm screen size segment held a 43% share in 2024 and is expected to maintain a strong CAGR of 8.9% through 2034. This size strikes an optimal balance-large enough to support core features like GPS tracking, video calls, fitness monitoring, and interactive apps, yet compact enough to fit comfortably on a child's wrist without feeling bulky or intrusive. Its design allows for durable builds and larger batteries, extending usability between charges. Parents prefer this segment as it enhances safety while offering practicality for school and play settings.

United States Kids Smartwatch Market held a 79% share and generated USD 3.4 billion in 2024. Rising safety concerns among American parents and a growing interest in real-time monitoring tools have spurred rapid adoption. These devices are being used as an effective solution for managing child safety in both physical and digital environments. Features like location tracking, parental controls, and school mode functionality resonate with modern parenting values. U.S. households are especially responsive to the combination of smart technology, child-specific design, and parental peace of mind. The country's high disposable income, access to advanced telecom infrastructure, and early adoption of tech-centric lifestyles further support market expansion.

Notable players in the Kids Smartwatch Industry include Tinitell, Huawei Technologies, VTech Holdings, Garmin, Tencent Holdings, Xplora, Starmax Technology, Neptune Computer, Fitbit, Apple, Xiaomi Global Community, Omate, Pebble, Precise Innovation, and Contixo. Key strategies employed by companies to build and maintain leadership in the kid's smartwatch market focus on innovation, ecosystem integration, and child safety. Leading brands are continuously enhancing device functionality by integrating more advanced GPS systems, AI-powered health monitoring, and customized parental control settings. Many firms are also offering seamless connectivity with smartphones through family-specific features, creating an ecosystem that allows parents full oversight of communication and activity. Strategic partnerships with telecom operators, schools, and educational content developers help boost product visibility and utility.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model.

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Screen size

- 2.2.4 Shape

- 2.2.5 Compatibility

- 2.2.6 Connectivity

- 2.2.7 Battery life

- 2.2.8 Water level resistance

- 2.2.9 Watchband material

- 2.2.10 Price

- 2.2.11 Consumer group

- 2.2.12 Distribution material

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Integrated

- 5.3 Standalone

Chapter 6 Market Estimates & Forecast, By Screen Size, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Up to 32.9 mm

- 6.3 33 to 34.9 mm

- 6.4 35 to 36.9 mm

- 6.5 37 mm & above

Chapter 7 Market Estimates & Forecast, By Shape, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Rectangular

- 7.3 Round

- 7.4 Square

Chapter 8 Market Estimates & Forecast, By Compatibility, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Android

- 8.2 IOS

Chapter 9 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Bluetooth

- 9.2 Wi-Fi

- 9.3 NFC

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Battery Life, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Up to 24 hours

- 10.2 Up to 48 hours

- 10.3 Up to 72 hours

Chapter 11 Market Estimates & Forecast, By Water Level Resistance, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Waterproof

- 11.2 Non-waterproof

Chapter 12 Market Estimates & Forecast, By Watchband Material, 2021 - 2034 ($Billion, Thousand Units)

- 12.1 Silicon

- 12.2 Plastic

- 12.3 Stainless steel

- 12.4 Others (rubber, nylon etc.)

Chapter 13 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Thousand Units)

- 13.1 Low (below $25)

- 13.2 Medium ($25-100)

- 13.3 High (above $100)

Chapter 14 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 ($Billion, Thousand Units)

- 14.1 Boy

- 14.2 Girl

Chapter 15 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 15.1 Key trends

- 15.2 Online

- 15.2.1 E-commerce

- 15.2.2 Company owned websites

- 15.3 Offline

- 15.3.1 Mega retail stores

- 15.3.2 Specialty stores

- 15.3.3 Others (independent stores, etc.)

Chapter 16 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 16.1 Key trends

- 16.2 North America

- 16.2.1 U.S.

- 16.2.2 Canada

- 16.3 Europe

- 16.3.1 Germany

- 16.3.2 UK

- 16.3.3 France

- 16.3.4 Spain

- 16.3.5 Italy

- 16.3.6 Netherlands

- 16.4 Asia Pacific

- 16.4.1 China

- 16.4.2 Japan

- 16.4.3 India

- 16.4.4 Australia

- 16.4.5 South Korea

- 16.5 Latin America

- 16.5.1 Brazil

- 16.5.2 Mexico

- 16.5.3 Argentina

- 16.6 MEA

- 16.6.1 South Africa

- 16.6.2 Saudi Arabia

- 16.6.3 UAE

Chapter 17 Company Profiles

- 17.1 Apple

- 17.2 Contixo

- 17.3 Fitbit

- 17.4 Garmin

- 17.5 Huawei Technologies

- 17.6 Neptune Computer

- 17.7 Omate

- 17.8 Pebble

- 17.9 Precise Innovation

- 17.10 Starmax Technology

- 17.11 Tencent Holdings

- 17.12 Tinitell

- 17.13 VTech Holdings

- 17.14 Xiaomi Global Community

- 17.15 Xplora