|

市場調查報告書

商品編碼

1773255

電動車絕緣市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Vehicle Insulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

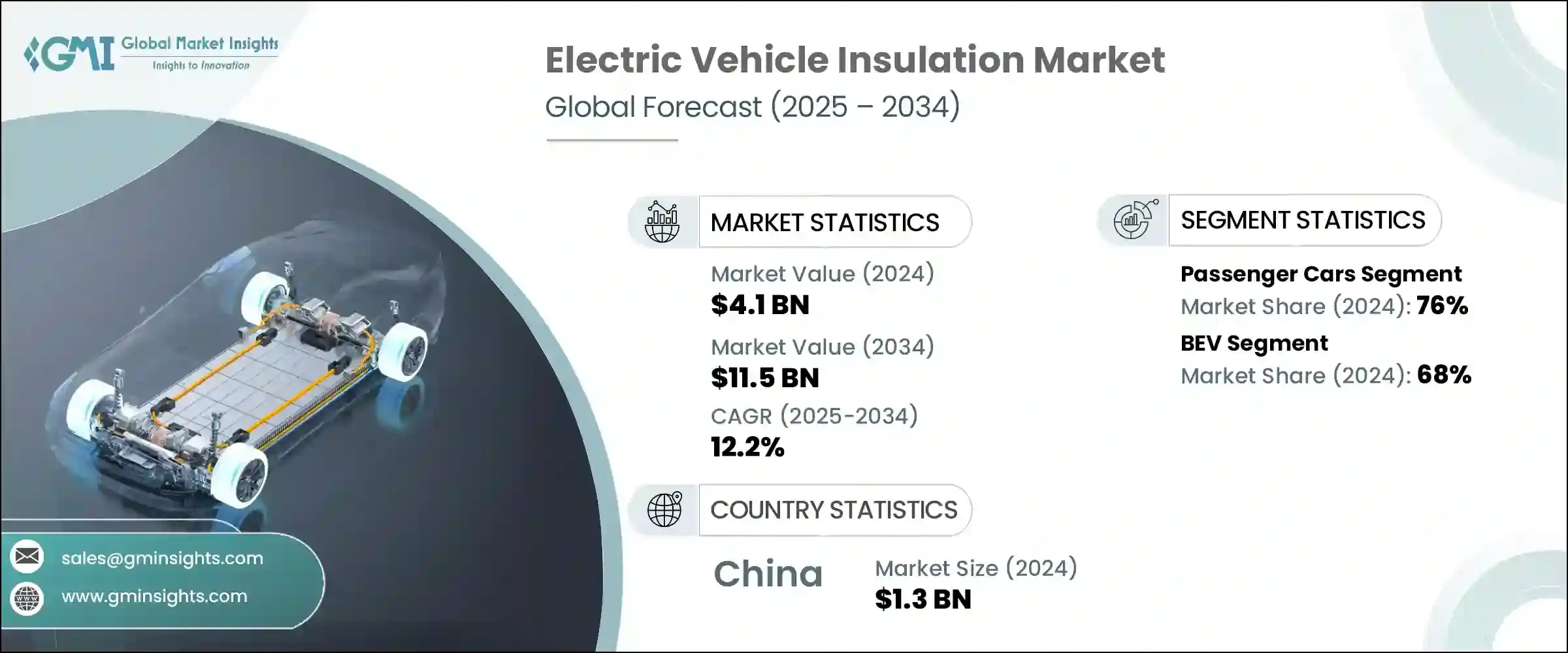

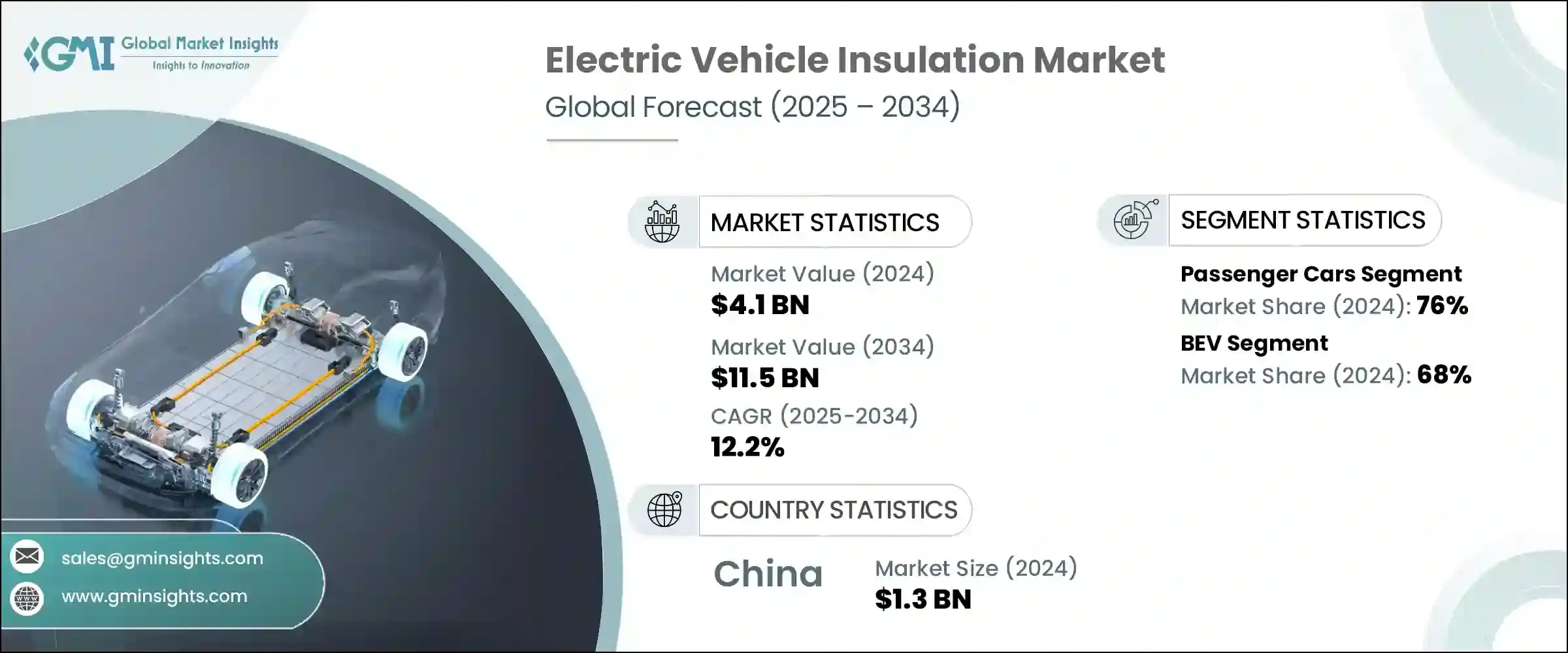

2024年,全球電動車絕緣材料市場規模達41億美元,預計2034年將以12.2%的複合年成長率成長,達到115億美元。電動車的普及以及全球充電網路的建設,正在顯著影響先進絕緣材料的需求。隨著電動車日益成為主流,絕緣材料在汽車中發揮著比傳統汽車更為重要的作用——它對於熱量管理、確保電氣完整性以及創造更安靜的座艙環境至關重要。電動傳動系統日益複雜且緊湊,不僅要求材料能夠耐高溫,還要求其能夠在高壓環境下保持電氣隔離。從控制電池溫度到屏蔽電子元件,絕緣材料對於提高車輛效率、可靠性和長期安全性至關重要。

