|

市場調查報告書

商品編碼

1773259

動力行動裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Powered Mobility Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

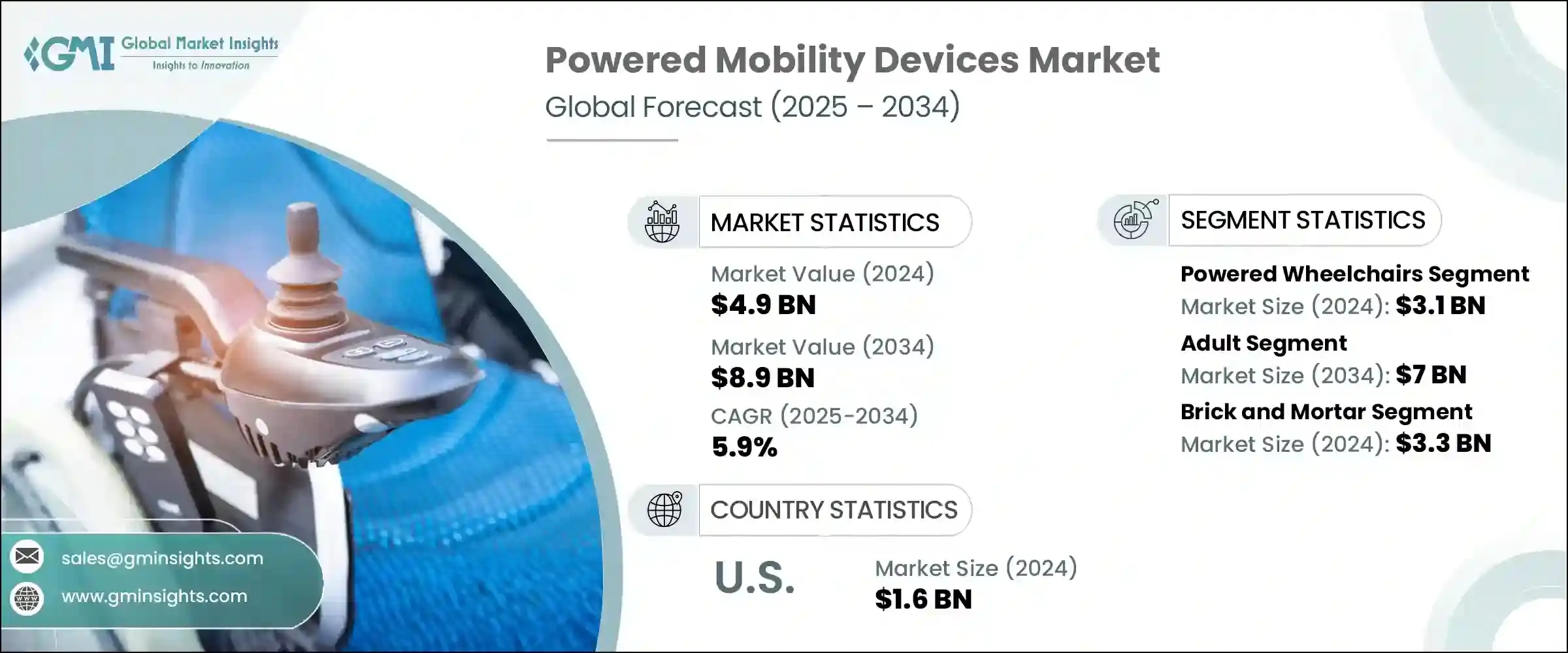

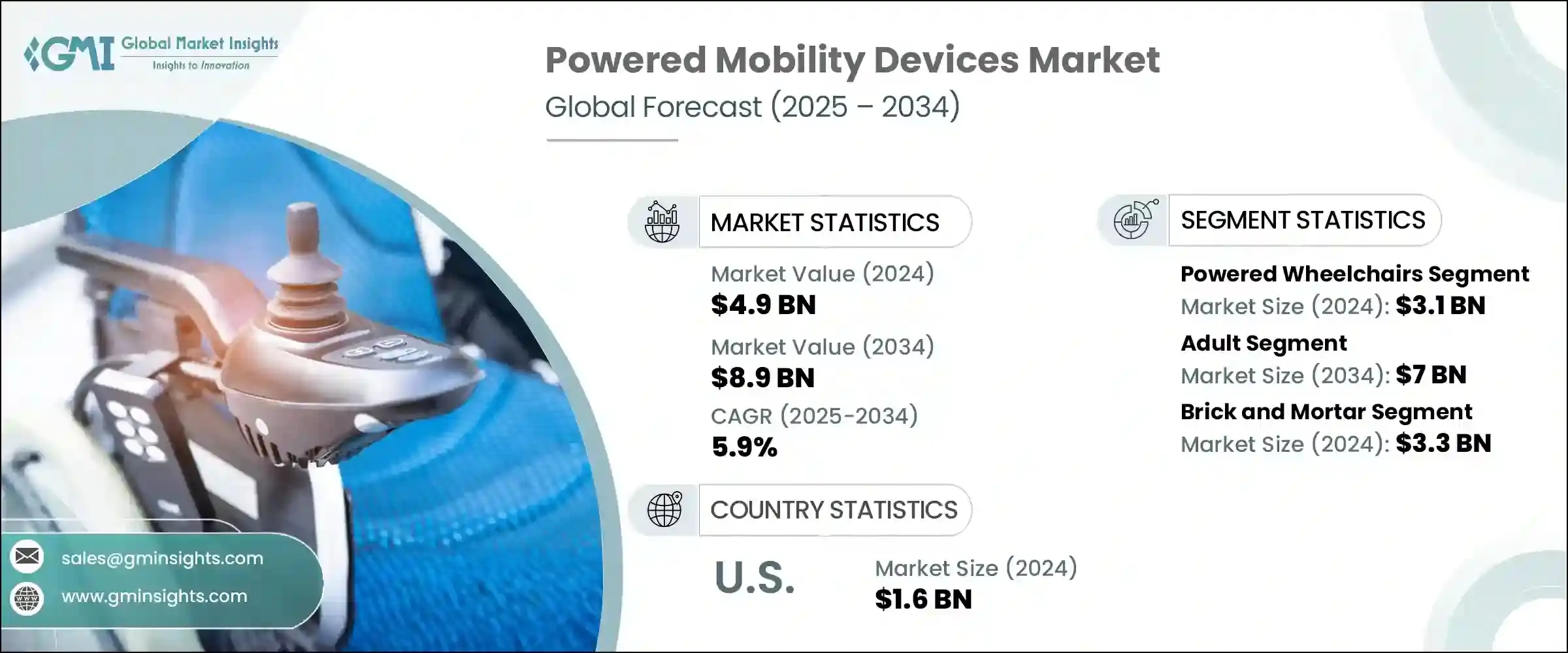

2024年,全球電動輪椅市場規模達49億美元,預計2034年將以5.9%的複合年成長率成長至89億美元。這一成長源於全球殘疾人比例上升、神經系統疾病盛行率上升以及助行器技術的快速進步。電池供電的行動解決方案能夠在手動移動困難或無法移動的情況下提供獨立性,從而顯著提高生活品質。配備感測器和攝影機的智慧輪椅的推出標誌著一項關鍵性進步,使用戶(尤其是神經系統疾病患者)能夠透過即時回饋安全地在環境中導航。這些智慧型設備不僅提高了行動性,還為醫療保健提供者提供了寶貴的行為洞察。未滿足的醫療需求、快速的技術進步和不斷變化的人口結構共同作用,清楚地解釋了為什麼電動輪椅在醫療保健和個人獨立方面變得不可或缺。