熱管理是電動車工程的核心重點,尤其是在製造商追求更高電池容量和更快充電週期的當下。為了滿足這些需求,市場對兼具高耐熱性和輕量化設計的材料表現出濃厚的興趣。由於電動傳動系統的工作電壓通常高達 800V,絕緣材料不僅必須能夠承受極端的溫度梯度,還必須在重複的熱循環下保持穩定的性能。隨著越來越多的汽車製造商競相提升續航里程、耐用性和駕駛體驗,絕緣材料的設計不再僅僅作為一道屏障,而成為整合在電池模組、電動馬達和電力電子設備中的性能賦能器。新型電動車平台的開發越來越注重在緊湊設計與有效的熱量和噪音控制之間取得平衡,這使得絕緣材料成為車輛安全和性能標準的核心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 12.2% |

在動力系統方面,純電動車 (BEV) 在 2024 年佔據市場主導地位,約佔全球市場佔有率的 68%。預計該細分市場在 2025 年至 2034 年期間的複合年成長率將超過 13.1%。 BEV 完全依賴電力驅動,這加劇了對所有高壓和熱敏感部件進行全面絕緣的需求。由於 BEV 包含大型電池組,並在運行和充電過程中產生大量熱量,因此對能夠保持穩定溫度並防止能量損失的材料的需求持續成長。 BEV 中的絕緣材料還可以隔離電場並減少電磁干擾,從而進一步提高電氣系統的效率和安全性。隨著原始設備製造商 (OEM) 探索更緊湊、更高能量密度的電池配置,絕緣解決方案也正在最佳化,以實現緊密整合、輕量化和高性能。

按產品類別分類,隔熱材料在2024年佔據主導地位,預計在整個預測期內仍將保持領先地位。隔熱材料對於電動車至關重要,能夠有效管理關鍵系統的溫度均勻性。過熱風險和能源效率低下會危及車輛安全和電池壽命,因此高性能隔熱材料被廣泛採用。這些材料如今已成為保護電池免受熱量積聚、保持電力電子設備最佳性能以及在極端運行條件下保障乘客安全的關鍵。隨著電動車技術的成熟,隔熱材料必須跟上快速充電系統和日益緊湊的電池組件不斷成長的散熱需求。

從區域來看,2024年中國約佔亞太地區電動車絕緣市場的68.3%,貢獻了約13億美元的收入。中國仍然處於全球電動車生產的前沿,擁有高度發展的本地供應鏈和對電動車技術的積極投資。其製造規模加上強勁的國內需求,使中國成為推動絕緣材料創新和大規模部署的主導力量。在區域製造商專注於擴大產能和提升產品性能的同時,全球公司也在該地區投資,以支持本地和出口市場。隨著車輛架構的演變和性能標準的日益嚴格,預計各類電動車對專用絕緣材料的需求將大幅成長。

隨著車輛架構的不斷變化以及人們對能源效率和乘客舒適度日益成長的期望,電動車絕緣市場正在迅速轉型。隨著電動車日益複雜,絕緣系統不僅要保護零件,還必須主動管理熱量、降低噪音,並在緊湊的動力總成環境中隔離電流。絕緣材料已成為支援下一代電動車功能的關鍵,包括高壓傳動系統、模組化電池系統和安靜的座艙體驗。目前,輕量、高耐用性的材料正在開發中,以改善能源利用並延長續航里程。這些解決方案旨在無縫整合到電動車的結構設計中,幫助汽車製造商滿足性能、安全性和監管目標。隨著全球電動車的加速發展,絕緣材料將繼續成為永續高效車輛系統的關鍵推動因素。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 電動車產量不斷成長

- 擴大電動車充電基礎設施

- 材料技術的進步

- 政府激勵措施和投資不斷增加

- 產業陷阱與挑戰

- 複雜的客製化需求

- 來自整合熱管理解決方案的競爭

- 市場機會

- 關注電池安全及防火

- 輕質材料需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

- 二輪車

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車

- 插電式混合動力

- 油電混合車

- 燃料電池電動車

第7章:市場估計與預測:依產品,2021 - 2034 年

- 主要趨勢

- 隔熱

- 隔音

- 電絕緣

- 混合

第8章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 熱介面

- 泡沫塑膠

- 陶瓷材料

- 玻璃棉/玻璃纖維

- 矽和橡膠基

- 其他

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 電池組和外殼

- 電動機

- 電力電子

- 客艙

- 引擎蓋下/熱管理系統

- 充電埠和系統

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- 3M

- Aerofoam (Hira Industries)

- Armacell International

- Autoneum

- BASF SE

- Covestro AG

- DuPont

- Flex

- ITW Formex

- Johns Manville (Berkshire Hathaway)

- L&L Products

- Morgan Advanced Materials

- Parker Hannifin

- Polymer Technologies

- Rogers Corporation

- Saint-Gobain

- Toray Industries

- UBE Corporation

- Unifrax (Alkegen)

- Zotefoams

The Global Electric Vehicle Insulation Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 12.2% to reach USD 11.5 billion by 2034. The increasing shift toward electric mobility and the global ramp-up of charging networks are significantly influencing the demand for advanced insulation materials. As EVs become more mainstream, insulation is playing a far more central role than in traditional vehicles-it is now critical to managing heat, ensuring electrical integrity, and supporting quieter cabin environments. The growing complexity and compactness of electric drivetrains require materials that not only resist high heat but also maintain electrical separation in high-voltage environments. From controlling battery temperatures to shielding electronic components, insulation is becoming essential in enhancing vehicle efficiency, reliability, and long-term safety.