這些設備整合了尖端技術,優先考慮使用者的安全和獨立性,引領著克服行動障礙的趨勢。它們配備先進的感測器、直覺的控制裝置和人工智慧導航,可根據個人需求提供更智慧、更響應迅速的操作。自主功能減少了對護理人員的依賴,使用戶能夠更自由地在各種環境中自信地行動。這些助行器將創新與人體工學設計相結合,不僅增強了身體的可及性,還提高了整體生活品質,促進了社會包容和情感健康。隨著技術的不斷發展,電動助行器正變得越來越適應性強、可靠且方便用戶使用,為個人化助行支援樹立了新的標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 89億美元 |

| 複合年成長率 | 5.9% |

電動輪椅市場在2024年引領市場,規模達31億美元,為室內外用戶提供無縫、輕鬆的行動體驗。電動輪椅擁有獨立驅動、站立式和攜帶式等多種選擇,用戶可享受高度可自訂的功能,例如可調節坐墊、符合人體工學的靠背和先進的空間傾斜機制——這些改進不僅提升了舒適度,還有助於康復,並減少繼發性健康問題。

預計到2034年,成年人口市場規模將達到70億美元,其中老年人是最大的使用者群體。老年人群體中殘疾人士的日益增多,是重要的成長動力。電動代步車在簡化日常任務、增強用戶自主性以及最大程度減少疲勞方面發揮著至關重要的作用,而這些優勢對於老年人來說至關重要,因為老年人中近40%面臨行動不便的問題。

2024年,美國電動代步設備市場規模達16億美元,這得益於神經系統疾病、脊髓損傷和人口老化的增加。優惠的報銷政策加上更高的可支配收入,加速了高階電動輪椅和代步車的普及,進一步增強了市場的成長動能。

全球動力移動出行設備市場的領先品牌包括 PRIDE MOBILITY、GOLDEN、Drive DeVilbiss Healthcare、KARMAN、INVACARE、Hoveround Mobility Solutions、Airwheel、Decon Mobility、MEYRA、Permobil、Ottobock、OSTRICH、Merits、LEVO 和 Frido。這些公司正在重新調整創新、資金和設計,以滿足用戶需求。領先的製造商正在透過研發整合感測器、物聯網連接和人工智慧導航的智慧功能來實現差異化,從而提供更安全、數據更豐富的行動出行解決方案。

他們正在透過模組化設計(可更換驅動單元、可調節座椅和站立機構)擴展產品組合,以適應更廣泛的用戶和情況。各公司正在與醫療保健提供者和付款人建立合作夥伴關係,以降低成本障礙並改善報銷途徑,同時針對老年人和神經系統殘疾患者進行定向行銷。對利基創新企業的策略性收購以及合資企業,有助於公司開拓新技術和地理市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 神經系統疾病盛行率不斷上升

- 動力移動產品的技術進步

- 老年人口比例上升

- 全球殘疾盛行率不斷上升

- 產業陷阱與挑戰

- 電動輪椅成本高

- 嚴格的監管框架

- 機會

- 專注於輕巧可折疊的電動輪椅

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 按產品類型分類的價格趨勢

- 未來市場趨勢

- 報銷場景

- 消費者行為分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 世界其他地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 電動輪椅

- 後輪

- 中輪

- 前輪

- 其他類型

- 機動車輛

- 三輪設備

- 四輪設備

- 五輪設備

- 動力附加裝置或推進輔助裝置

第6章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 實體店面

- 線上通路

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 居家護理

- 復健中心

- 醫院

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Airwheel

- decon

- drive DeVilbiss Healthcare

- Frido

- GOLDEN

- Hoveround Mobility Solutions

- INVACARE

- KARMAN

- LEVO

- merits

- MEYRA

- OSTRICH

- ottobock

- permobil

- PRIDE MOBILITY

The Global Powered Mobility Devices Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 8.9 billion by 2034. This surge is due to rising global disability rates, increased prevalence of neurological conditions, and rapid technological progress in mobility aids. Battery-powered mobility solutions offer independence where manual movement is challenging or impossible, significantly enhancing quality of life. The introduction of smart wheelchairs with sensors and cameras marks a pivotal advancement, enabling users-especially those with neurological challenges-to navigate environments safely with real-time feedback. These intelligent devices not only boost mobility but also support healthcare providers with valuable behavior insights. The convergence of unmet medical needs, rapid technological advancements, and evolving demographic patterns clearly explains why powered mobility devices are becoming indispensable in healthcare and personal independence.

These devices lead the way in overcoming mobility barriers by integrating cutting-edge technology that prioritizes user safety and independence. Equipped with advanced sensors, intuitive controls, and AI-powered navigation, they offer smarter, more responsive operations tailored to individual needs. Autonomous features reduce the reliance on caregivers, allowing users greater freedom to move confidently in various environments. By combining innovation with ergonomic design, these mobility aids not only enhance physical accessibility but also improve overall quality of life, fostering social inclusion and emotional well-being. As technology continues to evolve, powered mobility devices are becoming more adaptive, reliable, and user-friendly, setting new standards in personalized mobility support.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 5.9% |

The powered wheelchair segment led the market in 2024, reaching USD 3.1 billion, by providing seamless, effortless movement both indoors and outdoors. With diverse options such as independent drive, standing wheelchairs, and portable units, users benefit from highly customizable features like adjustable cushions, ergonomic backrests, and advanced tilt-in-space mechanisms-enhancements that not only improve comfort but also support rehabilitation and reduce secondary health issues.

The adult population segment is expected to reach USD 7 billion by 2034, especially seniors form the largest base of users. The increasing prevalence of disabilities within this demographic is a significant growth driver. Powered mobility devices play a vital role in simplifying everyday tasks, enhancing user autonomy, and minimizing fatigue-benefits that are crucial for older adults, nearly 40% of whom face mobility limitations.

United States Powered Mobility Devices Market was valued at USD 1.6 billion in 2024, supported by a rise in neurological conditions, spinal cord injuries, and an aging population. Favorable reimbursement policies combined with higher disposable incomes have accelerated the adoption of premium electric wheelchairs and mobility scooters, further strengthening the market's growth momentum.

Leading brands in the Global Powered Mobility Devices Market include PRIDE MOBILITY, GOLDEN, Drive DeVilbiss Healthcare, KARMAN, INVACARE, Hoveround Mobility Solutions, Airwheel, Decon Mobility, MEYRA, Permobil, Ottobock, OSTRICH, Merits, LEVO, and Frido. These companies are reshuffling innovation, funding, and design to meet user demands. Leading manufacturers are differentiating through R&D of intelligent features-integrating sensors, IoT connectivity, and AI-driven navigation-to offer safer, data-enriched mobility solutions..

They are expanding portfolios with modular designs-swappable drive units, adjustable seating, and standing mechanisms-to accommodate a wider range of users and conditions. Firms are forging partnerships with healthcare providers and payers to reduce cost barriers and improve reimbursement pathways, while targeted marketing addresses seniors and individuals with neurological disabilities. Strategic acquisitions of niche innovators, along with joint ventures, help companies tap new technologies and geographic markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Patient

- 2.2.4 Distribution channel

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of neurological diseases

- 3.2.1.2 Technological advancements in powered mobility products

- 3.2.1.3 Rising percentage of geriatric population

- 3.2.1.4 Increasing prevalence of disabilities worldwide

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of powered wheelchairs

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Opportunities

- 3.2.3.1 Focus on lightweight and foldable electric wheelchairs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product type

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Powered wheelchairs

- 5.2.1 Rear wheel

- 5.2.2 Mid-wheel

- 5.2.3 Front wheel

- 5.2.4 Other types

- 5.3 Power operated vehicles

- 5.3.1 3-wheel devices

- 5.3.2 4-wheel devices

- 5.3.3 5-wheel devices

- 5.4 Power add-on or propulsion-assist units

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 Online channel

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home care

- 8.3 Rehabilitation centers

- 8.4 Hospitals

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airwheel

- 10.2 decon

- 10.3 drive DeVilbiss Healthcare

- 10.4 Frido

- 10.5 GOLDEN

- 10.6 Hoveround Mobility Solutions

- 10.7 INVACARE

- 10.8 KARMAN

- 10.9 LEVO

- 10.10 merits

- 10.11 MEYRA

- 10.12 OSTRICH

- 10.13 ottobock

- 10.14 permobil

- 10.15 PRIDE MOBILITY