Thermal management is a core priority in EV engineering, especially as manufacturers push for higher battery capacities and faster charging cycles. To meet these demands, the market is seeing strong interest in materials that offer both high thermal resistance and lightweight design. With electric drivetrains often operating at voltages up to 800V, insulation must not only withstand extreme thermal gradients but also maintain stable performance under repeated thermal cycling. As more automakers compete to improve range, durability, and driver experience, insulation is being engineered not just as a barrier but as a performance enabler integrated across battery modules, electric motors, and power electronics. The development of new EV platforms is increasingly focused on balancing compact design with effective heat and noise control, which places insulation at the center of vehicle safety and performance standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 12.2% |

In terms of propulsion, Battery Electric Vehicles (BEVs) led the market in 2024, accounting for approximately 68% of the global share. This segment is projected to expand at a CAGR of more than 13.1% from 2025 to 2034. BEVs rely entirely on electric power, which intensifies the need for comprehensive insulation across all high-voltage and thermally sensitive components. Since BEVs contain large battery packs and generate considerable heat during operation and charging, the demand for materials capable of maintaining stable temperatures and preventing energy loss continues to grow. Insulation in BEVs also serves to isolate electric fields and reduce electromagnetic interference, which further improves the efficiency and safety of electric systems. As OEMs explore more compact and high-energy-density battery configurations, insulation solutions are being optimized for tight integration, minimal weight, and high performance.

By product, the thermal insulation segment held the dominant share in 2024 and is expected to maintain its lead through the forecast period. Thermal insulation is essential in EVs to manage temperature uniformity across critical systems. Overheating risks and energy inefficiencies can compromise both vehicle safety and battery life, which has led to widespread adoption of high-performance thermal barriers. These materials are now fundamental to shielding batteries from heat buildup, preserving optimal performance of power electronics, and maintaining passenger safety under extreme operating conditions. As EV technology matures, thermal insulation must keep pace with rising thermal demands from fast-charging systems and increasingly compact battery assemblies.

Regionally, China represented about 68.3% of the Asia-Pacific EV insulation market in 2024, contributing approximately USD 1.3 billion in revenue. The country remains at the forefront of global EV production, with a highly developed local supply chain and aggressive investment in EV technologies. Its scale of manufacturing, combined with strong domestic demand, has made China a dominant force in driving innovation and mass deployment of insulation materials. While regional manufacturers are focused on expanding capacity and improving product performance, global companies are also investing in the region to support both local and export markets. As vehicle architectures evolve and performance standards grow more stringent, the demand for specialized insulation materials across all types of electric vehicles is expected to rise significantly.

The electric vehicle insulation market is transforming rapidly in response to shifting vehicle architectures and rising expectations for energy efficiency and passenger comfort. As EVs grow more complex, insulation systems must do more than just protect components-they must actively manage heat, reduce noise, and isolate electrical currents within tightly packed powertrain environments. Insulation has become instrumental in supporting next-generation EV features, including high-voltage drivetrains, modular battery systems, and quiet cabin experiences. Lightweight, high-durability materials are now being developed to improve energy use and extend driving range. These solutions are designed for seamless integration into the structural design of EVs, helping automakers meet performance, safety, and regulatory targets. With electric mobility accelerating worldwide, insulation will continue to be a key enabler of sustainable and efficient vehicle systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Product

- 2.2.5 Material

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising electric vehicle production

- 3.2.1.2 Expansion of EV charging infrastructure

- 3.2.1.3 Advancements in material technology

- 3.2.1.4 Rising government incentives and investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex customization needs

- 3.2.2.2 Competition from integrated thermal management solutions

- 3.2.3 Market opportunities

- 3.2.3.1 Focus on battery safety and fire protection

- 3.2.3.2 Rising demand for light weight materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

- 5.4 Two-wheelers

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 HEV

- 6.5 FCEV

Chapter 7 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Thermal insulation

- 7.3 Acoustic insulation

- 7.4 Electric insulation

- 7.5 Hybrid

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Thermal interface

- 8.3 Foamed plastics

- 8.4 Ceramic materials

- 8.5 Glass wool/Fiberglass

- 8.6 Silicon and Rubber-based

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Battery pack and housing

- 9.3 Electric motor

- 9.4 Power electronics

- 9.5 Passenger cabin

- 9.6 Under the hood/thermal management system

- 9.7 Charging port & system

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Aerofoam (Hira Industries)

- 11.3 Armacell International

- 11.4 Autoneum

- 11.5 BASF SE

- 11.6 Covestro AG

- 11.7 DuPont

- 11.8 Flex

- 11.9 ITW Formex

- 11.10 Johns Manville (Berkshire Hathaway)

- 11.11 L&L Products

- 11.12 Morgan Advanced Materials

- 11.13 Parker Hannifin

- 11.14 Polymer Technologies

- 11.15 Rogers Corporation

- 11.16 Saint-Gobain

- 11.17 Toray Industries

- 11.18 UBE Corporation

- 11.19 Unifrax (Alkegen)

- 11.20 Zotefoams